Electric Powertrain Market Insights, 2031

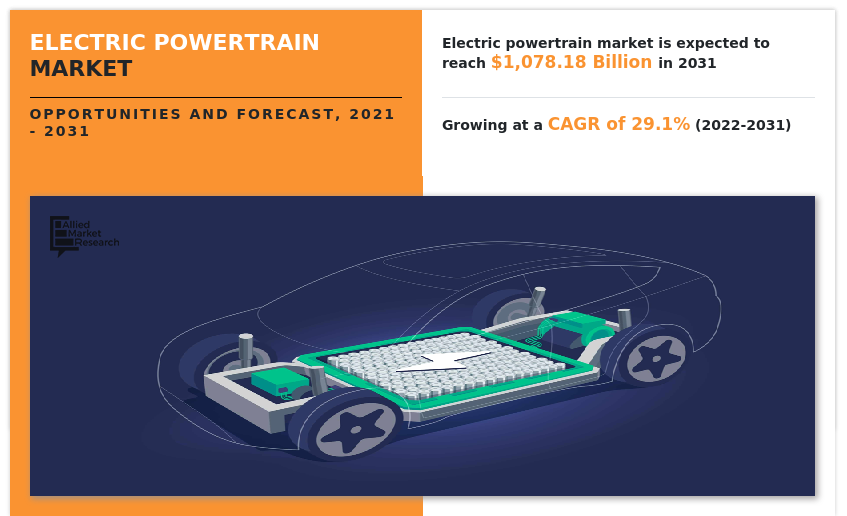

The global electric powertrain market size was valued at USD 83.66 billion in 2021, and is projected to reach USD 1,078.18 billion by 2031, growing at a CAGR of 29.1% from 2022 to 2031.

A powertrain is a set of components that generate power to move the vehicle. The electric powertrain encompasses the battery & electric motor and offers transmission of power, which is used to produce the power that is further utilized to drive or move the vehicle. The electric powertrain of a vehicle is defined by its performance, comfort, and safety. As a result of this, the powertrain systems and components manufacturers have been adopting electric powertrains to reduce fuel usage in vehicles. The engine and transmission are the major components of powertrain, and other key components include the clutch or torque converter, drive shaft or propeller shaft, differential, and axles. It widely finds its application in the battery electric vehicles (BEV), powered by 100% of electric energy. It is applicable in the plug-in-hybrid electric vehicles (PHEVs) and hybrid-electric vehicles (HEVs).

At present, the increase in demand for enhanced driving experience, adoption of light-weighted driving shaft, and technological innovation in the battery production technology have transformed electric vehicles into more competitive over conventional internal combustion engine (ICE) vehicles. For instance, in January 2022, Magna International Inc. unveiled the EtelligentForce, a battery electric 4WD powertrain system for pickup trucks and light commercial vehicles. The system had fewer moving parts than a traditional ICE powertrain, thereby requiring less maintenance.

The factors such as growth in trend of downsized engines, increased sales of electric vehicles, and stringent vehicular emission norms & regulations propel the demand for electric powertrain market. However, high manufacturing costs, range anxiety, and serviceability are the factors expected to hamper the market growth. In addition, rocketing infrastructural developments of EV infrastructure and advancement in technology are some of the factors that create lucrative opportunities for electric powertrain industry during the forecast period.

