Cornmeal Market Research, 2031

The global cornmeal market size was valued at $729.40 million in 2021 and is projected to reach $1.05 billion by 2031, growing at a CAGR of 3.9% from 2022 to 2031.

Cornmeal is a fair source of magnesium and thiamine. It is also the best source of selenium. Cornmeal is made from dried corn such as polenta, grits., Cornmeal is also an outstanding source of vitamin folic acid and B6. Since cornmeal is gluten-free, it mixes with flour to create the brittle texture used in baked goods. Coarse ground cornmeal is an important ingredient in North American cuisine. As a grain and as part of a healthy diet, cornmeal can offer several health benefits. There are different types of cornmeal such as Corn flour is the smallest, silkiest grind of cornmeal. Use it to make melt-in-mouth sablé cookies or moderate tempura batter. Fine and medium cornmeal is for daily purposes, use them for cornbread, ricotta pound cake, strawberry snacking cake, corn muffins, or pancakes.

Coarse cornmeal will make cakes gritty and pebbly, so keep that for breading catfish, making Southern-style cornbread (in that customers want that toothsome texture), and growing crunchy blueberry crisp topping or creamy, cheesy polenta.

Grits are coarsely ground white cornmeal, with an extra subtle, touchy flavor from the white corn. Use it to make the decadent shrimp and pimiento cheese grits.

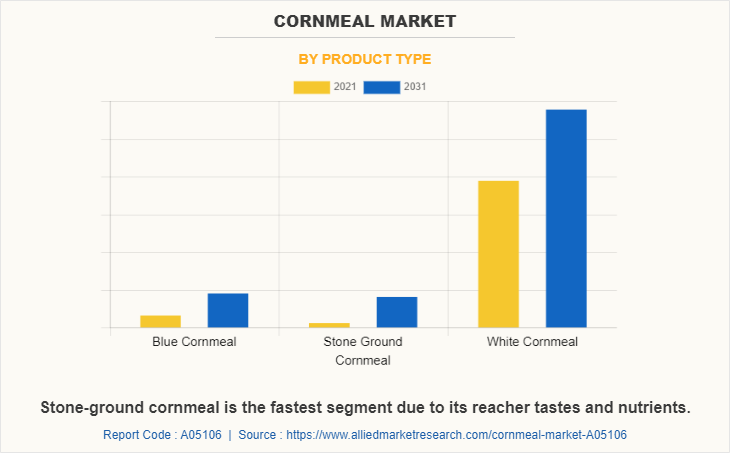

Blue cornmeal is generally an heirloom variety with indigenous roots in the course of the American South. Its sedation gives it a sweet, precise flavor.

Yellow cornmeal has the most remarkable corn flavor, at the equal time as white cornmeal has an extra touchy, subtle flavor.

