Energy Bar Market Research, 2032

The global energy bar market was valued at $696.3 million in 2022, and is projected to reach $1.3 billion by 2032, growing at a CAGR of 6.3% from 2023 to 2032. Energy bars are high in energy as they contain ingredients such as granola, oats, nuts, and seeds. These bars are recommended for providing an instant energy boost during short workout sessions such as running or cycling. Since there is no added sugar in energy bars, they are suitable for everyone. Energy bars are regarded as a convenient on-the-go snack that provides an instant boost of energy.

There has been increase in demand for convenience foods as a result of changes in consumption patterns and growing knowledge of healthy foods. On-the-go snacking has become extremely popular due to hectic lifestyles of working population. Consumers frequently choose energy bars that contain high concentration of micronutrients and deliver immediate energy. Therefore, the advantages offered by energy bars, such as their ease of consumption, disposable packaging, assurance of the product safety, raising demand for energy bars during the course of the Energy Bar Market Forecast.

As consumer preferences for packaged snacks and confectionery foods have grown, so has the demand for energy bars. The demand for energy bars is simultaneously rising as a result of busy work schedules and the demand for instant energy supplement. Further, the consumption of energy bars has been aided by rise in purchasing power and a rise in food preferences.

Moreover, during celebrations and festival events, people have started consuming nutrient-dense snacks comprised of chocolate, peanut butter, caramel, and milk. Thus, increased global participation in different events & festivals led to significant revenue generation. The Energy Bar Market Demand has further increased as a result of growth in acceptance of pre-packaged on-the-go snacks.

Convenience stores frequently offer energy bars in addition to other food & shopping items. As a result, the expansion of the retail sector has provided energy bars a boost. Rise in the consumption of these snacks for boosting energy was brought on by the proliferation of wellness & fitness facilities as well as exercise parks. Moreover, it is simpler for consumers to evaluate and select food items with suitable ingredients from a variety of other energy bars. In addition, it is anticipated that expanding marketing and communication techniques for such products on various television and digital media will significantly boost Energy Bar Industry revenue generation throughout the forecast period.

There are various energy bars in the market to cater to the consumers demand as a result of the ten-year spike in demand for them, particularly in developed nations. Energy bars are increasingly being consumed to make up for various nutrient insufficiencies brought on by inadequate intake of nourishing foods. In addition, many consumers are substituting energy snacks such as protein bars for their typical breakfast. The market for energy bars is likely to grow during the forecast period due to its taste and huge variety across the globe. Moreover, manufacturers are increasingly focused on reducing the amount of sugar and artificial chemicals in energy bar products to offer more nutritious products in the market. Thus, energy bars have gradually emerged as a meal replacement alternative in several parts across the globe, as a result of which, the demand for energy bars is expected to rise during the forecast period. Furthermore, the consumption of energy bars among athletes, sportsmen, and women coupled with growth in number of paid partnerships with social media influencers is expected to boost the overall sales of energy bars globally.

Growth in popularity of energy bars among athletes and young adults due to intensive training in sports is an emerging driver that is expected to boost market growth during the forecast period. Athletes require healthy energy food to perform well and to maintain stamina throughout the training period. Fiber-rich energy bars aid in appetite suppression, digestive health improvement, and weight management. As a result, there is increase in demand for these products among athletes.

The COVID-19 pandemic has created opportunities for many private players to enter the market to meet the increased demand. In addition, as snacks are a quick & convenient source of nutrition and energy, the demand for innovative snack products, such as energy bars, is consistently high in developed countries. Furthermore, COVID-19 has resulted in a significant shift in consumer behavior as customers in developing countries are less loyal to brand and are more willing to try new brands in a low-supply environment. As a result, online distributors are benefitting from this trend as home-bound consumers look for retail alternatives.

Attributed to factors, such as rise in millennial population, growth in disposable income, and increase in urban consumers, the global energy bar market is expected to witness increased popularity of online retailing. Fitness enthusiasts who want convenience while purchasing nutrition foods impose a strong demand for energy bars through online platforms.

The tough competition from energy bar competitors is a constraint for the market. Another constraint includes lack of taste and high sugar content in various energy bars, which force consumers to reconsider energy bars as a healthy food product.

Manufacturers in the global energy bar market are now focusing on labeling to expand brand presence, in addition to introducing new & appealing flavors & tastes. These labels mention added or fortified functional ingredients found in energy bars to market the products across developing countries such as India and China To eliminate the general perception of various health risks associated with the consumption of confectionery, manufacturers added functional ingredients to their final products of energy bars to regain their customer base and target new consumers in the growing energy bar market.

Segmental Overview

The global energy bar market is segmented on the basis of type, nature, distribution channel, and region. On the basis of type, the market is categorized into protein bar, nutrition bar, cereal bar, and fiber bar. As per nature, it is divided into organic and conventional. According to distribution channel, the energy bar market is fragmented into e-commerce and offline channel. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, France, the Netherlands, Germany, Turkey, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, the UAE, and the rest of LAMEA).

