Electrolyzer Market Overview

The global electrolyzer market was valued at USD 3 billion in 2022, and is projected to reach USD 34.4 billion by 2032, growing at a CAGR of 27.2% from 2023 to 2032. The market is witnessing strong growth driven by rising global demand for clean hydrogen, driven by the push for decarbonization across key sectors. Supportive government policies, increased investments in renewables, and the expanding use of hydrogen in transportation and power generation are key factors fueling this demand.

Key Market Trends & Insights

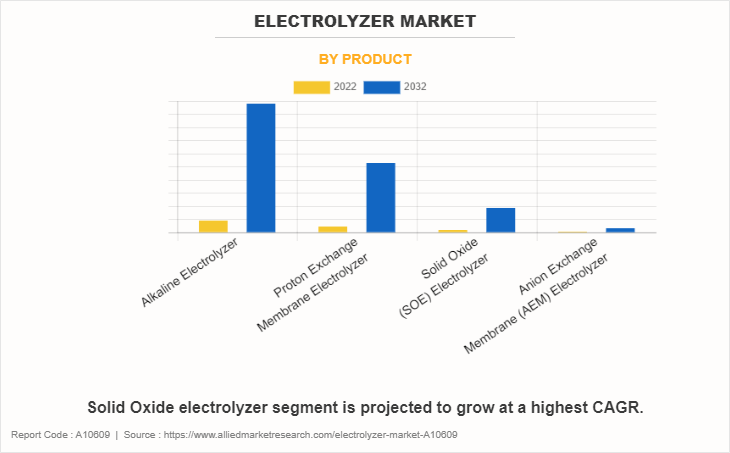

- The solid oxide electrolyzer segment is expected to grow at a CAGR of 28.1% in revenue during the forecast period.

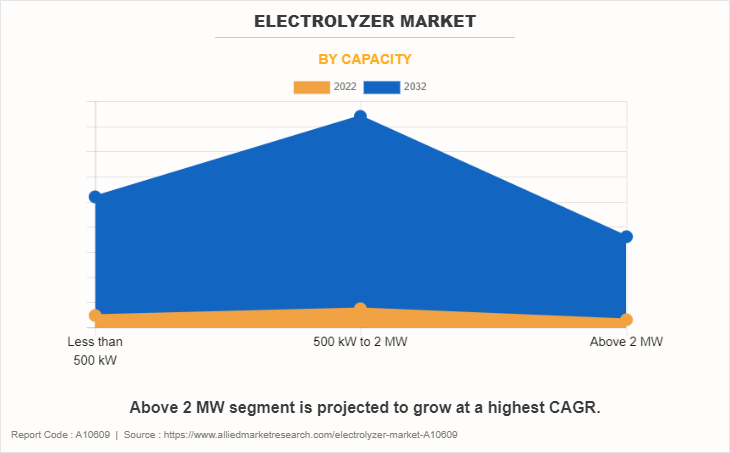

- By capacity, the above 2 MW electrolyzers are projected to grow at the fastest pace during the forecast period.

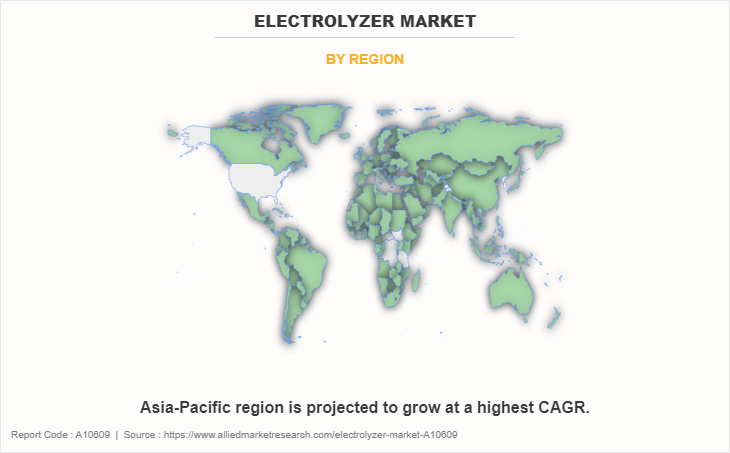

- Asia-Pacific led the market and is expected to retain its dominance during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 3 billion

- 2032 Projected Market Size: USD 34.4 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 27.2%

What is an electrolyzer

An electrolyzer is an equipment that breaks down water into hydrogen and oxygen through the process of electrolysis. An anode, a membrane, and a cathode make up the electrolyzers. On the cathode side, hydrogen is gathered and then stored for usage in a variety of industries. Either oxygen is gathered and employed in additional industrial operations, or it is discharged into the atmosphere.

