Enterprise Collaboration Market Overview

The global enterprise collaboration market was valued at USD 48.6 billion in 2022, and is projected to reach USD 195.1 billion by 2032, growing at a CAGR of 15.2% from 2023 to 2032.

The key factor that drives the growth of the enterprise collaboration market include growing demand for real-time and remote collaboration tools and increase in adoption of cloud-based services to accelerate collaboration. Enterprise collaboration tools help organizations by providing seamless communication between employees. This improves the operational efficiency and productivity of the employees, thereby helping organizations to meet their business goals. Enterprise collaboration tools provide data synchronization and collaboration solutions across organizations and include features such as checking official emails, calendars, and contacts.

In addition, growth in need for the project and task management solution is considered an important factor to boost the market. However, lack of network connectivity and infrastructure issue is expected to hamper market growth. Poor network connectivity hinders remote work by causing disruptions in video conferences, slow file transfers, and lag in real-time collaboration. Inadequate infrastructure limits the effectiveness of remote collaboration tools.

Contrarily, increase in adoption of AI and ML to improve collaboration capabilities contribute significantly to the growth of the market. Advanced technologies such as AI and ML are being implemented into enterprise collaboration tools to enhance collaborative capabilities. AI-based enterprise collaboration tools are able to track the activities of employees and the contents being shared. This is used to deliver anticipated business insights to the employees and help get the work done quicker. Therefore, these factors are expected to drive the enterprise collaboration market growth in upcoming years.

Introduction

Enterprise collaboration is the set of solutions which help employees within the business to work together and share information on projects from a variety of geographical locations. It includes sharing of information, resources, and expertise to enhance productivity and drive innovation between enterprises. Enterprise collaboration is crucial for organizations, as it promotes communication, teamwork, and knowledge sharing, which leads to improved decision-making.

The report focuses on growth prospects, restraints, and trends of the enterprise collaboration market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the enterprise collaboration market.

Segment Review

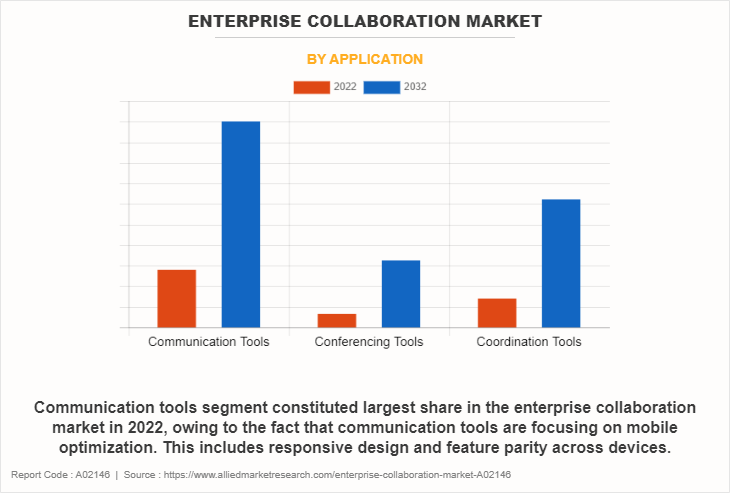

The enterprise collaboration market is segmented on the basis of type, deployment mode, application, industry vertical, and region. On the basis of type, the market is categorized into solution and service. As per deployment mode, the market is divided into on-premise and cloud. Depending on application, the market is segregated into communication tools, conferencing tools, and coordination tools. On the basis of industry vertical, it is divided into IT and telecom, manufacturing, BFSI, retail and consumer goods, education, transportation and logistics, healthcare, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, the communication tools segment attained the highest enterprise collaboration market size in 2022. This is attributed to the fact that communication tools are integrating more seamlessly with broader collaboration ecosystems, allowing users to access files, tasks, and information from within their communication platform.

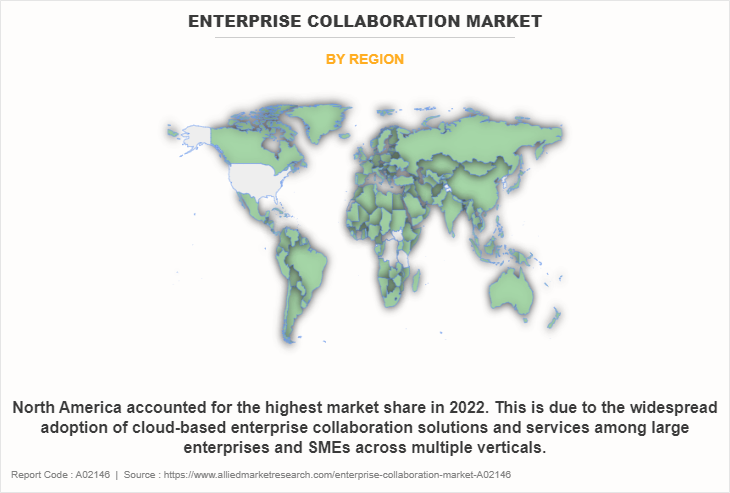

On the basis of region, North America held the highest market share in 2022. This is because North American businesses are actively pursuing digital transformation initiatives to remain competitive and meet the evolving needs of customers.

