Emulsifiers Market Research, 2031

The global emulsifiers market size was valued at $8.9 billion in 2021, and is projected to reach $15.1 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031.

Emulsifiers, also known as emulsifying agents, are substances that help stabilize mixtures of two immiscible liquids, such as oil and water, by reducing surface tension at the interface. These compounds are widely used in the food, pharmaceutical, cosmetic, and chemical industries to create stable and homogenous products. Emulsifiers work by having both hydrophilic (water-attracting) and lipophilic (oil-attracting) properties, allowing them to interact with both components of a mixture and form a stable emulsion.

In the food industry, emulsifiers are essential in the production of processed foods such as mayonnaise, margarine, ice cream, baked goods, and salad dressings. Common food-grade emulsifiers include lecithin (derived from soy or egg yolk), mono- and diglycerides, and esters of fatty acids. These substances ensure consistency, improve texture, and extend shelf life by preventing separation of ingredients. Pharmaceutical and cosmetic applications also rely on emulsifiers to maintain the stability of creams, lotions, ointments, and drug delivery systems. In industrial processes, emulsifiers are used in applications such as paint formulations, lubricants, and agrochemicals.

Emulsifiers can be synthetic or naturally derived and are subject to regulatory approval to ensure safety for human use. The selection of a suitable emulsifier depends on factors such as the type of emulsion (oil-in-water or water-in-oil), pH, and desired product stability.

Market Dynamics

The growing demand for processed and convenience foods is a significant driver for the emulsifiers industry, as these additives play a crucial role in ensuring the stability, texture, and shelf life of a wide range of packaged food products. With changing consumer lifestyles, urbanization, and increased workforce participation, there has been a marked shift toward ready-to-eat, ready-to-cook, and shelf-stable food products. Emulsifiers are essential in these applications because they help maintain the uniform dispersion of ingredients such as fats and water, preventing separation and ensuring a consistent texture and appearance.

In bakery products, emulsifiers improve dough strength, enhance crumb softness, and extend product freshness, making them indispensable in bread, cakes, and pastries. Similarly, in processed dairy products, sauces, dressings, ice creams, and spreads, emulsifiers contribute to desirable mouthfeel, creamy textures, and homogeneity, which are critical to consumer acceptance. As food manufacturers strive to meet rising consumer expectations for high-quality, long-lasting, and aesthetically pleasing products, the use of emulsifiers becomes increasingly important.

However, the emulsifiers market faces a significant restraint due to rising concerns over the potential health impacts of synthetic emulsifiers. Increasing research suggests that some synthetic emulsifiers, such as polysorbates and carboxymethylcellulose, may disrupt gut microbiota and contribute to inflammation or metabolic disorders when consumed in large quantities over time. These findings have raised alarms among health-conscious consumers and advocacy groups, prompting scrutiny of food additives and their long-term health effects. As consumer awareness grows, particularly in developed markets, there is a noticeable shift in preference toward clean-label and additive-free products, putting pressure on food manufacturers to reformulate offerings and reduce reliance on synthetic additives.

Regulatory bodies are also reacting to these concerns by tightening safety assessments and mandating clearer labeling of food additives, which can increase compliance costs for manufacturers and slow down product innovation. Additionally, public backlash and negative media coverage about certain emulsifiers can harm brand reputations and consumer trust. These challenges may limit the market growth of synthetic emulsifiers and increase demand volatility.

Moreover, Emerging markets in Asia-Pacific and Latin America are poised to create significant opportunities for the emulsifiers market, driven by the rapid expansion of the food and cosmetic industries. These regions are witnessing strong economic growth, rising urbanization, and an expanding middle-class population with increasing disposable incomes. As a result, there is a growing demand for processed, ready-to-eat, and convenience food products that rely heavily on emulsifiers to maintain texture, shelf life, and product stability. Countries like India, China, Brazil, and Mexico are experiencing a surge in food manufacturing and retail sectors, providing a fertile ground for emulsifier manufacturers to expand their footprint.

Simultaneously, the cosmetics and personal care industries in these regions are also growing at a robust pace, fueled by a younger, beauty-conscious population and increased access to international brands. Emulsifiers play a critical role in the formulation of creams, lotions, sunscreens, and other skincare products by ensuring uniformity and texture. Additionally, the shift toward natural and organic cosmetic products is prompting demand for plant-based and biodegradable emulsifiers, offering further growth potential.

