Electroceuticals/Bioelectric Market Research, 2032

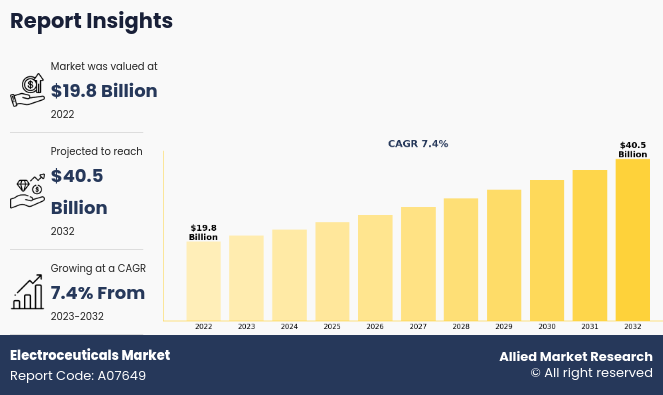

The global Electroceuticals/Bioelectric Market size was valued at $19.8 billion in 2022, and is projected to reach $40.5 billion by 2032, growing at a CAGR of 7.4% from 2023 to 2032.The growing geriatric population serves as a pivotal driver of the global electroceuticals/bioelectric medicine market. The World Health Organization (WHO) projects a substantial increase in the global elderly population, with an estimated 1.4 billion people aged 60 years and over by 2030. This demographic shift underscores the escalating prevalence of cardiovascular disorders and Parkinsons disease. Responding to this surge, the increased demand for advanced therapeutics technologies such as electroceuticals is driving the market growth.

Electroceuticals are medical devices that use electrical impulses to modulate neural circuits, tissues, or organs for therapeutic purposes. They offer a non-pharmacological approach to treating various conditions such as chronic pain, neurological disorders, and psychiatric conditions. By leveraging the body's own electrical signaling pathways, electroceuticals aim to restore normal physiological function and alleviate symptoms, providing innovative solutions for healthcare.

Key Takeaways

- On the basis of product, the cardiac pacemakers & implantable cardioverter defibrillators segment dominated the Electroceuticals/Bioelectric Market size in terms of revenue in 2022. However, the deep brain stimulator segment is anticipated to grow at the fastest CAGR during the forecast period.

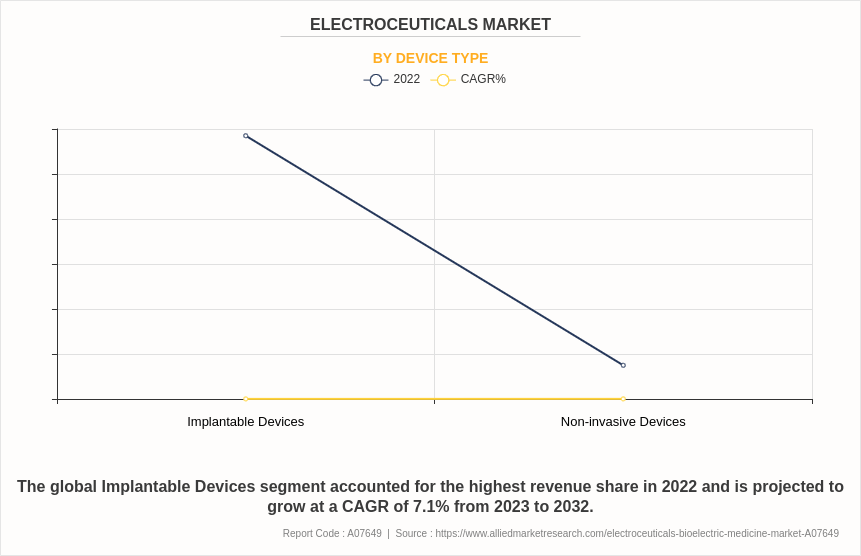

- By device type, the implantable devices was the major revenue contributor in 2022. However, the non-invasive devices segment is anticipated to register the fastest CAGR during the forecast period.

