Courier, Express, and Parcel (CEP) Market Insights, 2031

The global courier, express, and parcel (CEP) market was valued at USD 407.7 billion in 2021, and is projected to reach USD 749 billion by 2031, growing at a CAGR of 6.3% from 2022 to 2031. The factors such as the development of the e-commerce industry, rise in trade-related agreements, and increase in demand for the fast delivery of packages supplement the growth of the courier, express, and parcel market. However, poor infrastructure and higher logistics costs and lack of control of manufacturers on logistics services are the factors expected to hamper the growth of the courier, express, and parcel market. In addition, technological advancements in delivery services and emergence of last-mile deliveries coupled with logistics automation create market opportunities for the key players operating in the market.

Key Market Trends

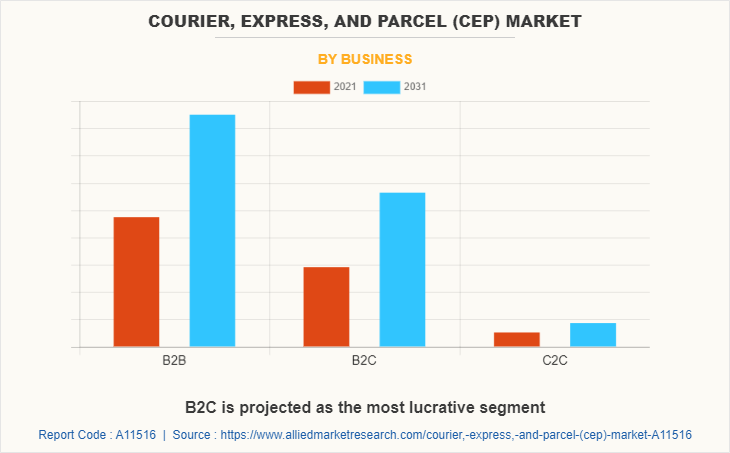

- B2C segment is projected to register the fastest growth in the courier, express, and parcel market.

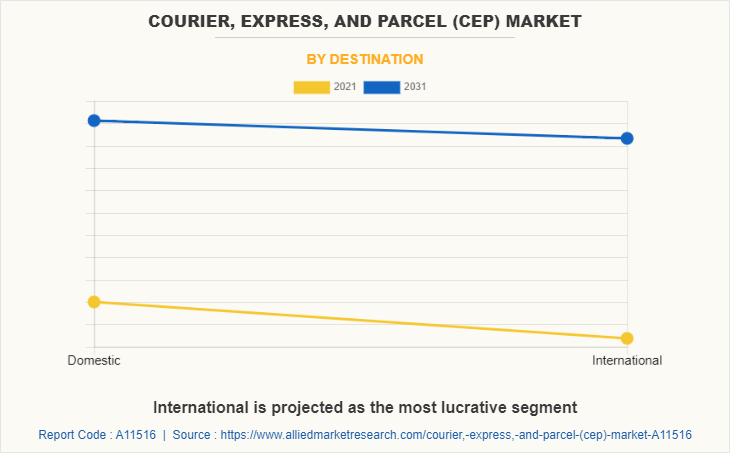

- International deliveries are expected to dominate in terms of growth rate.

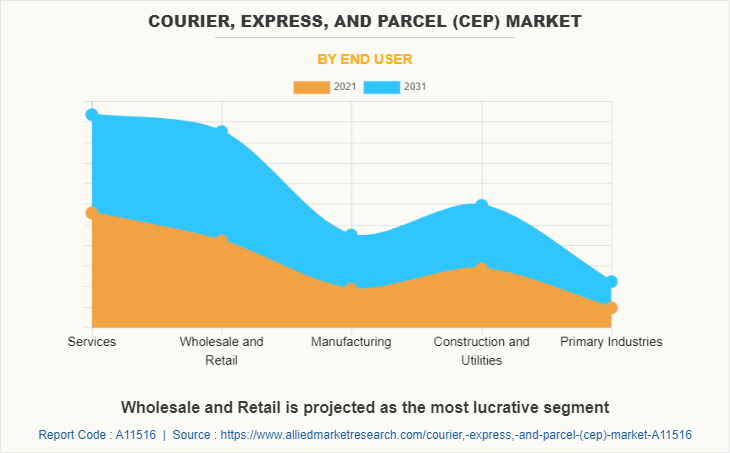

- Wholesale & retail segment is anticipated to lead the market growth among end-users.

