Digital Twins in Automotive Market Insights, 2032

The global digital twins in automotive market size was valued at $2.2 billion in 2022, and is projected to reach $34.6 billion by 2032, growing at a CAGR of 32.6% from 2023 to 2032.

Digital twins are virtual or digital replicas of physical vehicles, processes, or systems in the automotive industry. In the automotive sector, digital twins are developed by digitizing or copying real vehicles, which include every component and detail down to the smallest bolt. The term "twin" is used because the digital representation is intended to be identical to its physical counterpart.

- The digital twins in automotive market study covers around 15 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The digital twins in automotive market share is moderately fragmented in several players including Altair Engineering Inc., ANSYS, Inc, Bosch Rexroth AG, General Electric Company, IBM Corporation, PTC Inc., Rockwell Automation, Inc., SAP SE, Schneider Electric SE., and Siemens. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the digital twins in automotive market.

Previously, digital twins were created by photographing and replicating existing vehicles. However, as technology develops, digital twins are now being created even before their physical counterparts are manufactured. This enables automotive engineering teams to use the digital twin to design, simulate, and test various vehicle components and equipment without regard for physical constraints.

Factors such as increase in demand for efficient product design and development, need for efficient performance monitoring, and cost reduction due to virtual testing boost the growth of the digital twins in automotive market. However, integrating digital twin technology into existing systems, and vulnerability of digital twins to cyber attacks are anticipated to hinder market growth. On the other hand, utilization of emulation software and digital twin technology, sustainable practices and environmental impact provide a remarkable growth opportunity for the market players operating in the market.