- On the basis of application, the arrhythmia segment dominated the Electroceuticals/Bioelectric Market size in terms of revenue in 2022. However, the epilepsy segment is anticipated to grow at the fastest CAGR during the forecast period.

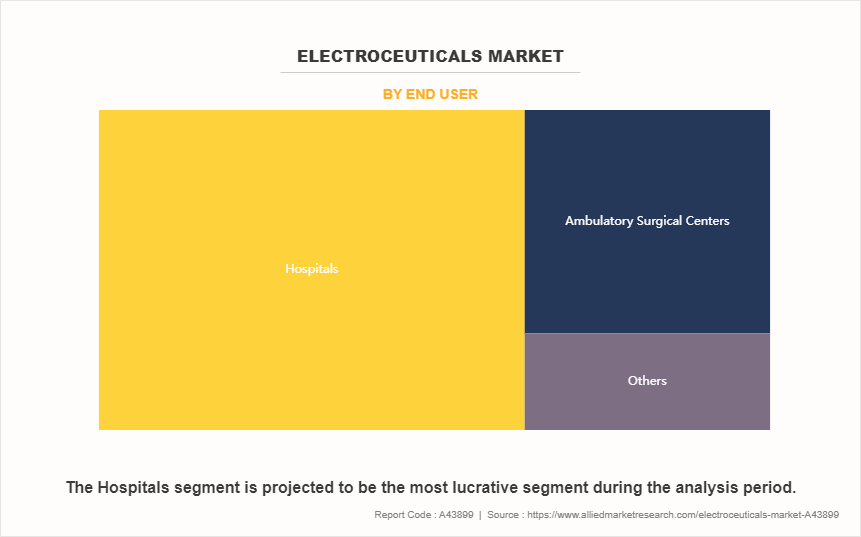

- Depending on end user, the hospitals segment accounted for the highest revenue in 2022. However, the ambulatory surgical centers segment is anticipated to grow at the fastest CAGR during the forecast period.

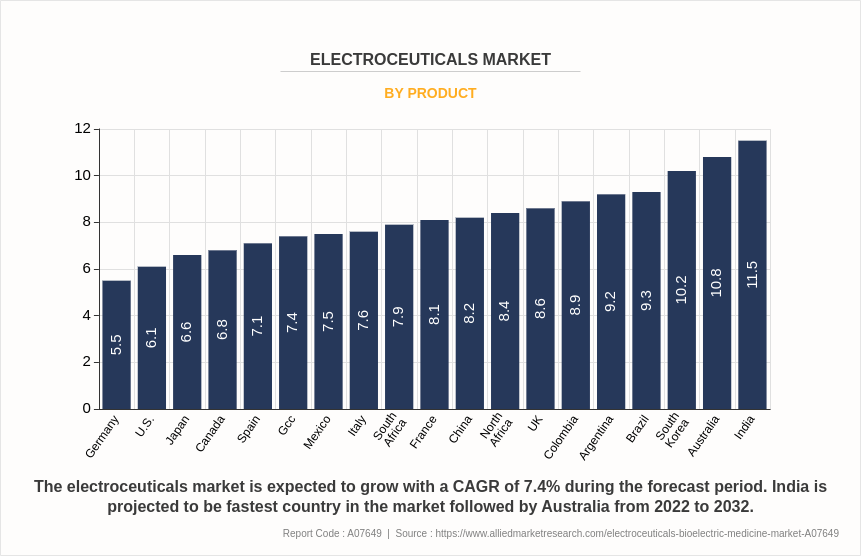

- Region wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The global Electroceuticals/Bioelectric Market growth is majorly driven by alarming increase in the prevalence of cardiovascular diseases, such as arrythmia, heart attack, and heart failure; surge in urinary incontinence cases; and rise in incidence of Parkinsons diseases. For instance, according to WHO, in 2020, approximately 17.9 million deaths were reported due to various types of cardiovascular diseases. As per the same source, it was observed that 39% of lobal death is caused due to cardiovascular disease and 85% of these deaths are due to stroke and heart attack. Similarly, according to the data published by the Parkinsons Foundation, around more than 10 million people are affected with Parkinsons globally. Their estimates suggest that approximately 930,000 people in the U.S. will be living with Parkinsons by the year 2020. Furthermore, the number is anticipated to grow up to 1.2 million by 2030. In addition, according to the WHO, depression is one of the most common mental disorders worldwide. Thus, rise in prevalence of various diseases is driving the demand for electroceuticals.

