Dental Imaging Market Research, 2032

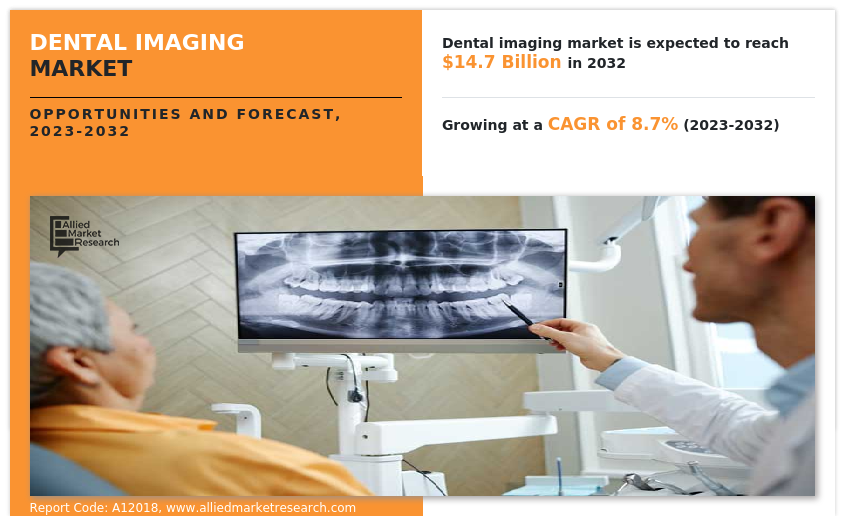

The global dental imaging market size was valued at $6.4 billion in 2022, and is projected to reach $14.7 billion by 2032, growing at a CAGR of 8.7% from 2023 to 2032. Dental imaging is a technology that produces visual representation of the teeth, jaws, and surrounding oral structures for diagnostic and treatment purposes. Dental imaging technologies are used by dentists and oral surgeons to visualize the teeth, jaws, and surrounding tissues in order to identify and diagnose various oral health conditions.

There are several types of dental imaging technologies available including X-ray systems, intraoral cameras, scanners, and others. Dental X-rays are also commonly used to examine teeth structures. It uses electromagnetic radiation to capture images of the mouth. The radiation beam passes through soft tissues and creates images of teeth and bones. Dental imaging has a wide range of applications, including detection of dental and oral health conditions, monitoring progress of treatment, and cosmetic industry.

Dental Imaging Market Dynamics

Rise in demand for more accurate and efficient diagnostic tools such as intraoral cameras in dental practices drives dental imaging market growth. Rise in digital technologies led to development of new imaging devices and software, which offer improved resolution, faster processing times, and greater ease of use is expected to drive the market growth led to development of new imaging devices and software, which offer improved resolution, faster processing times, and greater ease of use is expected to drive the market growth.Furthermore, the increase in prevalence of dental disorders such as cavities, gum disease, and oral cancer are driving the demand for dental imaging technologies which is expected to drive the market growth.

Growing demand for cosmetic industry as people are increasingly concerned about the appearance of their teeth and smiles which further support the market growth. Dental imaging technologies such as intraoral cameras, and 3D imaging systems are used in cosmetic dental procedures such as teeth whitening, orthodontics, and dental implants. Thus, the rise in adoption of dental imaging procedure in cosmetic industry contributes towards the growth during dental imaging market forecast.

The growth of the dental imaging market is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, rise in prevalence of oral diseases such as oral cancer and tooth decay.

Increase in awareness among patients about the importance of maintaining good oral health led to an increase in demand for dental imaging technologies. Rise in awareness about benefits of early detection and prevention of dental disorders led to propels the market growth. Moreover, governments initiatives in various countries are taking initiatives to promote oral health and improve access to dental care which is expected to boost the market growth. For instance, the American Dental Association and the Centers for Disease Control and Prevention (CDC), in U.S. developed the guidelines to promote the use of dental imaging technologies for the prevention and treatment of dental disorders. Such initiatives are expected to drive growth of dental imaging industry.