Key Market Players

Enterprise collaboration key players such as Adobe Inc., Cloud Software Group, Inc., Microsoft Corporation, Huawei Technologies Co. Ltd., SAP SE, IBM Corporation, Cisco Systems, Inc., Salesforce, Inc., Meta, and Google LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the enterprise collaboration market.

Top Impacting Factors

Growth in Demand for Real-time and Remote Collaboration Tools

Enterprise collaboration tools help organizations by providing seamless communication between employees. This improves the operational efficiency and productivity of the employees, thereby helping organizations to meet their business goals. Enterprise collaboration tools provide data synchronization and collaboration solutions across organizations and include features such as checking official emails, calendars, and contacts. Furthermore, video conferencing helps to provide employees with more engaging communication and share ideas.

In addition, real-time collaboration tools enable instant decision-making, problem-solving, and feedback exchange. This leads to increased productivity as teams work together without the delays associated with traditional communication methods. The ability to access information and communicate in real time improves efficiency. Moreover, the COVID-19 pandemic highlighted the importance of real-time collaboration tools for business continuity. These tools are now considered critical for maintaining operations during crises, ensuring that teams can continue to work efficiently even when they cannot be physically present in the office. All these trends drive the growth of the enterprise collaboration industry.

Adoption of Cloud-based Services to Accelerate Collaboration

Cloud-based collaboration tools easily scale to meet the changing needs of businesses. This scalability is crucial as organizations grow or experience fluctuations in demand. As more users or teams need access, cloud services can quickly accommodate them, eliminating the need for extensive on-premises infrastructure expansion. Moreover, cloud-based collaboration tools often follow a subscription or pay-as-you-go model, which reduces upfront capital expenditures. This makes them an attractive option for organizations looking to optimize costs and allocate budgets more efficiently. Further, cloud collaboration platforms enable multiple users to work on documents or projects simultaneously, fostering collaborative innovation. This feature is invaluable for creative teams and those working on complex projects.

For instance, in August 2023, CloudMile, a leading AI technology company, had announced a strategic partnership with MongoDB, providing CloudMile’s corporate clients with MongoDB Atlas. Through this partnership, CloudMile's customers will have access to MongoDB Atlas, a cloud-native developer data platform on Google Cloud, to provide developers with the flexibility and scalability required to quickly and easily build enterprise-grade applications.

Growth in Need for the Project and Task Management Solution

The growth in the need for project and task management solutions is a prominent driver for the expansion of the enterprise collaboration market. Modern work environment involves complex projects that require collaboration among multiple teams, departments, and external partners. Project and task management solutions provide a centralized platform for organizing and overseeing these complex workflows.

In addition, these solutions enhance transparency within an organization by providing a clear view of project progress, task ownership, and responsibilities. This accountability reduces confusion and minimizes the risk of missed deadlines or miscommunication. Furthermore, project and task management tools offer features for tracking accountability and ensuring compliance with project-related requirements and regulations. This is particularly crucial in industries with strict regulatory standards.

Network Connectivity and Infrastructure Issue

The enterprise collaboration market has witnessed substantial growth, due to the surge in remote work. However, poor network connectivity hinders remote work by causing disruptions in video conferences, slow file transfers, and lag in real-time collaboration. Inadequate infrastructure limits the effectiveness of remote collaboration tools. Moreover, real-time messaging and communication platforms, which are central to collaboration, require low latency and a stable network connection. Network issues can introduce delays in messaging and hamper the flow of real-time communication. In addition, in regions with limited or unreliable network infrastructure, the adoption of collaboration tools may be hindered, as businesses and employees may face challenges accessing and using these solutions.

Increase in Adoption of AI and ML to Improve Collaboration Capabilities

Advanced technologies such as AI and ML are being implemented into enterprise collaboration tools to enhance collaborative capabilities. AI-based enterprise collaboration tools are able to track the activities of employees and the contents being shared. This is used to deliver anticipated business insights to the employees and help get the work done quicker. Moreover, organizations can also leverage video analytics to gain insights regarding various business applications, including consumer behavior, employee retention, office utilization, and performance optimization, by correlating visual analytics with production checkpoints.

In addition, AI and ML help to suggest relevant content and resources during collaboration, aiding decision-making and problem-solving. This leads to more informed discussions and faster progress on tasks. Therefore, these factors are expected to drive the growth of the enterprise collaboration industry in upcoming years.

