Zero Emission Vehicle Market Overview

The global zero emission vehicle market was valued at USD 182.83 billion in 2021, and is projected to reach USD 1,201.76 billion by 2031, growing at a CAGR of 21.1% from 2022 to 2031. The factors such as surge in concern about environmental pollution, stringent regulations on vehicle emission norms by governments, and increase in demand for fuel-efficient & high-performance vehicles supplement the growth of the zero emission vehicle market. However, high manufacturing cost and range anxiety and serviceability are the factors expected to hamper the growth of the market. In addition, technological advancements and proactive government initiatives are expected to create ample opportunities for the key players operating in the low emission vehicle market.

Key Market Trend & Insights

- Rise in adoption of automation and ZEVs to reduce environmental harm caused by internal combustion engines.

- Stringent emission norms by global governments are accelerating the shift toward ZEVs.

- Major investments in EV infrastructure, such as battery plants and charging networks, support market growth.

- Government incentives and policies, like FAME-II and ZEV policies in India, are boosting adoption.

- Increasing use of renewable energy sources, such as solar, in vehicle power systems.

- Advancements in ZEV technology including high-performance, cost-efficient, and compact engines.

- Vehicle trends:

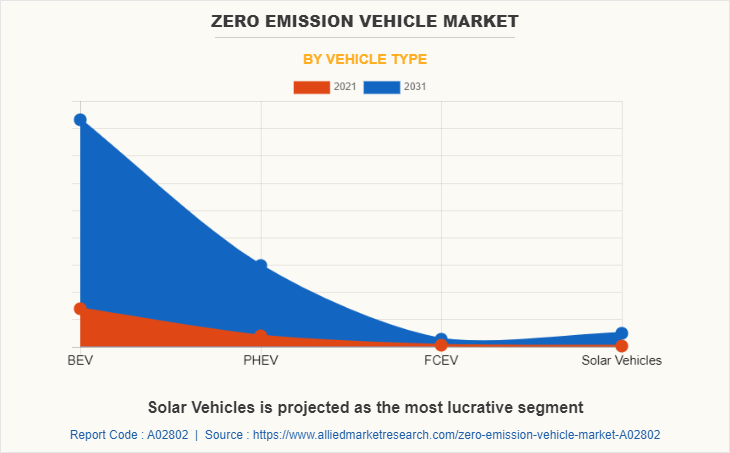

- Solar vehicles lead in growth rate.

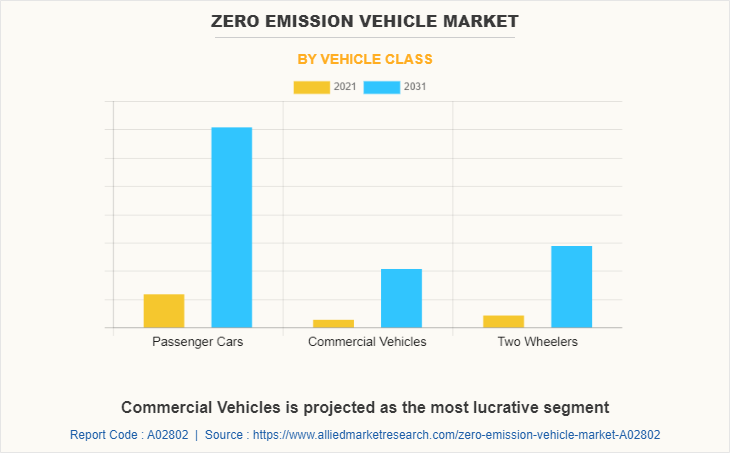

- Commercial vehicles segment shows high growth potential.

