Data Protection as a Service (DPaaS) Market Insights:

The global data protection as a service market size was valued at USD 15.49 billion in 2020, and is projected to reach USD 170.54 billion by 2030, growing at a CAGR of 27.2% from 2021 to 2030.

The advent of cloud computing and software-defined data centers with virtualized infrastructure components delivered as a service has fostered the need for data protection in the present business scenario. Increase in need for data protection among cloud service providers has led to the introduction of data-protection-as-a-service (DPaaS). DPaaS is a cloud-based, web-delivered service designed to safeguard data assets of businesses. The deployment of DPaaS market has increased in organizations across the globe, owing to the advantages of better network security and advanced data security.

The global DPaaS market is influenced by several factors such as increase in concerns about data loss; rise in need for data backups & archives; and governance, risk, and compliance requirements for storage. However, high incurrence of costs is projected to hamper growth of the market. On the contrary, increase in demand for cloud-based disaster recovery and backup for virtual machines are expected to be opportunistic for the data protection as a service market growth.

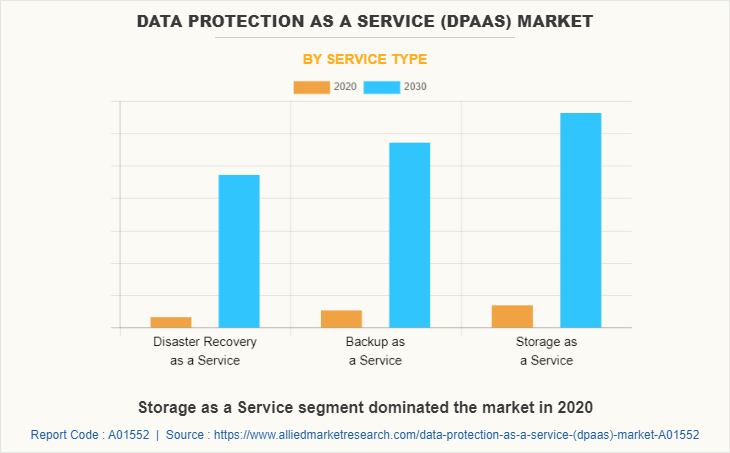

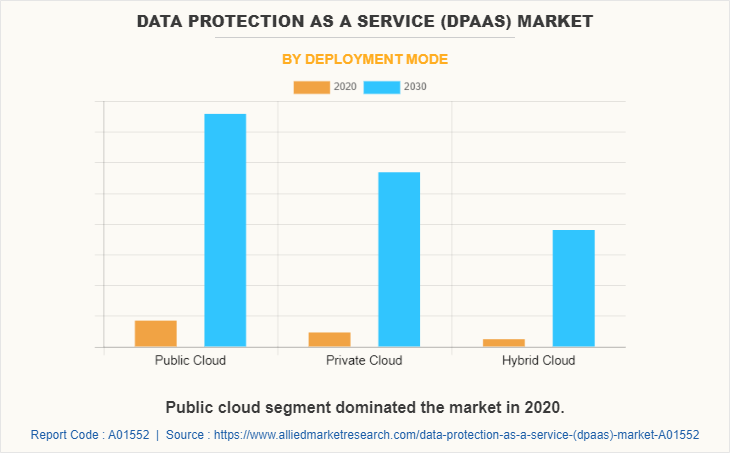

The global Data Protection as a Service (DPaaS) Industry is segmented into on deployment model, service type, end user, and region. Depending on the deployment model, the market is categorized into public, private, and hybrid cloud. On the basis of type of service, the market is categorized into disaster recovery-as-a-service (DRaaS), backup-as-a-service (BaaS), and storage-as-a-service (STaaS). The end users of the market are large enterprises and small & medium enterprises. The Data Protection as a Service Industry is analyzed based on four regions, namely North America, Europe, Asia-Pacific, and LAMEA along with the country-level analysis of each region.

In 2020, On the basis of service, the STaaS segment dominated the data protection as a service market share in 2020, and is expected to maintain its dominance in the upcoming years. This is attributed to cost-effectiveness of STaaS and no initial costs required for deploying hard drives, servers, and IT technicians. The provision of long-term data storage and business stability is a major growth factor of the overall market.

By deployment, the private segment dominated the market in 2020, and is expected to maintain its dominance in the upcoming years. This is attributed to the fact that private cloud provides improved security, greater server control, and enhanced flexibility. Furthermore, private cloud is deployed and customized according to the preferences of users. However, the hybrid segment is expected to register highest growth rate during forecast period.

