Eddy Current Testing Market Statistics, 2030

The global eddy-current testing market size was valued at $964.45 million in 2020 and is projected to reach $2.3 billion by 2030, growing at a CAGR of 9.5% from 2022 to 2030. Eddy current testing is an enhanced non-destructive testing inspection method that is used to discover flaws, measure material &coating thickness, identify materials, and determine the heat treatment state of specific materials. Eddy current testing is a specifically built coil powered by an alternating current, which is positioned near the test surface, creating a changing magnetic field that interacts with the test part and generates an eddy current measurement in the region.

In addition, eddy current inspection uses a receiver coil to monitor the alternating current flowing in the primary excitation coil. Moreover, the rise in penetration of automation solutions in industrial sectors is anticipated to offer significant growth opportunities for the eddy-current testing market forecast.

The eddy-current testing market share is expected to witness notable growth during the forecast period, owing to a rise in safety regulations by governments. Furthermore, advancement in the new ECT technology is expected to drive the growth of the eddy current testing Industry. Moreover, the surge in outsourcing of services is projected to propel the eddy current testing market growth during the forecast period.

However, the lack of a skilled and qualified workforce is one of the prime factors that restrain the eddy current testing market outlook. On the contrary, increased infrastructural developments in emerging economies and manufacturing opportunities in BRICS are expected to provide lucrative opportunities for the growth of the eddy-current testing market outlook during the forecast period.

The outbreak of COVID-19 has significantly impacted the growth of the eddy current testing in 2020; however, the rise in safety and security regulations in the oil & gas and manufacturing sectors is expected to drive the market by the end of 2022. Nevertheless, the market was principally hit by several obstacles created amid the COVID-19 pandemic, such as a lack of skilled workforce availability and delay or cancellation of projects owing to partial or complete lockdowns globally. In contrast, the rise in technological advancement in emerging economies significantly boosts the need for advanced testing and security solutions, which is expected to drive the growth of the eddy-current testing market opportunity during the forecast period.

Segment Overview

The eddy-current testing market is segmented into technique, service, and industry verticals.

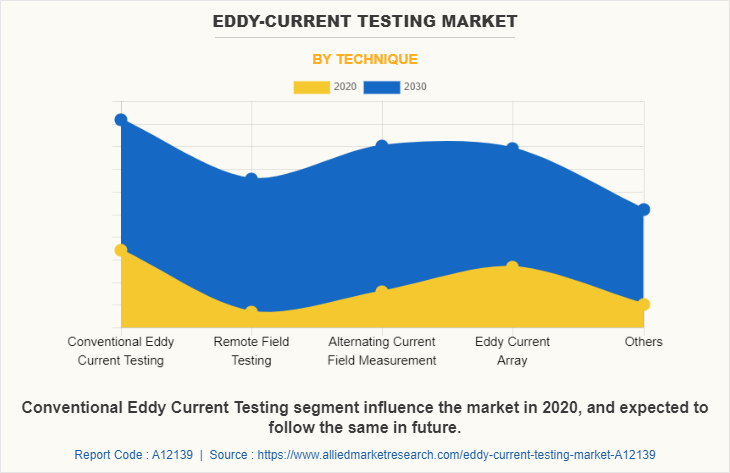

By technique, the market is segmented into conventional eddy current testing, remote field testing, alternating current field measurement, eddy current array, and others. The remote field-testing segment dominated the market, in terms of revenue, in 2020, and is expected to follow the same trend during the forecast period.

By service, the market is split into inspection services, equipment rental services, calibration services, and training services. The inspection services segment dominated the eddy-current testing industry in 2020 and is anticipated to drive the market in the coming years.

By Service

Inspection Services segment hold domination position in 2020.

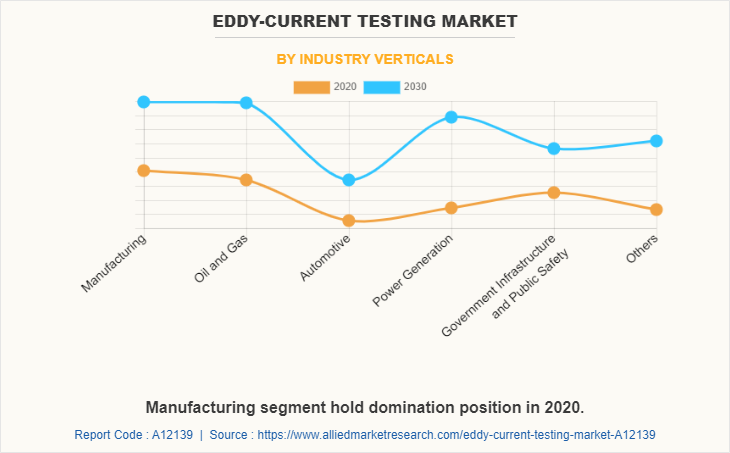

Based on industry vertical, it is classified into manufacturing, oil & gas, automotive, power generation, government infrastructure & public safety, and others. The oil & gas segment acquired the largest share in 2020, and the BFSI segment is expected to grow at a high CAGR from 2022 to 2030.