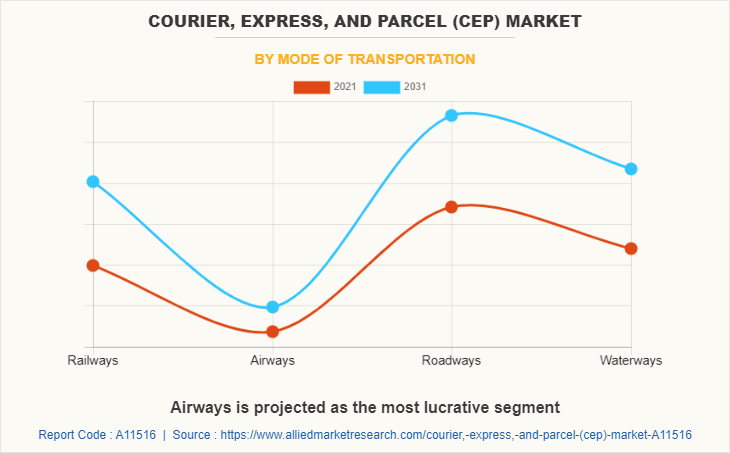

- Airways transport is projected to dominate the market growth by destination.

Market Size & Forecast

- 2031 Projected Market Size: USD 749 billion

- 2021 Market Size: USD 407.7 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 6.3%

Introduction

Courier, express, and parcel (CEP) services deliver parcels and documents to numerous customers, such as retail customers, government agencies, and business customers. It involves the delivery of various goods and products through different mediums such as air, water, and land across regions. The service operator delivers non-palletized packages and charges a specific rate based on the package's weight and the urgency of delivery of the package. Currently, the courier, express, and parcel (CEP) service providers are gaining traction across the globe due to safe delivery options, cost-effectiveness, and parcel tracking facilities.

The increase in courier, express, and parcel (CEP) market growth is estimated in developing countries owing to the increase in international trade across regions, the rise in internet-based services, and the growing number of smartphones among users. Also, technological advancements, including the utilization of digital technologies with crowd-sourced delivery models, are creating a positive outlook for the market. For instance, in June 2022, DHL Parcel UK announced a new partnership with ZigZag, the technology platform specializing in e-commerce returns. ZigZag network of over 100 retailers, including Selfridges, GAP, and Superdry, will now have access to DHL Just Right Returns service, a fast, convenient, and high-quality returns solution.

Market Dynamics

The courier, express, and parcel (CEP) market is segmented into business, destination, end-user, mode of transportation, and region. By business, the market is divided into B2B, B2C, and C2C. By destination, it is fragmented into domestic and international. By end-user, it is categorized into services, wholesale & retail trade, manufacturing, construction & utilities, and primary industries. By mode of transportation, it is further classified into railways, airways, roadways, and waterways. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Which are the Top Courier, Express, and Parcel (CEP) companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the courier, express, and parcel ndustry.

- Aramex

- Deutsche Post AG

- FedEx

- One World Express Inc. Ltd

- Poste Italiane

- PostNL Holding B.V.

- Qantas Airways Limited

- Royal Mail Group Limited

- SF Express

- Singapore Post Limited

- United Parcel Service of America, Inc.

- Yamato Transport Co., Ltd.

What are the Top Impacting Factors

Key Market Driver

Development of the e-commerce industry

E-commerce is a virtual store where goods & services do not need any physical space and are sold through websites. Although the e-commerce industry utilizes courier, express, and parcel services to manage and oversee the supply chain of e-commerce companies. Moreover, easy availability, convenient shopping experiences, and heavy discounts, offers & deals make e-commerce a popular medium for purchasing various products. These factors have collectively contributed to the growth of the market for e-commerce services. Furthermore, rising cross-border trade channels have boosted international trade and B2C shipment adoption, especially in developing nations. For instance, in June 2022, Aramex PJSC acquired Access USA Shipping LLC (MyUS), a technology-driven platform enabling cross-border e-commerce, for a cash purchase price of $265 million.

