Corporate Lending Market Research, 2031

The global corporate lending market was valued at $17.6 trillion in 2021, and is projected to reach $47.2 trillion by 2031, growing at a CAGR of 10.7% from 2022 to 2031.

Corporate lending is the financial support provided to businesses and other similar entities to cover ongoing costs, expand, and pay working capital needs, and others. These loans can include working capital financing, term loans, letter of credit, and infrastructure financing. The corporate lending solutions are the best way for businesses to focus on their growth and generate more revenue.

The flexible long-term lending offered by corporate lending options acts as a major driver in the market. In addition, the market is boosted by increasing collaboration between digital lending organizations, FinTech companies for payment collection and green lending company. However, non-performing assets (NPA), especially during the pandemic, hampered the growth of the market. On the contrary, developing economies are increasingly digitizing various banking operations owing to the tech-savvy generation. Moreover, the advancements in smartphones have enabled many companies to provide lending services on applications. Moreover, the growing adoption of digital lending services among euro lending company is expected to provide lucrative opportunities for the market to grow.

The report focuses on growth prospects, restraints, and trends of the corporate lending market overview. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the corporate lending market outlook.

The corporate lending market is segmented into Loan Type, Type, Enterprise Size and Provider.

Segment Review

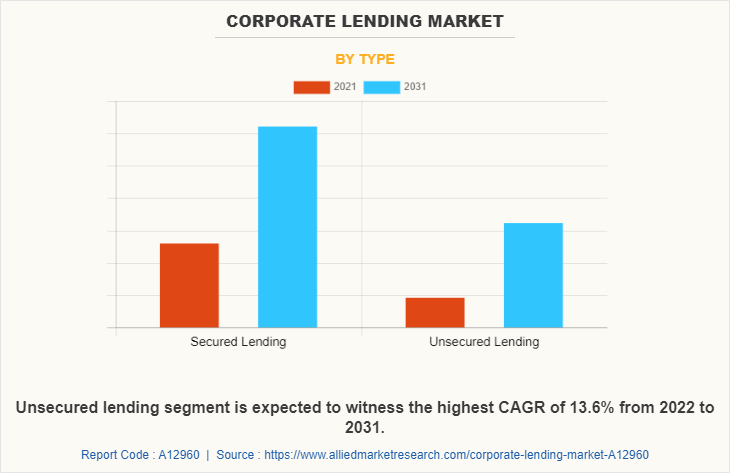

The corporate lending market is segmented into loan type, type, enterprise size, provider, and region. By loan type, the market is fragmented into term loan, overdraft, invoice finance, loan against securities, and others. Depending on type, it is bifurcated into secured lending and unsecured lending. By enterprise size, the market is classified into large enterprises and small & medium-sized enterprises. By provider, the market is categorized into bank, NBFCs, and credit union. Region-wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the secured lending segment attained the highest corporate lending market size in 2021. This is attributed to the lower rates of secured loans and high borrowing limits. Moreover, the secured loans also feature long repayment period which help businesses to comfortably repay the debt. This factor is fueling the growth of secured loans segment in corporate lending market.

Region-wise, Asia-Pacific dominated the corporate lending market share in 2021. This is attributed to the fact that the rise of the technology has changed consumer expectations & behaviour, consumer prefer digital solutions for their financial requirements and hence, banks and financial institutions are adopting technology to serve the rising consumer demands for corporate loans.

The key players that operate in the global corporate lending market include as Ashurst, Bank of America Corporation, Citigroup, Inc., Clifford Chance, CREDIT SUISSE GROUP AG, Goldman Sachs, JPMorgan Chase & Co., JULIUS BAER, Morgan Stanley, and UBS. These players have adopted various strategies to increase their market penetration and strengthen their position in the corporate lending industry.

Market Landscape & Trends

One of the key factors propelling the corporate lending market growth is the introduction of new players in the lending market. For instance, in March 2022, Mobility firm Ola has signed an agreement to acquire neo bank Avail Finance which provides financial services to the blue-collared workforce and has over 6 million users. The acquisition is a key step in Ola's broader push into the fintech space as it looks to build a mobility-focused financial services business under Ola Financial.

Furthermore, the continuous developments and innovations for better consumer experience in the lending market are expected to create lucrative opportunities for corporate lending market to grow during the forecast period. For instance, in June 2022, NeoGrowth, an MSME-focused fintech lender leveraging the digital payments ecosystem, has launched a business loan offering, NeoGrowth Accelerator. NeoGrowth Accelerator is a collateral-free term loan of up to $24,253.28 for the underserved MSME segment comprising manufacturers, distributors, traders, dealers, and service providers. The product is designed to fulfill the working capital requirements of GST-registered MSMEs based on their cash flows.

Moreover, the corporate lending industry's growing innovations and the companies' increasing investments for digitalization propel the growth of the market. For instance, in January 2021, JPMorgan Chase announced that it is expected to offer U.K. consumers a completely new banking choice when it launches a digital retail bank in the coming months. Using the Chase brand, the bank will provide products and features tailored to meet the needs of customers in the U.K., delivered via an innovative mobile app.

