Controlled Release Fertilizers Market Size & Insights:

The global controlled release fertilizers market size was valued at $2.3 billion in 2021, and is projected to reach $4.3 billion by 2031, growing at a CAGR of 6.6% from 2022 to 2031. The growing adoption of precision agriculture, which leverages technology to optimize farming practices, is significantly driving the demand for controlled release fertilizers. These fertilizers enable more efficient nutrient delivery to crops, reducing wastage and minimizing environmental impact, aligning with the goals of precision farming. As a result, there is drive the demand for the controlled release fertilizers market.

Introduction:

Controlled release fertilizers are generally used as specialty fertilizers in applications, such as agricultural applications, lawn & turf, fruits and vegetables, nurseries and gardens, among others. Thus, the agriculture industry will hold a dominant share in the demand for controlled and slow-release fertilizers. Increasing investments in sustainable and eco-friendly fertilizers are expected to propel the demand for these controlled release fertilizers during the forecast period. Market Dynamics:

Market Dynamics:

The global agricultural industry is anticipated to register a high growth rate of over 3.8% due to increase in population, change in eating habits and improvement in economies of developing countries. Moreover, increasing penetration of controlled and slow-release fertilizers in the developing markets is anticipated to provide impetus to the growth of the controlled and slow-release fertilizers market during the forecast period. However, the use of new technologies in the production of controlled and slow release fertilizers makes them more expensive than conventional fertilizers. Similarly, lack of awareness among growers and farmers about the benefits of controlled and slow release fertilizers will hamper the controlled release fertilizers market growth.

The rising demand for organic farming presents significant opportunities for the controlled release fertilizers market, as these fertilizers align with the principles of sustainable and eco-friendly agriculture. Organic farming emphasizes the use of natural inputs and practices that minimize environmental impact, making controlled release fertilizers an ideal solution due to their ability to reduce nutrient leaching and optimize nutrient availability over time. As consumers increasingly prefer organic products and governments implement policies supporting organic agriculture, the need for efficient, environmentally conscious fertilization solutions is growing, thus driving the adoption of controlled release fertilizers in organic farming practices. All these factors are anticipated to drive the demand for the controlled release fertilizers market growth.

North America region is second largest market of controlled release fertilizers. Countries such as the U.S. and Canada are the largest producers in the region. Technical and scientific advances have made fertilizers more efficient in recent years and have helped farmers maximize fertilizers' benefits while reducing risks. For instance, slow-release fertilizers and controlled-release fertilizers are widely used on turf and in nurseries but also in large scale crops like maize. According to the US Department of Agriculture, the U.S. has expanded the farmlands to plant 94 million acres of corn and 85 million acres of soybeans, resulting in greater nitrogenous fertilizers consumption in 2021, supporting the domestic crop production in the country. According to the International Fertilizer Association (IFA), the global demand for urea is expected to increase by 1.6% per annum, to reach 188 million metric tons by 2022, while the supply (effective capacity) may reach 197 million metric tons. North America is one of the world’s largest exporters of nitrogen fertilizers and has developed into one of the most promising nitrogen investment destinations.

Segment Overview:

The global controlled release fertilizers market is segmented on the basis of type, mode of application, end-use, and region.

On the basis of type, it is segmented into slow release, nitrogen stabilizer, and coated & encapsulated. On the basis of mode of application, the market is segmented into foliar, fertigation, soil, and others. On the basis of end-use, the market is segmented into agricultural, and non-agricultural. Furthermore, agricultural segment is further classified into cereals & grains, oilseed & pulses, fruits & vegetables, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest share of the market, followed by North America, and Europe.