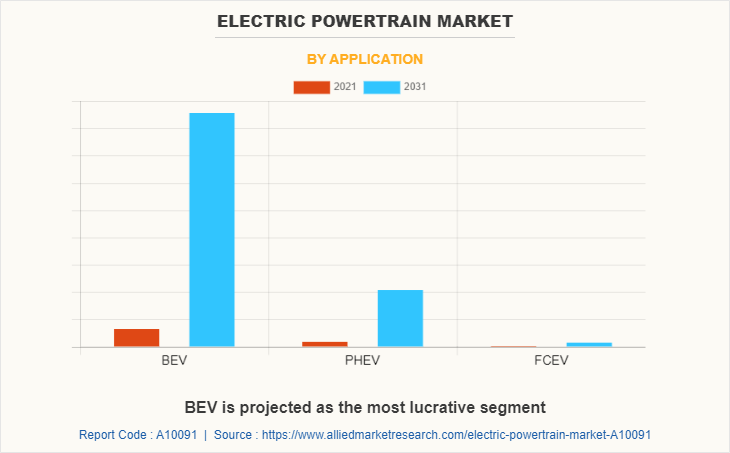

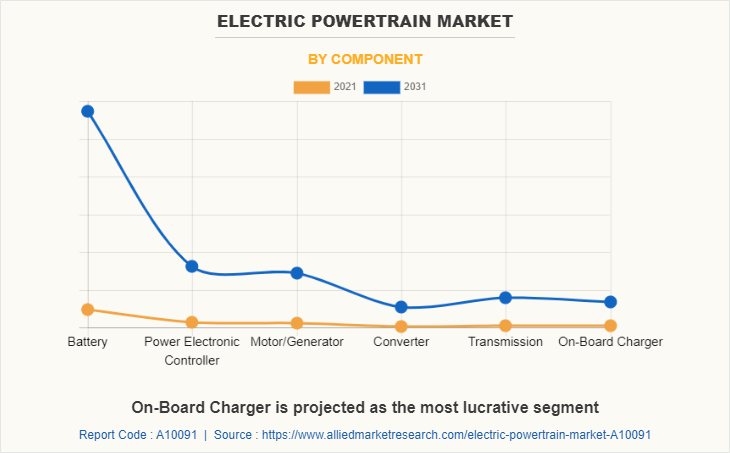

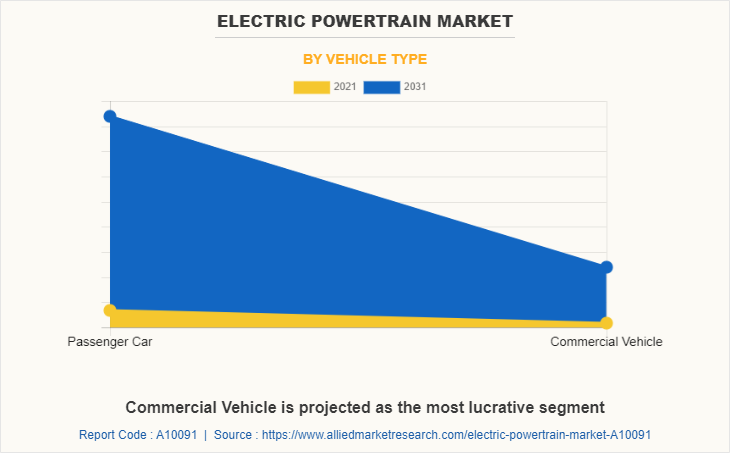

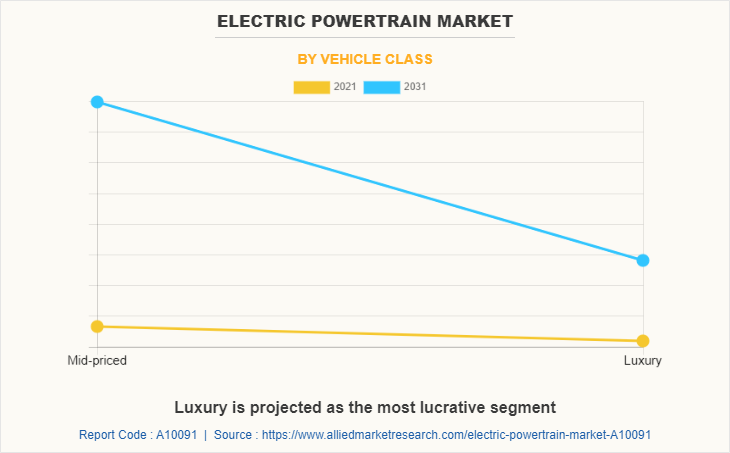

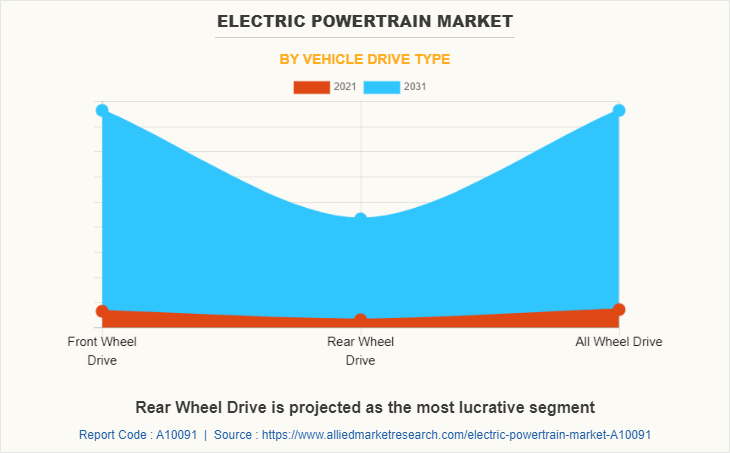

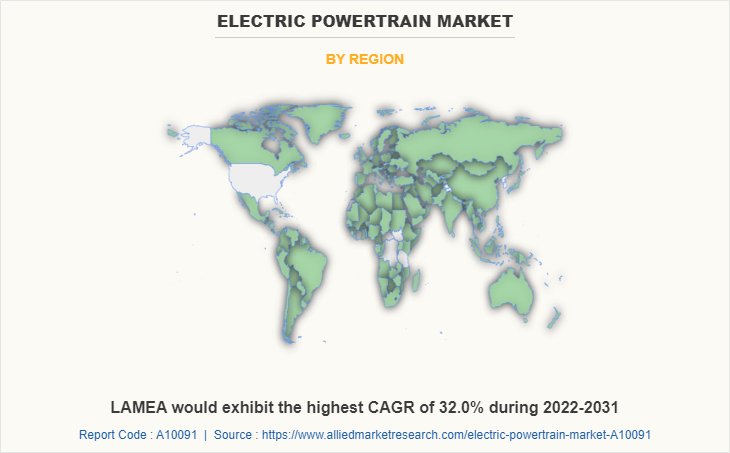

The electric powertrain market is segmented into component, vehicle type, vehicle class, vehicle drive type, application, and region. By component, the market is categorized into battery, power electronic controller, motor/generator, convertor, transmission, and on-board charger. By vehicle type, the market is fragmented into passenger car and commercial vehicle. By vehicle class, the market is divided into mid-priced and luxury. By vehicle drive type, the market is further classified into front wheel drive, rear wheel drive, and all-wheel drive. By application, the market is categorized into battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and fuel cell electric vehicle (FCEV). By region, the market has been studied across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the electric powertrain market are BorgWarner, Robert Bosch GmbH, Continental AG, Dana Incorporated, Denso, Hitachi, Magna International Inc., Magneti Marelli Ck Holdings, Mitsubishi Electric Corp., Nidec Corporation, Panasonic, Schaeffler AG, Toyota Industries Corporation, Valeo, ZF Friedrichshafen AG, Brusa Electronik (Key Innovator) and Kelly Controls, Inc. (Key Innovators).

Growing trend of downsized engines

The downsizing of an engine is a practice of improving fuel efficiency in an internal combustion engine (ICE) to utilize smaller combustion engines over larger ones of the same power capacity when manufacturing vehicles. Hence, engine designers are finding better ways to extract more power from smaller amounts of fuel. For instance, in September 2021, Hitachi Ltd. and and Hitachi Astemo, Ltd. announced the development a compact, lightweight direct-drive system for the EV segment. This system combined the motor, inverter, and brake into a single unit which allowed for installation of the entire system into the wheel. This allowed for the elimination of drive shafts and other indirect mechanisms which allows motor power to be applied directly to EV operation thereby reducing energy loss by up to 30%. Moreover, as compared to naturally charged atmospheric pressure engines, automotive turbochargers are more efficient and eco-friendlier as they offer increased engine power without increasing piston displacement. Hence, by reducing the frictional loss and weight while turbocharging is used to maintain the peak power from an engine. In addition, the downsizing of the engine can help in reducing fuel consumption and emissions inside the engine. Hence, the increasing trend for the downsizing of the engine has rapidly increased the demand for the electric powertrain testing market all across the globe.