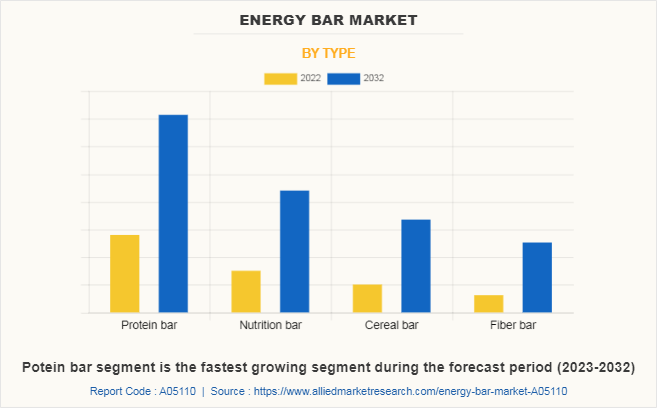

By Type

Depending on type, the protein bar segment dominated the market in 2022, garnering around one-third of the market share; moreover, the protein bar segment is expected to grow at the highest CAGR of 6.7% from 2023 to 2032. In addition, due to growing health consciousness, shifting socioeconomic needs, and lack of time to prepare nutritious food, the demand for processed & convenience foods is rapidly rising. Further, protein bars are among the energy and weight management products that consumers are choosing these days to maintain a healthy lifestyle. Thus, the demand for protein bars is being driven by this change in lifestyle.

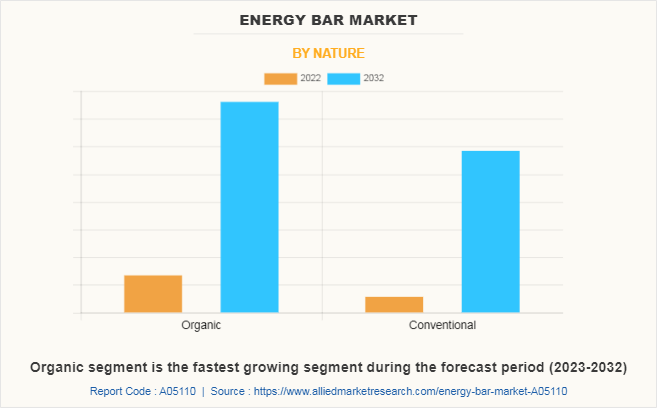

By Nature

By nature, the organic segment dominated the market in 2022, garnering around half of the market share. Moreover, the organic segment is expected to grow at the highest CAGR of 6.4% from 2023 to 2032. In addition, the popularity of sports and athletic activities is rising among young people. Further, the expansion of the organic segment is anticipated to be fueled by rise in demand for healthy & organic snacks with high nutritional content as well growth in demand for sports nutrition. In addition, these bars can help with weight management by replacing high-calorie items such as chocolate, cakes, and cookies. Thus, this segment is expected to boost the Energy Bar Market Growth.

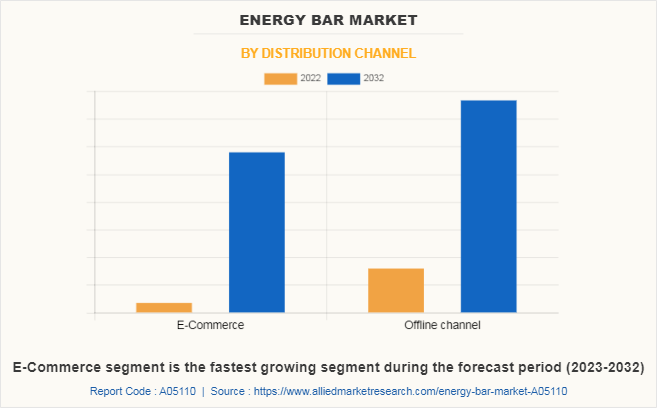

By Distribution channel

As per distribution channel, the offline channel segment dominated the market in 2022, garnering majority of the market share. Moreover, the e-commerce segment is expected to grow at the highest CAGR of 6.5% from 2023 to 2032. In addition, the offline channel provides a vast product portfolio in almost every segment across the globe., thus, making it simply accessible for the clients. As a result, the development of offline channels in numerous locations opens up lucrative prospects for the expansion of the energy bar market. Through these channels, manufacturers provide special discounts and encourage hypermarket & supermarket chains to sell huge variety of products, which significantly increases the sale of energy bars.