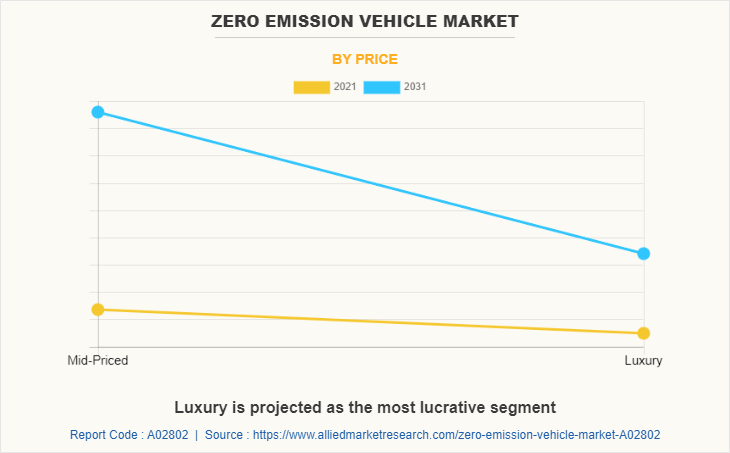

- Luxury ZEVs dominate revenue.

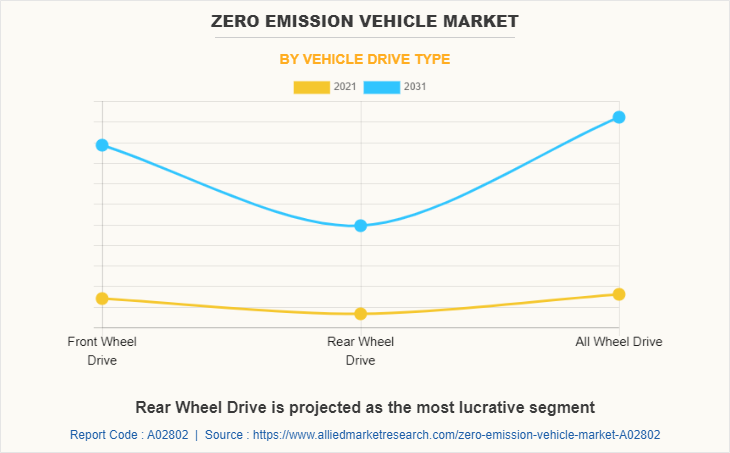

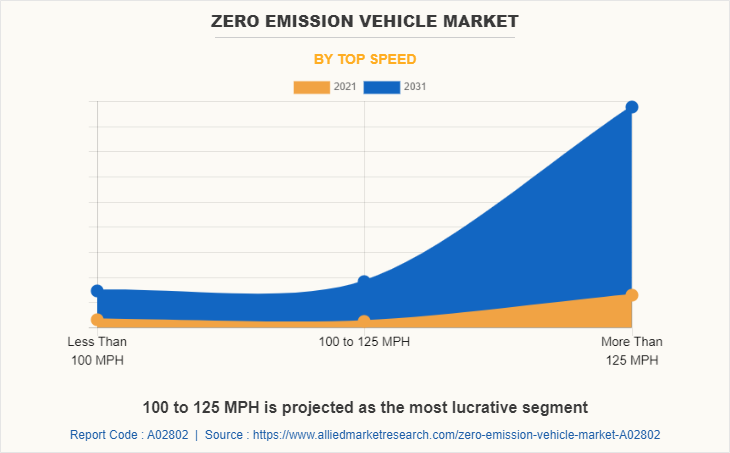

- Rear-wheel drive ZEVs and models with top speeds of 100–125 MPH are growing rapidly.

Market Size & Forecast

- 2031 Projected Market Size: USD 1,201.76 billion

- 2021 Market Size: USD 182.83 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 21.1%

Introduction

Zero emission vehicle (ZEV) is a vehicle that does not emit the tailpipe pollutant from the onboard source of power. These vehicles have significant emission benefits over conventional vehicles, and run-on alternate power sources such as battery electricity, natural gas, and solar power. It is primarily designed to replace conventional ways of travel as they lead to environmental pollution. It has gained popularity owing to numerous technological advancements. It outperforms the conventional vehicle providing higher fuel economy, low carbon emission & maintenance, convenience of charging at home, smoother drive, and reduced sound from engine. At present, most zero emission vehicles employ a highly efficient electric drive system integrating high voltage storage batteries, a high-speed charging system, and one or more forms of onboard electric power generation, such as brake regeneration or solar panels. For instance, in December 2021, General Motors launched the off-road EV super truck (GMC Hummer EV Edition) & commercial delivery EV (BrightDrop EV600), both built on ultium platform, which offers reduced vehicle emissions & strong protection of vehicle battery to accelerate the last-mile delivery. However, the zero-emission vehicle (ZEV) market is still in its nascent stage, and it is expected to expand exponentially in the next few years.