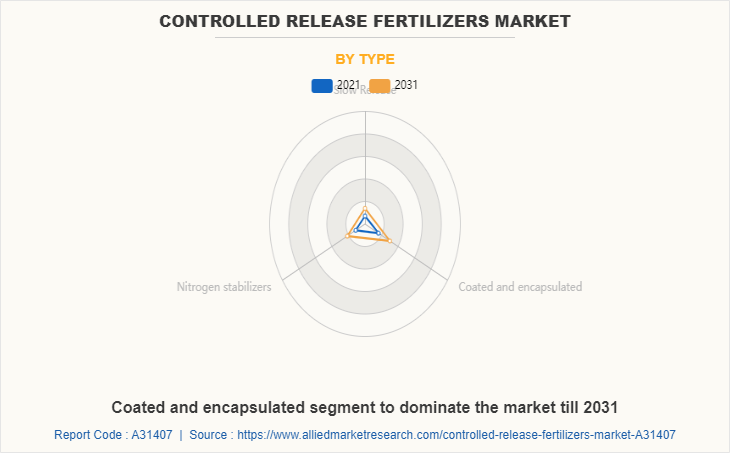

Controlled Release Fertilizers Market By Type

The coated and encapsulated segment dominates the global controlled release fertilizers market. A variety of coatings have been applied to fertilizer particles to control their solubility in soil. Controlling the rate of nutrient release can offer multiple environmental, economic, and yield benefits. A wide range of materials have been used as coatings on soluble fertilizers. polymer coating technology that can be applied to any granular substrate. Provide extended-release capabilities and improve the efficiency of common crop fertilizers. These encapsulated fertilizers will be controlled-release to the plant when needed. The factors such as increasing market demand for high-value crops coupled with the growing production of fertilizer and urea products around the world emerge as the major factor fostering the growth of the coated and encapsulated fertilizers market. In addition to this, the rising application rates of fertilizers in emerging countries along with the less availability of land are further estimated to cushion the growth of the market in the forecast period.

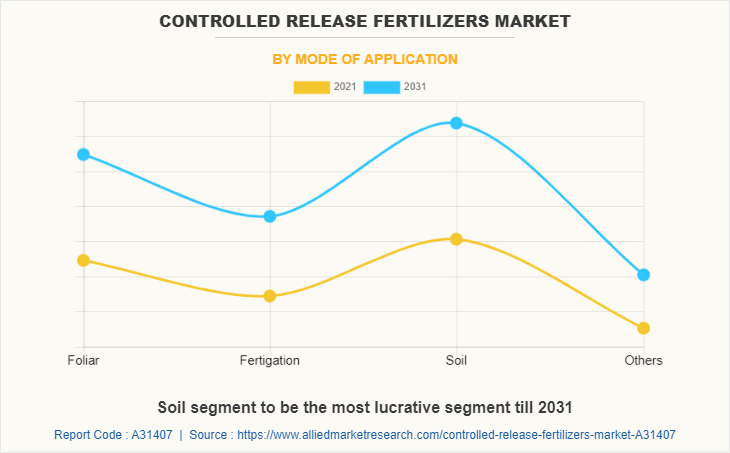

Controlled Release Fertilizers Market By Mode of Application

The soil segment dominates the global controlled release fertilizers market. Soil fertilizer, natural or artificial substance containing the chemical elements that improve growth and productiveness of crop. Fertilizers enhance the natural fertility of the soil or replace chemical elements taken from the soil by previous crops. The increase in the population and surge in the demand for food products has led to increase in the demand for crop production in agricultural industry. The presence of this demand has led to utilization of controlled release fertilizer with soil to improve the nutrients present in them; hence improve the yield of the crop production. The above-mentioned factors will provide ample opportunities for the development of the market during the forecast period.

The non-agricultural segment dominates the global controlled release fertilizers market. Non-agricultural end-use of the controlled release fertilizer is mostly seen in farming of crops which are used in the production of alternative fuels and biogas. Biodiesel is a liquid fuel produced from renewable sources, such as new and used vegetable oils is a cleaner-burning replacement for petroleum-based diesel fuel. Biodiesel is nontoxic and biodegradable and is produced by combining alcohol with vegetable oil, animal fat, or recycled cooking grease. Biogas is a naturally occurring and renewable source of energy, resulting from the breakdown of organic matter. Biogas can be used readily in all applications designed for natural gas such as direct combustion including absorption heating and cooling, cooking, space and water heating, drying, and gas turbines. The need for huge amount of feedstock in order to produce electricity and fuel resources to form sustainability has driven the demand for controlled release fertilizers market. In addition, the government policies and investments toward the construction of biofuel and biogas production plants have led to increase in the demand for raw materials which will drive the market growth. The above-mentioned factors will provide ample opportunities for the development of the market during the forecast period.

