Embedded SIM Market Research, 2032

The global embedded subscriber identity module (e-sim) market was valued at $3.4 billion in 2022 and is projected to reach $12.7 billion by 2032, growing at a CAGR of 14.3% from 2023 to 2032. An embedded subscriber identity module (E-SIM) is a type of SIM card that is embedded directly into a device, such as a smartphone, tablet, smartwatch, or other connected devices, during the manufacturing process. It is a programmable chip that serves the same purpose as a traditional SIM card, which is to identify and authenticate the device on a mobile network.

E-SIMs offer a more flexible and convenient approach, unlike physical SIM cards that are removable and require manual swapping to switch between mobile network operators (MNOs). Users may remotely activate, provision, and manage their mobile network connectivity without the need for a physical SIM card with E-SIM technology.

E-SIM technology offers greater flexibility, convenience, and design possibilities compared to traditional physical SIM cards. It simplifies the process of switching between mobile network operators and enables remote management of device connectivity, making it an increasingly popular choice in the connected world.

Segmentation Overview

The embedded subscriber identity module (e-sim) market is segmented into Application and Industry Vertical.

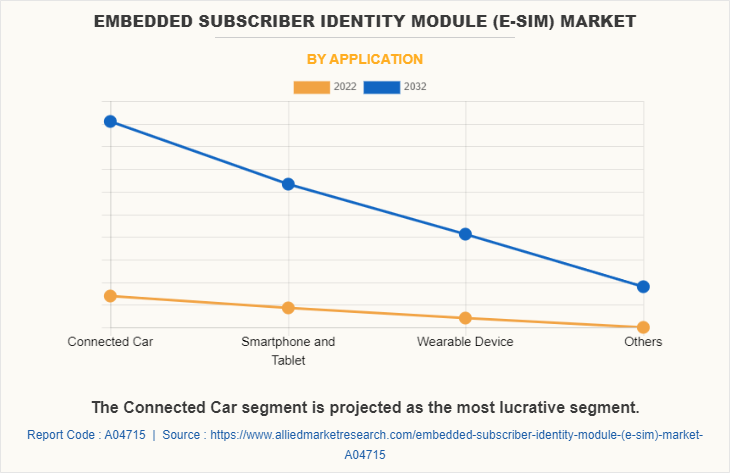

Based on application, the market is divided into connected cars, smartphones & tablets, wearable devices, and others. The connected car segment was the highest revenue contributor to the market.

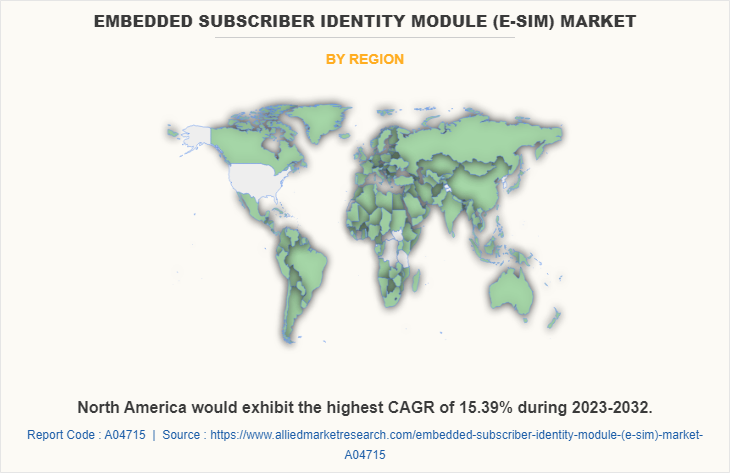

Based on region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the Rest of Asia-Pacific) and LAMEA (Latin America, Middle East, and Africa).

