Distributed Energy Generation Market Overview:

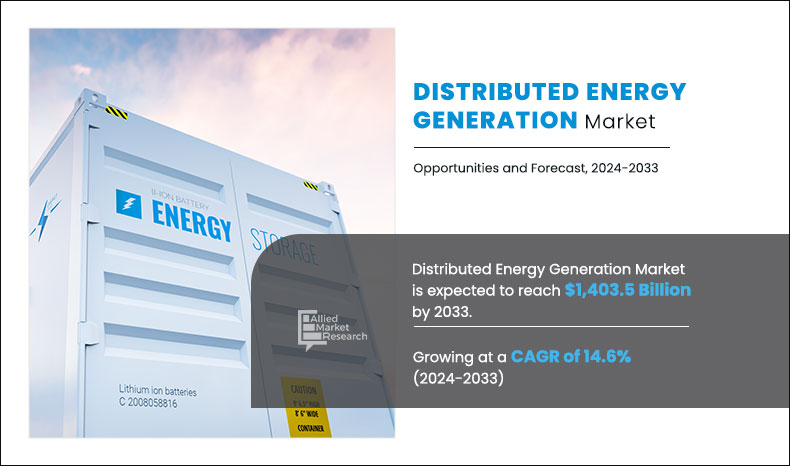

The global distributed energy generation market size was valued at USD 360.4 billion in 2023 and is projected to reach USD 1,403.5 billion by 2033, growing at a CAGR of 14.6% from 2024 to 2033. The surge in demand for reliable and decentralized energy solutions, coupled with growing environmental concerns and ambitious renewable energy targets, is driving the demand for distributed energy generation systems. These innovative systems offer a unique combination of energy security, grid independence, and the ability to integrate multiple renewable sources, making them suitable for a wide range of applications such as rural electrification and industrial energy supply. Additionally, advancements in smart grid technologies and energy storage solutions enhance the efficiency and reliability of distributed generation, further propelling their adoption across various sectors in the energy market.

Key Market Trends & Insights

- The solar PV segment is expected to record the highest revenue CAGR of around 17.6% during the forecast period.

- By application, the commercial segment is expected to dominate the market during the forecast period.

- Asia-Pacific leads the market, driven by rapid economic development, urbanization, and a rising demand for energy.

Market Size & Forecast

- 2023 Market Size: USD 360.4 billion

- 2033 Projected Market Size: USD 1,403.5 billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 14.6%

Introduction

Solar panels, wind turbines, and combustion engines are examples of distributed generation technologies that generate electricity at or near the point of usage. Distributed generation power is a single structure, such as a home or company, or it is part of a microgrid, such as at a big industrial complex, military base, or college campus. Distributed generating helps deliver clean, reliable power to more consumers and reduce electricity losses along transmission and distribution lines when connected to the electric utility's lower voltage distribution lines.

Key Takeaways

- The distributed energy generation market share has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of technology, end-use industry, and region.

- The distributed energy generation market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the distributed energy generation market analysis are Siemens, General Electric, Mitsubishi Electric Corporation, Schneider Electric, Caterpillar Power Plants, Doosan Corporation, Vestas Wind Systems A/S, Rolls-Royce Power Systems AG, Toyota Turbine and Systems Inc., and Capstone Turbine Corporation.

- The report facilitates strategy planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the perovskite solar cells industry.

- The Asia-Pacific region holds a significant share of the distributed energy generation market growth.

Market Dynamics

Increase in government policies and greenhouse gas (GHG) emission reduction targets, drive the growth of the distributed energy generation market during the forecast period. Several states and municipal governments are advancing laws to encourage increased deployment of renewable technologies due to the benefits of renewable technology, such as energy security, resiliency, and carbon reductions. Furthermore, an increase in R&D initiatives for the development of new technologies is also expected to propel market growth. Moreover, distributed energy generation (DEG) systems are less expensive than traditional power production techniques. As a result, the need for a clean source of energy, along with the product's low cost, is expected to have a favorable impact on market growth throughout the forecast period. These are some of the distributed energy generation market trends observed globally.