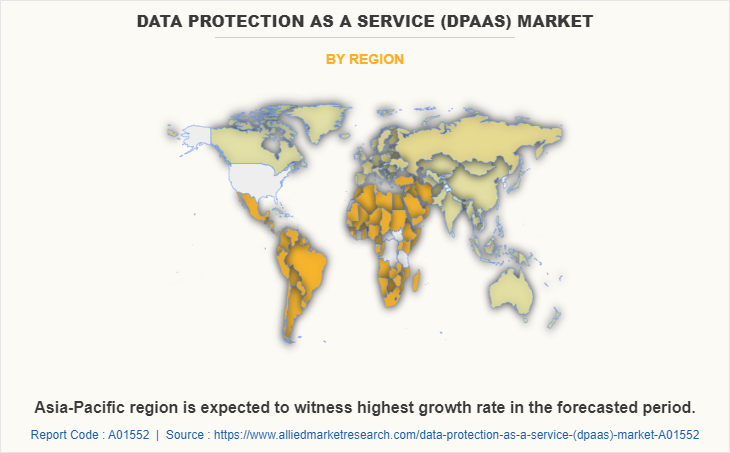

North America dominates the market. The expansion of cyber security and cloud service business in North America has driven the market for DPaaS in the region. Moreover, increase in implementation of legislative compliances to improve cloud security and reduce cyber-attacks has boosted the market growth. The presence of numerous vendors that offer a variety of customized solutions is opportunistic for the market. In addition, factors such as data disclosure mandates, need for strict compliance toward sensitive data protection, increase in spending pattern on security forums, and surge in internet penetration have fueled the demand for DPaaS in the region.

However, Asia-Pacific is expected to witness highest growth rate during the forecast period. The market growth in Asia-Pacific is majorly supported by increased reliability on ICT infrastructure coupled with increase in opportunities for cloud exporters. Furthermore, rise in number of strategic partnerships among regional and U.S. providers has fueled the market growth. In Asian countries, the growing trend of cloud computing and BYOD has driven the market growth in the recent years.

Top Impacting Factors:

Increased concerns about data loss

Data loss is a growing concern for large enterprises as well as small & medium enterprises. Further, data that are difficult to protect such as big data and data accessed by ubiquitous mobile devices are stored in hybrid clouds. Many vendors have developed advanced data protection tools to reduce the costs and consequences of data loss.

Increase in need for data backups and archives

Archives provide a snapshot of the desired file from a specific location. Moreover, data backups provide a fail-safe mechanism for all retrieval of data in a system. The old data is overwritten by new data on a regular basis. DPaaS has the ability to scale data assets integrity and retention of data over long period using data backups and archives. This is essential for organizations in the present business scenario that are vulnerable to data theft and other threats to adopt this measure.

Governance, risk, and compliance requirements for storage

As businesses collect and generate massive volume of data assets, the need for aligning strict internal governance policies has increased in the recent years. Furthermore, adherence to regulatory norms regarding data storage, management, and encryption is crucial for market players. This has majorly driven the market for DPaaS among business professionals.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data protection as a service (dpaas) market analysis from 2020 to 2030 to identify the prevailing data protection as a service (dpaas) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the data protection as a service (dpaas) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Data Protection as a Service (DPaaS) Market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global data protection as a service market size, data protection as a service market trends, key players, market segments, application areas, and market growth strategies.

Data Protection as a Service (DPaaS) Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Enterprise Size |

|

| By Deployment Mode |

|

| By Region |

|

| Key Market Players | VMWARE, HEWLETT-PACKARD DEVELOPMENT COMPANY, IBM CORPORATION, VERITAS TECHNOLOGIES, COMMVAULT SYSTEMS, ASIGRA, CISCO SYSTEMS, QUANTUM CORPORATION, L.P., EMC CORPORATION, AMAZON WEB SERVICES |

Analyst Review

According to the insights of the CXOs of leading companies, the Data protection-as-a-service (DPaaS) market exhibits promising opportunities. North America has witnessed the highest adoption of this service, followed by Europe, Asia-Pacific, and LAMEA. In addition, market players have adopted innovative techniques to provide advanced and innovative offerings.

Some of the factors that have become the driving force behind the increasing reliance on DPaaS are disaster recovery and cost-effectiveness. By using DPaaS, businesses are provided with an affordable way to bring backup, storage, and disaster recovery options into their business operations. In addition, by providing services to companies at an affordable price, DPaaS helps businesses step into the future by providing the tools necessary for businesses to succeed.

Private cloud is the preferred deployment model in the market, followed by public and hybrid cloud. At present, storage as a service (STaaS) is extensively used by large enterprises and SMEs. Among end users, large enterprises exhibited the highest revenue growth in the global market.

The global DPaaS market is dominated by key players such as IBM Corporation, Amazon Web Services, Inc., HP Development Company, LP, Commvault Systems, Inc., EMC Corporation, VMware, Inc., Quantum Corporation, Asigra, Inc., Veritas Technologies, and Cisco Systems. The key players have adopted various growth strategies to enhance and develop their product portfolio, strengthen their edge computing market share, and to increase their market penetration.

For instance, in February 2022, Veritas Technologies announced the latest version of NetBackup™ powered by Cloud Scale Technology, the next generation of NetBackup’s industry-leading architecture, which is the foundation for Autonomous Data Management and multi-cloud data protection at scale.

The global data protection as a service market size was valued at $15.49 billion in 2020, and is projected to reach $170.54 billion by 2030

The data protection as a service market is projected to grow at a compound annual growth rate of 27.2% from 2021 to 2030.

The global DPaaS market is dominated by key players such as IBM Corporation, Amazon Web Services, Inc., HP Development Company, LP, Commvault Systems, Inc., EMC Corporation, VMware, Inc., Quantum Corporation, Asigra, Inc., Veritas Technologies, and Cisco Systems.

Asia-Pacific is expected to witness highest growth rate during the forecast period.

The global DPaaS industry is influenced by several factors such as increase in concerns about data loss; rise in need for data backups & archives; and governance, risk, and compliance requirements for storage.

Loading Table Of Content...