Digital Multimeter Market Research, 2031

The Global Digital Multimeter Market was valued at $0.61 billion in 2021 and is projected to reach $1.1 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031. Digital multimeters are a type of multimeter that is used to measure quantities such as capacitance, wattage, current, voltage, and resistance. The various types of these instruments, such as mini digital multimeters and automotive multimeters, show the measured values on a digital display on the device so that they can be easily read by first-time users, hobbyists, as well as professionals.

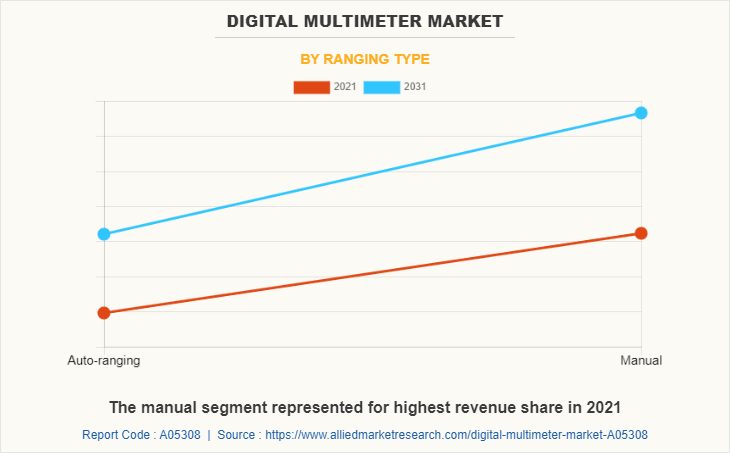

These instruments fall under the category of test and measurement instruments and can be used to check the working condition of equipment such as electric circuits, fuses, automotive batteries, HVAC units, semiconductors, and printed circuit boards. In some digital multimeters, the measurement range needs to be selected manually, and in others, this range is selected automatically. The latter type of digital multimeters can be used easily by hobbyists and beginners, while the former type is more suited to professionals.

The digital multimeter industry is expected to witness growth during the forecast period, owing to its higher precision in comparison to analog testers. This high precision means the ability of a digital multimeter to accommodate higher resolutions because its digital display is capable of showing more digits. Digital multimeters are considerably less susceptible to reading errors on account of their easy-to-read digital displays. On the other hand, there is a higher possibility of people making mistakes while reading values from analog testers, because those devices indicate values using a needle, which a person may read improperly. Such errors, called reading errors, are avoided on digital multimeters.

Further, the adoption of technology is increasing considerably in various industries. Particularly, automation and process control equipment are making strides at a rapid pace in industries.

This has led to the expanding use of existing electronics, such as passive components and electromechanical components in existing products. For instance, the automobile industry has witnessed an increasing level of automation in manufacturing as well as in the product itself. This technology adoption is also an important driver of the digital multimeter industry. Meanwhile, the digital multimeter market growth is facing a challenge from small manufacturers.

These players manufacture the device at lower costs by reducing its quality. Small manufacturers have found the market barrier to be low due to digital multimeters being a long-established technology and the minimum complexity in the product’s design. On a positive note, according to digital multimeter market analysis, the increasing adoption of Industry 4.0 and the Internet of Things (IoT) is expected to lead to a digital multimeter market opportunity during the forecast period.

The Internet of Things (IoT) consists of web-connected smart devices that collect and analyze data from their surroundings using embedded systems such as processors, sensors, and communication hardware. Industry 4.0 is revolutionizing the manufacturing industry by bringing robotic technology, automation, and the Internet of Things (IoT) to production facilities. The maintenance and testing of all these electronic systems is expected to boost the demand for digital multimeters and positively affect the digital multimeter market outlook.

Segmentation Overview

The digital multimeter market is segmented into Product Type, Ranging Type, and Industry Vertical.