In addition, in October 2019, FedEx Cross Border, a subsidiary of FedEx, expanded its global e-commerce business to new locations in Saddle Brook, NJ (U.S.), Fontana, CA (U.S.), and Venlo (The Netherlands). This expansion enables FedEx Cross Border to help more merchants reach new customers in over 200 countries and territories worldwide. Furthermore, the growth in consumer preference for shopping online through several e-commerce portals also boosts market growth.

In addition, COVID-19 contributed to the development of the e-commerce industry across the globe. Various governments imposed lockdowns in their regions to limit the spread of the virus. As there was no access to a physical marketplace, people started to purchase goods or products online, resulting in the development of the e-commerce sector. For instance, according to the U.S. Census Bureau 2020, the U.S. retail e-commerce industry extended by $211.5 billion, up 31.8% from the first quarter of 2020 and 44.5% year-over-year.

Rise in trade-related agreements

Dynamic market conditions and development in the global economy are the key factors driving globalization. Thus, due to globalization, several trade-related activities have witnessed an increase. Moreover, the development of the overseas market is a significant factor that fuels the market's growth. Courier, express, and parcel services are vital for price-sensitive customers who require a wider choice of high-quality products with timely delivery. Thus, the increase in trading activities due to globalization fuels the growth of the courier, express, and parcel market. For instance, in 2019, Nepal and China signed the protocol on implementing an agreement on transit and transport along with six other agreements to enable Nepal to access Chinese sea and land ports. China has agreed to let Nepal use Tianjin, Shenzhen, Lianyungang, and Zhanjiang open seaports and Lanzhou, Lhasa, and Xigatse dry ports for trading with other countries. In addition, in December 2020, India and the UK announced a plan to finalize free trade agreement (FTA) in areas such as pharmaceuticals, fintech, chemicals, defense manufacturing, petroleum, and food products by 2021.

Restraints

Poor infrastructure and higher logistics costs

The availability and quality of infrastructure are the key components in determining the courier, express, and parcel services globally. It is observed that in terms of infrastructure, the services suffer from limited capacity and capability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption, and poor skills of delivery professionals. Also, poor road transportation infrastructure is one of the key issues affecting the courier, express, and parcel market. Moreover, metropolis traffic congestion is a major issue in the population concentrated areas which affects the market. In addition, air freight transport is very important for the delivery of items, especially for international parcel deliveries that are time-bound. As many countries lack postal codes and rely on local landmarks for addresses, shipping companies often have trouble delivering parcels successfully. Furthermore, factors such as lack of skilled manpower, poor IT infrastructure, and over-reliance on cash-on-delivery (CoD) payment also affect the growth of the market in several countries across the globe. Therefore, poor infrastructure is anticipated to hinder the growth of the courier, express, and parcel market.

Opportunity

Technological advancements in delivery services

Technological advancements, such as increased penetration of the Internet of things (IoT), GPS tracking, and others, boost the growth of the courier, express, and parcel services market. Moreover, some courier service providers are increasing spending and using technologically advanced systems for delivery enhancement. These technologies aid the service providers in improving their overall operational efficiency and effectively meeting the customers' requirements. For instance, in November 2019, express courier service provider, Ninja Van, invested in apps and technologies to give better experiences to customers. Ninja Van joined forces with the ride-hailing company, Grab, to provide a nationwide delivery service through GrabExpress. Customers can send goods on Grab app with real-time tracking. Furthermore, technological advancements, including using digital technologies with crowd-sourced delivery models, create a positive outlook for the CEP market. These technologies aid the service providers in increasing their overall operational efficiency and effectively meeting the customers' requirements. Automated package and freight shipping solutions are available to improve efficiency for the entire shipping process of retail vendors.