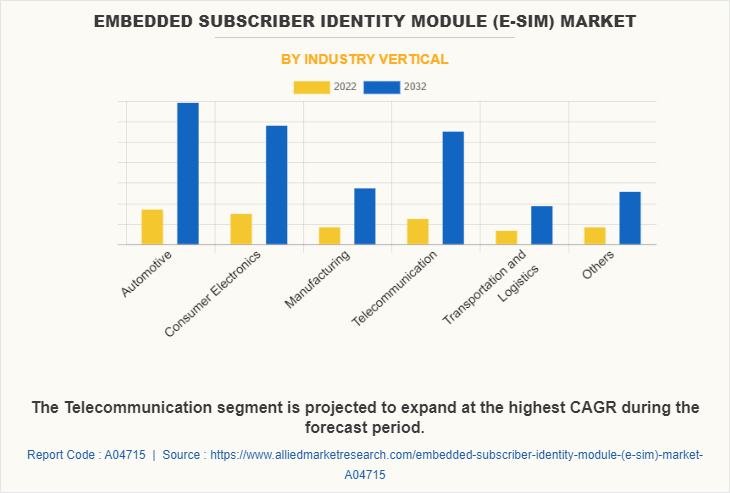

Based on industry vertical, the market is segregated into automotive, consumer electronics, manufacturing, telecommunication, transportation & logistics, and others. The automotive segment emerged as the leading revenue generator for the market.

Country-wise, the U.S. acquired a prime market share in the North American region and is expected to grow at a significant CAGR during the forecast period of 2023-2032. This dominant position can be attributed to several key factors. Firstly, the U.S. boasts a robust technology and innovation ecosystem that fosters advancements in E-SIM technology. Secondly, the country has a history of early adoption of advanced technologies, providing a competitive advantage. Furthermore, the U.S. benefits from a favorable regulatory environment that supports the deployment of E-SIMs. Additionally, the growing demand for connected services, driven by a tech-savvy population, contributes to the U.S.'s strong market position. Lastly, the thriving consumer electronics market in the U.S. promotes the integration of E-SIMs into various devices. These factors have propelled the U.S. to a prime embedded subscriber identity module (E-SIM) market share and are expected to drive continued embedded SIM market growth.

In Europe, Germany emerged as the dominant player in terms of revenue share in the embedded subscriber identity module (E-SIM) market in 2022, and this trend is expected to continue during the forecast period. Several factors contribute to Germany's stronghold in the market. Germany has a highly developed industrial sector, including automotive and manufacturing industries, which are early adopters of advanced technologies like E-SIMs. The country also has a robust telecommunications infrastructure and a favorable regulatory environment that supports the widespread adoption of embedded SIM technology. Furthermore, Germany's strong emphasis on technological innovation and its skilled workforce contribute to its market leadership in the E-SIM industry within Europe.

In the Asia-Pacific region, China is anticipated to become a prominent market for the embedded subscriber identity module (e-SIM) industry. There are several factors contributing to China's prominence in this market. China has a massive consumer base and a rapidly growing market for connected devices and services. The increasing adoption of smartphones, wearables, and IoT devices in China drives the demand for E-SIM technology to enable seamless connectivity and remote management capabilities. Additionally, China has a vibrant ecosystem of technology companies and startups that are actively involved in research, development, and innovation in the E-SIM space. This ecosystem fosters technological advancements and drives the growth of the embedded subscriber identity module (e-SIM) industry.

In the LAMEA region, the Middle East dominated the embedded subscriber identity module (E-SIM) market size in terms of revenue in 2022. The key driver for this dominance is the region's strong emphasis on digitalization and smart city initiatives have fuelled the demand for seamless connectivity and remote management capabilities, leading to the increased adoption of E-SIMs. Additionally, the Middle East has a high smartphone penetration rate and a tech-savvy population, contributing to the demand for connected devices and services. E-SIMs provide convenient connectivity options and enable users to switch between multiple networks without the need for physical SIM cards, further driving their adoption.