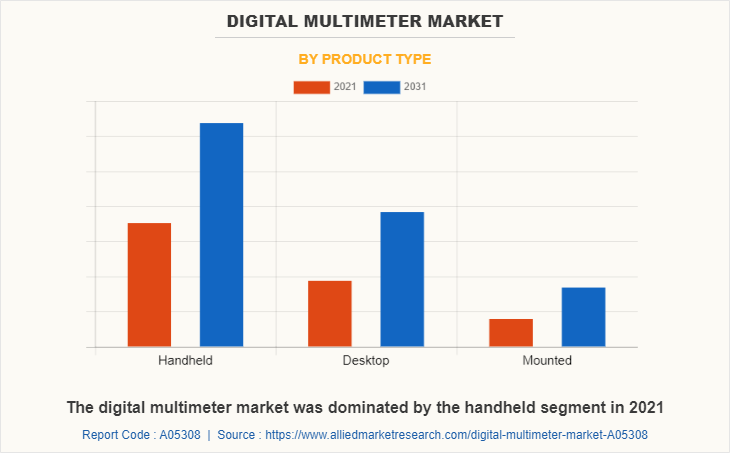

Based on product type, the digital multimeter market size is segmented into handheld, desktop, and mounted. The handheld/portable segment dominated the market in terms of revenue in 2021. However, the mounted segment is expected to expand at a higher growth rate during the digital multimeter market forecast. Handheld digital multimeters can be used in more locations and scenarios, which is a major driving factor for their usage. They are typically used when the measurements need to be taken in field operations, or of hazardous systems, and when mobility is an important factor in the work.

Based on the ranging type, the digital multimeter market share is segmented into auto-ranging and manual. The manual segment dominated the market in 2021, whereas the auto-ranging segment is likely to expand at a faster rate during the forecast period. Manual digital multimeters provide many benefits to professionals in various industries such as electronics, electrical, technology, and scientific research. To use a manual digital multimeter, a person needs to have considerable knowledge, including which range the value falls under. But it also allows professionals to put the digital multimeter to considerable use and gain many types of readings, as compared to amateurs. Hence, the sales of manual digital multimeters are high and driven by professionals.

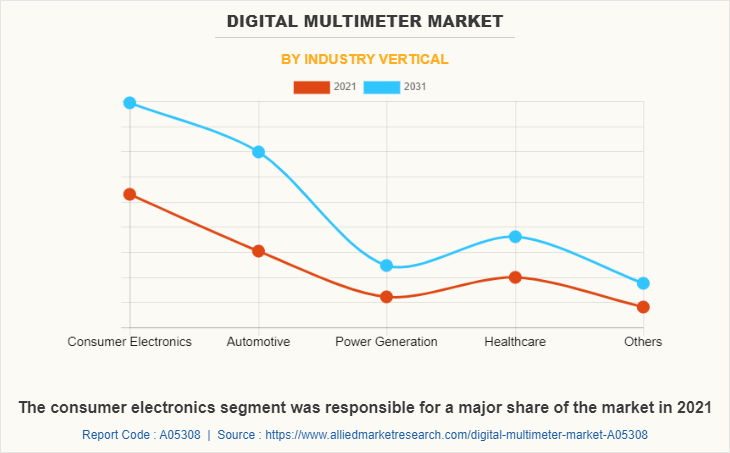

In terms of industry verticals, the market is segmented into consumer electronics, automotive, power generation, healthcare, and others. The consumer electronics segment dominated the market in 2021, whereas the automotive segment is likely to expand at a faster rate during the forecast period. The rising sales of consumer electronics on account of the improving living standards of the population is a major driver of the segment. The increasing adoption of technology in the automotive industry, including the introduction and fast-rising sales of electric vehicles, is likely to boost the sales of digital multimeters in the forecast period.

In terms of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the market with the largest share in 2021, and it is also expected to witness the highest growth rate during the forecast period. Several of the major companies in the market are located in the Asia-Pacific region. This presents a significant opportunity for them to expand their product line-up and geographic reach in the market. Furthermore, this region also has several of the world’s largest semiconductor and electronics firms, such as Taiwan Semiconductor Manufacturing Company and LG Electronics, which are major consumers of digital multimeters. The combination of these and other factors is responsible for the high sales of digital multimeters in the Asia-Pacific.

Competitive Analysis

Competitive analysis and profiles of the major digital multimeter market players that have been provided in the report include National Instruments Corporation, Keysight Technologies, Gossen Metrawatt GmbH, Fluke Corporation, FLIR Systems, Inc., Tektronix, Inc., Yokogawa Electric Corporation, Rohde & Schwarz GmbH & Co KG, Hioki E.E. Corporation, and Sanwa Electric Instrument Co., Ltd. These key players adopt several strategies, such as new product launch and development, acquisition, partnership and collaboration, and business expansion, to increase their market share in the global digital multimeter market during the forecast period.

Top Impacting Factors

Some of the significant factors impacting the global digital multimeter market include that they provide more precision as compared to analog testers, have an expanding use in different end-user industries, are versatile, and face competition from small manufacturers selling cheap versions of the product. The increasing demand from various industries for the incorporation of technology is a major influencer of the demand for digital multimeters. However, the sale of low-quality and cheap digital multimeters by local manufacturers is expected to restrain the growth of the market. Meanwhile, the increasing number of applications due to the adoption of the Internet of Things (IoT) and Industry 4.0 provides an opportunity for market players during the forecast period.