Segments Overview

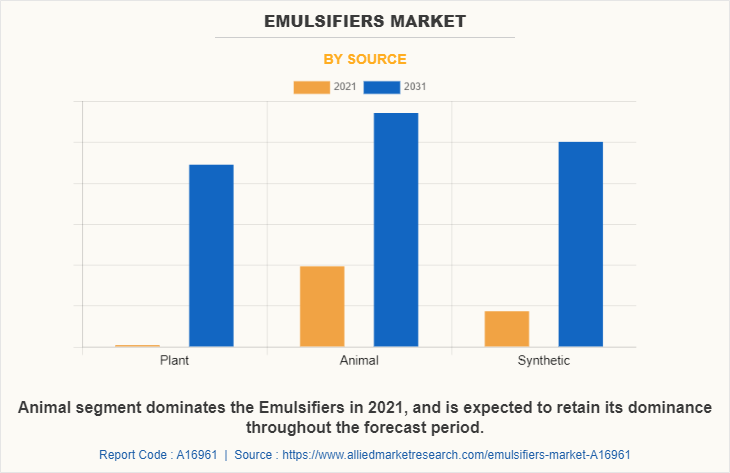

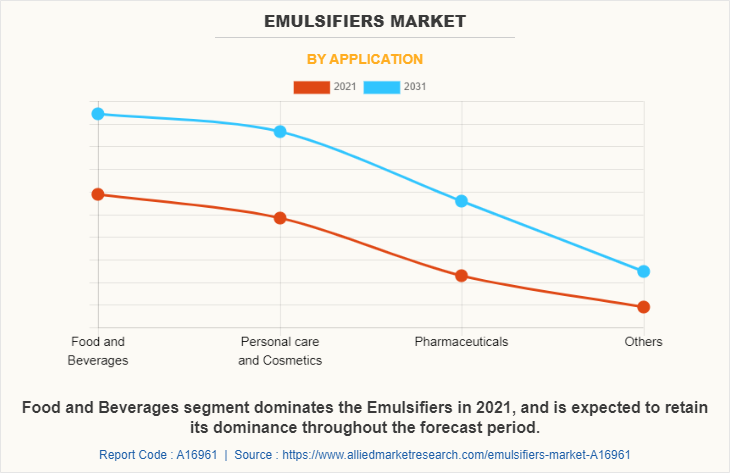

The emulsifiers market is segmented into source, application, and region. On the basis of source, the market is categorized into the plant, animal, and synthetic. Depending on application, it is segregated into food & beverages, personal care & cosmetics, pharmaceuticals, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Turkey, South Africa, Argentina, and Rest of LAMEA).

According to market, on the basis of source, the animal segment garnered a major share in the global market in 2021, and is expected to sustain its market share during the emulsifiers market forecast period. This is attributed to the fact that animal is the most common source from which emulsifiers are made as they cost less time period to extract and are easily available.

By application, the food & beverages segment dominated the global market, and is estimated to register a CAGR of 4.4%. The others segment accounted for approximately 35% of the global emulsifiers market share in 2021, and is expected to sustain its share during the forecast period.

According to emulsifiers market analysis, region wise, North America dominated the global market in 2021, and is expected to be dominant during the forecast period. This is attributed to strong presence of food & beverages, cosmetics, pharmaceutical, and paints & oils companies in North America, which increases the demand for emulsifiers.

Competitive Analysis

The players operating in the global emulsifiers market have adopted various developmental strategies to expand their market size, increase profitability, and remain competitive in the market. The key players profiled in this report include Archer Daniels Midland, AkzoNobel N.V., BASF SE, Cargill, Inc., Clariant AG, DuPont, Evonik Industries, Kerry Group, Koninklijke DSM N.V., and Solvay S.A.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2021 to 2031 to identify the prevailing emulsifiers market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the emulsifiers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global emulsifiers market trends, key players, market segments, application areas, and emulsifiers market growth strategies.

Emulsifiers Market Report Highlights

| Aspects | Details |

| By Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | Clariant AG, Archer Daniels Midland, Cargill Incorporated, BASF SE, Solvay S.A., Koninklijke DSM N.V., Evonik Industries AG, Dow DuPont, Akzonobel N.V., Kerry Group |

Analyst Review

According to the insights of the CXOs, the usage of semi-synthetic emulsifiers will increase in the next years, as they are both natural and synthetic. Phospholipids are semi-synthetic emulsifiers that are widely employed in the pharmaceutical business as wetting agents, emulsifiers, and builders or components of various lipid mesophases, including liposomes, micelles, mixed micelles, inverted micelles, and cubosomes. These functional qualities are used in a variety of pharmaceutical formulations, including suspensions, emulsions, solid dispersions, lipid nanoparticles, and drug/phospholipid complexes. In terms of their physiological significance, phospholipids exhibit very low toxicity profile and may be administered by any route, including injectable, oral, and topical.

The global emulsifiers market size was valued at $8.9 billion in 2021, and is projected to reach $15.1 billion by 2031

The global Emulsifiers market is projected to grow at a compound annual growth rate of 5.5% from 2022 to 2031 $15.1 billion by 2031

Solvay S.A., Akzonobel N.V., Kerry Group, Koninklijke DSM N.V., Dow DuPont, Clariant AG, Archer Daniels Midland, BASF SE, Cargill Incorporated, Evonik Industries AG

North America dominated the global market in 2021

Significant advancements in emulsion science that lead to improvement in product quality & efficiency and minimization of processing time and usage of natural emulsifiers in culinary items drive the growth of the global emulsifiers market.

Loading Table Of Content...