Increasing sales of electric vehicles

Electric vehicles (EVs) are experiencing a rise in popularity over the past few years as the technology has matured & costs have declined, and support for clean transportation has promoted awareness, increased charging opportunities, and facilitated EV adoption. Furthermore, growing vehicle emission concerns and depletion of non-renewable energy resources have attracted the attention of several governments to invest in electric vehicles. The European countries are among the frontrunners in adopting electric mobility. According to European Environment Agency, in 2020, electric car registrations surged, accounting for 11% of newly registered passenger cars in which battery electric vehicles (BEVs) accounted for 6% of total new car registrations, while plug-in hybrid electric vehicles (PHEVs) represented 5%. Also, the production and sales of electric vehicles globally have been growing at a high rate, owing to positive regulatory environment, such as subsidies and tax exemptions for both the industry and consumers in the European and Asia-Pacific region. Major automakers have also increased their investments in the development of electric vehicles to cater to the anticipated growth in demand for such vehicles in the coming decade. Volvo Motors announced that starting from 2020, the company will develop and manufacture only hybrid and electric cars. Hence, the increasing adoption of EVs around the world is expected to drive the growth of electric powertrain market in the forecast period.

High manufacturing cost

Electric vehicles are advantageous over conventional vehicles; however, their cost is higher than traditional vehicles. Also, the electric powertrain market is expected to face challenges in the form of procurement of rare earth metals used in permanent magnets for synchronous motors, as the metals used in these motors are subject to export restrictions and supply risks. In addition, purchase of e-powertrain vehicles is expected to cost around twice the cost of traditional gasoline-powered vehicles. This large price difference between internal combustion and electric vehicles has made many fleet owners about making investment as there are lot of unknown variables present in determining total cost of ownership of electric vehicles. Thus, high initial cost of electric vehicles hinders growth of the electric powertrain market. According to a report on Forbes by energy innovation, the manufacturing cost of an electric vehicle is much higher currently compared to diesel or petrol trucks, but by 2030, it will be 50% cheaper compared to diesel and petrol variants with falling battery prices. Thus, high cost of electric vehicles challenging growth of the electric powertrain market.

Rocketing infrastructural developments for EV stations

Creating charging infrastructure can be daunting and expensive. It involves disrupting already congested travel corridors and finding suitable charging spaces and substantial outlays to achieve a decent EV charging infrastructure network. This needs to be supplemented with alternate solutions such as installing charging points within residential complexes, housing societies (including for visiting parking slots), shopping malls, parking lots, railway stations, offices, and small shops. Meanwhile, governments worldwide are focusing on infrastructural development for the EV landscape and thereby promoting EV use. Due to the heavy investment made by governments, public charging stations are installed in every possible public place. For instance, in April 2022, automobile manufacturer BYD India partnered with Chargezone, Volttic, and Indipro to set up charging infrastructure for EVs in India. This tie-up addresses the charging needs of the company’s electric multipurpose vehicles across multiple cities and major highways in the country. Also, in June 2021, the Canadian government announced an investment of about USD 2.35 million to install EV fast chargers in the country. Additionally, few governments like the government of China and France are subsidizing the construction of public charging stations, further expanding the electric powertrain systems market. Thus, the rising investments made by countries in developing EV charging infrastructure will create an opportunity for electric powertrain industry growth in the electric powertrain market forecast period.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global electric powertrain market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall electric powertrain market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global electric powertrain market with a detailed impact analysis.

