Data Center Rack Market Overview

The global data center rack market was valued at USD 3.9 billion in 2021, and is projected to reach USD 9.5 billion by 2031, growing at a CAGR of 9.7% from 2022 to 2031.

On the contrary, server virtualization is getting popular and remote control gains more attention, such factors positively impacting the growth of the market. In addition, increase in adoption of data center rack technology across enterprises to enhance operation & productivity, propel the growth of the market for future. Furthermore, stringent security requirement and increase demand for more compact and scalable server types are expected to provide the lucrative growth opportunities for the market during the forecast period. However, data security and improper power management and UPS battery failures, hamper the growth of the market.

A data center rack is a framework that is designed to house servers and other data center computing equipment. Data center racks are an essential part of a data center to keep everything nicely organized. A data center rack’s structure allows placing data center equipment’s, networking devices, and cables easily. Racks are mainly designed to host components such as networking equipment, telecommunication equipment, cooling systems, and UPS.

Moreover, data center racks can come in different form factors, including rack-mounted or blade servers. Racks are mostly designed with specific slots to allow connecting electrical, networking, and internet cables easily. It is also important for proper data center cooling. Racks that allow proper airflow let the circulation of air to cool the components. Racks can also protect valuable devices against impacts or disasters such as earthquakes. Hence, many organizations such as IT, retail, and other sectors are adopting data center rack due to its benefits. This factor creates lucrative growth opportunities in the market during the forecast period.

The data center rack market is segmented into component, rack type, data center size, industry vertical, rack height and region. By component, it is bifurcated into solution and service. By rack type, it is divided into cabinets/ enclosed racks and open frame rack. By data center size, the market is segregated into large data centers and small and mid-sized data centers. Basis of rack height, market is classified into below 42U, 43U up to 52U and above 52U. By industry vertical, the market is classified into BFSI, manufacturing, IT & telecom, retail, healthcare, media and entertainment and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

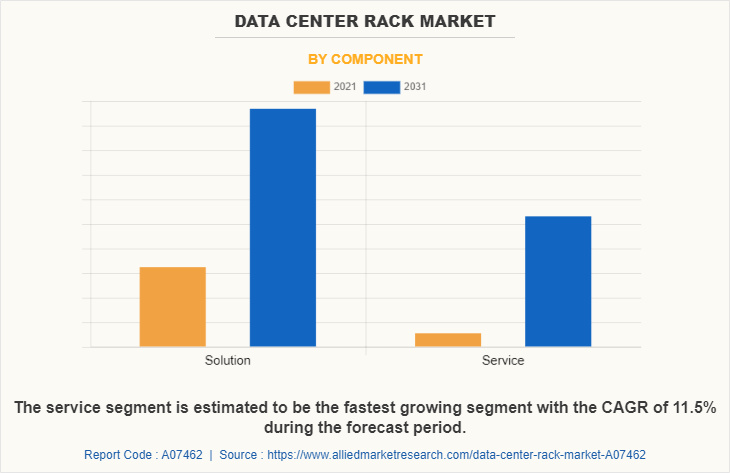

Depending on the component, the solution segment dominated the data center rack market share in 2021 and is expected to continue this trend during the forecast period. owing to advances in technologies enabling data center rack to transform industries worldwide, from financial services, to manufacturing, healthcare, and many others, drive the growth of the market. However, the services segment has the highest growth market share in the upcoming year. The adoption of data center rack services enhances software implementation, maximize the value of existing installation by optimizing it, and minimize the deployment cost & risks, and others, further fuel the data center rack market growth for this segment.