Market Segmentation

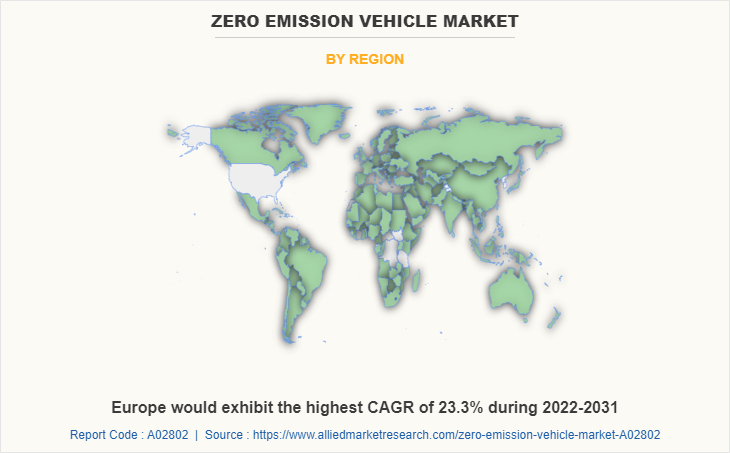

The zero emission vehicle market is segmented into vehicle class, price, vehicle type, vehicle drive type, top speed and region. By vehicle type, the market is divided into battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), fuel cell electric vehicle (FCEV), and solar vehicles. By vehicle class, it is fragmented into passenger cars, commercial vehicles, and motorcycles. By price, it is categorized into mid-priced and luxury. By vehicle drive type, it is classified into front wheel drive (FWD), rear wheel drive (RWD), and all-wheel drive (AWD). By top speed, it is fragmented into less than 100 MPH, 100 to 125 MPH, and more than 125 MPH. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

What are the Top Impacting Factors

Key Market Driver

Surge in concern about environmental pollution

Increase in trend for automation in vehicles has enforced vehicle manufacturers to adopt technologies, which cause less harm to the environment. Emission caused due to internal combustion engines of the vehicles degrades the environment to a much larger extent, as the tailpipes of the vehicle emits chlorofluorocarbons and other harmful gases, which lead to environment pollution. Meanwhile, zero emission vehicles (ZEVs) are a solution to these issues, as these vehicles emit no pollutants as exhaust gas. Furthermore, they employ renewable energy sources for power, such as solar, which is expected to reduce the dependence on fossil fuel. Thus, with the introduction of zero emission vehicles (ZEVs), the use of internal combustion engines in vehicles is expected to reduce to a much larger extent leading to less environment pollution. Also, governments of developed countries have established initiatives to reduce vehicular and industrial pollution to decrease individual carbon footprints. By 2030, numerous countries expect their roads to feature electric vehicles with the same power as gasoline-powered vehicles.

For instance, in September 2021, Hyundai Motor Group & LG Energy Solutions Ltd. announced a strategic partnership with Government of Indonesia to build EV battery cell plant in Karawang, with annual capacity of 10-GWh worth of battery cells enough for over 150,000 E-GMP battery electric vehicles. Hence, rise in concern about environment pollution is anticipated to supplement the growth of zero emission vehicle market during the forecast period.

How do emission norms drive growth in the ZEV market?

With rise in environmental concerns, governments and environmental agencies across the world are enacting stringent emission norms and laws to reduce vehicle emission. Major regulatory measures are stringent emission targets for the reduction of nitrogen oxides (NOx) and carbon dioxide (CO2) in air. High amounts of greenhouse gases being emitted from vehicles have led federal and state governments in the U.S. to increase their efforts to make transportation cleaner.

