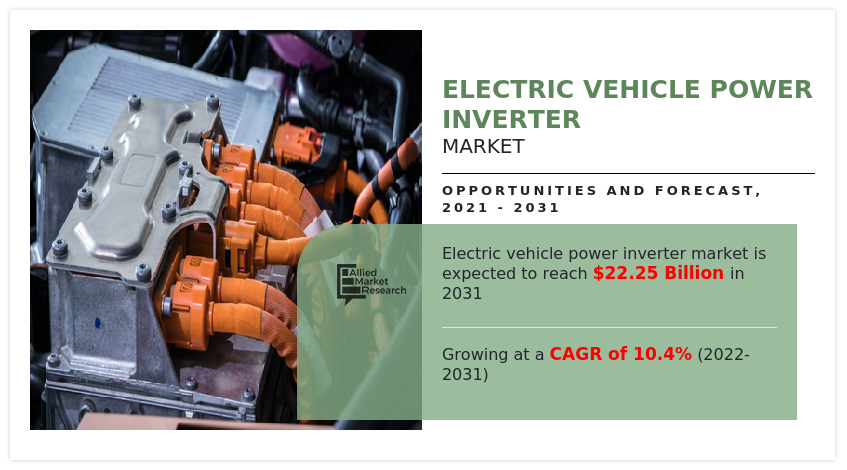

Electric Vehicle Power Inverter Market Insights, 2031

The global electric vehicle power inverter market was valued at USD 8.67 billion in 2021, and is projected to reach USD 22.25 billion by 2031, growing at a CAGR of 10.4% from 2022 to 2031.

The electric vehicle power inverter market is segmented into Propulsion, Inverter Type, Vehicle Type, Level of Integration and Distribution Channel.

An electric vehicle power inverter is a device that converts the Direct Current (DC) power used in an electric vehicle motor to Alternating Current (AC). Electric vehicle power inverter has wider application in electric vehicles. The converted current is further utilized by motors to operate compatible devices and sensors, which utilizes AC current for their operation. Moreover, in electric vehicles, the power can be utilized for plug-in outlets and other standard 120-volt devices.

Factors such as increase in demand for electric vehicles, proactive government initiatives for the development of electric vehicle, and surge in demand for low-emission & fuel-efficient vehicles are anticipated to boost the growth of the global electric vehicle power inverter market during the forecast timeframe. However, lack of sufficient infrastructure for electric vehicles and high manufacturing cost of electric vehicles are expected to hinder the growth of the global electric vehicle power inverter industry during the forecast period. Moreover, technological advancement in electric vehicles and rise in demand for solar powered electric vehicles are anticipated to create an opportunity for the electric vehicle power inverter market in near future.