Historical Data & Information

The digital multimeter market is fairly competitive, owing to the strong presence of existing vendors. Market vendors are expected to gain a competitive advantage over their competitors because they can cater to market demands with a wide range of products. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies are adopted by key vendors.

Key Developments/Strategies

Keysight Technologies, FLIR Systems Inc., Fluke Corporation, and Tektronix Inc. are among the top companies that hold a prime share in the digital multimeter market. Top market players have adopted various strategies, such as product launches, contracts, and others, to expand their foothold in the digital multimeter market.

- In July 2021, Fluke launched Fluke IRR1-SOL, which has been designed from the ground up to simplify the installation, commissioning, and troubleshooting of photovoltaic arrays by measuring irradiance, temperature, inclination, and direction of the solar array with a single handheld tool.

- In May 2021, Teledyne Technologies, Inc. completed the acquisition of FLIR Systems in a cash-and-stock deal worth approximately $8.2 billion. By acquiring FLIR Systems, Teledyne not only expanded its imaging sensor and meters portfolio in terms of volumes, but the deal also helped it gain production efficiency.

- In September 2020, Gossen Metrawatt developed DAkkS-calibrated multimeter generation, adding a device for the automotive sector. The new METRAHIT IM E DRIVE is an all-in-one solution combining all relevant test and measurement functions for the maintenance, service, and diagnostics of electric machines, drives, and systems.

- In December 2022, HIOKI launched the DC Hipot tester ST5680 for the safety inspection process of battery modules. The DC Hipot test is one of the electrical safety tests in the module production of LIBs (lithium-ion batteries). The required test conditions depend on the standards required for each battery. The DC Hipot tester ST5680 has the specifications to comply with a wide range of international standards.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital multimeter market from 2021 to 2031 to identify the prevailing digital multimeter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the digital multimeter market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global digital multimeter market trends, key players, market segments, application areas, and market growth strategies.

Digital Multimeter Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.2 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 213 |

| By Product Type |

|

| By Ranging Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | FLIR Systems, Inc., HIOKI E.E. CORPORATION, Fluke Corporation, Keysight Technologies, TEKTRONIX, INC., Rohde & Schwarz GmbH & Co KG, National Instruments Corporation, Sanwa Electric Instrument Co., Ltd., Gossen Metrawatt GmbH, Yokogawa Electric Corporation |

Analyst Review

Digital multimeters have provided consistent sales in the market for a very long time and this is expected to continue in the foreseeable future as well. The demand is expected to be driven by several factors such as the versatility of the device, its availability in various forms such as handheld, mounted, auto-ranging and manual, and its rapidly increasing usage in several industries on account-of their ongoing transformation driven by technological adoption.

Adoption of technology by industries and governments for all sections of supply-chain, ranging from manufacturing to transportation and delivery of public services is expected to have the largest impact on the global digital multimeter market in the coming years. For instance, Industry 4.0 now seems to be in full swing, since its start in 2011. Start-ups are now receiving around $3 billion in funding each year, M&A activity has doubled, and more than 50,000 research papers were written on the subject in 2021 itself. Furthermore, this has happened on the back of powerful electrical and electronic equipment such as powerful chipsets, widespread cloud services adoption, open interfaces for edge-computing hardware, better communication standards and protocols, and highly relevant AI models. The global COVID-19 pandemic only helped further the trend towards Industry 4.0 and the progress in Internet of Things (IoT) has also encouraged further adoption. These trends are only expected to continue in the forthcoming years, on the back of widespread competition between countries as well as companies on the technological front, as the adoption of technologies is expected to drive efficiencies, productivity and profits.

Demand for digital multimeters is expected to be driven by these developments as not only is the adoption of this technology important, but also its proper testing, maintenance and repair. According to a report by the National Association of Software and Services Companies (NASSCOM) and Capgemini, global investments in Industry 4.0 have approximately 10X in the past decade and will reach $200+ billion by 2025. Such large investments in technology will also involve investments in their testing, maintenance and repair, and this aspect is expected to prove highly beneficial to the global digital multimeter market.

The estimated market size of digital multimeter market in 2021 was $617.54 million and it is expected to reach $1,186.94 million by 2031 at a CAGR of 6.7%.

The handheld type of digital multimeter isd the leading type in the market.

Consumer electronics is the leading industry vertical of the digital multimeter market

Asia-Pacific is the largest regional market of the digital multimeter market

The top companies to hold a share in the digital multimeter market are Keysight Technologies, Gossen Metrawatt GmbH, National Instruments Corporation, Tektronix, Inc., Yokogawa Electric Corporation, Fluke Corporation, FLIR Systems, Inc., Rohde & Schwarz GmbH & Co KG, Sanwa Electric Instrument Co., Ltd., and Hioki E.E. Corporation

Loading Table Of Content...