eHealth Market Research, 2027

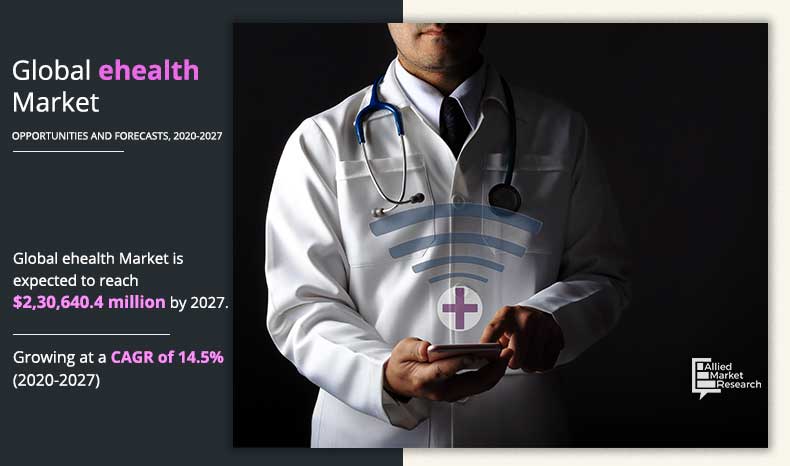

The global eHealth market was valued at $74,476.4 million in 2019, and is projected to reach $2,30,640.4 million by 2027 at a CAGR of 14.5% from 2020 to 2027. eHealth is broadly defined as the use of information and communication technology (ICT) in health. ICT has been widely used in the form of medical health records, medical apps, and telemedicine. With the help of e-health, it is possible to electronically store the data related to patients, staff, and finance of hospitals. This has resulted in transformation in the means of storing healthcare data. Initially, data was recorded manually by the healthcare staff. On the other hand, currently, single unique identification number is required to be entered and all the data of patients is available within seconds.

eHealth offers multiple advantages over conventional methods of clinical data management such as it prevents the use of manual records and facilitates timely access to patient data. Furthermore, automated and interoperable healthcare information systems are anticipated to improve medical care, reduce healthcare costs, increase efficiency, reduce error, and enhance patient satisfaction, while optimizing reimbursement for ambulatory and inpatient healthcare providers.

Almost every nation is dealing with the outbreak. Most markets are dropping down as COVID-19 outbreak has negatively affected various healthcare-related markets. This pandemic is expected to present growth opportunities for E-health market in the future. eHealth market includes major suppliers such as Cerner Corporation, GE Healthcare, and Allscripts. These suppliers have their manufacturing facilities spread across various countries across North America, Asia-Pacific, Europe, South America, and RoW. COVID-19 has impacted their businesses as well. For instance, In April 2020, GE Healthcare extended its longtime collaboration with Microsoft to launch a cloud-based COVID-19 patient monitoring software for health systems, which will further boost the eHealth market growth. In addition, e-health providers has undertaken the task of providing a global overview of the e-health solutions available for COVID-19. Solution providers, consultants advising the healthcare system, and healthcare professionals have been prompted on the internet to contribute with solutions for COVID-19.

The growth of the global eHealth market is majorly driven by increase in government initiatives supporting the use of e-health solutions and services, surge in need to manage regulatory compliance through use of e-health solutions, and dearth of healthcare professionals. However, reluctance among medical professionals to adopt advanced e-health solutions and high cost of deployment and maintenance of e-health solutions hinder the market growth. Conversely, increase in opportunities in emerging nations; expansion of mHealth, telehealth, and remote patient monitoring markets; and rise in use of e-health solutions in outpatient care facilities are expected to provide lucrative growth opportunities for the market growth.

eHealth Market Segmentation

The global eHealth market is segmented on the basis of type, end user, and region. By type, the market is segregated into electronic health records (EHR), vendor neutral archive (VNA), picture archiving, & communications systems (PACS), laboratory information systems (LIS), telehealth, prescribing solutions, medical apps, clinical decision support systems (CDSS), pharmacy information systems, and others. Depending on end user, it is fragmented into healthcare providers, payers, healthcare consumers, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product

By product, the medical apps segment is anticipated to grow with the largest share throughout the forecast period. This is attributed to rise in demand for quality healthcare services & solutions, increase in acceptance of mHealth practices, surge in demand for improved patient safety and patient care, and increase in government initiatives to promote e-health. Moreover, surge in adoption of smartphones, tablets, and other mobile platforms is driving the growth of the market.

By Type

Medical Apps is projected as one of the most lucrative segment.

By End User

On the basis of end user, the healthcare provider solution held the largest market share, due to rise in adoption of electronic health records (EHR) and other hospital information systems by healthcare providers.