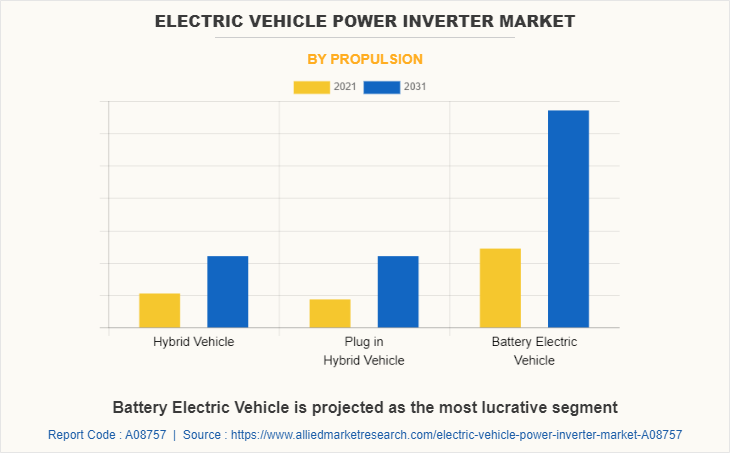

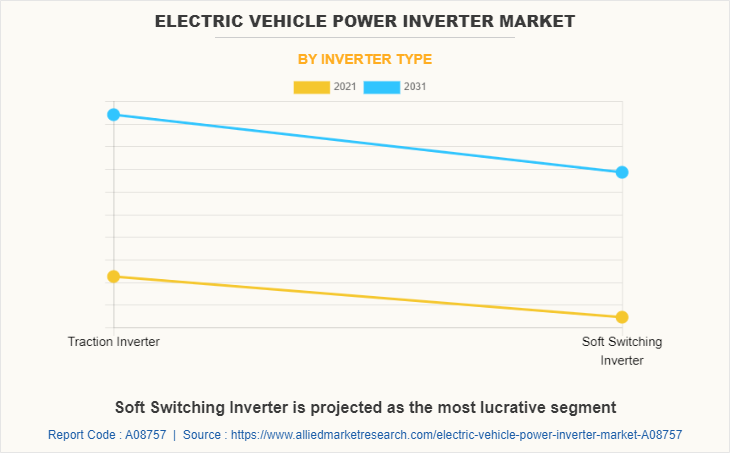

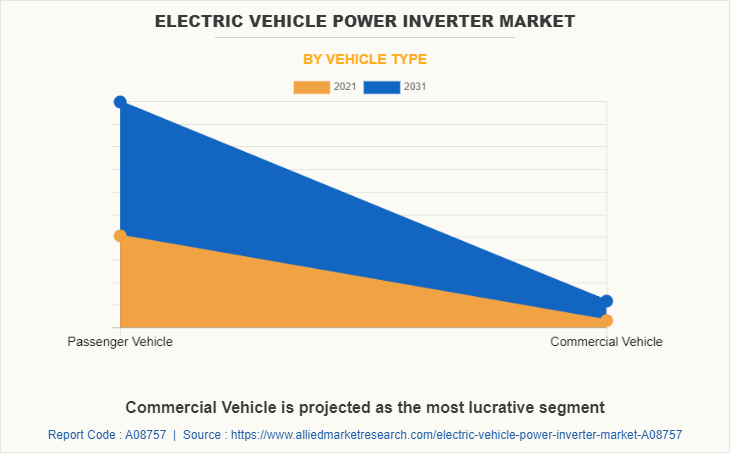

Electric vehicle power inverter market is segmented on the basis of propulsion, inverter type, vehicle type, level of integration, distribution channel, and region. By propulsion, it is divided into full hybrid vehicle, plug-in hybrid vehicle, and battery electric vehicle. By inverter type, it is fragmented into traction inverter, and soft switching inverter. By vehicle type, it is bifurcated into passenger cars and commercial vehicles. By level of integration, it is divided into integrated inverter system, separate inverter system, and mechatronic integration system. By distribution channel, the market is divided into OEM and Aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in this electric vehicle power inverter market are Aptiv, BYD COMPAY LTD., Continental AG, CWB Automotive Electronics Co., Ltd., Denso Corporation, Hitachi Astemo, Ltd. (Subsidiary of Hitachi, Ltd.), Lear Corporation, Marelli Holdings Co., Ltd., Meidensha Corporation, Mitsubishi Electric Corporation, Nissan motors co., Ltd., Robert Bosch GmbH, Siemens, Sungchang, Toyota Industries Corporation, Valeo, and Vitesco Technologies.

Increase in demand for electric vehicles

Electric vehicles offer multiple advantages such as low operating cost compared to conventional gasoline engine, implementation of stringent government regulations to limit environment pollution, and decreased emissions from tailpipes, which significantly boost their demand across the globe. For instance, electric vehicle sales have increased, owing to growth in China, the U.S., and Europe. Sales of electric vehicles increased by 160% in the first half of 2021 from a year earlier, to 2.6 million units, representing 26% of new sales in the global automotive market. Further, this, in turn, is expected to escalate the need for electric vehicle power inverter for electric vehicles during the forecast period. In addition, key players operating in the electric vehicle power inverter market are adopting various strategic moves such as product development and product launch to tap the business potential. For instance, ABB Ltd. launched all-in-one electric vehicle charger, which provides the fastest charging experience in the market. The new electric vehicle charger is the world‐™s fastest charger that can deliver 100 km of range in less than three minutes. Further, the new charger is designed explicitly to charge up to four vehicles at once. Therefore, factors such as increase in charging stations in public places & highways, low operating cost, and implementation of stringent government regulations to limit environment pollution are expected to spur electric vehicles across the globe. The market for power inverter is directly related to the growth of automotive production and sales of electric vehicles as these vehicles are equipped with large circuits. Owing to this, the growth in electric vehicles market is expected to propel the market for electric vehicle power inverter industry during the forecast period.

