Dairy Market Research, 2032

The global dairy market size was valued at $883.2 billion in 2022, and is projected to reach $1.5 trillion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

The dairy industry consists of milk production, milk processing for sale, and dairy product manufacture. Milk, yoghurt, cheese, butter, cream, and other dairy products are available on the dairy market.

Market Dynamics

Consumer trends such as the desire for healthy and "clean label" products, growing demand for "functional foods," and higher protein consumption will drive industry innovation. While strong technological capabilities are essential for capitalizing on these trends, they are insufficient. The capacity to find and leverage consumer insights from local marketplaces is also critical for increasing value for consumers and producing better margin products.

Furthermore, various trends, such as the rise of a healthy snacking culture, increased food consumption outside the home, and the rise of online and mobile shopping, are altering the way food is purchased and consumed. Retailers are responding to these shifts by improving their use of technology and data to target customers with personalized offers and ensuring that supply and demand can be met in smaller stores through better inventory management.

The global milk price climbed by 23% in 2021, owing to an imbalance between supply and demand. Dairy products have been advocated as a rich source of protein and an important part of the diet for immune system strengthening. Demand for dairy products increased as the number of COVID-19 infections increased in Asia and other regions of the world. Demand for imported dairy products has been particularly strong in the Chinese market, which increases the future risk to milk prices if exporters rely on only a few trading partners and other countries are unable to absorb the gap in demand near the conclusion of the pandemic. On the supply side, some of the major milk producers and net exporters experienced a tightening of the raw milk pool, driven by high farm input costs, weather-related constraints and increasing uncertainties about the future.

In the coming year, the demand for dairy ingredients will be a determinant factor in dairy market balance. The economic crisis has affected importers hard, and their citizens have had to deal with diminishing purchasing power. China, which announced the decision to relax its zero-Covid policy, is currently inundated with instances, resulting in a severely disrupted domestic dairy market. Furthermore, the dynamism of Chinese collecting and the government's goal to boost domestic dairy production have an impact on imports.

As regards internal demand in the major exporting countries, since demand for dairy products can only be considered inelastic in the short term, it would now seem to be starting to fall, a situation that might become more pronounced if prices continue to rise and consumers continue to lose purchasing power.

Government, non-profit organizations, and consumers are all putting pressure on food firms to establish sustainability policies and set waste and greenhouse emission reduction objectives. With more regulation in this area, coordination along the supply chain to decrease waste and enhance energy management, both on-farm and in-factory, will become increasingly crucial. Arla Foods, for instance, has just introduced a green scheme that pays farmers a premium for their milk if they meet specific environmental standards. Farmers that sign up for Arla's new CARE label make a variety of promises, including allowing cows to graze on grass as long as the weather permits. They are also awarded for environmental initiatives such as the use of renewable energy such as solar and biogas, as well as the improvement of ecosystems and biodiversity.