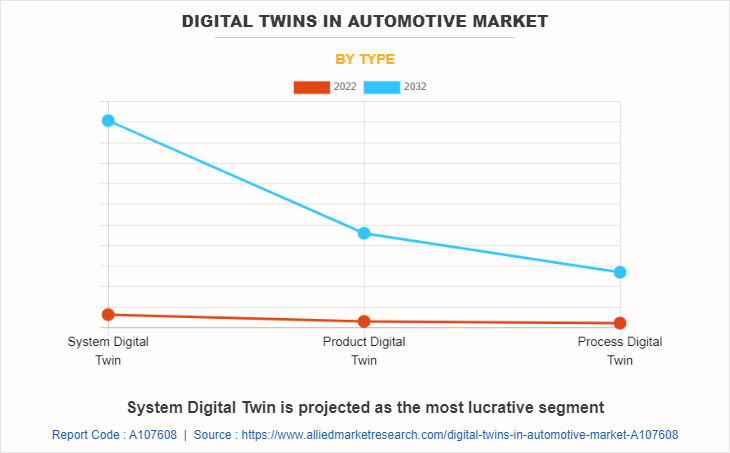

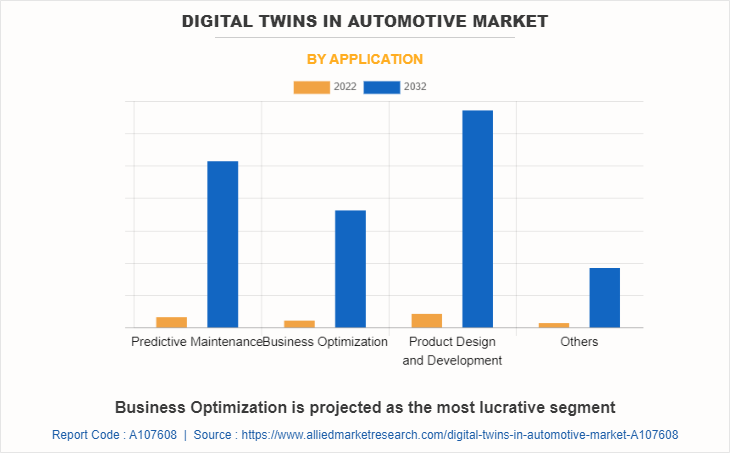

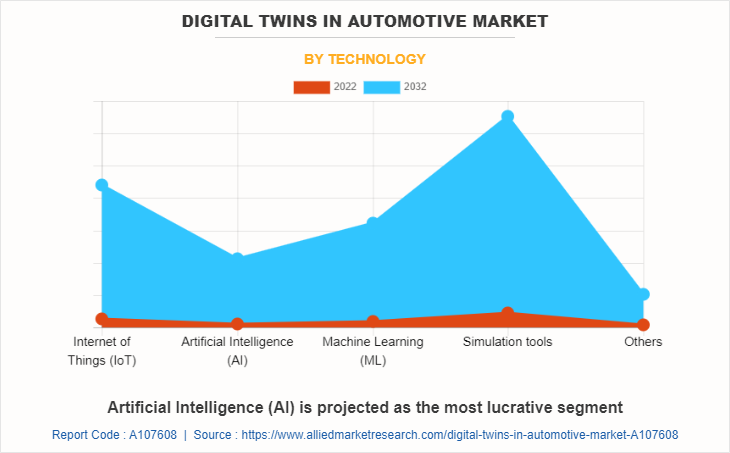

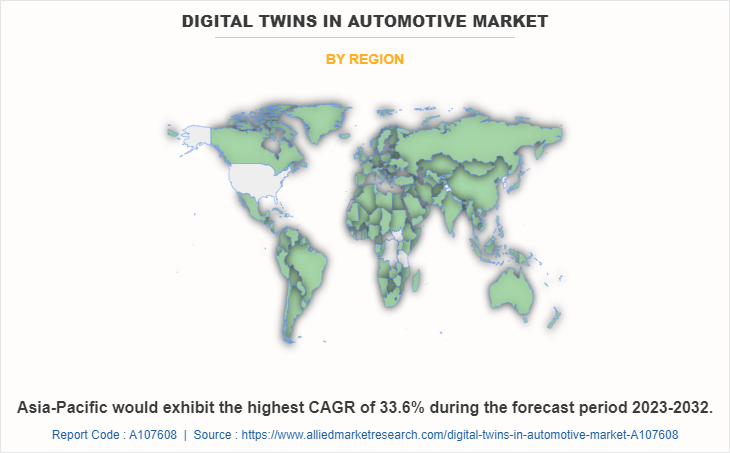

The global digital twins in automotive market is segmented into type, application, technology, and region. On the basis of type, it is bifurcated into system digital twin, product digital twin, and process digital twin. By Application, it is categorized into predictive maintenance, business optimization, product design & development, and others. On the basis of technology, it is segregated into internet of things (IoT), artificial intelligence (AI), machine learning (ML), simulation tools, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America is a prominent region in the digital twins in automotive market, comprising the U.S., Canada, and Mexico. North America has emerged as a potential market for digital twins in the automotive industry, as automotive manufacturers in North America are leveraging digital twins to enhance operational efficiency. By creating virtual replicas of their production facilities, companies may optimize manufacturing processes, streamline supply chain management, and reduce downtime. With the increasing popularity of connected cars and IoT in the region, there are opportunities for digital twins to play a crucial role in managing and optimizing the connectivity and data exchange within vehicles, creating personalized experiences for drivers and passengers.

In addition, North American companies are collaborating with automation robot companies to provide advanced automotive manufacturing process. For instance, in April 2021, Rockwell Automation entered into a collaboration with Comau, a renowned industrial automation and robot manufacturing company, with the objective of simplifying robot integration for manufacturers. Through this collaboration, end users of various industries, including automotive, are provided with advanced analytics and digital twin tools, enabling them to gain comprehensive insights into machine performance and identify potential opportunities for production optimization.

Moreover, U.S. attracted investments from automotive digital twin solution providers for further expansion of the company. For instance, in December 2022, Bosch Rexroth AG inaugurated its new Customer Innovation Center (CIC) in Austin, Texas. The CIC aims to cater to customers involved in various sectors such as electric vehicle manufacturing, battery production, consumer packaged goods, and semiconductor manufacturing. The facility leverages advanced technologies, including virtual connections and digital twin capabilities, to enhance the customer experience. These developments further support the growth of digital twin in the automotive market.

