Digital Payment Market Overview

The global digital payment market size was valued at USD 95.5 trillion in 2022, and is projected to reach USD 457.8 trillion by 2032, growing at a CAGR of 17.2% from 2023 to 2032. Increase in adoption of digital payment for online shopping due to reduced transaction time and convenience acts as a major driver in the ePayment market. In addition, increase in penetration of smartphones coupled with fast internet connectivity, rise in preference among consumers for digital payment, and massive adoptions of this payment channel among merchants are accelerating the digital payment market growth.

Key Market Trends & Insights

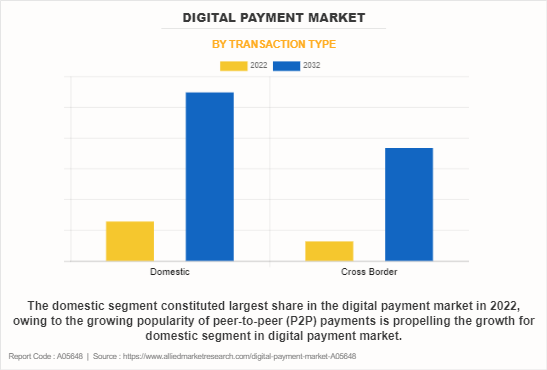

- On the basis of transaction type, the cross border segment is expected to exhibit the fastest growth rate during the forecast period

- By offering, the solution years segment led the highest digital payment market share

- Region wise, Asia-Pacific generated the highest revenue in 2022 in digital payment market size.

Market Size & Forecast

- 2022 Market Size: USD 95.5 Trillion

- 2032 Projected Market Size: USD 457.8 Trillion

- Compound Annual Growth Rate (CAGR) (2023-2032): 17.2%

However, increase in data breaches and expensive & geo-locational preference of payment gateway hamper growth of the digital payment market. On the contrary, developing economies offer significant opportunities for digital payment companies to expand their offerings, owing to factors such as growth in the middle-class segment, rapid urbanization, rise in literacy level, and increase in tech-savvy youth generation. Moreover, growth in developments and initiatives toward digitalized payments is anticipated to provide a potential growth opportunity for ePayment market.

Digital payments are made electronically between parties via digital platforms or technologies, doing away with the need for cash or conventional banking procedures. This method of financial transaction makes use of mobile devices, the internet, and other electronic systems to safely and effectively trade money. Credit and debit card transactions, online bank transfers, mobile wallets, and newer technologies like cryptocurrencies are examples of common digital payment methods. To ensure secure transactions, critical financial information is encrypted during the procedure.

Digital payment systems have become an essential part of modern economies since they offer users accessibility, speed, and ease everywhere. They have completely changed how individuals and businesses conduct financial transactions by streamlining the process of transmitting money, making purchases, and remotely managing accounts. The increasing use of smartphones, increased internet penetration, and the expansion of online commerce have all contributed to the general acceptance of digital payments. Digital payment methods develop along with technology, offering creative answers to the changing demands of businesses and customers in a more digitally connected and interconnected world economy.

The report focuses on growth prospects, restraints, and trends of the digital payment market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the market outlook.

Top Impacting Factors

Increased penetration of smartphones and access to high-speed internet

Rate of adoption of smartphones in countries, such as Canada, China, and India, has significantly increased in the past few years. In addition, proliferation of 3G and 4G connectivity has enabled customers to have hassle-free access to conduct payments on their smartphones. Moreover, 5G networks is gaining traction across North America, Asian, European, and Middle Eastern countries, and this is further propelling the digital payment market growth.

Furthermore, extensive growth in distribution network of smartphone companies has made smartphone devices easily available for end users. For instance, Samsung and MI are major mobile phone brands in rural India, owing to their pan India distribution channel, thus making online payments accessible for rural population via their mobile phones. Furthermore, rise in use of smartphones and surge in faster connectivity have enabled retailers and customers to receive payments via their smartphones, which propels the growth of the digital payment industry.

Growth of m-commerce industry

A boom in mobile commerce has been witnessed over past few years, owing to growth in penetration of smartphones, coupled with fast connectivity. Consumers are gradually opting for mobile purchase for a number of goods and services such as apparel & accessories, groceries, health & beauty, computer & electronics, and books, owing to ease of ordering and receiving it at one’s doorstep. In addition, special offers and discount coupons offered by various vendors available on the m-commerce platforms attract customers toward mobile purchases.