Proactive government initiatives for the development of electric vehicle

The electric vehicles market has grown exponentially due to factors, such as climate change and efforts to achieve net zero emissions. Moreover, favorable incentives and policies introduced by governments of different countries to promote electric vehicles boost the growth of the EV industry. For instance, in 2021, in California, the Clean Vehicle Rebate Project (CVRP) promoted clean vehicle adoption in California by offering rebates ranging from $1,000 to $7,000 for purchases or leases of new zero-emission vehicle. Moreover, in 2021, New Zealand proposed clean car discount, in which new car buyers received $8,625 rebate for electric vehicles (EVs) less than $80,000, including GST and road costs. Rise in awareness of climate change and surge in demand for electric cars lead to increase in the production of electric vehicles. For instance, according to a report by the IEA organization, 2022, EV vehicles globally reached 6.7 million units in 2021, a 3.7 million units over 2020, accounting for 4.1% of the market share. In 2020, the electrical percentage of automobile income was about 2.4%, which increased from about 2% in 2019. Moreover, some countries announced policies banning and phasing out gasoline and diesel cars. Such measures taken by various governments encourage automakers and other market players to adopt the new electric vehicle trend. For instance, in 2022, Ford Motor plans to invest $20 billion in an effort to expand electrification of its lineup with an investment of 20 billion dollars. In addition, in 2021, China's tech giant, Xiaomi officially confirmed its plans to enter the smart electric vehicle business by investing RMB 10 billion (roughly $1.55 billion) in the first phase. Such proactive government initiatives for the development of electric vehicles fuel the growth of electric vehicles, which further boost the electric vehicle power inverter market.

Lack of sufficient infrastructure for electric vehicles

A robust EV charging infrastructure is necessary for the adoption of electric vehicles. Electric vehicles are yet to become mainstream despite their benefits from environmental and economic perspectives. Lack of electric vehicle charging stations limit the electric vehicle industry. For instance, according to a report by Grant Thornton-Bharat and the Federation of Indian Chambers of Commerce & Industry (FICCI), in June 2021, India was expected to require a four lakh public charging station to power an estimated total of 2 million electric vehicles on the road by 2026. As of December 2021, India currently has only 1,028 public electric vehicle charging stations. In addition, according to a report published by International Energy Agency (IEA) in 2021, the global electric vehicle fleet reached 10 million units in 2020, which increased by 43% from 2019, gaining 1% stake share. Battery electric vehicles (BEVs) covered two-thirds of new electric car registrations and two-thirds of the stock in 2020. Hence, unavailability of enough charging stations decreases the growth of electric vehicles, which makes it difficult for electric vehicle power inverter market to prosper. Thus, negatively impacting the electric vehicle production and acceptance, which in turn hampers the growth of the EV power inverter market. Therefore, such misalignment between charging demand and the allocation of infrastructure discourages the production of electric vehicles and further hinders the growth of the market.

Technological advancement in electric vehicles

Automobile companies focus on production of advanced electric vehicle systems that are expected to have lower particular emission at relatively lowers costs. Companies have started producing downsized engines to be implemented in vehicles as smaller engines help achieve the upcoming fuel emission norms such as Bharat Stage VI and Euro VI. This is owing to the fact that they produce lesser emissions as compared to heavier and larger engines. Compactness and cost-effectiveness of these downsized small engines add another dimension to their usefulness in order to improve the efficiency of the vehicle. Similarly, the companies operating in electric vehicle power inverter market are developing advanced integrated motor and inverter in order to reduced system complexity, faster system setup & construction, and increased motor driver compatibility. For instance, in April 2019, Dana launched the TM4 MOTIVE, an integrated motor and inverter for the light vehicle market. The TM4 MOTIVE includes a high-RPM permanent magnet electric motor, power-dense electronic inverter, and advanced controls. Such developments in the field of electric vehicles is expected to propel the market for vehicle inverters during the forecast period

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle power inverter market analysis from 2021 to 2031 to identify the prevailing electric vehicle power inverter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle power inverter market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle power inverter market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Power Inverter Market Report Highlights

| Aspects | Details |

| By Propulsion |

|

| By Inverter Type |

|

| By Vehicle Type |

|

| By Level of Integration |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Meidensha Corporation, Siemens, Lear Corporation, Sungchang Autotech Co., Ltd., Hitachi Astemo Ltd, Vitesco Technologies, Aptiv PLC, Marelli Corporation, CWB Automotive Electronics Co., Ltd., Changsha BYD, DENSO Corporation, Robert Bosch GmbH, Continental, Valeo Group, Toyota Industries Corporation, Nissan, Mitsubishi Electric Corporation |