For instance, the U.S. Environmental Protection Agency (EPA) announced that they are working on new rules to decrease emissions of nitrogen oxide (NOx) and other pollutants from heavy-duty trucks. In addition, in India, the most recent & notable amendments for the encouragement & development of ZEVs include the extension of FAME-II (Faster Adoption & Manufacturing of Electric Vehicles) scheme until March 2024, which was earlier valid till 2022. Furthermore, Maharashtra’s new zero emission vehicle (ZEV) policy aims to have a 10% share of electric vehicles among total vehicle registrations by 2025 to reduce vehicular emissions, stated by the Director of Maharashtra Pollution Control Board (MPCB). Therefore, with enactment of emission regulations for fossil fuel-powered vehicle, the burden on vehicle manufacturers, especially on commercial vehicle manufacturers, has further increased. This, in turn, is expected to drive the demand for zero emission vehicles. Thus, stringent emission norms imposed on fossil-fuel powered commercial vehicles are significantly driving the growth of the zero emission vehicle (ZEV) market.

Restraint

High manufacturing cost

Zero emission vehicles (ZEVs) are advantageous over conventional vehicles; however, their cost is higher than traditional vehicles. Additional cost of buying a ZEV instead of fuel-powered vehicle is mainly attributed to high cost of battery. In addition, initial investments for producing zero emission vehicles is much higher compared to that of petroleum, diesel, or CNG vehicles. Involvement of expensive manufacturing process and use of costly raw material are the major reasons for high cost of zero emission vehicles. In addition, purchase of these vehicles is expected to cost around twice the cost of traditional gasoline-powered vehicles. This large price difference between internal combustion and zero emission vehicles has enabled fleet owners to invest in the zero emission vehicle industry, due to a lot of unknown variables present in determining total cost of ownership of ZEVs. Thus, high initial cost of zero emission vehicles hinders growth of the market.

Opportunity

Technological advancements

The future of zero emission vehicles is quite bright as their adoption is witnessing exponential growth by offering an opportunity to replace fossil fuels in the transport sector. Automobiles companies are focusing on production of advanced zero emission vehicle systems that are expected to have lower particular emission at relatively lowers costs. Companies have also started producing downsized engines to be implemented in vehicles as smaller engines help achieve the upcoming BHARAT STAGE VI emission norms. This is because they produce lesser emissions as compared to heavier and larger engines. Compactness and cost-effectiveness of these downsized small engines also add another dimension to their usefulness. Thus, development of advance GDI systems presents various opportunities for leading players in the future.

Furthermore, in November 2020, Hyundai Group collaborated with IONITY, a high-power charging station network for EVs to operate & expand network of high-powered EV charging stations across Europe. This charging network uses 100% renewable energy to make mobility emission-free and carbon-neutral. Thus, integrating technological enhancements in zero emission vehicles to make mobility emission-free is opportunistic for ZEV market expansion.

Which are the Top Zero Emission Vehicle companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the zero emission vehicle industry.

Ampere Vehicles

Benling India Energy and Technology Pvt Ltd.

BMW AG

BYD Company Limited

Chevrolet Motor Company

Mercedes-Benz Group AG

Energica Motor Company S.p.A.

Ford Motor Company

General Motors (GM)

Hero Electric

Hyundai Motor Company

Karma Automotive

Kia Corporation

Lucid Group, Inc.

Mahindra Electric Mobility Limited

NIO

Nissan Motor Co., Ltd.

Okinawa Autotech Pvt. Ltd.

Rivian

Tata Motors

Tesla, Inc.

Toyota Motor Corporation

Volkswagen AG

WM Motor

XPeng Inc.

Alke

Hanergy Thin Film Power Group Limited

Solar Electric Vehicle

Sono Motors

Key Benefits for Stakeholders

- This study presents analytical depiction of the global zero emission vehicle market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall zero emission vehicle market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global zero emission vehicle market with a detailed impact analysis.