Market Dynamics

Electrolysis capacity for dedicated hydrogen production has been growing in the past few years, however, the pace slowed down in 2022 with about 130 MW of new capacity entering operation, 45% less than the previous year. However, electrolyzer manufacturing capacity increased by more than 25% since 2021, reaching nearly 11 GW per year in 2022. The realization of all the projects in the pipeline could lead to an installed electrolyzer capacity of 170-365 GW by 2030. Electrolysis capacity is growing from a low base and requires a significant acceleration to get on track with the Net Zero Emissions by 2050 (NZE) Scenario, which requires installed electrolysis capacity to reach more than 550 GW by 2030.

In addition, advantageous government regulations that provide subsidies and other advantages boost the electrolyzer business. However, the market expansion is hampered by the limited supply of electrolyzers. Furthermore, the expansion of the electrolyzer market is restricted by the tardiness of authorization grants from national or local government bodies. Government policies that encourage the use of electric vehicles are underway, and in the near future, technological advancements may present a profitable opportunity for business expansion.

The market for electrolyzers is anticipated to expand if the government takes a few steps to encourage healthy energy generation. These include exempting electrolyzers from grid fees, taxes, and levies, granting access to limited electricity and grid service revenues, and acknowledging the value and cost of green hydrogen. Traditionally, electrolyzer for specialized hydrogen production have been constructed in small quantities for specialized markets. However, through economies of scale and automation, it is anticipated that increased production volumes and the corresponding expansion of factory size will lower investment costs for all electrolyzer technologies. Cost savings from the optimization of the supply chains for electrolyzer are also anticipated.

Because electrolyzer efficiency depends on system design and optimization objectives, tracking its evolution is very difficult. Comparable in efficiency, alkaline and PEM electrolyzer can function flexibly to enable direct linkage with changeable renewable electricity sources, contingent on their design. Since SOEC systems require temperatures higher than 650 °C to operate, they have reached higher electrical efficiency (84% achieved by Sunfire; however, given the additional heat input needed in SOEC systems, this is not directly comparable with other technologies). Where waste-heat is available, such as in industrial hubs, SOEC systems can be a promising solution. Recently, there have been reports of extremely high electrolyzer efficiencies from new designs. One such design is Hysata's capillary technology, which has an efficiency of 80% on a low heating value basis

Key Report Highlights:

- The report outlines the current electrolyzer market trends and future scenario of the market from 2023 to 2032 to understand the prevailing opportunities and potential investment pockets.

- The global electrolyzer market has been analyzed in terms of value ($ billion). The analysis in the report is provided for 4 major regions and more than 15 countries.

- The electrolyzer market is fragmented in nature with few players such as Cummins, Inc., Nel ASA, Siemens AG, Toshiba Corporation, Air Liquide, and Plug Power Inc., which hold a significant share of the market.

- The report provides strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the electrolyzer market.

What are the Top Impacting Factors

Increase in concern toward reducing carbon emissions.

Global warming and carbon emissions are becoming more and more of a concern. Governments everywhere have put in place a number of policies and directives that demand a decrease in carbon emissions from a range of industries. Hydrogen is produced by electrolysis, a process that uses electricity to divide water into hydrogen and oxygen. Electrolyzers are employed in this process. One of two types of resources is used to create electricity: renewable or nonrenewable. Hydrogen can also be produced using an electrolyzer in conjunction with solar or wind power to generate energy. This process promotes the production of green hydrogen that emits no carbon. In order to reduce their carbon footprint, numerous enterprises are choosing on-site electrolyzers with a capacity of 1 to 5 MW, which significantly aids in the expansion of the global market.

Decline in costs of renewable energy.

Because of the worrisome growth in carbon emissions, the increase in global temperature, and growing concerns about climate change, renewable energy sources have become increasingly popular. In an effort to practice responsible business practices, many companies are switching from using fossil fuels to generate power to more abundant natural resources including solar, wind, natural gas, and water bodies. However, the creation of such enterprises came at a hefty initial cost. On the other hand, numerous government regulations were created in support of renewable energy due to technological developments and strong advocacy for its benefits. With the added benefit of a smaller carbon impact, the cost of renewable energy has decreased. Electrolyzer demand is driven by these declining costs. This is explained by the fact that electricity for the development of green hydrogen will come from renewable resources.

Limited technological advances

Alkaline electrolyzers have been used for the electrolysis process for many years. Alkaline electrolyzers are unstable because they can be damaged by an abrupt spike in power. The industry's technological progress was impeded by the abundance of alternatives for hydrogen generation, which hindered the electrolyzer market's expansion. Furthermore, one of the main factors impeding the worldwide electrolyzer market is the delayed delivery of equipment.