The COVID-19 pandemic has had a significant impact on the corporate lending industry, owing to an increase in corporate loans as most of the businesses went bankrupt. In addition, small-business participation in corporate lending was a key factor in this increased development. Many banks reported being overburdened by the increase in corporate loans during the pandemic as firms continued to seek financing. Moreover, COVID-19 has also enhanced the financial industry's attention on digital services, as well as customer demand for them. Owing to the closure of bank offices and significant wait times for phone help, even previously hesitant internet users have turned to these channels for corporate loans during the pandemic. This, in turn, has become one of the major growth factors for the corporate lending market during the global health crisis.

Top Impacting Factors

Lowest Interest Rates of all Loan Options

Corporate lending offers the lowest interest rates of all loan options, enabling business owners or corporates to access critical funding while maintaining lower overhead costs. Moreover, corporate lending typically has lower interest rates than other unsecured borrowing. Choosing to have fixed monthly repayments means borrowers can accurately use them in their business planning and forecasting, enabling them to structure the finance of their business with a bit more certainty. In addition, corporate lending payment plans usually extend for several years which allows a business to focus on other important business matters such as sales, monitoring overheads and training staff. Therefore, this is a major driving factor for the corporate lending market.

Shorter Application Processes

Corporate lending aims to approve loan applications within 24 hours. The application usually takes less time as corporate business finance application is just a matter of filling out an online form, sending a few documents via email, and chatting through the terms of the loan. With this short application process, small business owners can easily apply for corporate loan. The corporate lender uses these documents and decide if they qualify for their financing. If the borrower qualifies, lenders then use this information to determine the loan amount.

Further, various key players are introducing various attractive products for the customers to strengthen the market position. For instance, in January 2022, Kinara Capital has introduced a short-term working capital loan option for its current MSME customers. When managing shifting company objectives, such as trying to complete a new purchase order, printing a new signboard, buying raw materials, stocking up on necessary inventory, and others, MSMEs often operate on a limited budget and usually struggle with constrained cash flow. Hence, MSMEs use a corporate loan for a wide range of company needs. Moreover, corporate lending helps provides the cash injection that borrowers need to invest in new equipment, meet payroll, or afford other business expenses. Therefore, this is a major propelling factor for the growth of the market.

Access to Large Sums of Money

Small business owners often do not have the financial capability to raise funding in the debt or equity markets. Nor do they typically have the contacts to raise funding through venture capitalists. This can make starting a business extremely expensive and risky. However, with a corporate lending, it is possible to cover all the business startup expenses with just one loan. This also makes it significantly less intimidating for business owners without extensive resources to obtain a relatively large amount of funding. In addition, by consolidating all the financing on one loan, corporate lending helps to access large sum of money for small businesses. Therefore, this is a major driving factor for the corporate lending market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the corporate lending market analysis from 2021 to 2031 to identify the prevailing corporate lending market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities in the corporate lending market forecast.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the corporate lending market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global corporate lending market trends, key players, market segments, application areas, and market growth strategies.

Corporate Lending Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 47.2 trillion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 276 |

| By Loan Type |

|

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| By Region |

|

| Key Market Players | GOLDMAN SACHS, CREDIT SUISSE GROUP AG, Citigroup, Inc., Morgan Stanley, Ashurst, UBS, Bank of America Corporation, Clifford Chance, JPMorgan Chase & Co. , JULIUS BAER |

Analyst Review

With advancement in technologies in banking sector, the corporate lending processes have been hassle-free and swift due to which the businesses can conveniently take loans. In addition, the consumers today want to keep track of the status of their loans, mortgages, & credit cards; compare & find lower rates and distinguish & regulate access to their financial information. These advancements in technologies propel the growth of the market. Moreover, corporate loan interest rates are substantially cheaper than credit card loan repayments, which is why people opt for corporate loans.

The COVID-19 outbreak has a significant impact on the corporate lending market and has boosted the corporate lending market owing to bankruptcy of various businesses due to lockdown. Moreover, during this global health crisis, the technological advancements in corporate lending industry have automated long and hectic processes. This, as a result, has promoted the demand for corporate lending, thereby accelerating the revenue growth.

The corporate lending market is fragmented with the presence of key players such as Ashurst, Bank of America Corporation, Citigroup, Inc., Clifford Chance, Credit Suisse Group AG, Goldman Sachs, JPMorgan Chase & Co., Julius Baer, Morgan Stanley, and UBS. Major players operating in this market are adopting various strategies that include business expansion and partnerships to reduce supply and demand gaps. With increase in awareness and demand for corporate lending across the globe, major players are collaborating on their product portfolio to provide differentiated and innovative product.

The corporate lending market is estimated to grow at a CAGR of 10.7% from 2022 to 2031.

The corporate lending market is projected to reach $47.23 billion by 2031.

Lowest interest rates of all loan options, shorter application processes and travel access to large sums of money majorly contribute toward the growth of the market.

The key players profiled in the report include Ashurst, Bank of America Corporation, Citigroup, Inc., Clifford Chance, Credit Suisse Group Ag, Goldman Sachs, JPMorgan Chase & Co., Julius Baer, Morgan Stanley, and UBS.

The key growth strategies of corporate lending market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...