Mobile phones with internet connectivity provide access to several shopping sites; thus, consumers now opt more for mobile apps to make their purchases. In addition, this compels retailers to shift their business on online platforms to provide convenient services to their customers. China, Mexico, and the U.S. are the three major countries where shopping via apps is more popular. Moreover, millennial are major target customer segments for the mobile commerce industry as they use their smartphones for search or purchases, which propels growth of the digital payment industrry.

Massive adoption of mobile payments for online and retail shopping

Several businesses that are engaged in providing wide range of goods are inclining toward offering mobile payment apps options to their customers. In addition, consumer experience on mobile sites has increased significantly, and the trend of click & collect is gaining high traction in the market. These factors made retail shopping for everyday purchases more common during the pandemic. In addition, consumers are gradually opting for digitalized payments while purchasing a number of goods & services such as apparel & accessories, groceries, health & beauty, computer & electronics, and books, owing to ease of making payments.

For instance, a study conducted by PayPal in 2020 projected that 57% of consumers prefers merchants’ digital payment options while shopping from stores. Therefore, increase in preference among consumers for mobile payments and massive adoption of this payment channel among merchants strengthen the electronic payment industry.

Segment Review

The digital payment market is segmented into offering, transaction type, industry vertical, and region. By offering, the market is differentiated into solution and service. Depending on the transaction type, it is fragmented into domestic and cross border. The industry vertical segment is segmented into BFSI, IT and telecom, healthcare, retail & e-commerce, media & entertainment, transportation, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By transaction type, the domestic segment has acquired the highest digital payment market share in 2022. This is attributed to the fact that the growth of the e-commerce industry in emerging countries is driven by rise in online shopping through mobile devices, which, in turn, propels growth of the electronic payment market.

Region wise, the digital payment market size was dominated by North America in 2022, owing to the growth in use of smartphones for internet usage in day-to-day activities contributes toward growth of the online retail mobile payment transaction market in this region.

Key Digital Payment Companies:

The following are the leading companies in the digital payment market. These players have adopted various strategies to increase their market penetration and strengthen their position in the digital payment industry.

Paypal Holdings Inc.

Adeyn N.V.

Fiserv Inc.

ACI Worldwide

Stripe Inc.

Mastercard Incorporated

Temenos AG

FIS Global

Visa Inc.

PayU.

Regional Insights

The digital payment market is experiencing rapid growth globally, with significant regional variations driven by differing levels of technological adoption, regulatory frameworks, and consumer behavior.

North America Digital Payment Market, particularly the U.S. and Canada, the market has matured, with widespread adoption of mobile wallets, contactless payments, and peer-to-peer (P2P) transfers. Major players like PayPal, Apple Pay, and Google Pay dominate the market, while robust infrastructure and high internet penetration support this growth. Additionally, the push for seamless user experiences in e-commerce and retail has accelerated digital payment innovations.

Europe Digital Payment Market, the digital payment industry is seeing increasing adoption, spurred by regulations such as the Revised Payment Services Directive (PSD2), which encourages competition and innovation among payment service providers. The market is characterized by a shift towards mobile and contactless payments, particularly in Western Europe. Nordic countries, such as Sweden and Denmark, are leading the way towards becoming cashless societies. These regions benefit from a strong regulatory environment and tech-savvy populations, which has led to faster demand for digital payment solutions.

Asia-Pacific Digital Payment Market, the market is undergoing exponential growth, driven by the proliferation of smartphones and internet connectivity. Countries like China and India are at the forefront, with platforms like Alipay, WeChat Pay, and Paytm dominating the market. Government initiatives, such as India's Digital India campaign and China's cashless society drive, have further fueled this growth. In Southeast Asia, a burgeoning middle class, coupled with increased internet penetration, is contributing to the expansion of digital payments, making the region a hotspot for future market opportunities.

These regional differences underscore the dynamic nature of the digital payment industry across the globe, with unique drivers influencing growth in each region.

Market Trends and Landscape

The introduction of new and innovative products in the market by key players is expected to boost the growth of the digital payment market during the forecast period. For instance, in July 2023, ACI Worldwide, a global leader in mission-critical, real-time payments software, announced that it has launched ACI Instant Pay — a real-time payments solution that enables merchants to accept instant online, mobile, and in-store payments via a simple API integration with ACI Payments Orchestration Platform — in Europe and the U.K.

Moreover, increase in partnerships to enhance online transactions and integration of the advance technologies are some of the trends flourishing the digital payment market growth. For instance, in September 2023, Temenos announced that Varo Bank, N.A., the first all-digital, nationally chartered consumer techbank in the U.S., has extended its relationship with Temenos. Temenos Banking Cloud enabled Varo to scale based on customer demands, deploy new products quickly, and drive down operational costs substantially. This has helped the bank to bring innovative products to market faster and at scale to meet the surge in digital banking.