The distributed energy generation market faces significant challenges due to the high installation costs and negative environmental impacts. Initial setup expenses for technologies such as solar panels, wind turbines, and energy storage systems are prohibitively expensive, deterring widespread adoption. In addition, the end-of-life disposal of equipment and the potential for environmental degradation pose serious concerns. These factors hinder the market's growth despite the increasing demand for decentralized energy solutions. Addressing these restraints requires technological advancements to reduce costs and the development of sustainable practices for managing the environmental impact of distributed energy systems.

The application of hybrid energy systems presents a significant opportunity for the distributed energy generation market. By integrating various renewable energy sources, such as solar, wind, and bioenergy, with traditional power systems, hybrid energy solutions enhance reliability and efficiency. These systems provide a consistent power supply even in fluctuating environmental conditions, reducing dependence on a single energy source. This versatility is crucial for remote and off-grid areas, promoting energy access and sustainability. In addition, advancements in energy storage technologies further perfect hybrid systems, making them a viable and attractive option for decentralized energy generation and contributing to the global transition toward greener energy solutions.

Segments Overview

The distributed energy generation market forecast is segmented on the basis of technology, end-use industry, and region. By technology, the market is classified into micro-turbines, combustion turbines, micro-hydropower, reciprocating engines, fuel cells, wind turbines, solar PV, and others. By end-use industry, the market is classified into residential, commercial, and industrial. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest share of the market, followed by LAMEA and Europe.

Global Market By Technology

On the basis of technology, Fuel cells dominate the distributed energy generation market due to their high efficiency, reliability, and environmental benefits. Unlike traditional combustion-based power generation, fuel cells convert chemical energy directly into electrical energy through an electrochemical process, resulting in higher efficiency and lower emissions. They utilize various fuels, including hydrogen, natural gas, and biogas, making them versatile for different applications. Fuel cells also offer scalable solutions, from small residential units to large industrial systems, providing flexibility in power generation. Their ability to provide consistent and uninterrupted power makes them ideal for critical infrastructure and remote locations where reliability is paramount. Additionally, advancements in fuel cell technology have reduced costs and improved performance, further driving their adoption. As concerns over environmental sustainability and energy security grow, fuel cells present a promising solution, aligning with global efforts to reduce carbon footprints and enhance distributed energy generation systems.

By Technology

Solar PV is projected as the most lucrative segment.

Global Market By End Use Industry

The industrial segment dominates the distributed energy generation market due to its high and continuous energy demand, which requires reliable and cost-effective power solutions. Industries such as manufacturing, mining, and petrochemicals often operate around the clock and cannot afford power interruptions. Distributed energy generation systems, including combined heat and power (CHP) and renewable energy installations, provide these industries with a stable and efficient energy supply, reducing dependence on the central grid and mitigating the risks associated with grid outages. Additionally, the ability to generate energy on-site helps industries lower energy costs and enhance operational efficiency. The growing emphasis on sustainability and reducing carbon footprints also drives industries to adopt distributed energy solutions, integrating renewable energy sources like solar and wind to meet environmental regulations and corporate social responsibility goals. Thus, the industrial segment’s need for reliable, economical, and sustainable energy significantly propels its dominance in the distributed energy generation market.

By End-use Industry

Commercial is projected as the most lucrative segment.

Global Market By Region

The Asia-Pacific region dominates the distributed energy generation market due to its rapid economic growth, urbanization, and increasing energy demand. Countries like China, India, and Japan are at the forefront of adopting distributed energy solutions to address their expanding energy needs and reduce dependence on centralized power grids. The region's strong governmental support and favorable policies for renewable energy adoption, coupled with significant investments in smart grid technologies, further drive market growth. Additionally, the abundance of renewable resources such as solar, wind, and biomass in the Asia-Pacific region enhances the feasibility and attractiveness of distributed energy generation. The focus on reducing greenhouse gas emissions and improving energy access in rural and remote areas also propels the deployment of distributed energy systems. Overall, the combination of economic incentives, supportive regulatory frameworks, and abundant natural resources positions Asia-Pacific as a leader in the distributed energy generation market.

By Region

Asia-Pacific is projected as the most lucrative segment.

Key Distributed Energy Generation Companies:

Key players in the distributed energy generation industry include

- Siemens

- General Electric

- Mitsubishi Electric Corporation

- Schneider Electric

- Caterpillar Power Plants

- Doosan Corporation

- Vestas Wind Systems A/S

- Rolls-Royce Power Systems AG

- Toyota Turbine

- Systems Inc.