Significant advancements in dental imaging technology led to the development of advanced imaging system with improved image quality, and diagnostic accuracy has supported the market growth. For instance, cone-beam computed tomography uses a cone shaped beam of x-rays to produce high resolution 3D images of the teeth, jawbone, and surrounding tissues. These advancements enable dentists to provide better care to their patients and increase the demand for dental imaging technology.

The demand for dental imaging is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in adoption of extraoral imaging and intraoral imaging systems and increase in awareness toward early diagnosis and treatment, further drive the growth of the dental imaging market size.

However, the high cost of dental imaging equipment and procedures negatively impacted the market growth. Dental imaging technologies can be expensive, and the cost can be a major barrier for some dental practices and patients. In addition, there are also concerns around the potential health risks associated with repeated exposure to ionizing radiation from X-ray imaging. While dental X-rays are generally considered safe, the risks associated with radiation exposure can be a concern for some patients and healthcare professionals which may restrain market growth.

The outbreak of COVID-19 disrupted workflows in the health care sector around the world. The delay in diagnosis and treatment of dental disorders during the pandemic had a significant impact on patient outcomes. Many dental practices were temporarily closed or had reduced capacity during the pandemic, leading to a decline in the demand for dental imaging technologies. In addition, patients may have hesitance to visit dental offices due to concerns about infection risk, leading to further decreases in demand. Many dental clinics and hospitals postponed non-urgent procedures during the pandemic, including dental imaging procedures. This led to a decrease in demand for dental imaging technologies. Thus, pandemic initially had a negative impact on the dental imaging market.

However, after the pandemic the dental practices adapted to the pandemic and implemented safety measures, and the demand for dental imaging technologies has started to recover. In addition, the pandemic has highlighted the importance of infection control measures in dental settings, which may lead to increase in adoption of technologies such as intraoral cameras and digital radiography that can help minimize patient contact and reduce the risk of infection which is contribute towards the growth during dental imaging market analysis.