Recent Partnerships in Market

In December 2023, Klarna and Adyen extended global strategic partnership with aim of simplifying payments and improving the customer experience. Payment platform, Adyen, has strengthened its global partnership with Klarna. The BNPL fintech, which now designs itself as an AI powered global payments network and shopping assistant, will benefit from Adyen’s acquiring capabilities to simplify card payments for its 150 million consumers and 500,000 retail partners globally.

In October 2022, PayPal and Mastercard announced an expansion of their partnership with the introduction of Hyperwallet Original Credit Transaction. This new engagement will allow large businesses and marketplaces using Hyperwallet to conduct closed-loop payouts on pre-selected debit or credit cards. The product is available across the European Union and the United Kingdom, allowing transactions in EUR and GBP.

In October 2023, Fiserv, Inc., a leading global provider of payments and financial services technology solutions, has partnered with Melio, a leading B2B payments platform, to enable financial institutions to better meet the payments needs of small businesses. CashFlow CentralSM from Fiserv, launched through an exclusive relationship with Melio, would combine the easy-to-use accounts payable and receivable workflows for which Melio is known with the market-leading biller and merchant network and payment capabilities of Fiserv.

Recent Acquisitions in Market

In October 2023, Fiserv, Inc., a global leader in payments and financial technology, announced the acquisition of Skytef, primary distributor of Software Express’s SiTef (Solução Inteligente de Transferência Eletrônica de Fundos), from Fiserv, the leading Electronic Funds Transfer solution in Brazil. With the integration of the two companies and the addition of new associates, Fiserv expands its capacity to support large clients with complex after-sales demands.

In October 2021, Stripe, a global technology company that builds economic infrastructure for the internet, announced the acquisition of Recko, a leading provider of payments reconciliation software for internet businesses. Recko joins Stripe’s integrated suite of products that helps users optimize growth and efficiently manage revenue. Recko would automate key steps in the payments reconciliation process that slow most businesses down.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital payment market forecast from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities of digital payment market overview.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing digital payment market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global digital payment market trends, key players, market segments, application areas, and market growth strategies.

Digital Payment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 457.8 trillion |

| Growth Rate | CAGR of 17.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Offering |

|

| By Industry Vertical |

|

| By Transaction Type |

|

| By Region |

|

| Key Market Players | Adyen N.V., Fiserv, Inc., Stripe, Inc., ACI Worldwide, Temenos AG, PAYU, Mastercard Incorporated., FIS Global, VISA, INC., PayPal Holdings, Inc. |

Analyst Review

With enabling data-driven personalization and enhancing user experience, retailers are increasingly looking to accommodate consumer demand for secure and hassle-free transactions via digital payment method. Moreover, consumers continue to use innovative payment technology in replacement of cash. Benefits associated with digital payment, such as increase in convenience & reduced transaction time and rise in adoption of smartphones among end users, drive the market growth. In addition, several key players are enhancing & providing advanced digital payment options and are offering coupons & promotions by directing customers to a landing page or downloadable coupons, which can be used for their next purchase.

The COVID-19 outbreak has a significant impact on the digital payment market, and has accelerated the usage & adoption of online selling & purchases among retailers and consumers, respectively. Moreover, during this global health crisis, the adoption of digital payment technology increased among large & small retailers. This, as a result promoted the demand for digital payment, thereby accelerating the revenue growth.

The digital payment market is fragmented with the presence of regional vendors such as Paypal Holdings Inc., Adeyn N.V., Fiserv, Inc., ACI Worldwide, Stripe, Inc., Mastercard Incorporated, Temenos AG, FIS Global, Visa, Inc., and PayU. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for digital payment across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The global digital payment market size was valued at $95.5 trillion in 2022, and is projected to reach $457.8 trillion by 2032

The global cloud gaming market is projected to grow at a compound annual growth rate of 17.2% from 2023-2032 to reach USD 457.8 trillion by 2032

The key players profiled in the report include digital payment market analysis includes top companies operating in the market such as Paypal Holdings Inc., Adeyn N.V., Fiserv, Inc., ACI Worldwide, Stripe, Inc., Mastercard Incorporated, Temenos AG, FIS Global, Visa, Inc., and PayU.

The digital payment market size was dominated by North America in 2022

Owing to driving factors such as growth in the middle-class segment, rapid urbanization, rise in literacy level, and increase in tech-savvy youth generation.

Loading Table Of Content...

Loading Research Methodology...