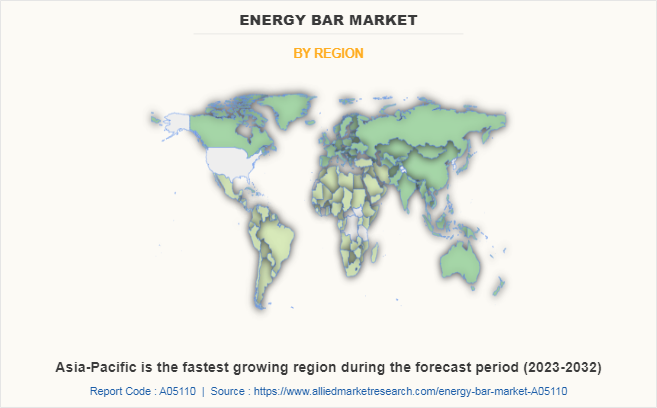

By Region

Region wise, North America dominated the market in 2022, garnering a market share of 36.4%. In addition, the demand for energy bars is being driven by increase in the number of gym-going people who wish to keep healthy & fit. In North America, especially in the U.S., the popularity of clean label‐™ and free-from‐™ products is growing and is anticipated to significantly contribute to the expansion of the energy bar market in the upcoming years. Energy bars have many advantages, which makes them appealing to a variety of customers, including athletes. For instance, as they do not contain caffeine, energy bars are becoming more popular among athletes in the U.S. Thus, there are high opportunities for the key players to boost the Energy Bar Market Size in the North America region.

Competitive Analysis

The major players operating in the global energy bar market are Brighter Foods Ltd, Cliff Bar & Company, General Mills Inc, Kind LLC, McKee Foods Corporation, NuGo Nutrition, Premier Nutrition Inc, Probar LLC, Quest Nutrition, and Kellogg Company. The key players have adopted various strategies such as product launch to increase their market share.

Some Instances of Product Launch in the Global Energy Bar Market

- In October 2022, Kellogg Company launched new bars under its Nutri-Grain brand, which include Chocolatey Banana Bites, which is mainly marketed for children. It further introduced these bars in strawberry and squash variety. With this launch, it has expanded its product offering and icreased its Energy Bar Market Share.

- In July 2022, Kind brand of Mars, Incorporated launched, Kind Thins, which is a product line featuring thin bars in dark chocolate nuts & sea salt and caramel nuts & sea salt flavors. With this launch, it has expanded its product portfolio.

- In June 2022, General Mills, Inc., launched new HFSS-compliant Fruit & Nut range, energy bar under its Nature Valley brand. With this launch, it has expanded its product offering.

- In March 2022, Clif Bar & Company, division of Mondelez International, Inc., launched new CLIF Thins Snack Bars, in chocolate chip, chocolate peanut brownie and white chocolate macadamia nut flavor. With this, launch it has expanded its product portfolio.

- In February 2022, McKee Foods Corporation launched Panada chewy granola bars, under its Sunbelt Bakery brand. These bars are made from whole grain, and chocolate. With this launch, the company has expanded its product offering.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the energy bar market analysis from 2022 to 2032 to identify the prevailing energy bar market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the energy bar market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global energy bar market trends, key players, market segments, application areas, and market growth strategies.

Energy Bar Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.3 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 259 |

| By Type |

|

| By Nature |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | THG plc, NuGo Nutrition, Inc., Mars, Incorporated., BellRing Brands, Inc, PROBAR LLC, Kellogg Company, General Mills Inc., MONDELEZ INTERNATIONAL, INC., McKee Foods Corporation, The Simply Good Foods Company |

Analyst Review

According to the insights of CXOs of leading companies, energy bars, also known as supplemental bars, predominantly provide quick energy to replace a meal as cereals and high-energy foods are included in energy bars. An energy bar is a convenient way to supplement protein, which increases muscle mass and helps to keep fat in control. These bars are popular due to their nutritional and food quality, wherein organic energy bars and conventional energy bars are the two main types.

Attributed to rise in complex health issues, such as heart disease, obesity, blood cholesterol, and diabetes, consumers are becoming more conscious of their eating habits. To prevent and treat such complex diseases, consumers are inclining toward healthy foods that provide instant energy.

The sports nutrition industry is expected to play a significant role in the growth of the energy bar market as tournament organizers of major world leagues of sports, such as the Olympics, World Cup, and other championships, make energy bars widely available to athletes competing in any such event. These steps will create new growth opportunities for established market players in the energy bar market.

Players in the global energy bar market are aiming to expand their geographical presence to capitalize the untapped opportunities. For instance, major market participants are forming strategic alliances. This type of strategy is expected to provide lucrative opportunities to meet customer demands for quality & productivity as well as to leverage global reach, bringing innovative products to a larger customer base.

The global energy bar market was valued at $696.3 million in 2022, and is projected to reach $1.3 billion by 2032

The global Energy Bar market is projected to grow at a compound annual growth rate of 6.3% from 2023 to 2032 $1.3 billion by 2032

The major players operating in the global energy bar market are Brighter Foods Ltd, Cliff Bar & Company, General Mills Inc, Kind LLC, McKee Foods Corporation, NuGo Nutrition, Premier Nutrition Inc, Probar LLC, Quest Nutrition, and Kellogg Company. The key players have adopted various strategies such as product launch to increase their market share.

Region wise, North America dominated the market in 2022, garnering a market share of 36.4%.

Rising Health Awareness & Nutritional Needs, Expanding Retail & E-commerce Channels, Fitness & Wellness Trends, Product Innovation & Marketing, Busy Lifestyles & Demand for Convenience majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...