High initial costs coupled with privacy concerns and data security threat.

Upgrading to advanced electrolyzers solutions, particularly smart meters, be expensive for both utilities and consumers. These upfront costs be a barrier to adoption. The collection of detailed data by smart meters has raised privacy concerns, as it provides insights into individuals' daily routines and activities. Ensuring the security of data transmitted from smart meters is a significant challenge, as it requires robust cybersecurity measures to protect against data breaches and cyberattacks.

Growing market for IoT, smart cities, and energy as a service

Electrolyzers play a key role in the development of smart cities, where IoT devices and sensors enable real-time monitoring and control of energy usage. The rise of energy-as-a-service models, where companies provide energy management solutions as a service, creates new business opportunities in the electrolyzers market.

Segment Overview

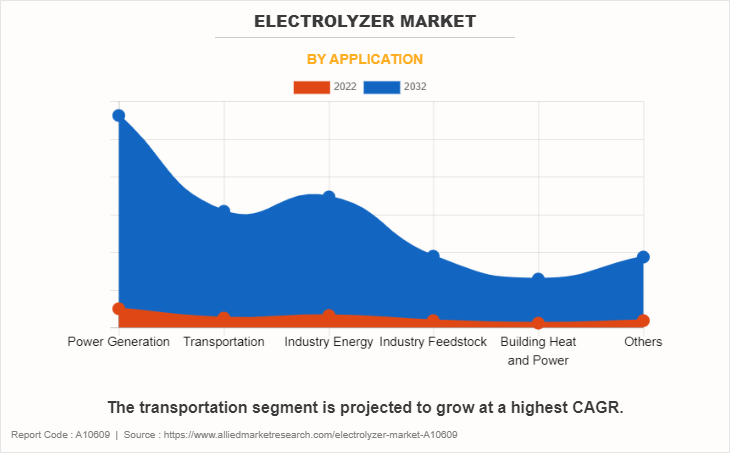

The electrolyzer market size is segmented on the basis of product, capacity, application, and region. Depending on the product, the market is categorized into alkaline electrolyzer, proton exchange membrane (PEM) electrolyzer, solid oxide electrolyzer, and anion exchange membrane (AEM). On the basis of capacity, the market is classified into less than 500 kW, 500 kW to 2 MW, and above 2 MW. By application, the electrolyzer market is segmented into power generation, transportation, industry energy, industry feedstock, building heat & power, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Market By Product

Depending on product, the electrolyzer market is segmented into alkaline electrolyzer, proton exchange membrane (PEM) electrolyzer, solid oxide electrolyzer, and anion exchange membrane (AEM) electrolyzer. The alkaline electrolyzer dominated the electrolyzer market share in 2022. It is projected to grow at a significant CAGR of 27.1%. The solid oxide electrolyzer is projected to dominate the growth during the electrolyzer market forecast period. The high operating temperatures of Solid Oxide Electrolyzers lead to higher hydrogen production efficiency. This growth is consistent with the industry's focus on developing technologies that maximize electrolysis efficiency. The growing demand for hydrogen as a clean and adaptable energy carrier in the industrial sector was driving the use of Solid Oxide Electrolyzers. Industries interested in decarbonizing the process were looking into SOEs for on-site hydrogen production.

Global Market By Capacity

By capacity, the electrolyzer market is divided into less than 500kW, 500kW to 2 MW and above 2 MW. The above 2 MW electrolyzers are projected to grow at the fastest pace during the electrolyzer market forecast period. Electrolyzers with capacity above 2 MW are usually used in projects that require huge amounts of hydrogen. Such electrolyzers have applications in aerospace activities, fertilizers manufacturing, chemical processing, and food & beverage industries.

Global Market By Application

Depending on application, the electrolyzer market size is studied for power generation, transportation, industry energy, industry feedstock, building heat & power, and others. The power generation application dominated the revenue for 2022. Power generation uses a variety of sources ranging from fossil fuels like coal and oil to renewable sources like wind and solar. The energy mix for electricity generation is dominated by fossil fuels like coal, oil, and natural gas, with the three constituting almost 65% of the global energy mix. However, the transportation segment is projected to grow at the fastest pace during the forecast period.

Hydrogen produced is stored in fuel cells that is further used to power vehicles. Fuel cell vehicles (FCVs) are currently available in many countries such as Germany and the U.S. These FCVs are available in form of buses, heavy & light duty trucks, material handling, unmanned aerial vehicle, rail, and marine transportation. Germany already has rails running on fuel cells, and now Japan and South Korea are ready to deploy the same. Companies such as Hyundai, Toyota, and Honda provide commercial FCVs. Such application of hydrogen in fuel cells produced from electrolysis drives the electrolyzer market growth.