Segmental Overview

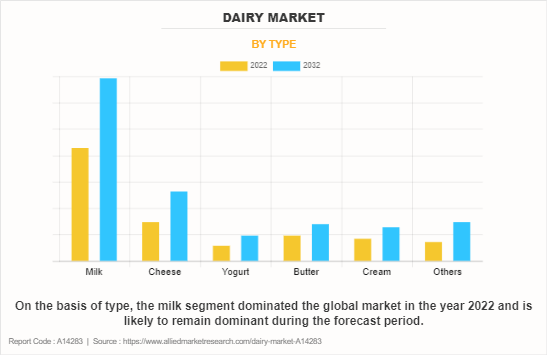

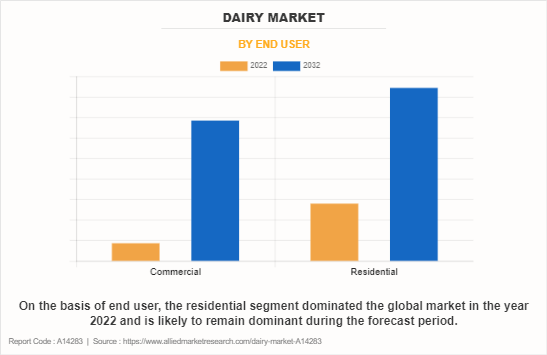

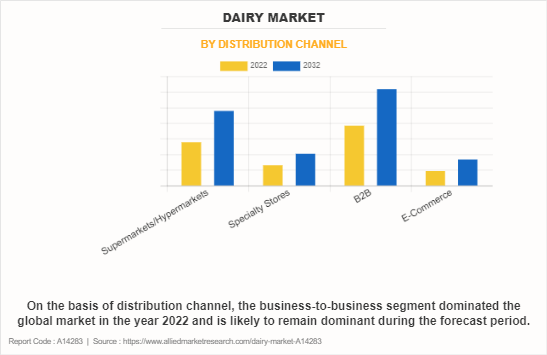

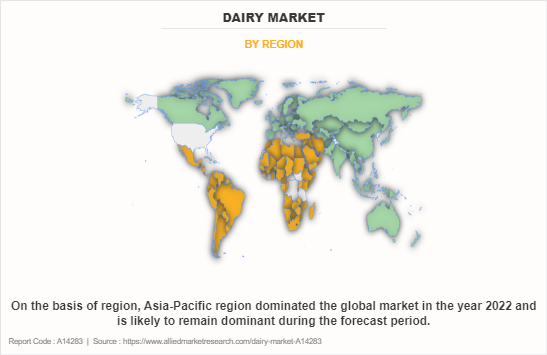

The dairy market is segmented into type, end-user, distribution channel, and region. By type, the dairy market is categorized into milk, cheese, yogurt, butter, cream, and others. By end user, it is fragmented into commercial and residential. By distribution channel, the market is categorized into hypermarkets/supermarkets, specialty stores, B2B, and E-commerce. Region-wise, the dairy market is analyzed across North America (U.S., Canada, Mexico), Europe(UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific) and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, and Rest of LAMEA).

By Type

On the basis of type, the milk segment had the dominating dairy market share in the year 2022 and is likely to remain dominant during the forecast period. Since milk is one of the most important commodities in the sector, stronger procedures for end-to-end handling are required. From the time the milk is extracted until it reaches the consumer, there is an increasing demand for minimal waste, maximum safety, and increased shelf life. To meet this crucial demand, milk storage or cooling infrastructure, milk testing facilities, particularly at the village level, and improved packaging techniques need to be provided to reinforce the smooth supply chain. To meet the growing demand for healthier food options, as well as processed versions, it is critical that technologies such as Ultra-High Temperature (UHT) processing, aseptic packaging, intelligent packaging with biosensors or controlled atmosphere, and others be implemented as soon as possible.

By End User

On the basis of end user, the residential segment dominated the global dairy market share in the year 2022 and is likely to remain dominant during the forecast period. The commercial dairy products market has witnessed several key trends in recent years, driven by evolving consumer preferences and growing dairy market demand for traditional dairy offerings. Popular brands such as Nestlé, Danone, Lactalis, and Dairy Farmers of America continue to dominate the global market. One prominent trend is the increasing popularity of value-added dairy products, including yogurt, cheese, and flavored milk, as consumers seek convenient and nutritious options.

By Distribution Channel

On the basis of distribution channel, the business-to-business segment dominated the global market in the year 2022 and is likely to remain dominant during the dairy market forecast period. The major factor driving the dairy market growth of the business-to-business dairy sales is the rising outdoor dining trend among consumers. As the disposable income is on the rise, the consumption of food outside the house is increasing and owing to which the demand for dairy is also rising. QSR like McDonalds, Dominos, Pizza Hut, and Taco Bell are utilizing refrigerated or frozen products in order to provide quick services to its customers.

By Region

On the basis of region, Asia-Pacific region dominated the global dairy market size in the year 2022 and is likely to remain dominant during the forecast period. Increase in the consumption of fast food, influence of western culture in Asian cuisine, rapid urbanization, improvement in logistics and demand for different ethnic food such as Italian cuisine in the Asian market has led to an increase in the consumption of dairy byproducts among millennial, which is thereby increasing the demand for dairy in the region.

Competitive Landscape

Key players included in the dairy market are Dairy Farmers of America, Inc., Nestle S.A., Arla Foods amba, Danone S.A., Lactalis Group, Gujarat Cooperative Milk Marketing Federation Ltd., Britannia Industries Limited, Inner Mongolia Yili Industrial Group Co., Ltd., Fonterra Co-operative Group Limited, China Mengniu Dairy Company Limited, Arla Foods amba and Saputo Inc.

Recent Developments in the Market

Product Launch

- April 2020, Nestle S.A. launched nesQino, a superfood drink in the form of superfood sachets including milk shakebased sachets.

- March 2021, Danone S.A. launched the UK's first formula milk in pre-measured tab format produced in partnership with Japanese food manufacturer, Meiji to provide greater convenience and ease when preparing formula milk feeds.

- May 2021, Lactalis India, a part of Lactalis Group launched the Lactel Turbo yogurt drink available in mango and strawberry flavors to diversify its yogurt category.

- November 2020, Lactalis Group launched President lighter slightly salted spreadable butter to target the lighter spreadable butter market

- August 2023, Lactalis Group launched whipped creme available in two varieties under its brand President to increase its consumer base.

- March 2023, Lactalis Group launched flagship milk brand Lactel UHT toned milk under its Indian arm to compete with its rivals.