Dental Imaging Market Segmental Overview

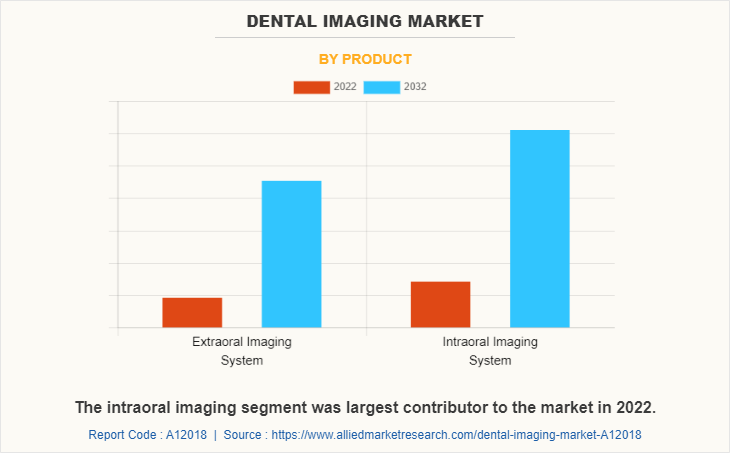

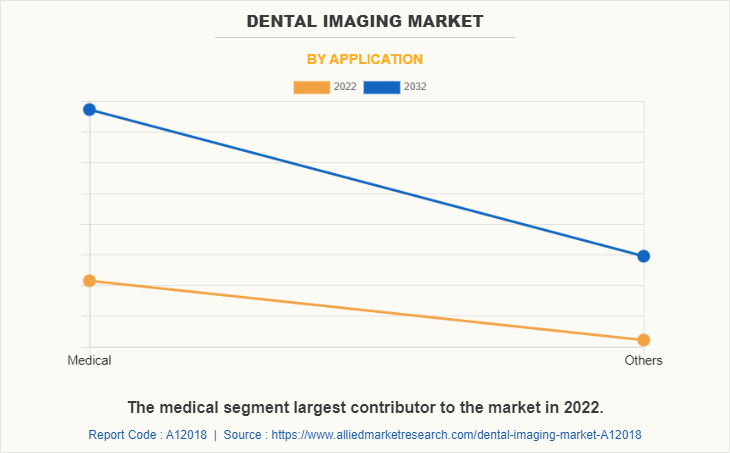

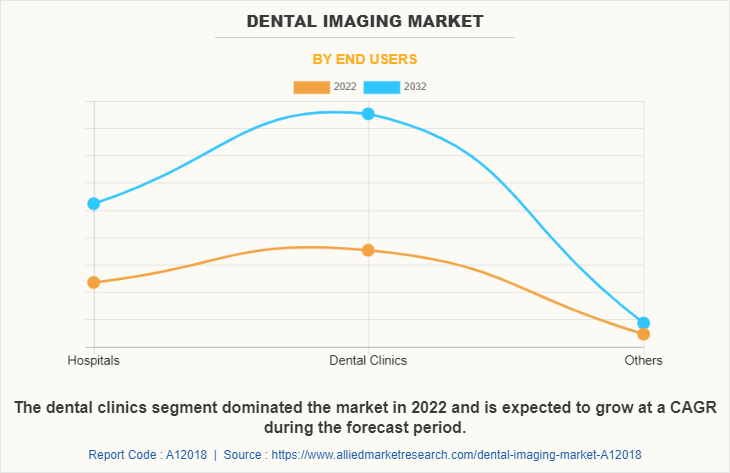

The dental imaging market is segmented into product, application, end user, and region. By product, the market is categorized into extraoral imaging and intraoral imaging systems. Extraoral imaging systems segment is further classified into panoramic systems, cephalometric systems, and 3D CBCT systems. Intraoral imaging systems segment is further categorized into intraoral scanners, intraoral X-ray systems, intraoral sensors, intraoral PSP systems, and intraoral cameras. On the basis of application, the market is bifurcated into medical and others. By end user, the market is segregated into dental hospitals & clinics, dental diagnostic laboratories, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product

The intraoral imaging systems segment dominated the global market in 2022 and is also expected to grow at the highest rate during the forecast period, owing to the rise in adoption of intraoral imaging systems such as scanners and cameras as they are smaller and less invasive than traditional X-ray systems, and comfortable for patients.

By Application

The medical segment dominated the global dental imaging market share in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to the growing prevalence of dental disorders such as cavities, gum disease, and oral cancer and rise in advancements in dental imaging technologies.

By End User

The dental clinics held the largest dental imaging market share in 2022 and is expected to remain dominant throughout the forecast period, owing to increase in number of dental procedures, availability of advanced imaging technologies, and rise in awareness about the importance of dental health.

By Region

The dental imaging industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the dental imaging market in 2022 and is expected to maintain its dominance during the forecast period.

Increase in demand for accurate and efficient diagnostic tools such as intraoral cameras, which are driving the growth of the dental imaging market in the region. In addition, high prevalence of dental disorders such as cavities, gum disease, and oral cancer, which is driving the demand for dental imaging technologies for diagnosis and treatment and propel the market growth.Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to growing awareness of dental hygiene and the importance of regular dental check-ups in the Asia-Pacific region. This led to a rise in demand for dental imaging technologies to detect and prevent dental disorders which support the market growth in this region.

Competition Analysis

Competitive analysis and profiles of the major players in dental imaging, such as Acteon, Air Techniques, Inc., Corix Medical Systems, Cefla s.c., Dentsply Sirona Inc, Envista Holdings Corporation, J. MORITA CORP., Midmark Corporation Planmeca OY, and Vatech are provided in this report. Key players have adopted product approval, partnership, acquisition, branding, and product launch as key developmental strategies to improve the product portfolio of the dental imaging market.

Recent Product Launches in the Dental Imaging Market

- In May 2023, Planmeca launched the product by expanding its Viso family of imaging units with a new addition called the Planmeca Viso G3.

- In September 2022, Midmark Corp, a provider of dental solutions, launched a new product line called the Midmark Extraoral Imaging System (EOIS) which includes 2D panoramic and 3D cone-beam computed tomography (CBCT) imaging X-ray devices.

- In September 2020, Vatech launched Green X, a premium CT that provides high-resolution images suited for endodontic treatment.