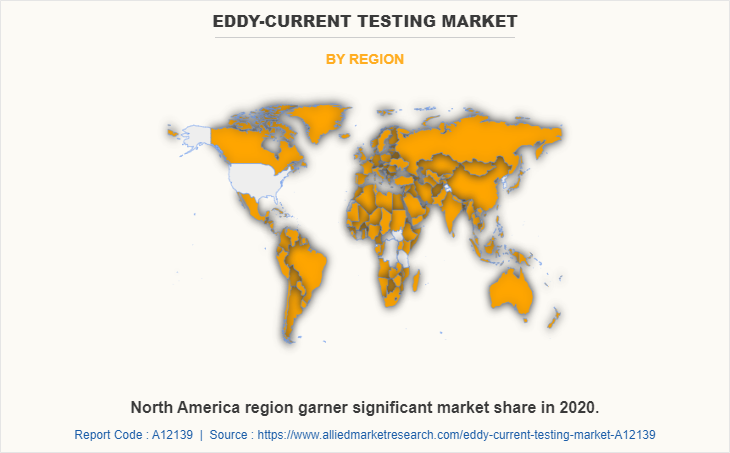

By region, the eddy current testing market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America, specifically the U.S., remains a significant participant in the global eddy-current testing market growth. Major organizations and government institutions in the country are intensely putting resources into the technology.

Competition Analysis

Competitive analysis and profiles of the major eddy current testing market players, such as General Electric Company, Ether NDE Limited, Olympus Corporation, Eddyfi NDT Inc, Mistras Group Inc., Ashtead Technology Ltd., TUV Rheinland AG, Ibg NDT System Corporation, Fidgeon Limited, and Magnetic Analysis Corporation Inc., are provided in this report

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the eddy-current testing market from 2020 to 2030 to identify the prevailing eddy-current testing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the eddy current testing market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global eddy-current testing market trends, key players, market segments, application areas, and market growth strategies.

Eddy-current Testing Market Report Highlights

| Aspects | Details |

| By Technique |

|

| By Service |

|

| By Industry Verticals |

|

| By Region |

|

| Key Market Players | Eddyfi NDT Inc, Mistras Group Inc, General Electric Company, Olympus Corporation, Magnetic Analysis Corporation, Fidgeon Limited, Ashtead Technology Ltd, TUV Rheinland AG, Ether NDE Limited, Ibg NDT System Corporation |

Analyst Review

The eddy current testing industry has enormous development potential globally. The market, which is still in its early stages, has begun to contribute considerably to the broader testing industry. Furthermore, the contribution to the worldwide market is predicted to grow considerably in the coming years. In addition, the rise in demand for smart infrastructure and artificial intelligence solutions across the industrial, commercial, and manufacturing sectors is projected to drive the growth of the eddy current testing market in the coming years.

The global eddy current testing market is highly competitive, owing to the strong presence of existing vendors. Eddy's current testing vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The surge in demand for safety and security solutions across manufacturing, aerospace, and oil & gas sectors globally drives the need to enhance eddy current testing systems. Moreover, prime economies, such as the U.S., China, the UK, and Japan, plan to develop and deploy next-generation eddy current testing solutions across various sectors. For instance, in July 2020, Xiamen COBE NDT Technology Co. Ltd introduced the Eddy Current Flaw Detector, a new generation of eddy current nondestructive testing device that uses the most advanced digital electronic technology, photovoltaic technology, and microprocessor technology, which is anticipated to provide lucrative opportunities for the market growth.

Among the analyzed regions, North America exhibits the highest adoption rate of eddy current testing and has experienced a massive expansion of the market. On the other hand, Asia-Pacific is expected to grow at a faster pace, predicting lucrative growth due to emerging countries, such as China, Japan, and India, investing in these technologies. Regions, such as the Middle East and Latin America, are also expected to offer new opportunities in the eddy current testing market in the future.

The key players profiled in the report include eddy's current testing markets players, such as General Electric Company, Ether NDE Limited, Olympus Corporation, Eddyfi NDT Inc, Mistras Group Inc., Ashtead Technology Ltd., TUV Rheinland AG, Ibg NDT System Corporation, Fidgeon Limited, and Magnetic Analysis Corporation Inc.

The rise in safety regulations by governments is anticipated to drive the growth of eddy current testing and the rise in safety regulations by governments are some of the upcoming trends of the Eddy-current Testing Market in the world

The manufacturing sector is the leading application of the Eddy-current Testing Market.

North America is the leading player in the eddy-current testing market.

The eddy current testing market was valued at $ 964.4 million in 2020.

General Electric Company, Olympus Corporation, ibg NDYT System Corporation, TUV Rheinland AG, and Magnetic Analysis Corporation are the top companies to hold the market share in Eddy-current Testing.

Loading Table Of Content...