In addition, rise in government initiatives for development of medical device and advancements in the technology of healthcare are driving the market growth. Moreover, in August 2020, the Government of India launched productive-linked incentive (PLI) scheme to promote domestic manufacturing of medical devices. This scheme is expected to increase manufacturing of medical devices and attract large key players in medical device sector.

Moreover, rise in minimally invasive procedures is bolstering the growth of the electroceuticals/bioelectric medicine market. These procedures, characterized by smaller incisions and less tissue disruption, often utilize electroceutical devices for pain management, neuromodulation, and other therapeutic purposes. Patients and healthcare providers increasingly favor minimally invasive approaches due to benefits such as reduced recovery time, lower risk of complications, and improved patient outcomes. As demand for minimally invasive procedures continues to surge across various medical specialties, the need for advanced electroceutical devices compatible with these techniques rises accordingly, thus driving the market growth. This trend underscores the significance of electroceuticals in modern healthcare, offering effective solutions for minimally invasive interventions and contributing to improved patient care.

However, competition from pharmaceuticals and limited reimbursement present significant challenges to the growth of the electroceutical market. Traditional pharmaceutical treatments often dominate the healthcare landscape, enjoying established market shares and extensive reimbursement coverage. This competition can limit the adoption of electroceutical devices, despite their potential benefits. Moreover, reimbursement policies may not adequately cover the costs of electroceutical treatments, making them less accessible to patients and healthcare providers. Without sufficient reimbursement, healthcare facilities may be reluctant to invest in electroceutical technologies, further hindering the market growth. Overcoming these obstacles requires strategic positioning of electroceuticals relative to pharmaceuticals, advocating for improved reimbursement policies, and demonstrating the cost-effectiveness and clinical value of electroceutical therapies to stakeholders in the healthcare ecosystem.

Moreover, technological advancements and increasing regulatory support are driving the launch and availability of electroceutical devices. These innovations enable the development of more advanced and effective treatments. Regulatory approvals, such as those from the U.S. Food and Drug Administration (FDA), validate the safety and efficacy of these devices, fostering confidence among healthcare providers and facilitating their adoption in clinical practice, ultimately benefiting patients with improved therapeutic options. For instance, in January 2020, Medtronic Plc. announced that it received the FDA approval of Micra AV, the worlds smallest pacemaker with atrioventricular (AV) synchrony. Similarly, in May 2020, Boston Scientific received the FDA approval for the WaveWriter Alpha portfolio of spinal cord stimulator (SCS) systems. In addition, in January 2022, Medtronic Plc received the FDA approval of its Intellis rechargeable neurostimulator and Vanta recharge-free neurostimulator for the treatment of chronic pain associated with diabetic peripheral neuropathy (DPN).

Segments Overview

The global electroceuticals industry is segmented into product, device type, application, end user, and region. On the basis of product, the market is categorized into cardiac pacemakers & implantable cardioverter defibrillators, cochlear implants, spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, sacral nerve stimulators, and others. Depending on device type, it is bifurcated into implantable devices and non-invasive devices. On the basis of application, it is classified into arrhythmia, sensorineural hearing loss, epilepsy, parkinson's disease, and others. By end user, it is segregated into hospitals, ambulatory surgical centers, and others. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and Latin America (Brazil, Colombia, Argentina, and rest of Latin America), and Middle East & Africa (GCC, South Africa, North Africa, and rest of Middle East & Africa).