By End User

Healthcare Providers holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

By Region

North America accounted for the largest share of revenue in 2019, and is anticipated to maintain its dominance from 2020 to 2027, due to favorable regulatory scenario toward e-health, surge in adoption of e-health solutions to curtail soaring healthcare costs, regulatory requirements regarding patient safety, and presence of a large number of e-health companies, such as Allscripts Healthcare Solutions, Cerner Corporation, GE Healthcare, and McKesson Corporation, and Infor, Inc.

By Region

Asia-Pacific region would exhibit the highest CAGR of 17.2% during 2020-2027.

Competition Analysis

Some of the key players operating in the market include Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., Cisco Systems, Inc., InTouch Health, International Business Machines Corporation (IBM), General Electric Company (GE Healthcare), Medtronic plc., UnitedHealth Group (Optum), Koninklijke Philips N.V., and Siemens Healthineers.

Key Benefits For Stakeholders

- This report entails a detailed quantitative analysis along with the current global eHealth market trends from 2020 to 2027 to identify the prevailing opportunities along with the strategic assessment.

- The market forecast is studied from 2020 to 2027.

- The eHealth market size and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the eHealth market.

- Key players are profiled and their strategies are analyzed thoroughly to understand the competitive outlook of the market.

eHealth Market Report Highlights

| Aspects | Details |

| By Type |

|

| By END USER |

|

| By Region |

|

| Key Market Players | ALLSCRIPTS HEALTHCARE SOLUTIONS, INC, MEDTRONIC PLC, CISCO SYSTEMS INC, KONINKLIJKE PHILIPS N.V, GENERAL ELECTRIC COMPANY, UNITEDHEALTH GROUP (OPTUM), SIEMENS AG (SIEMENS HEALTHINEERS), TELADOC HEALTH, INC. (INTOUCH TECHNOLOGIES, INC.), ATHENAHEALTH, INC, INTERNATIONAL BUSINESS MANAGEMENT CORPORATION (IBM) |

Analyst Review

In accordance with several interviews conducted, rapid digitization of products and services allow remote recording and remote sharing of medical records. Moreover, solutions such as mHealth apps and telemedicine services help in monitoring various health parameters at home, eliminating the need for hospital visits. Owing to the several benefits of patient-centric solutions, their utilization for remote monitoring, consultation, diagnosis, treatment, and prevention is expected to increase in the coming years.

With increase in penetration of smartphones, tablets, & laptops, the use of mobile apps solutions & telehalth solutions is expected to grow rapidly in the near future. This is attributed to the fact these solutions are cost-effective, convenient, and offer enhanced healthcare service.

A rapid growth was observed in the adoption of e-health solutions such as EHR & other hospital information systems to provide improved healthcare services in emerging nations, and is expected to offset the challenging conditions in mature markets such as North America and Europe. Although North America and Europe are expected to dominate the world e-health market during the forecast period, emerging countries in Asia-Pacific and LAMEA are expected to offer significant growth opportunities.

The total market value of ehealth Market is $74,476.4 million in 2019.

The forcast period for ehealth Market is 2020 to 2027

The market value of ehealth Market in 2020 is $89,498.2 million.

The base year is 2019 in ehealth Market

Top companies such as,Allscripts, Athenahealth, Cisco Systems, InTouch Health, IBM, GE Healthcare (General Electric), Medtronic, Optum (UnitedHealth Group), Koninklijke Philips N.V and Siemens Healthineers held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in rigions.

Type segment is the most influencing segment owing to rising demand of quality healthcare services and solutions, increasing acceptance of mHealth practices, surging demand for improved patient safety and patient care, and increasing government initiatives to promote HCIT. Moreover, surging adoption of smartphones, tablets and other mobile platforms is also driving the growth of the market.

The major factor that fuels the growth of the ehealth Market includes driven by extensive use of software and ICT healthcare, growing need to manage regulatory compliance through use of ehealth solution, reduce cost, improve quality, availability of infrastructure for implementation of e-health and safe and adequate storage of data. Furthermore, with fast and easy data sharing, ehealth solutions fosters collaboration among healthcare providers, while enabling to improve patient outcomes and increasing patient safety.

North America accounted for the largest share of revenue in 2019, and is anticipated to maintain its dominance from 2020 to 2027, due to favorable regulatory scenario, high adoption of HCIT solutions to curtail soaring healthcare costs, regulatory requirements regarding patient safety, and presence of a large number of E-health companies, such as Allscripts Healthcare Solutions, Cerner Corporation, GE Healthcare, and McKesson Corporation, Infor, Inc.

E-health is the delivery of health care using modern electronic information and communication technologies when health care providers and patients are not directly in contact and their interaction is mediated by electronic means.

ehealth applications are the software and services that manage, transmit, store or record information used in the delivery of healthcare treatment, payment or record keeping. Typically ehealth applications use the Internet to transmit and store patient data either for a provider or payer.

Loading Table Of Content...