- The current zero emission vehicle market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Zero Emission Vehicle Market Report Highlights

| Aspects | Details |

| By Vehicle Class |

|

| By Price |

|

| By Vehicle Type |

|

| By Vehicle Drive Type |

|

| By Top Speed |

|

| By Region |

|

| Key Market Players | Kia Corporation, Tata Motors, Hanergy Thin Film Power Group (Key Innovator), Chevrolet Motor Company, Tesla Inc., Solar Electric Vehicle Company (Key Innovator), Toyota Motor Corporation, BMW AG, NIO, Energica Motor Company S.p.A., WM Motor, General Motors, Alke (Key Innovator), Ford Motor Company, Rivain, Mahindra Electric Mobility Limited, Daimler AG, Benling India Energy and Technology Pvt Ltd, Okinawa Autotech Pvt. Ltd., Karma Automotive, BYD Company Limited, Hyundai Motor Company, Hero Electric, Xiaopeng Motors, Volkswagen AG, Lightyear (Key Innovator), Lucid Group, Inc., Sono Motors (Key Innovator), Nissan Motors Co., Ltd., Ampere Vehicles |

Analyst Review

This section provides the opinions of various top-level CXOs in the global zero emission vehicle market. The market is expected to witness a steady growth due to stringent vehicle emission norms and an increase in demand for fuel-efficient & low-emission vehicles. The market in the developed countries, such as the U.S., Canada, Mexico, and Germany, is projected to report a slower growth rate as compared to the developing regions, such as India, South Africa, and the Middle East, owing to rapid industrialization and high sales of vehicles in the developed region. In addition, numerous developments have been carried out by different companies such as Volkswagen AG, Toyota Motor Corporation, Ford Motors, Mahindra & Mahindra, and General Motors who have made innovations related to zero emission vehicles, which supplement the market growth. For instance, in January 2022, Mahindra Electric Mobility launched the e Alfa three-wheeler cargo electric vehicle. It had a payload capacity of 310 kg with peak power of 1.5 kW and was priced at $1800 (INR 1.44 Lakh). This helped provide a sustainable, pollution free alternative to conventional vehicles in the cargo transport segment.

Furthermore, automobile companies are focusing on the production of advanced and low-maintenance zero emission vehicles, which have low particulate emission. For instance, in May 2022, BYD Company Limited partnered with Link Transit, which is the public transit authority of Chelan and Douglas counties in the U.S. to supply eight additional BYD battery-electric buses. This further speeded up the electrification of transit vehicles in the U.S. to cleaner, zero emission alternatives. In addition, Indian automotive manufacturers also aim to produce downsize engines, which cater to the Bharat Stage VI emission norms, as they discharge less pollutants compared to larger engines. Also, nine European Union (EU) nations hastened the phase-out of petrol and diesel automobiles in early 2021 as part of their commitment to decarbonization under the EU Green Deal (climate neutrality plan) and Next Generation EU & Recovery Plan. Such initiatives enhance the zero emission vehicle market.

The market growth is supplemented by factors such as surge in concern about environmental pollution, stringent government regulations on vehicle emission norms, and increase in demand for fuel-efficient & high-performance vehicles supplement the growth of the zero emission vehicle market. However, high manufacturing cost and range anxiety and serviceability are the factors expected to hamper the growth of the zero emission vehicle market. In addition, technological advancements and proactive government initiatives are expected to create ample opportunities for the key players operating in the zero emission vehicle market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, Europe is expected to lead during the forecast period, due to increase in concerns related to emission of hazardous pollutants fuels the adoption of zero emission vehicles in countries across the Europe.

Introduction of solar & electric vehicles are the upcoming trends of Zero Emission Vehicle Market in the world

Reducing vehicle based emission is the leading application of Zero Emission Vehicle Market

China is the largest regional market for Zero Emission Vehicle

The global zero emission vehicle market was valued at $182.83 billion in 2021, and is projected to reach $1,201.76 billion by 2031, registering a CAGR of 21.1% from 2022 to 2031

The leading players operating in the zero emission vehicles market are Ampere Vehicles, Benling India Energy and Technology Pvt Ltd., BMW AG, BYD Company Limited, Chevrolet Motor Company, Mercedes-Benz Group AG, Energica Motor Company S.p.A., Ford Motor Company, General Motors (GM) and others

Loading Table Of Content...