Cyber Warfare Market Overview

The global cyber warfare market size was valued at USD 37.5 billion in 2022, and is projected to reach USD 127.1 billion by 2032, growing at a CAGR of 13.3% from 2023 to 2032.

Surge in rise in advance cyberattacks and increased dependence on technology are the major factors that is striking the market growth during the forecast period. However, shortage of shared real-time information on rapidly evolving threats and insufficiently trained workforce to address new threats are primarily restraining the market growth. Moreover, increase in reliance on connected systems and technology is expected to create a lucrative opportunity for the market growth during the forecast period.

The market for cyber warfare is a rapidly expanding market that includes a number of goods, services, and technological advancements associated with the application of digital strategy in conflict. It involves the deployment of cyber capabilities to interfere with, harm, or destroy an adversary's computer systems, networks, or information infrastructure of an adversary to gain a strategic advantage or accomplish particular military goals. This market consists of a number of different facets, including cyber threat intelligence, offensive and defensive cyber capabilities, cyber intelligence, cyber weapons, and cyber training and simulation. The development and implementation of advanced tools and methods to launch cyberattacks on systems of opponents are instances of offensive cyber capabilities.

However, defensive cyber capabilities concentrate on shielding vital networks and infrastructure from online dangers. Moreover, the cyber warfare market includes the establishment and utilization of cyber weapons, which are created with the purpose of finding and exploiting loopholes in computer systems and networks. Critical infrastructures, such as power grids, financial systems, or communication networks, are expected to be affected by or rendered inoperable by these weapons.

Segment Overview

The market is segmented into component, end user and region. On the basis of component, it is categorized into hardware, software and services. On the basis of end user, it is fragmented into government, corporate and private, aerospace and defense, BFSI, healthcare and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report focuses on growth prospects, restraints, and analysis of the global cyber warfare market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global cyber warfare market share.

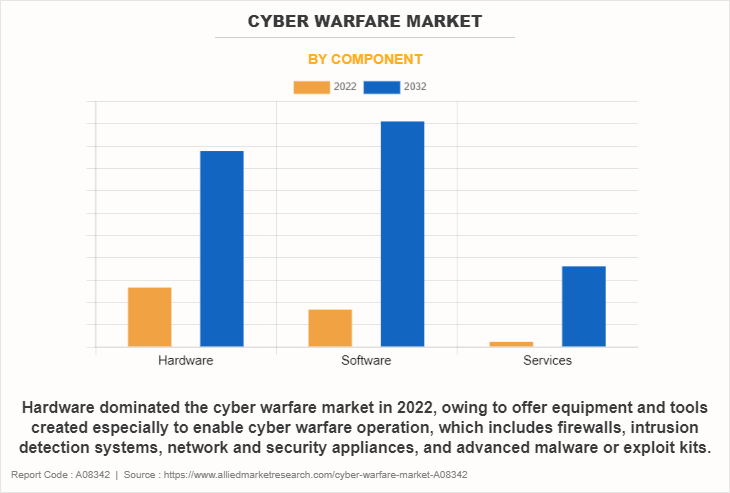

On the basis of component, hardware segment dominated the cyber warfare market in 2022 and is expected to maintain its dominance in the upcoming years owing to offer equipment and tools created especially to enable cyber warfare operation, which includes firewalls, intrusion detection systems, network and security appliances, and advanced malware or exploit kits propels the market growth significantly. However, the software segment is expected to witness the highest growth, owing to offer a wide variety of capabilities, including data analysis, vulnerability assessment, intrusion detection and prevention, network reconnaissance and scanning, exploit development, and malware generation and distribution.

Region-wise, the cyber warfare market size was dominated by North America in 2022 and is expected to retain its position during the cyber warfare market forecast period, owing to the factors such as the increasing use of smartphones and enhanced internet connectivity aiding the growth of the market. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to enables enterprises and managed security service providers to improve operational efficiencies, cost-effectiveness, and security outcomes is expected to fuel the market growth in this region.

Top Impacting Factors

Rise in Advance Cyber Attacks

Cyber threats have multiplied and become more complicated. The cyber warfare industry is significantly being driven by the development in complexity of cyber threats. Cyber threats have become more prevalent as society gets more digitalized and technology develops. Cyber attackers, such as state-sponsored hackers, criminal gangs, and hacktivists, have continually come up with novel and highly technical ways to exploit weaknesses in digital systems. These dangers are able to take many different forms, from targeted attacks on particular businesses or people to massive operations intended to damage vital infrastructure or steal confidential information.