By Product Type

Depending on product, the Electroceuticals/Bioelectric Market is segmented into cardiac pacemakers & implantable cardioverter defibrillators, cochlear implants, spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, sacral nerve stimulators, and others. The cardiac pacemakers & implantable cardioverter defibrillators segment accounted for the largest Electroceuticals/Bioelectric Market share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period. This is attributed to increase on prevalence of cardiovascular diseases such as arrhythmias and heart failure, ongoing advancements in cardiac device technology, growing aging population, and rise in awareness about the importance of cardiovascular health and the availability of advanced treatment options.

However, the deep brain stimulators segment is expected to exhibit the fastest CAGR during the forecast period. This is primarily attributed to increasing R&D activities in neurostimulation therapies for conditions such as essential tremor, dystonia and parkinsons disease. Innovations in technology and expanded indications are driving adoption. Moreover, the growing prevalence of neurological disorders and the demand for non-pharmacological treatment options further fuel the segment's accelerated growth.

By Device Type

Depending on device type, the market is bifurcated into implantable devices and non-invasive devices. The implantable devices segment accounted for the largest Electroceuticals/Bioelectric Market share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period. This is attributed to factors such as extended service life of implantable devices, which reduces replacement frequency and enhances cost-effectiveness. In addition, ongoing technological advancements improve device performance and durability, thereby bolstering the demand. However, the non-invasive devices segment is expected to exhibit the fastest CAGR during the forecast period. This is attributed to increasing patient preference for minimally invasive treatments, coupled with advancements in technology making non-invasive devices more effective. Moreover, rising demand for home healthcare solutions and expanding applications across various medical specialties contribute to the segment's accelerated growth.

By Application

Depending on application, the market is fragmented into arrhythmia, sensorineural hearing loss, epilepsy, parkinson's disease, and others. The arrhythmia segment accounted for the largest electroceuticals/bioelectric medicine market share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period. This is attributed to increasing prevalence of arrhythmias globally. Factors such as aging population, lifestyle changes, and advancements in arrhythmia management technologies contribute to sustained demand for diagnostic and treatment solutions in this segment.

However, the epilepsy segment is expected to exhibit the fastest CAGR during the Electroceuticals/Bioelectric Market forecast period. The rising prevalence of epilepsy worldwide and increasing adoption of deep brain stimulation as an effective treatment option for drug-resistant epilepsy, contributing to the segment's accelerated growth trajectory.

By End User

Depending on end user, the market is fragmented into hospitals, ambulatory surgical centers, and others. The hospitals segment accounted for the largest electroceuticals/bioelectric medicine market size in terms of revenue in 2022 and is expected to maintain its lead during the forecast period. This is attributed to the fact that hospitals play a central role in providing comprehensive healthcare services, thus increasing patient admissions. Moreover, advancements in medical technology requiring hospital infrastructure and government policies incentivizing hospital-based care contribute toward the growth of the segment.

However, the ambulatory surgical centers segment is expected to exhibit the fastest CAGR during the forecast period. The increasing demand for outpatient procedures, advancements in minimally invasive surgery techniques, and cost-effectiveness compared to traditional hospital settings boost the segment growth. Moreover, favorable reimbursement policies and convenience for patients drive the segment's accelerated growth trajectory.

By Region

Region wise, the Electroceuticals/Bioelectric Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America acquired the largest electroceuticals/bioelectric medicine market size in terms of revenue in 2022 and is expected to maintain its lead during the forecast period owing to a well-established healthcare infrastructure, high healthcare spending, extensive adoption of advanced therapeutic technologies, robust R&D activities, and favorable government initiatives supporting healthcare innovation. In addition, the region's large population base and increasing prevalence of chronic diseases contribute to the continued growth of the Electroceuticals/Bioelectric Market.

However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period. The region's robust economic development, coupled with a rapidly expanding population, is contributing to increase in the number of patients suffering from various diseases. In addition, rising healthcare awareness and improving healthcare infrastructure in countries across Asia-Pacific are fostering greater access to electroceuticals.