Controlled Release Fertilizers Market By Region

Asia-Pacific segment dominated the global controlled release fertilizers market. China accounted for the majority share of the overall consumption of controlled release fertilizers and was closely followed by India and Japan. Together, these countries held a share of around 87% of its overall demand in this region that year. Over the coming years, the demand for controlled release fertilizers is expected to increase at a faster rate than conventional fertilizers in these countries. As cereals and grains are one of the most important parts of traditional diets in Asia Pacific they hold almost two-third share of the overall calorie intake of an average Asian person - local farmers and agriculturists are being encouraged to uptake sustainable agriculture practices in order to increase their production with the efficient usage of specialty fertilizers such as controlled release fertilizers. The above mentioned policies and investments are major factor driving the growth of the market in this region during the forecast period.

Competitive Landscape

The major companies profiled in this report include Yara International ASA, Nutrien Ltd, The Mosaic Company, ICL Group, Nufram Lts, Kingenta, ScottsMiracle-Gro, Koch Industries, Helena Chemical, SQM, JNC Corporation, Haifa Chemicals, AGLUKON, Pursell Agri-Tech, and Ekompany International BV. The above-mentioned factors will have positive impact on the demand for energy storage devices. Additional growth strategies such as expansion of storage capacities, acquisition, partnership and research & innovation in the sustainable chemical fertilizers have led to attain key developments in the global controlled release fertilizers market trends.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the controlled release fertilizers market analysis from 2021 to 2031 to identify the prevailing controlled release fertilizers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the controlled release fertilizers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global controlled release fertilizers market trends, key players, market segments, application areas, and market growth strategies.

Controlled Release Fertilizers Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.3 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 305 |

| By Type |

|

| By Mode of Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | ICL Group, JNC Corporation, ScottsMiracle-Gro, SQM, Pursell Agri-Tech, Nufram Lts, Kingenta, Koch Industries, AGLUKON, Nutrien Ltd, Yara International ASA, helena chemical company, Haifa Chemicals, Ekompany International BV, The Mosaic Company |

Analyst Review

According to CXO Perspective, the global controlled release fertilizer market is expected to witness increased demand during the forecast period, due to surge in the demand for food products owing to surge in population across the globe.

Controlled release fertilizers are types of fertilizers used to decrease the loss of nutrients to the environment. It extends the availability period of nutrients for plant consumption as compared to conventional fertilizers. It is an effective alternative to conventional fertilizers due to their advantages like environment friendly, resource saving, and labor saving. However, because of their high price in comparison to conventional fertilizer, their use is still limited to small scale applications.

Increase in consumption of bio-fuel and bio-energy in Europe increased the demand for fodder crops. Fodder crops are the more fertilizer-consuming crops, which boosted the demand for the consumption of fertilizers in Europe. Fertilizers play an important role in improving plant growth and productiveness, resulting in enhanced soil fertility and maximum yield.

The increase in adoption of precision farming technology and increase in environmental concerns are the key factors boosting the Control release fertilizers market growth.

The market value of Control release fertilizers in 2031 is expected to be $4.3 billion

Yara International ASA, Nutrien Ltd, The Mosaic Company, ICL Group, Nufram Lts, Kingenta, ScottsMiracle-Gro, Koch Industries, Helena Chemical, SQM, JNC Corporation, Haifa Chemicals, AGLUKON, Pursell Agri-Tech, and Ekompany International BV.

Agriculture industry is projected to increase the demand for Control release fertilizers Market

The global controlled release fertilizer market is segmented on the basis of type, mode of application, end-use, and region. On the basis of type, it is segmented into slow release, nitrogen stabilizer, and coated & encapsulated. On the basis of mode of application, the market is segmented into foliar, fertigation, soil, and others. On the basis of end-use, the market is segmented into agricultural, and non-agricultural. Furthermore, agricultural segment is further classified into cereals & grains, oilseed & pulses, fruits & vegetables, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Increase in utilization in emerging economies is the Main Driver of Control release fertilizers Market.

Post pandemic crisis, the governments of various countries across the globe have invested in the fertilizer industries to provide boost in the agriculture sector and improve the crop yield. The decline in food resources during the pandemic outbreak period has led to national food security issues, especially in African continent where most of its population is starving is also another factor which led to surge in the utilization of controlled release fertilizer industry.

Loading Table Of Content...