In addition, as attackers use innovative methods such as advanced persistent threats (APTs), zero-day exploits, and social engineering techniques, the complexity of cyber threats has also grown. These strategies frequently go over traditional security measures, which makes it more difficult to identify and defend against cyberattacks. Governments and defense organizations have become more aware of the necessity to build up powerful cyber warfare capabilities to effectively protect their vital infrastructure, national security, and citizen data.

Furthermore, continuous investment in R&D is also necessary to remain ahead of dynamic dangers due to the increase in quantity and complexity of cyber threats. The need for innovative cyber warfare techniques, technologies, and skills is fueled by this. Governments and defense organizations across the globe have invested a huge number in cyber defense and offense capabilities to ensure successful identification, determination, and response to cyber threats. This expenditure involves the development of offensive cyber capabilities to confront prospective adversaries, and project power in cyberspace.

Increased Dependence on Technology

Nations have been increasingly depending on technology and the internet for various areas of their daily operations, including national security and defense, in an increasingly globalized world. Governments have realized the significance of cyber warfare capabilities to protect their interests and defend against potential cyber threats as geopolitical tensions increase and wars develop. The connectivity of digital environment has made it simpler for both state-sponsored and non-state actors to conduct cyberattacks against other countries.

In addition, cyberattacks have become a popular choice for nations to conduct covert operations without being directly identified due to the anonymity and deniability they offer. This has increased the demand for states to have the ability to conduct cyber warfare in order to establish deterrence and respond to future cyber threats. Furthermore, geopolitical unrest and conflict also result in cyber espionage, and theft of confidential data or intellectual property. Nations involved in conflict or rivalries frequently target vital infrastructure, governmental networks, and private sector businesses of one another to acquire a competitive edge. The cyber warfare market has expanded due to the rise in demand for cybersecurity services and products.

Key Market Players

The key players operating in the cyber warfare industry include BAE Systems, Cisco Systems, Inc., DXC Technology Company, RTX, Booz Allen Hamilton Inc., General Dynamics Corporation, Intel Corporation, L3Harris Technologies, Inc., IBM, and Airbus. Furthermore, it highlights the strategies of the key players to improve the cyber warfare industry share and sustain competition.

Cyber Warfare Market Regional Insights:

The cyber warfare market is experiencing rapid growth across various regions due to increasing geopolitical tensions, rising cyberattacks, and the growing adoption of digital technologies in defense and critical infrastructure.

North America cyber warfare market holds a dominant position in the global cyber warfare market, driven by the significant investments made by the U.S. government in cybersecurity and defense. The U.S. Department of Defense (DoD) and other government agencies are focusing heavily on cyber defense strategies to protect national security from foreign and domestic cyber threats. The presence of leading cybersecurity firms and advanced military technology infrastructure further enhances North America's leadership in this market. Canada is also investing in cyber defense initiatives, supporting the region’s overall market growth.

Europe cyber warfare market is a key player in the global cyber warfare market, with countries like the U.K., Germany, and France leading in cyber defense capabilities. The European Union’s increasing focus on cybersecurity, especially after high-profile cyberattacks on government systems and critical infrastructure, has led to higher investments in this space. The U.K.'s National Cyber Security Centre (NCSC) and similar organizations across Europe are working to enhance the continent’s cyber defense systems. Additionally, rising concerns over cyber espionage and the protection of military and critical infrastructure networks drive demand for cyber warfare solutions.

APAC cyber warfare market is the fastest-growing region in the market, with significant investments being made by countries like China, India, Japan, and South Korea. These countries are increasingly recognizing the importance of cybersecurity in national defense due to rising geopolitical tensions and increased cyberattacks. China, in particular, has become a major player in both offensive and defensive cyber capabilities, investing heavily in developing cyber warfare technologies. India is also expanding its cyber defense infrastructure, with government initiatives focused on protecting critical infrastructure and defense networks. The region’s expanding digital economy and increased military spending are expected to further boost the cyber warfare market.

Latin America and the Middle East & Africa cyber warfare market are emerging markets. In Latin America, countries like Brazil and Mexico are investing in cyber defense initiatives as cyber threats increase alongside digital transformation. The Middle East, especially the UAE and Israel, is also investing heavily in cyber defense technologies due to regional geopolitical tensions and the need to protect critical energy infrastructure.

Key Industry Development

Recent Upgradation/Development in the Market

On May 2023, BAE Systems demonstrates cognitive electronic warfare capabilities and cyber warfare capabilities at Northern Edge 2023 an F-15 flies through the clouds. The rendering of an artist electronic warfare capabilities emanates from the aircraft.