Recent Product Approval in the Dental Imaging Market

- In October 2020, Vatech announced that Green X, a new CT that provides precision images for endodontics, has received the FDA approval.

- In September 2022, Midmark Corp, a provider of dental solutions, launched a new product line called the Midmark Extraoral Imaging System (EOIS) which includes 2D panoramic and 3D cone-beam computed tomography (CBCT) imaging X-ray devices.

Recent Partnerships in the Dental Imaging Market

- In March 2022, ClearChoice partnered with Planmeca to offer improved digital imaging capabilities for more cohesive care to dental implant patients in the U.S.

- In January 2022, Envista Holdings Corporation and leading dental support organization Pacific Dental Services (PDS) announced that the extension of their implant and imaging commercial relationship for an additional five years, and the expansion of this relationship to include Envista's Spark clear aligners.

Recent Acquisition in the Dental Imaging Market

- In April 2022, Envista Holdings Corporation announced the completion of the acquisition of Carestream Dental's Intraoral Scanner business. This business will be rebranded as DEXIS and will operate as part of the Envista Equipment and Consumables Segment.

Recent Branding in the Dental Imaging Market

In March 2022, Envista Holdings Corporation announced Envista's KaVo imaging business will be re-branded as DEXIS. DEXIS has been a leader in digital intraoral radiography and diagnostic software innovation for over 20 years.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dental imaging market analysis from 2022 to 2032 to identify the prevailing dental imaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental imaging market segmentation assists to determine the prevailing dental imaging market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental imaging market trends, key players, market segments, application areas, and market growth strategies.

Dental Imaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.7 billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 247 |

| By Product |

|

| By Application |

|

| By End Users |

|

| By Region |

|

| Key Market Players | Planmeca OY, Acteon, J. MORITA CORP., Air Techniques, Inc., Envista Holdings Corporation, Cefla s.c., Midmark Corporation, Corix Medical Systems, Dentsply Sirona Inc., Vatech |

Analyst Review

The global dental imaging market is expected to exhibit high growth potential attributable to rise in development of portable and cost-effective imaging system. The rise in awareness regarding oral health and the availability of various digital X-ray configurations have piqued the interest of numerous companies to create imaging systems However, shortage of skilled professionals in some regions limit the growth of the dental imaging market.

The rise in adoption of imaging systems by hospitals and private clinics over traditional systems drive the market growth. In addition, the increase in prevalence of dental diseases such as dental caries, gum disease, and oral cancers has led to a surge in demand for portable and precise imaging systems, thereby driving the market's growth.

Furthermore, North America is expected to witness largest growth, in terms of revenue, owing to rise in adoption of advanced imaging systems such as intraoral camera and digital X-Ray and surge in prevalence of dental disorders such as cavities. However, Asia-Pacific is anticipated to witness notable growth owing to high prevalence of aging population with increased need for dental procedures, a surge in incidence of dental caries, and increase in awareness regarding oral health.

Dental imaging refers to the use of various techniques and technologies to capture detailed images of the teeth, jaws, and surrounding structures for diagnostic and treatment purposes.

Rise in prevalence of oral disorders, increase in awareness about oral health and early diagnosis among the general population and healthcare professionals, and rise in technological advancements are the factors responsible for the market growth.

The introaral imaging systems segment is the most influencing segment owing to rise in demand for intraoral imaging systems as they have ability to provide detailed and close-up images of specific teeth and structures within the mouth, aiding in accurate diagnosis, treatment planning, and monitoring of dental conditions.

Top companies such as Dentsply Sirona Inc., Planmeca OY, Envista Holdings Corporation, and Vatech held high market share in 2022.

The estimated industry size of dental imaging in 2032 is $14,647.82 million.

The forcast period for dental imaging market is 2023 to 2032

The base year is 2022 in dental imaging market.

North America is the largest regional market for dental imaging owing to rise in prevalence of oral disorders such as oral cancer, high oral health awareness and rise in awareness about early diagnosis and treatment has increased the adoption of dental imaging technologies in this region.

Loading Table Of Content...

Loading Research Methodology...