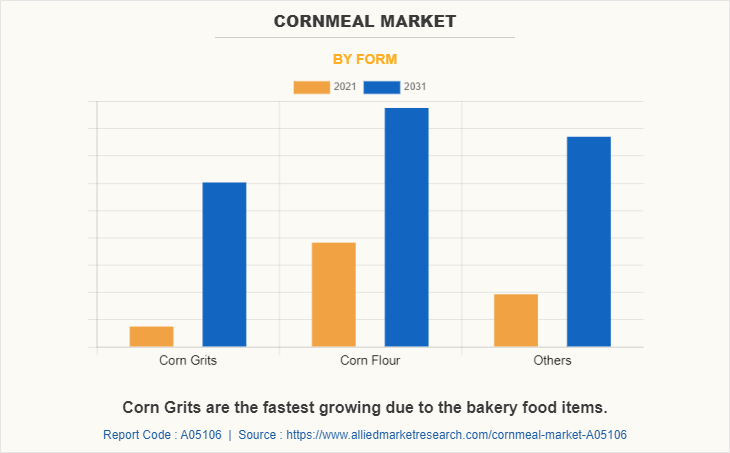

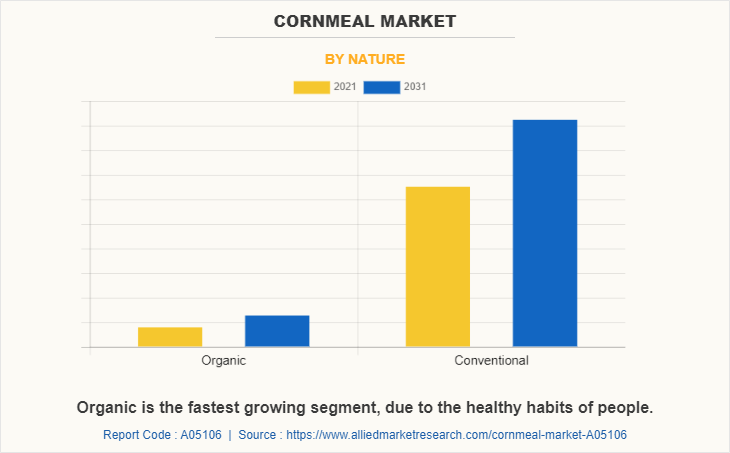

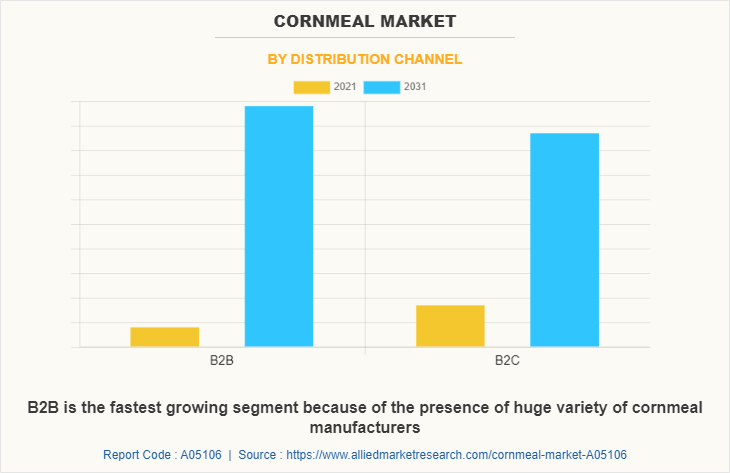

Polenta is a dish of cornmeal porridge that originated among farmers in Northern Italy. Today, it`s a staple on many Italian American tables and Italian and modern American restaurant menus alike. Polenta is also billed as an ingredient, and in recipes, the term is often used interchangeably with cornmeal. To make polenta, add corn Masara to boiling salt water and cook over low heat with frequent stirring until the mixture is thick. Warm polenta seasoned with freshly ground pepper and sea salt is perfect for numerous beef, chicken, or vegetarian dishes. According to cornmeal market analysis, the global market is segmented on the basis of form, nature, product type, distribution channel, application, and region. On the basis of form, the market is classified into corn grits, corn flour, and others. On the basis of nature, the market is segmented into organic and conventional. On the basis of product type, the market is segmented into blue , stoneground and white cornmeal. By distribution channel, it is categorized into B2B and B2C. On the basis of application, it is categorized into the food industry and animal feed. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The corn grits segment is the fastest-growing segment in the global cornmeal market size, owing to the adoption of innovative and latest tastes in food products. The market is more concentrated in North America and grows rapidly in Europe. Developing regions of Asia-Pacific and LAMEA are anticipated to provide great opportunities to the market during the forecast period.

The organic segment is the fastest-growing segment in the global market. This is attributed to the ease of healthy and growing demand for a healthy lifestyle. Moreover, this type of organic cornmeal is easy to digest.

The stone-ground segment is the fastest-growing segment in the global market. This retains approximately germs and stains, so it gives a thicker texture and more attractive flavor to baked goods. Moreover, this stone-ground segment various nutritious products and helps to grow the market.

The B2B segment is the fastest-growing segment in the global market, owing to the adoption of innovation and the latest technology. The market is more concentrated in North America and grows rapidly in Europe.

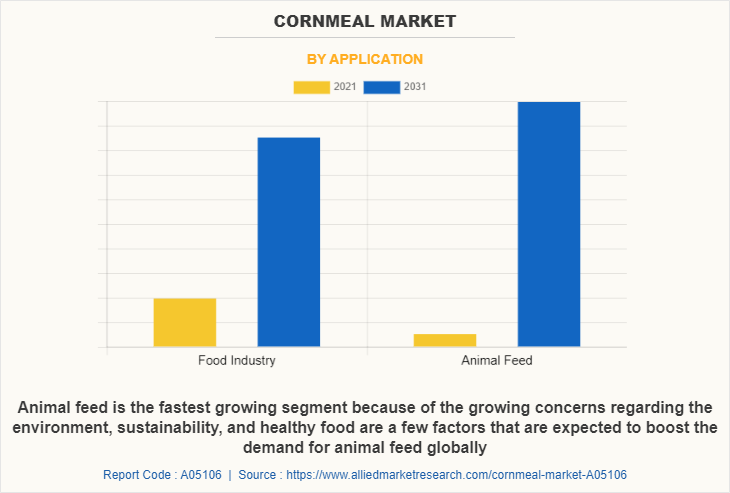

Animal feed is the most lucrative segment in the global cornmeal machine market, owing to the growing number of food products. In addition, the rising trend of animal life is also driving the cornmeal market growth of the segment.