On April 2023, Cisco System Inc enhanced its cyber security portfolio and updated the latest progress towards its vision of the Cisco Security Cloud, a unified, AI-driven, cross-domain security platform. The new XDR solution of Cisco and the release of advanced features for Duo MFA is expected to help organizations better protect the integrity of their entire IT ecosystem.

On October 2023, Booz Allen Hamilton Inc. upgraded its security solutions and expanded its services to bring AI to government offices. Also, Booz Allen’s launched AI factory, aiSSEMBLE™, which provides a holistic approach to designing, developing, and fielding AI for the federal government with reusable components and configurable templates to foster scalable enterprise AI.

Recent Expansion in the Market

On March 2021, L3Harris Technologies, Inc expanded its security solutions and received a contract from Lockheed Martin for development of a new advanced electronic warfare system to protect the international F-16 multirole fighter aircraft against emerging radar and electronic threats.

Recent Product Launch in the Market

On October 2022, BAE Systems launched cybersecurity system for F-16 fighter aircraft. It supports over 100 F-16 onboard systems, including flight- and mission-critical components such as radar, engine control, navigation, communications, crash data recorders, and electronic warfare, mission and flight control..

On April 2023, Raytheon Technologies launched RAIVEN, a revolutionary electro-optical intelligent-sensing capability, which will enable pilots to have faster and more precise threat identification.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the cyber warfare market share, segments, current trends, estimations, and dynamics of the cyber warfare market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The cyber warfare market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing cyber warfare market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the cyber warfare industry players.

The report includes the analysis of the regional as well as global cyber warfare market trends, key players, market segments, application areas, and cyber warfare market growth strategies.

Cyber Warfare Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 127.1 billion |

| Growth Rate | CAGR of 13.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 334 |

| By Component |

|

| By End User |

|

| By Region |

|

| Key Market Players | RTX, Intel Corporation, Booz Allen Hamilton Inc., Cisco Systems, Inc., Airbus, L3Harris Technologies, Inc., IBM, General Dynamics Corporation, BAE Systems, DXC Technology Company |

Analyst Review

The increase in reliance on digital infrastructure across different sectors, including government, defense, banking, healthcare, and energy, is the factor that has driven the industry. Organizations have increasingly networked and digitalized, which increases the risk of cyberattacks and the urgency of having robust cyber defense capabilities. The attack surface for cybercriminals and state-sponsored hackers has grown as cloud computing, IoT devices, and AI have become more widely adopted. The demand for innovative cybersecurity solutions has increased significantly due to this. These solutions include threat intelligence, network security, encryption, and incident response systems. Governments all across the globe have made significant investments in cyber warfare capabilities to safeguard essential infrastructure and security of the nation. In terms of cyber warfare capabilities and investments, the U.S., China, Russia, and Israel are among the top nations. Multiple countries have rapidly developed offensive cyber capabilities to obtain an advantage in the global geopolitical environment. In addition, the market has experienced the growth of private sector actors providing services for both offensive and defensive cyber warfare. These businesses offer specialized knowledge and tools to businesses seeking to defend their digital assets and conduct offensive cyber operations against rivals. However, the market for cyber warfare addresses a number of difficulties, including a shortage of cybersecurity experts, a complicated regulatory environment, and the quick evolution of cyber threats. Furthermore, it continues to be extremely difficult to attribute cyberattacks, making it impossible to hold guilty parties accountable.

For instance, in April 2023, Raytheon Technologies launched RAIVEN, a revolutionary electro-optical intelligent-sensing capability, which enables pilots to have faster and more precise threat identification. RAIVEN can identify objects optically and spectrally simultaneously in real-time a single electro-optical/infrared, or EO/IR, system has never been able to do this before. The 'intelligent sensing' capability of RAIVEN uses AI, hyperspectral imaging, and light detection and ranging, or LiDAR, to enable operators to see up to five times farther and clearer than traditional optical imaging. This helps increase platform survivability and gives the warfighter decision advantage over peer threats.

The Cyber warfare Market was valued for $37,513.42 million in 2022 and is estimated to reach $127,052.97 million by 2032.

The Cyber warfare market is projected to grow at a compound annual growth rate of 13.3% from 2023 to 2032.

BAE Systems, Cisco Systems, Inc., DXC Technology Company, RTX, Booz Allen Hamilton Inc., General Dynamics Corporation, Intel Corporation, L3Harris Technologies, Inc., IBM, and Airbus. are the top companies to hold the market share in Cyber Warfare.

North America is the largest regional market for Cyber Warfare

Rise in advance cyberattacks and increased dependence on technology are the upcoming trends of Cyber Warfare Market in the world.

Loading Table Of Content...

Loading Research Methodology...