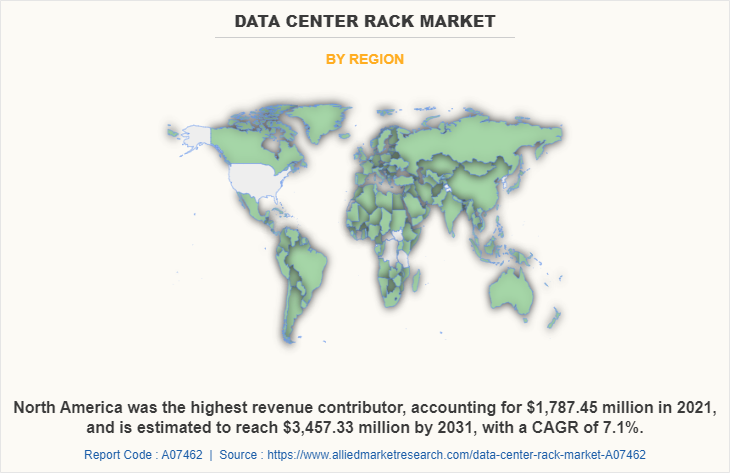

By region, North America dominated the market share in 2021 for the data center rack market. The increasing investment in advanced technologies and rising adoption of data center rack solution to improve businesses and the customer experience are anticipated to provide lucrative growth opportunities for the data center rack market in North America. However, Asia-Pacific is expected to exhibit highest growth during the forecast period. This is attributed to increase in penetration of digitalization and higher adoption of advanced technology that propel the growth of the data center rack industry in this region.

Top Impacting Factors

Increasing the Use of AI

Physical security breaches can sometimes be the result of human error. To minimize this risk, integrate AI-based technology into data center rack security to transform it into a preventative, pre-emptive, and proactive defense system, such factors drive the growth of the market. Security surveillance, environmental monitoring, and condition-based maintenance are possible with the actionable intelligence generated by AI. With the assistance of AI, data center rack can leverage predictive analytics capabilities that help them identify the waning functionality of a security device. This allows security teams to rectify the situation before problems arise that could harm a data center.

With the rapid expansion of data center racks, more solutions are needed to ensure their security during this period of expansion. Such emerging trends can enable their continued protection and also help to build a solid security system culture driven by everyone within the organization.

Server Virtualization is Getting Popular

Virtualization technology drives data center rack to move towards virtualized data centers. The last decade has seen overwhelming virtualization dominating enterprise data center rack. Server virtualization is one of the most significant infrastructures in data center rack virtualization. Through virtualization, a single physical server can house multiple virtual servers.

Server virtualization is an inevitable trend, as it is a great way to maximize the physical infrastructure space and reduce capital costs. Server virtualization makes full use of public cloud resources, which eliminates the challenges caused by limited data center rack floor space. Meanwhile, the advent of cloud computing requires high-scale network servers, which increase the servers deployed in the existing data center floors.

Remote Control Gains More Attention

New technology and the global pandemic have resharpened how data center rack work. Changes in data center rack have brought a lot of transformation in infrastructures. Though remote control is not a new norm, it gains more attention in the face of the pandemic. Many operators who are working at home are not able to go to the field to manage the server infrastructures. Whether renting servers or choosing collocation data centers, network servers with remote control function is the best selection these days.

Key Strategies/Development:

For instance, in April 2022 - Rittal, a global manufacturer and system solutions provider of industrial and IT enclosures, announced a U.S. partnership with TD SYNNEX, a global distributor and solutions aggregator for the IT ecosystem. Through the partnership, Rittal distributes IT rack enclosures, solutions, and accessories to information technology (IT) customers through TD SYNNEX.

For instance, in September 2021 - Oracle announced the launch of Oracle Exadata X9M platforms, the latest version of the industry’s fastest and most affordable systems for running Oracle Database. The new Exadata X9M offerings include Oracle Exadata Database Machine X9M and Exadata Cloud-Customer X9M, the only platform that runs Oracle Autonomous Database in customer data centers.

For instance, in June 2020 - Fujitsu announced the expansion of its storage portfolio with four new series of the Fujitsu Storage ETERNUS, that leverage NetApp's advanced data management software. This launch represents the next step of Fujitsu's strategic partnership with NetApp in offering a data management infrastructure that supports digital transformation.