Analyst Review

The electric vehicle power inverter market is expected to witness significant growth, due to stringent vehicle emission norms and an increase in the demand for fuel-efficient & low-emission vehicles. Usage of electric vehicles has increased in a wide range of cars, which include compact hatchbacks to SUVs and even two wheelers. The presence of stringent fuel efficiency norms in Europe has compelled vehicle manufacturers to develop zero emission technology for the vehicles. This further enhances the growth of the electric vehicle industry

Factors such as increase in demand for electric vehicles, proactive government initiatives for the development of electric vehicle, and surge in demand for low-emission and fuel-efficient vehicles are anticipated to boost the growth of the global electric vehicle power inverter market during the forecast timeframe. However, lack of sufficient infrastructure for electric vehicles and high manufacturing cost of electric vehicles are expected to hinder the growth of the global electric vehicle power inverter market during the forecast period. Moreover, technological advancement in electric vehicles and rise in demand for solar powered electric vehicles are expected to create an opportunity for the electric vehicle power inverter market in near future.

To fulfil the changing demand scenarios, market participants are concentrating on product developments and product launch to offer a diverse range of products and meet new business opportunities. For instance, in May 2022, Hitachi, Ltd and Hitachi Astemo, Ltd. developed basic technology for a thin-type inverter that achieves both energy conservation and miniaturization as a power converter for electric vehicles. Moreover, on 7th July 2022, Marelli Holdings Co., Ltd. launched its new 800 Volt Silicon Carbide inverters platform at Dritev. With higher efficiency and reduced size & weight, the solution allows increased driving range and further benefits in electric vehicles. In addition, market participants are continuously focusing on business expansion to improve their geographic and customer reach. For instance, in May 2022, Hitachi Astemo, Ltd. announced the start of mass production of electric vehicle inverters at its Miyagi No.4 Plant, located in Murata, Miyagi Prefecture, to meet the increasing demand for electrification products. To meet this increasing demand, Hitachi Astemo has expanded its production capabilities and product line-up of core components for electric vehicles, such as motors and inverters, through the establishment of manufacturing subsidiaries and the four company integration, which was completed in January 2021.

Furthermore, Electric vehicle power inverter market is segmented basis of propulsion, inverter type, vehicle type, level of integration, distribution channel, and region. By propulsion, it is divided into full hybrid vehicle, plug-in hybrid vehicle, and battery electric vehicle. By inverter type, it is divided into traction inverter, and soft switching inverter. By vehicle type, it is segmented into passenger cars, and commercial vehicles. By level of integration, it is divided into integrated inverter system, separate inverter system, and mechatronic integration system. By distribution channel, the market is divided into OEM, and aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in this market are Aptiv, BYD COMPAY LTD., Continental AG, CWB Automotive Electronics Co., Ltd., Denso Corporation, Hitachi Astemo, Ltd. (Subsidiary of Hitachi, Ltd.), Lear Corporation, Marelli Holdings Co., Ltd., Meidensha Corporation, Mitsubishi Electric Corporation, Nissan motors co., Ltd., Robert Bosch GmbH, Siemens, Sungchang, Toyota Industries Corporation, Valeo, and Vitesco Technologies

The global electric vehicle power inverter market was valued at $8.67 billion in 2021, and is projected to reach $22.25 billion by 2031.

Integrated Inverter System is the leading segment of Electric Vehicle Power Inverter Market

Asia-Pacific is the largest regional market for Electric Vehicle Power Inverter

The key players that operate in this market are Aptiv, BYD COMPAY LTD., Continental AG, CWB Automotive Electronics Co., Ltd., Denso Corporation, Hitachi Astemo, Ltd. (Subsidiary of Hitachi, Ltd.), Lear Corporation, Marelli Holdings Co., Ltd., Meidensha Corporation, Mitsubishi Electric Corporation, Nissan motors co., Ltd., Robert Bosch GmbH, Siemens, Sungchang, Toyota Industries Corporation, Valeo, and Vitesco Technologies

Increase in use of efficient electric vehicle power inverter for improved performance, higher efficiency and power density is major trend in the market

Loading Table Of Content...