- Capstone Turbine Corporation.

In the distributed energy generation market trends, companies have adopted agreements, product development, and innovation to expand the market or develop new products. For instance, in January 2024, Caterpillar successfully tested hydrogen fuel cells at the Microsoft data center. The company says the demonstration provided insights into the capabilities of fuel cell systems to power multi-megawatt data centers, ensuring uninterrupted power supply to meet 99.999% uptime requirements. Furthermore, in December 2023, Doosan Corp. announced the development of hydrogen polymer electrolyte membrane fuel cell (H2-PEMFC) systems for buildings and homes, with capacities of 1kW and 10kW. The H2-PEMFC systems directly utilize hydrogen fuel, unlike conventional systems that rely on natural gas reformation. Moreover, in March 2023, Vestas secured a 50 MW order in Germany for a wind project that is expected to provide energy for green hydrogen production from Energiepark Bad Launchstadt GmbH.

Key Benefits of Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the distributed energy generation market analysis from 2023 to 2033 to identify the prevailing distributed energy generation market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the distributed energy generation market statistics and segmentation assists in determining the prevailing market opportunities.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the distributed energy generation market trends, key players, market segments, application areas, and market growth strategies.

Distributed Energy Generation Market Report Highlights

| Aspects | Details |

| By TECHNOLOGY |

|

| By END USE INDUSTRIES |

|

| By Region |

|

| Key Market Players | Schneider Electric, Rolls-Royce Power Systems AG, Mitsubishi Electric Corporation, Vestas Wind Systems A/S, Caterpillar Power Plants, Siemens, Doosan Corporation, General Electric, Toyota Turbine and Systems Inc., Capstone Turbine Corporation. |

Analyst Review

According to the analyst, the global distributed energy generation market is anticipated to witness growth during the forecast period, driven by increased environmental awareness and stringent government policies on reduction in emission of greenhouse gases.

The deployment of DEG technologies has increased since 2014 owing to the adoption of supportive government policies, such as Production Tax Credit (PTC) that provides a per-kilowatt-hour tax credit for the electricity generated by DEG resource and Investment Tax Credit (ITC) that allows the tax credit to be taken based on the amount invested instead of the electricity produced. Several states and local governments are advancing policies to encourage greater deployment of renewable technologies due to their benefits, including energy security, resiliency, and emissions reductions.

However, high installation cost and negative environmental effect can have a restraining effect on the growth of the market. Distributed energy generation technologies that involve burning fossil fuels—can produce many types of impacts as larger fossil-fuel-fired power plants, such as air pollution. Also, hybrid energy systems are defined as the integration of several types of energy generation equipment such as electrical energy generators, electrical energy storage systems, and renewable energy sources. Hybrid energy systems may be utilized in grid-connected mode, isolated from grid, and special aims. This is expected to provide growth opportunities for the distributed energy generation market during the forecast period.

Increased environment awareness, government policies, and green house gas emission reduction targets are the key factors boosting the Distributed Energy Generation Market growth.

The global distributed energy generation market size was valued at $360.4 billion in 2023 and is projected to reach $1,403.5 billion by 2033, growing at a CAGR of 14.6% from 2024 to 2033.

Key players in the distributed energy generation market include Siemens, General Electric, Mitsubishi Electric Corporation, Schneider Electric, Caterpillar Power Plants, Doosan Corporation, Vestas Wind Systems A/S, Rolls-Royce Power Systems AG, Toyota Turbine and Systems Inc., and Capstone Turbine Corporation.

Application in hybrid energy systems is the opportunity to the distributed energy generation Market growth.

The distributed energy generation market is segmented on the basis of technology, end-use industry, and region. By technology, the distributed energy generation market is segmented into micro-turbines, combustion turbines, micro-hydropower, reciprocating engines, fuel cells, wind turbines, solar PV, and others. By end-use industry, the market is divided into residential, commercial, and industrial. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

High installation cost and negative environmental effect at the end hamper the growth of distributed energy generation Market growth.

Commercial is the fasting growing segment on the basis of end use in distributed energy generation Market.

Loading Table Of Content...