The automotive industry has been a major catalyst for the adoption of E-SIM technology, as connected cars heavily rely on it to deliver a wide range of services. E-SIMs enable in-car connectivity, allowing vehicles to access the internet and connect to cellular networks. This connectivity is the foundation for real-time navigation services, providing drivers with up-to-date maps, traffic information, and route guidance. In addition, E-SIMs support entertainment services, enabling passengers to enjoy streaming music and videos while on the move. Moreover, they facilitate remote diagnostics, enabling manufacturers to monitor the performance of vehicles, detect issues, and perform maintenance remotely.

Furthermore, E-SIMs enable over-the-air software updates, allowing manufacturers to deliver new features, bug fixes, and security enhancements directly to connected cars, ensuring they are always up to date. Overall, E-SIMs provide seamless connectivity and unlock advanced features and services that enhance the driving experience in connected cars. On the other hand, limited operator support for E-SIM technology poses a restraint to its adoption. The successful implementation of E-SIM requires cooperation and active participation from mobile network operators (MNOs). However, not all MNOs have fully embraced E-SIM, resulting in the limited availability of E-SIM-compatible networks and services in certain regions. This lack of widespread support creates a significant barrier for consumers who wish to utilize E-SIM functionality. Users may be restricted in their choice of operators and face limitations in accessing the benefits offered by E-SIM technology, without a broad range of MNOs supporting E-SIM, such as seamless connectivity and easy switching between networks.

The emergence of digital SIM technology has transformed the way mobile devices are connected to networks, providing greater flexibility and convenience for users. Additionally, the E-SIM market has been presenting numerous opportunities across consumer electronics devices. One of the key advantages of E-SIM technology is its ability to eliminate the need for physical SIM cards. This enables manufacturers to design devices that are sleeker, more streamlined, and space-efficient. Furthermore, the removal of physical SIM cards brings convenience to users, allowing them to switch between different mobile network operators (MNOs) without the hassle of obtaining and inserting new SIM cards. This is particularly beneficial for frequent travelers who may effortlessly connect to local networks in various countries without the need to acquire and swap SIM cards. Moreover, E-SIM reduces the dependency on specific MNOs, empowering users to choose and switch between operators based on their preferences and requirements. In summary, E-SIM technology offers enhanced convenience, compact designs, and greater flexibility in consumer electronics devices, fueling embedded subscriber identity module (e-SIM) market growth and presenting exciting opportunities.

Top Impacting Factors

The growth of the Internet of Things (IoT) and the increase in the adoption of connected devices drive the expansion of the E-SIM market. E-SIM technology caters to the connectivity needs of IoT devices by offering seamless connectivity and remote management capabilities. It allows for the deployment of a large number of IoT devices without physical SIM cards and enables effortless switching between mobile network operators or plans. Similarly, for connected devices, E-SIM simplifies the process of device activation and provides flexibility in choosing network operators. However, device compatibility remains a restraint as not all devices support E-SIM functionality. Nevertheless, there are significant opportunities in enterprise solutions, where E-SIM streamlines connectivity, enhances device management, and ensures secure access to corporate resources.

Competitive Analysis

The embedded subscriber identity module (e-SIM) market outlook report highlights the highly competitive nature of the embedded subscriber identity module (E-SIM) market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing market demands. The competitive environment in this market is expected to increase as agreements, mergers, partnerships, product launches, collaborations, and new product development strategies are adopted by key vendors. Competitive analysis and profiles of the major embedded subscriber identity module (E-SIM) market players that have been provided in the report include STMicroelectronics, Infineon Technologies AG, Thales, Sierra Wireless, Deutsche Telekom AG, Giesecke+Devrient Mobile Security GmbH, Telenor Group, Vodafone Group Plc, NTT DOCOMO, Inc., and NXP Semiconductors.

Key Developments/ Strategies

According to the latest E-SIM market forecast, Thales, STMicroelectronics, Giesecke+Devrient Mobile Security GmbH, Infineon Technologies AG, Sierra Wireless, and NXP Semiconductors are the top players in the embedded subscriber identity module (E-SIM) market. Top market players have adopted various strategies, such as agreements, mergers, partnerships, product launches, collaborations, and new product developments, to expand their foothold in the embedded SIM market.