Competitive Analysis

The major players such as Boston Scientific Corporation and LivaNova have adopted product launch, acquisition, product development, product launch, and product approval as key developmental strategies to strengthen their foothold in the competitive market. For instance, in July 2023, Boston Scientific Corporation announced that it received FDA approval for its Vercise Neural Navigator 5 software. This software is designed to be used alongside the Vercise Genus deep brain stimulation (DBS) systems, providing clinicians with straightforward and practical data for the treatment of individuals with Parkinson's disease or essential tremor. Clinicians can efficiently program the DBS system and deliver optimal treatment to patients with this software.

Recent Developments in Electroceuticals Industry

- In February 2023, LivaNova launched a new device called SenTiva DUO, an implantable pulse generator that aims to treat epilepsy in patients resistant to drug therapy. The device is specifically intended to deliver Vagus Nerve Stimulation (VNS) therapy and has a dual-pin header. The latest technology treats and offers benefits to patients who have been embedded with a dual-pin lead and IPG.

- In May 2022, Microport received approval for its platinum implantable cardioverter defibrillator (ICD) from Chinas National Medical Products Administration (NMPA). The platinum ICD was the first ICD product introduced by MicroPort Soaring CRM (Shanghai) Co., Ltd. (MSC).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Electroceuticals/Bioelectric Market analysis from 2022 to 2032 to identify the prevailing Electroceuticals/Bioelectric Market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Electroceuticals/Bioelectric Market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Electroceuticals/Bioelectric Market trends, key players, market segments, application areas, and market growth strategies.

Electroceuticals/Bioelectric Medicine Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 257 |

| By Product |

|

| By Device Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Oticon Medical AB, Abbott Laboratories, Boston Scientific Corporation, LivaNova PLC, Medtronic, Nevro Corporation, Cochlear Limited, electroCore, Inc., Sonova Holding AG, Biotronik SE & Co. KG |

Analyst Review

The electroceuticals market highlights sustained growth driven by growth in population, increased prevalence of diseases, and technological advancements. In addition, rise in awareness of early diagnosis, and shift in healthcare landscape toward patient-centric approaches are anticipated to drive the market growth. Furthermore, government initiatives by providing funding for research and development, supportive regulatory frameworks for new product approvals, and improvement in healthcare infrastructure contribute to the market's positive trajectory. With a strong emphasis on focusing on lifestyle-related risk factors, the electroceuticals market is positioned for sustained growth.

Furthermore, North America is expected to remain dominant during the forecast period, due to surge in the use of electroceuticals. This is attributed to a well-established healthcare infrastructure and high healthcare expenditure. Furthermore, the presence of major market players fosters innovation and product development. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to key players, due to surge in awareness toward preventative healthcare.

The total market value of electroceuticals market is $19.8 billion in 2022.

The forecast period for electroceuticals market is 2023 to 2032.

The market value of electroceuticals market in 2032 is $40.5 billion.

The base year is 2022 in electroceuticals market .

Top companies such as Medtronic, Abbott Laboratorie, Boston Scientific Corporation; Cochlear Ltd., held a high market position in 202

2. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LA and MEA.

The cardiac pacemakers & implantable cardioverter defibrillators segment is the most influencing segment in electroceuticals market. This is attributed to the increasing incidence of cardiovascular diseases like arrhythmias and heart failure, continuous innovations in cardiac device technology, expanding aging demographic, and heightened awareness regarding cardiovascular health and advanced treatment alternatives. These factors collectively contribute to the segment's continued dominance in revenue generation.

The major factor that fuels the growth of the electroceuticals market are increasing prevalence of chronic diseases, advancements in technology, and rising demand for non-invasive therapies.

Electroceuticals are medical devices that use electrical impulses to modulate neural circuits, tissues, or organs for therapeutic purposes. They offer a non-pharmacological approach to treating various conditions such as chronic pain, neurological disorders, and psychiatric conditions.

Loading Table Of Content...

Loading Research Methodology...