- The current Electric Powertrain market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Electric Powertrain Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Component |

|

| By Vehicle Type |

|

| By Vehicle Class |

|

| By Vehicle Drive Type |

|

| By Region |

|

| Key Market Players | Denso, Brusa Electronik (Key Innovator), Toyota Industries Corporation, Cc Power Electronics (Key Innovator), Continental AG, Magna International Inc., Valeo, Panasonic, ZF Friedrichshafen AG, Schaeffler AG, BorgWarner, Dana Incorporated, Bosch Limited, Nidec Corporation, Hitachi, Mitsubishi Electric Corp, Magneti Marelli Ck Holdings |

Analyst Review

This section provides the opinions of various top-level CXOs in the global electric powertrain market. The market is expected to witness a significant growth owing to the evolving consumer preferences and technological advancements in the EV industry significantly. Furthermore, the immense development of electric car component manufacturers worldwide is also driving the electric powertrain market.

Major automotive component manufacturers have been investing in electric axle drives to capitalize on the increasing sales of electric and hybrid vehicles to increase their market share. Companies have been increasing production capacity, particularly in large electric vehicle markets, such as China, the United States, and the European region. For instance, in May 2022, Nidec Corporation announced the construction of a flagship factory to produce its traction motor system, E-Axle, in the city of Pinghu, Zhejiang Province in China. This allowed them to achieve their target of 10 trillion sale by 2030 and also increased the availability of e-axels for the e-mobility segment.

According to the insights of the CXOs of leading companies, massive investments in electric vehicles by major automotive companies, such as Toyota, Honda, Tesla, General Motors, and Ford, among others, are expected to drive the electric motor market in the near future. Additionally, the evolving partnerships between motor manufacturers and automotive companies are expected to expand the electric vehicle powertrain market, globally. For instance, in July 2020, Toyota Motor Corporation announced a collaboration with BluE Nexus Corporation, manufacturer of electric drive modules to bring further developments in its offerings in the e-mobility space.

The partnership saw the expertise of BluE Nexus in electric drive modules combined with Toyotas’ expertise in manufacturing of the complete powertrain systems to further innovate upon its technological offerings for the electric vehicles segment. In addition, electric powertrain manufacturers across the world are entering the Chinese market to capitalize on the increasing demand for electric vehicles by establishing joint ventures and partnerships with local electric vehicle manufacturers. For instance, Magna International entered an agreement with Huayu Automotive Systems to expand its electric drive footprint in China.

Factors such as growing trend of downsized engines, increasing sales of electric vehicles, and stringent vehicular emission norms & regulations propels the demand for electric powertrain market. However, high manufacturing costs and range anxiety and serviceability are the factors expected to hamper the market growth. In addition, rocketing infrastructural developments of EV infrastructure and advancement in technology are some of the factors that create lucrative opportunity of electric powertrain market during the forecast period.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America and LAMEA. On the basis of forecast analysis, LAMEA is expected to maintain its lead during the forecast period, owing to the increased demand for electric mobility to be present across the region.

The global electric powertrain market is projected to grow at a compound annual growth rate of 29.1% from 2022 to 2031.

The global electric powertrain market size was valued at USD 83.66 billion in 2021, and is projected to reach USD 1,078.18 billion by 2031,

The factors such as growth in trend of downsized engines, increased sales of electric vehicles, and stringent vehicular emission norms & regulations propel the demand for electric powertrain market. However, high manufacturing costs, range anxiety, and serviceability are the factors expected to hamper the market growth. In addition, rocketing infrastructural developments of EV infrastructure and advancement in technology are some of the factors that create lucrative opportunities for electric powertrain industry during the forecast period.

Asia-Pacific is the largest regional market for Electric Powertrain

The key players operating in the electric powertrain market are BorgWarner, Robert Bosch GmbH, Continental AG, Dana Incorporated, Denso, Hitachi, Magna International Inc., Magneti Marelli Ck Holdings, Mitsubishi Electric Corp., Nidec Corporation, Panasonic, Schaeffler AG, Toyota Industries Corporation, Valeo, ZF Friedrichshafen AG, Brusa Electronik (Key Innovator) and Kelly Controls, Inc.

Loading Table Of Content...