Furthermore, the trend for delivery of packages utilizing drones and other autonomous vehicles has increased due to technological advancement and the demand for faster delivery of packages. For instance, in September 2019, FedEx collaborated with Wing Aviation LLC, an Alphabet company, to launch a first-of-its-kind drone delivery service in Christiansburg, Virginia. The pilot program will demonstrate the benefits of drone delivery to communities by exploring methods to enhance last-mile delivery service, improve access to health care products, and create a new avenue of growth for local businesses. Thus, technological advancements are expected to offer future growth opportunities for the courier services market.

Key Benefits for Stakeholders

- This study presents an analytical depiction of the global courier, express, and parcel market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall courier, express, and parcel market opportunity are determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global courier, express, and parcel market with a detailed impact analysis.

- The current courier, express, and parcel market are quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Courier, Express, and Parcel (CEP) Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 749 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 305 |

| By Business |

|

| By Destination |

|

| By End User |

|

| By Mode of Transportation |

|

| By Region |

|

| Key Market Players | United Parcel Service of America, Inc., Royal Mail Group Limited, PostNL Holding B.V., Singapore Post Limited, Yamato Transport Co., Ltd., ARAMEX, Qantas Airways Limited, Poste Italiane, DHL, SF Express, one world express inc. ltd, FedEx |

Analyst Review

This section provides the opinions of various top-level CXOs in the global courier, express, and parcel market. The growing demand to reach the customer expectations by delivering the services on time has created a huge demand for the market. In addition, increasing the expenditure capacity of individuals and the burgeoning e-commerce industry on account of the shifting consumer preferences towards online shopping is contributing to market growth. For instance, according to Digital Commerce 360’s analysis of the U.S. Department of Commerce figures, U.S. consumers spent $861.12 billion online, up a 44.0% year-over-year growth. Similarly, according to a report from the National Intellectual Property Administration, cross-border e-commerce transactions in China are estimated to reach to around $3.15 trillion (¥20.5 trillion) in 2022, maintaining an annual growth rate of 30%.

In addition, expansion of private firms to serve wide range of services in the courier, express, and parcel sector is expected to drive the market growth. For instance, in January 2022, Urb-it, a fast-expanding sustainable logistics network, announced the debut of its sustainable delivery services in Spain. This is the next step in Urb-ambitious it's expansion strategy across Europe, with Spain joining France and the UK as the third market. Also, strategic partnerships within the grocery stores & logistics operators supplements the market growth. For instance, in January 2019, Supermercato24, a same-day delivery service for online grocery entered into a partnership with Lidl to support the same day delivery infrastructure. These companies are aimed at delivering ordered groceries to customers at their home in a shorter time span

The growth of the global courier, express and parcel (CEP) market is backed by numerous factors such as evolution of the e-commerce industry, surge in trade-related agreements, and increment in demand for the fast delivery of packages which boosts the growth of the courier, express, and parcel market across the globe. However, the restraining factors such as impoverished base & higher logistics costs and inconsistent control of manufacturers on logistics services are the factors hampering the growth of the courier, express, and parcel market in the current scenario. In addition, technological updation in delivery services and the implementation of last-mile deliveries coupled with logistics automation create numerous opportunities for the growth of the courier, express, and parcel (CEP) market across the globe.

Among the analyzed regions, Asia-Pacific is the hghest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to grow at a suitable CAGR during the forecast period, due to increasing consumer preference for the availability of products efficiently across the region.

The key players operating in the courier, express, and parcel market are Aramex, Deutsche Post AG, FedEx, One World Express Inc. Ltd, Poste Italiane, PostNL Holding B.V., Qantas Airways Limited, Royal Mail Group Limited, SF Express, Singapore Post Limited, United Parcel Service of America, Inc., and Yamato Transport Co., Ltd.

The global courier, express, and parcel market was valued at $407,655.6 million in 2021, and is projected to reach $749,018.3 million by 2031, registering a CAGR of 6.3% from 2022 to 2031

Asia-Pacific is the largest regional market for Courier, Express, and Parcel (CEP)

Usage in Wholesale And Retail are the leading application of Courier, Express, and Parcel (CEP) Market

Increased roadways transportation for CEPs are the upcoming trends of Courier, Express, and Parcel (CEP) Market in the world

Loading Table Of Content...