Global Market By Region

By region, the electrolyzer market is studied across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the market growth and is further projected to maintain its dominance during the projection period. The rise in demand for electrolyzers in building & construction, manufacturing plants, automobile, and electric vehicle drives the demand for electrolyzers, owing to the fact that they help in reducing carbon footprint through electricity generated from green hydrogen (electrolysis using renewable sources of energy such as solar and wind power).

Key Electrolyzer Companies:

Major companies profiled in the electrolyzer industry include:

- Cummins, Inc.

- Nel ASA

- Siemens AG

- Toshiba Corporation

- Air Liquide

- Plug Power Inc.

- McPhy Energy

- ITM Power

- Iberdrola S.A.

- Bloom Energy

The companies adopted key strategies such as collaboration to increase their market share. The drivers, restraints, and opportunities are explained in the report to better understand the market dynamics. This report further highlights the key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and the role of each stakeholder. The report features strategies adopted by key market players to maintain their foothold in the market. Furthermore, it highlights the competitive landscape of key players to increase their market share and sustain the intense competition in the industry.

What are the Recent Developments in the Electrolyzer Market

The US Congress enacted the Bipartisan Infrastructure Law in 2021, which provides incentives to support infrastructure and electrolysis production as well as funds for the establishment of hydrogen hubs, with chosen projects scheduled for announcement in Q3 2023. Signed in August 2022, the IRA provides a number of tax credits and grant funds to assist hydrogen technologies, which is anticipated to have an effect on the production facilities and electrolyzer deployment.

With an emphasis on hydrogen technology, the European Commission authorized funds of EUR 5.4 billion in July 2022 to support its first Important Project of Common European Interest (IPCEI) connected to hydrogen. The Commission passed the Delegated Act outlining the production standards necessary for hydrogen to qualify as a sustainable energy source in February 2023. The EU Hydrogen Bank was established in March 2023 with the goal of paying the initial green premium for renewable hydrogen that is produced both domestically and abroad. In Q3 2023, the first auction will take place.

Germany started the H2Global project in 2021. It makes use of a method similar to the Carbon Contracts for Difference (CCfD) strategy, using grant funds from the German government to offset the price differential between supply and demand. Delivery is scheduled for the end of 2024; however, the bidding procedure was started in December 2022. The deadlines for the tenders have since been extended.

The UK unveiled a low-carbon hydrogen business plan in 2021 that was subject to public consultation in 2022 and was based on a methodology akin to CCfDs. The government preselected projects and started the first Electrolytic Allocation Round in July 2022–January 2023 with the goal of supporting at least 250 MW of capacity. By the end of 2023, the second allocation cycle is anticipated to begin.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electrolyzer market analysis from 2022 to 2032 to identify the prevailing electrolyzer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electrolyzer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electrolyzer market trends, key players, market segments, application areas, and market growth strategies.

Electrolyzer Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 34.4 billion |

| Growth Rate | CAGR of 27.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Capacity |

|

| By Application |

|

| By Product |

|

| By Region |

|

| Key Market Players | Plug Power Inc., McPhy Energy, Siemens AG., ITM Power, Cummins, Inc., Bloom Energy, Iberdrola S.A., Nel ASA, Toshiba Corporation., Air Liquide |

Analyst Review

According to the insights from the CXO’s, the market for electrolyzers is extremely fragmented. The electrolyzers are employed in the process of producing hydrogen. Water is electrolyzed to produce oxygen and hydrogen, which are then stored in liquid or gas form and employed in chemical processing and other industrial processes. The market is being driven by reasons including the growing need for fuel cells from the electric vehicle industry, which aims to reduce carbon emissions, and the increased need for hydrogen. However, the market's expansion is constrained by a lack of significant technological improvements and a delayed equipment supply. Government initiatives, however, can present a profitable opportunity for the industry's growth. Examples of these initiatives include recognizing the value and price of green hydrogen, offering access to curtailed electricity and grid service income, and exempting electrolyzers from grid fees, taxes, and levies.

$34.4 billion is the estimated industry size of Electrolyzer by 2032.

Increase in concern toward reducing carbon emissions, decline in costs of renewable energy, and the growing market for IoT, smart cities, and energy as a service are the upcoming trends of Electrolyzer Market in the world.

Power generation is the leading application of Electrolyzer Market.

Asia-Pacific is the largest regional market for Electrolyzer.

Cummins, Inc., Nel ASA, Siemens AG, Toshiba Corporation, Air Liquide, Plug Power Inc., McPhy Energy, ITM Power, Iberdrola S.A., and Bloom Energy are the top companies to hold the market share in Electrolyzer.

Loading Table Of Content...

Loading Research Methodology...