In February 2023, Sequans, the leader in cellular IoT chip technology, and Thales, the leader in digital security, are partnering to bring to market a new integrated SIM (iSIM) solution supporting the latest GSMA SGP.31/.32 eSIM IoT specifications on Sequans LTE-M/NB-IoT Monarch 2 chip. The new version of the GSMA standard leverages industry experience with GSMA's M2M and consumer eSIM architectures to bring a more advanced remote SIM provisioning architecture that is fully suitable for any IoT device. This gives service providers and OEMs/ODMs more flexibility to manage manufacturing, deployment, and operations of massive fleets of IoT devices without heavy investment.

In January 2023, Sierra Wireless introduced its new offering called Smart Connectivity Premium, which incorporates enhanced features and capabilities enabled by eUICC (embedded Universal Integrated Circuit Card) technology. This innovation allows for simplified and flexible management of connectivity across different regions and networks, enabling seamless switching between mobile network operators. The eUICC technology eliminates the need for physical SIM cards and offers remote provisioning, making it easier for enterprises to manage their IoT devices' connectivity on a global scale.

In June 2022, STMicroelectronics launched the ST4SIM-201 embedded SIM (eSIM) for machine-to-machine (M2M) communication, which meets the latest standards for 5G network access, M2M security, and flexible remote provisioning and management.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the embedded subscriber identity module (e-sim) market from 2022 to 2032 to identify the prevailing embedded subscriber identity module (e-sim) market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the embedded subscriber identity module (e-sim) market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global embedded subscriber identity module (e-sim) market trends, key players, market segments, application areas, and market growth strategies.

Embedded Subscriber Identity Module (e-SIM) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.7 billion |

| Growth Rate | CAGR of 14.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 248 |

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Giesecke+Devrient Mobile Security GmbH, Infineon Technologies AG, STMicroelectronics, Telenor group, NTT DOCOMO, Inc., Thales, Sierra Wireless, Vodafone Group Plc, Deutsche Telekom AG, NXP semiconductors |

Analyst Review

The E-SIM market in the automotive industry is poised for high growth. The automotive sector is experiencing significant expansion, especially in developing regions such as China and India, driven by population growth and increased vehicle demand. Companies in this industry adopt innovative techniques such as mergers and acquisitions to strengthen their position in the competitive landscape.

The global embedded SIM market is primarily driven by the widespread adoption of IoT technology and favorable government regulations that boost machine-to-machine communication. Automotive industry verticals have actively developed improved concepts and innovative product designs to meet customer demands and enhance E-SIM efficiency, thereby leaving a lasting impact on the market.

North America currently leads in E-SIM adoption and has witnessed substantial market expansion. However, the Asia-Pacific region is expected to grow at a faster pace, fueled by the rise in demand for smartphones and consumer electronics, particularly in countries such as China and India.

The embedded SIM market offers numerous growth opportunities for market players such as Deutsche Telekom AG, Gemalto NV, NXP Semiconductors N.V., and Sierra Wireless. The E-SIM industry is projected to grow at a significant rate in the coming years with supportive government schemes promoting IoT technology and a readily available workforce.

The Embedded Subscriber Identity Module (e-SIM) Market is expected to grow at a CAGR of 14.34% from 2023-2032.

Connected cars is the leading application of Embedded Subscriber Identity Module (e-SIM) Market.

North America is the largest regional market for Embedded Subscriber Identity Module (e-SIM).

The industry size of Embedded Subscriber Identity Module (e-SIM) is estimated to be $3,345.7 million in 2022.

The top companies to hold the market share in Embedded Subscriber Identity Module (e-SIM) are Thales, STMicroelectronics, Giesecke+Devrient Mobile Security GmbH, Infineon Technologies AG, Sierra Wireless, and NXP semiconductors.

Loading Table Of Content...

Loading Research Methodology...