The key players profiled in the digital twins in automotive industry research report include Altair Engineering Inc., ANSYS, Inc, Bosch Rexroth AG, General Electric Company, IBM Corporation, PTC Inc., Rockwell Automation, Inc., SAP SE, Schneider Electric SE., and Siemens.

The leading companies adopt strategies such as product launch, partnership, acquisition, expansion, and collaboration to strengthen their market position.

Recent Developments:

- In January 2023, Schneider Electric SE. acquired AVEVA, a leading industrial software provider. AVEVA software the aims to drive efficiency and cost reduction across various industries. AVEVA product offerings include a Digital Twin solution that covers the entire asset lifecycle, from Engineering through to Operations and Maintenance. The acquisition strengthens Schneider Electric's position in the industrial software market and expands its capabilities in delivering comprehensive digital solutions

- In October 2022, Altair Engineering Inc., a prominent global provider of computational science and artificial intelligence (AI) solutions, launched a comprehensive digital twin solution. This solution offers highly connected and cross-functional capabilities, making it suitable for deployment at any stage of a product's lifecycle. Altair's digital twin solution is designed to enhance product development and optimization by providing advanced simulation and AI-driven capabilities.

- In December 2021, Siemens announced partnership with Hyundai Motor Company and Kia Corporation, subsidiaries of the Hyundai Motor Group, for advanced product data management and engineering needs. The digital twinning approach is expected to involve cloud-based model-based simulations integrated with real-world performance analytics and test data, enhancing their capabilities in this domain.

Increase in demand for efficient product design and development

Automotive manufacturers are facing intense competition, and reducing the time required to bring a new product to market is crucial. By utilizing digital twins, automotive companies can simulate and analyze various design iterations and configurations in a virtual environment. This enables them to identify potential issues, optimize performance, and make necessary improvements before the physical prototype stage. Consequently, the product development cycle is shortened, allowing faster time-to-market.

Digital twins are used to create virtual models of vehicles, which are used to simulate different scenarios and test different design options. Various chip manufacturers collaborated to bring new digital twin products for automobile manufactures. For instance, in January 2020—a chip design company—Arm and—manufacturing conglomerate—Siemens announced a partnership aimed at accelerating automotive design with digital twins. Pave360, a digital twin product from Siemens, incorporating Arm technologies, utilizes high-fidelity modeling techniques to simulate various aspects of vehicle design, such as sensors, integrated circuits, and vehicle dynamics. These models allow automakers to simulate sub-system designs. The market for digital twin solutions is expected to grow significantly in the automotive industry, due to benefits such as improved product development, reduced downtime, and predictive maintenance.

As the automotive industry continues to evolve, the demand for efficient product design and development is expected to increase significantly. Digital twins serve as a powerful tool that may help automotive manufacturers to meet this demand, thus boosting the demand for digital twins in automotive market.

Need for efficient performance monitoring and predictive maintenance

Digital twins offer valuable capabilities for monitoring the performance of vehicles and enabling predictive maintenance, which contributes to improved operational efficiency and cost savings.

Digital twins provide real-time monitoring of the performance of automotive components, systems, and even entire vehicles. By capturing and analyzing data from sensors embedded in the physical assets, digital twins enable continuous monitoring of various parameters such as temperature, pressure, and vibration. This real-time monitoring allows automotive companies to detect any anomalies or deviations from expected performance, enabling them to take proactive measures before any critical issues arise.

Digital twins facilitate predictive maintenance strategies by leveraging real-time data and advanced analytics. By continuously monitoring the performance and condition of vehicles, Digital Twins may detect early signs of potential failures or maintenance needs. With the help of machine learning algorithms, historical data, and pattern recognition, digital twins predict the remaining useful life of components, estimate failure probabilities, and recommend optimal maintenance schedules. This proactive approach to maintenance helps prevent unexpected breakdowns, minimize downtime, optimize maintenance costs, and extend the service life of critical assets.