- August 2021, Lactalis Group launched an organic whole milk powder to meet the demand from customers for organic food.

- July 2023, Fonterra Co-operative Group Limited launched cheese products in Indonesia, such as cheddar cheese through its brand Anchor to meet the increasing demand for cheese products

- July 2020, Gujarat Cooperative Milk Marketing Federation Ltd. launched 33 products that include its core dairy products and FMCG products into the market.

Geographical Expansion

November 2022, Nestle S.A. announced a new research and development (Randamp;D) center for Latin America to work across several product categories including sustainable dairy products.

- July 2022, Westland Milk Products, a subsidiary of Yili Group, opened its new butter plant in Hokitika, West Coast, New Zealand to offer products to customers more efficiently.

- July 2022, Inner Mongolia Yili Industrial Group Co., Ltd. launched a global smart manufacturing industrial park in Hohhot, China to bring four major projects, including a liquid milk production base, a milk powder production base, the Chilechuan ecological intelligent pasture, and the Yili intelligent manufacturing experience center into operation.

- May 2023, China Mengniu Dairy Company Limited established a liquid milk factory, a fully intelligent dairy factory to increase the production of dairy products.

- February 2023,Danone S.A. launched a new research and innovation center on the Paris-Saclay campus for the development and innovation of Danone's fresh dairy products category.

- July 2020, Britannia Industries Limited announced to establish new plants in Bihar, Uttar Pradesh, and Tamil Nadu and add new units at its existing factories in Orissa and Ranjangaon to enhance production capacity to increase the production of bakery products and dairy products.

Joint Venture

November 2022, Britannia Industries Limited announced a joint venture agreement with French company Bel SA, and Britannia Dairy Private Limited (BDPL) for the development, manufacturing, marketing, distribution, trading, and selling of cheese products in India.

Agreement

July 2020, Gujarat Cooperative Milk Marketing Federation Ltd. signed a Memorandum of Understanding (MoU) with the state government of Andhra Pradesh to strengthen the cooperative dairy sector in the state.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dairy market analysis from 2022 to 2032 to identify the prevailing dairy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dairy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dairy market trends, key players, market segments, application areas, and market growth strategies.

Dairy Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.5 trillion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 289 |

| By Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Saputo Inc., Inner Mongolia Yili Industrial Group Co., Ltd., Britannia Industries Limited, China Mengniu Dairy Company Limited, Lactalis Group, Fonterra Co-operative Group Limited, Dairy Farmers of America, Inc., Nestle S.A., Danone S.A., Gujarat Cooperative Milk Marketing Federation Ltd. |

Analyst Review

The dairy sector currently serves over 7 billion consumers and provides livelihoods for approximately 1 billion people. As complexity and speed of change are rising, dairy stakeholders are working and living in an increasingly complicated environment. In addition, consumers are redefining what “healthy” and “better for me” mean, increasingly demanding products that are natural, green, organic, and free from additives.

The most successful product launches around the world deliberately target consumer concerns for health. Customers have made reviewing product information a regular step before purchase: instead of automatically placing a familiar product into their shopping cart, they are now scrutinizing labels for unpronounceable ingredients, artificial flavors and colors, genetically modified organisms, and high levels of sweeteners and sodium. This emphasis has translated to faster sales for fresh produce and health-oriented packaged goods.

It is estimated that by 2050, the food industry will need to sustainably feed 10 billion people. The current 120 million dairy farmers stand to play a large part in this, as they provide a key source of protein intake and thus have a major impact on global food security.

Despite the challenges the dairy industry has experienced in recent years, the appetite and demand for dairy products are on the rise. With a growing middle class who have more disposable income, consumers are seeking out healthy alternatives to fit in with a more active lifestyle, and thus, owing to a focus on natural ingredients, milk and dairy products are witnessing a rise in popularity.

The global dairy market size was valued at $883.2 billion in 2022, and is projected to reach $1.5 trillion by 2032

The global Dairy market is projected to grow at a compound annual growth rate of 5.1% from 2023 to 2032 $1.5 trillion by 2032

Key players included in the dairy market are Dairy Farmers of America, Inc., Nestle S.A., Arla Foods amba, Danone S.A., Lactalis Group, Gujarat Cooperative Milk Marketing Federation Ltd., Britannia Industries Limited, Inner Mongolia Yili Industrial Group Co., Ltd., Fonterra Co-operative Group Limited, China Mengniu Dairy Company Limited, Arla Foods amba and Saputo Inc.

On the basis of region, Asia-Pacific region dominated the global dairy market size in the year 2022 and is likely to remain dominant during the forecast period.

Higher attention to health and wellness, Rise in innovation and technological advancement in the dairy industry

Loading Table Of Content...

Loading Research Methodology...