For instance, in February 2020 - Power management company Eaton announced that it has acquired Power Distribution, Inc. (PDI), a leading supplier of mission-critical power distribution, static switching, and power monitoring equipment and services for data centers and industrial and commercial customers.

For instance, in December 2019 - Schneider Electric, the leader in digital transformation of energy management and automation, with Avnet and Iceotope, announced the creation of the industry’s first commercially available integrated rack with chassis-based, immersive liquid cooling. Optimized for compute-intensive applications, the solution combines a high-powered GPU server with Iceotope’s liquid cooling technology to increase energy efficiency.

Key Benefits for Stakeholders

The study provides an in-depth data center rack market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the data center rack market size is provided in the report.

The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the data center rack industry.

The quantitative analysis of the global data center rack market for the period 2021–2031 is provided to determine the data center rack market potential.

Data Center Rack Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.5 billion |

| Growth Rate | CAGR of 9.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 503 |

| By Component |

|

| By Rack Type |

|

| By Data Center Size |

|

| By Rack Height |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Samsung Electronics Co., Ltd, Eaton Corporation, Fujitsu, Rittal GmbH & Co. KG, Black Box, Hewlett Packard Enterprise Development LP, Schneider Electric, Great Lakes Data Racks & Cabinets, Dell Technologies Inc., Oracle Corporation |

Analyst Review

The adoption of data center rack has increased over the period to provide reliable and consistent experiences for their subscribers. In addition, the ability of data center rack to provide various opportunities for businesses to gain new insights to run the business efficiently is increasing its popularity among end users. Furthermore, many healthcare, retail & e-commerce, BFSI, IT & telecom, and others industries are investing in data center rack to increase security and reduce data center expense in organizations, which in turn fuels the growth of the market.

Furthermore, the market is expected to witness significant growth in the future, due to increase in use of low latency networks such as long-term evolution, LTE micro stations, and 5G networks in domestic user and rise in adoption of artificial intelligence-oriented business models among organizations. For instance, organizations such as Dell Technologies Inc., and HP are massively using data center rack to enhance customer experience. Moreover, rise in investments in artificial intelligence tools among every industry vertical further boosts the revenue growth.

Global data center rack market has been witnessing a steady growth worldwide due to the ever increasing volumes of data generated by different industry verticals. Increased usage of internet-based services along with cloud computing services among organizations have significantly fueled the demand for data centers rack across the world. The presence of a large number of providers in the global data center rack market increases the competitive rivalry among the key players. Therefore, data center rack providers are differentiating themselves from competitors and driving revenue growth by incorporating new digital business technologies such as artificial intelligence, machine learning, 5G networks their offerings to gain a competitive edge, and retain their market position.

The market is considerably concentrated with major players consuming significant market share. The degree of concentration will remain the same during the forecast period. The vendors operating in the market are taking several initiatives such as new product launches and partnership to stay competitive in the market and to strengthen their foothold in the market. In addition, companies are heavily investing in R&D activities to develop advanced data center solution & services, which is opportunistic for the market.

The global data center rack market was valued at $3.9 billion in 2021 and is projected to reach $9.5 billion by 2031.

The Data Center Rack market is projected to grow at a compound annual growth rate of 9.7% from 2022 to 2031.

Black Box, Eaton Corporation, Great Lakes Data Racks & Cabinets, Oracle Corporation, Schneider Electric, Hewlett Packard Enterprise Development LP, Fujitsu, Dell Technologies Inc., Rittal GmbH & Co. KG, Samsung Electronics Co., Ltd., are some top companies.

The North America is the largest market for the Data Center Rack.

Factor such as, increase in adoption of data center rack technology across enterprises to enhance operation & productivity, propel the growth of the market for future.

Loading Table Of Content...