Moreover, automotive manufacturers adopt digital twins to improve performance of electric vehicle (EVs). For instance, in May 2022, Hyundai Motor Group conducted a pilot program in partnership with Microsoft Korea to validate the efficacy of digital twin technology in enhancing the performance of EV batteries. The collaborative initiative aims to demonstrate the capability of digital twins to accurately predict the service life of individual EV batteries and optimize their overall performance. This project incorporates advanced technologies such as artificial intelligence (AI), machine learning (ML), and physical models to analyze driving data and other pertinent factors that influence battery longevity. Thus, the digital twins in automotive market is expected to witness steady growth as digital twins offer automobile manufactures advanced monitoring and performance testing features.

Cost reduction due to virtual testing

Digital twins exhibit multiple benefits in terms of testing and production optimization, resulting in cost savings. They enable virtual testing of automotive components and entire vehicles, eliminating the need for expensive physical prototypes. This approach reduces material and labor costs associated with traditional testing methods. By simulating real-world scenarios, performance testing, and failure analysis in a virtual environment, automotive companies can identify design flaws and potential issues early on, allowing for cost-effective improvements and optimizations.

In addition, digital twins help minimize risks in product development and production. Through virtual tests and simulations, automotive companies may proactively identify and address potential risks and failures before they manifest in the physical world. This proactive approach significantly reduces the likelihood of costly errors, recalls, and warranty claims. By mitigating issues early in the process, companies can save substantial costs that would otherwise be incurred in rectifying problems during production or after the product is released in the market.

Digital twins can optimize production processes by simulating and analyzing manufacturing operations. It provides insights into production line efficiency, resource allocation, and workflow optimization. By identifying bottlenecks, cycle time reductions, and process improvements in a virtual environment, automotive companies can optimize production schedules, minimize downtime, and enhance overall productivity. This leads to cost savings through improved production cycle. For instance, in March 2023, BMW formed a partnership with Nvidia to develop a digital replica of its upcoming EV factory. This collaboration is highly advantageous, both in terms of cost savings and streamlining operations. The technology being utilized, known as Omniverse, enables BMW to connect its intricate design databases into one comprehensive database. This virtual factory serves as an exact digital twin of future plant of BMW in Debrecen, Hungary, which is expected to manufacture approximately 150,000 vehicles annually starting in 2025. The implementation of this virtual factory is expected to revolutionize manufacturing processes of BMW and pave the way for increased efficiency and productivity.

Therefore, digital twins provide a range of advantages to the automotive industry, including cost savings, risk mitigation, and production optimization. By leveraging virtual simulations and analysis, companies can improve design, reduce errors, and enhance overall operational efficiency, which supports the growth of the digital twins in automotive market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital twins in automotive market analysis from 2022 to 2032 to identify the prevailing digital twins in automotive market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital twins in automotive market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digital twins in automotive market trends, key players, market segments, application areas, and market growth strategies.

Digital Twins in Automotive Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 34.6 billion |

| Growth Rate | CAGR of 32.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 285 |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bosch Rexroth AG, General Electric Company, Siemens, ANSYS, Inc., Schneider Electric SE., Rockwell Automation, Inc., Altair Engineering Inc., SAP SE, PTC Inc., IBM Corporation |

The global digital twins in automotive market was valued at $2,170.1 million in 2022, and is projected to reach $34,578.2 million by 2032.

Increase in demand for efficient product design and development and utilization of emulation software and digital twin technology are the upcoming trends of digital twins in automotive market

Product design and development is the leading application of digital twins in automotive market

North America is the largest regional market for Digital Twins in Automotive

Key players profiled in the report include Altair Engineering Inc., ANSYS, Inc, Bosch Rexroth AG, General Electric Company, IBM Corporation, PTC Inc., Rockwell Automation, Inc., SAP SE, Schneider Electric SE., and Siemens.

Loading Table Of Content...

Loading Research Methodology...