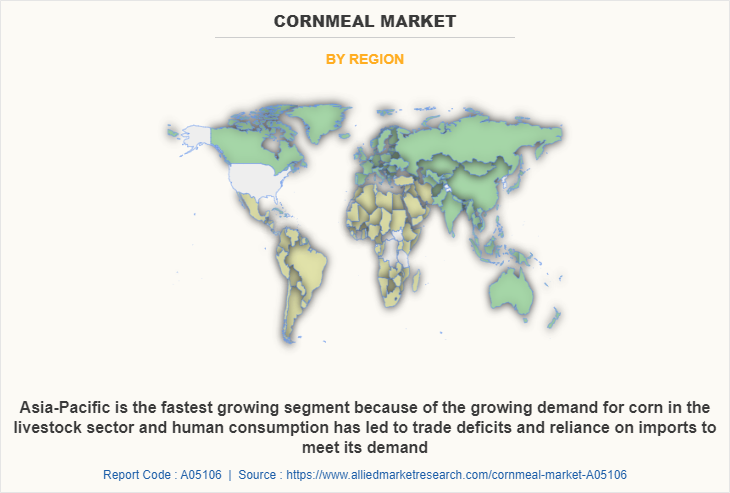

Region-wise, Asia-pacific dominated the market with the largest cornmeal market share during the cornmeal market forecast period. The factors such as rising disposable income, growing population, rise in recreational activities, and growing trend of parties in mid-weeks are propelling the cornmeal market growth of the anti-caking agent market in the North American region.

The Cornmeal Global Business research illustrates potential developments in advertising methods and other research findings. The report is an in-depth guide to comprehending cornmeal industry dynamics and preparing for the right business. Furthermore, the evaluation of costs, supply chain, commodity requirements, industry constraints and breakthroughs of cornmeal is implemented.

The major players analyzed for the cornmeal industry are Cargill, Bunge Limited, General Mills, Dover Corn Products Ltd, Archer Daniels Midland Company, Semo Milling, and Lifeline foods ltd. The key market players are adopting various strategies such as partnership, collaboration, mergers, and acquisitions to increase their share in the global market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2021 to 2031 to identify the prevailing cornmeal market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cornmeal market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cornmeal market trends, key players, market segments, application areas, and market growth strategies.

Cornmeal Market Report Highlights

| Aspects | Details |

| By Form |

|

| By Nature |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | SEMO MILLING, ASSOCIATED BRITISH FOODS, TATE AND LYLE, DOVER CORN PRODUCTS LTD, ARCHER DANIELS MIDLAND, LIFELINE FOODS, BOB’S RED MILL NATURAL FOODS, BUNGE, C.H. GUENTHER AND SON, GRUMA |

Analyst Review

The rise in technological advances and improvements have positively impacted the overall cornmeal market dynamics. The introduction of new technology in the market helps increase the production of cornmeal.

Corn is an important source of feed, fuels, exports, derivatives such as starch and sweeteners, and bioproducts such as paper, plastics and cosmetics. To supply this wide-growing market, US corn production has expanded over the past few decades. Since 1996, corn acreage in the United States has increased by more than 10%, reaching 40% in the northern Great Plains region (see map below). At the same time, the average yield of corn increased by more than 40%. The USDA Economic Research Service (ERS) report, released in July 2021, identifies and investigates technological and structural changes in US maize production since 1996, which are production cost, net yield, and productivity we focused on how they affected yields. To track these trends in maize production, researchers from 1996 to 2016 from the Agricultural Resource Management Survey (ARMS) and NASS Agricultural Census edited by the National Agricultural Statistics Service (NASS) of ERS and USDA.

An analysis of responses to the ARMS survey of maize farms from 1996 to 2016 showed that 20 years of new advanced techniques were reflected in changes in acreage and yield. In particular, the introduction of genetically modified seed varieties has progressed rapidly. For example, the proportion of single pest-resistant cultivars containing the protein of the bacterial pesticide Bacillus thuringiensis (Bt) increased from 2% of the corn acreage in 1996 to 21% in 2001 and 2016. Increased to 78%. Insecticide-tolerant varieties emerged in 3% of acres in 1996, expanded to 16% in 2001 and 84% in 2016. In 2016, growers planted some form of GM seeds on 91% of corn acres, many of which are "stacked" cultivars. It provides three or more protective properties, including resistance to multiple pests, pesticide resistance, and drought resistance. New seed technology has helped increase corn production in a variety of ways. Farmers were able to plant corn seeds more densely and early in the growing season. In addition, growers have expanded corn acreage as pest resistance and drought tolerance have enabled profitable production in previously problematic areas. Genetically modified seeds have also changed other production practices. For example, an increase in the use of drought-resistant seeds was consistent with a slight decrease in irrigated areas, and an increase in the use of insect-resistant seeds was consistent with changes in chemical application.

The global cornmeal market size was valued at $729.40 million in 2021 and is projected to reach $1.05 billion by 2031

The global Cornmeal market is projected to grow at a compound annual growth rate of 3.9% from 2022 to 2031 $1.05 billion by 2031

SEMO MILLING, ARCHER DANIELS MIDLAND, LIFELINE FOODS, DOVER CORN PRODUCTS LTD, BUNGE, GRUMA, ASSOCIATED BRITISH FOODS, C.H. GUENTHER AND SON, TATE AND LYLE, BOB’S RED MILL NATURAL FOODS

Region-wise, Asia-pacific dominated the market

Health benefits associated with consuming cornmeal, increase in demand for gluten free ingredients, rise in use of cornmeal in animal feed product, and surge in use of cornmeal in bakery products drive the growth of the global cornmeal market.

Loading Table Of Content...