The Rise in the Use of Networking Websites

Networking websites provide opportunities for professionals to connect with a wide range of industry peers, potential clients, partners, and experts. By integrating these platforms into enterprise collaboration, organizations can expand their professional networks and access a broader talent pool. In addition, networking websites are hubs for sharing insights, best practices, and industry-specific knowledge. Leveraging these platforms within enterprise collaboration fosters information sharing and knowledge transfer among employees, leading to more informed decisions and innovative solutions.

Furthermore, these websites create opportunities for businesses to explore partnerships, collaborations, and new client relationships. By integrating these platforms into their collaboration strategies, organizations can identify and connect with potential partners and clients. Therefore, the rise in the use of networking websites provides substantial opportunities for the growth of the enterprise collaboration market.

Regional Insights

North America enterprise collaboration market remains a leader in the global enterprise collaboration market, fueled by the presence of major technology companies such as Microsoft, Slack, and Zoom. The region's advanced technological infrastructure and high levels of digital literacy enable businesses to adopt innovative collaboration solutions effectively. Moreover, the COVID-19 pandemic has accelerated the transition to remote work, prompting companies to invest heavily in collaboration tools to maintain operational efficiency and team cohesion. Industries such as finance, healthcare, and technology are particularly focused on integrating collaboration solutions to enhance workflow and communication.

Europe enterprise collaboration market is expanding rapidly, particularly in countries like the UK, Germany, and France. Organizations are increasingly recognizing the importance of collaboration tools to support remote work and improve employee engagement. The European market is characterized by a strong emphasis on data privacy and security, leading companies to adopt collaboration solutions that comply with strict regulations such as the General Data Protection Regulation (GDPR). Furthermore, the rise of remote work has encouraged businesses to explore various collaboration platforms, enhancing their productivity and innovation capabilities.

The APAC enterprise collaboration market region is witnessing the fastest growth in the market, driven by the rapid digital transformation of businesses and increasing smartphone penetration. Countries like China, India, and Japan are at the forefront of this growth, with enterprises investing in collaboration tools to support their expanding workforces. The growth of remote work and the gig economy in these countries is further boosting demand for collaboration solutions. Additionally, local players are emerging alongside global providers, offering tailored solutions that cater to regional needs.

In Latin America enterprise collaboration industry is growing, particularly in Brazil and Mexico. The adoption of collaboration tools is being driven by the need for effective communication in increasingly distributed teams. However, challenges such as internet connectivity and technological infrastructure may slow the pace of growth in certain areas. Nevertheless, businesses are recognizing the value of collaboration solutions to enhance productivity and teamwork, leading to increased investment in these tools.

In the Middle East & Africa enterprise collaboration industry is evolving as organizations recognize the need for efficient communication and collaboration to drive business growth. Countries such as the UAE and South Africa are seeing increased investments in collaboration solutions, driven by a young, tech-savvy workforce and a growing emphasis on digital transformation. The region's focus on enhancing workplace productivity and efficiency is propelling the adoption of various collaboration platforms.

Key Industry Developments

Partnerships and Acquisitions: Major players in the enterprise collaboration market are increasingly forming strategic partnerships and acquiring smaller firms to expand their service offerings and market reach. For instance, in September 2023, Microsoft announced its acquisition of a leading collaboration tool provider to enhance its Teams platform, further integrating communication and project management capabilities.

Innovations in AI and Machine Learning: Companies are leveraging artificial intelligence (AI) and machine learning to enhance collaboration tools. In October 2023, Zoom introduced AI-powered features that enable users to schedule meetings, summarize discussions, and provide actionable insights, streamlining workflow and improving productivity.

Emphasis on Security and Compliance: As organizations become more aware of data privacy and security concerns, enterprise collaboration tools are evolving to offer robust security features. In November 2023, Slack announced new compliance tools to help organizations meet regulatory requirements and protect sensitive information shared on their platform.

Rise of Hybrid Work Solutions: With hybrid work models becoming the norm, many collaboration tool providers are developing features that cater specifically to remote and in-office employees. In December 2023, Google Workspace launched a new set of features designed to improve collaboration for hybrid teams, allowing users to easily transition between virtual and physical workspaces.

Market Landscape and Trends

The expansion of organizations globally, increased productivity, and growth in the trend of bring your own device (BYOD) and the IoT are some significant factors expected to boost the global enterprise collaboration market. With the rise in remote work and data breaches, collaboration tools are focusing on robust security features and compliance capabilities. This is especially important in industries with strict regulations like healthcare and finance. Moreover, collaboration tools are emphasizing integration with third-party apps and services. Open APIs and integration capabilities allow organizations to customize their collaboration ecosystem to meet specific needs.

In addition, the COVID-19 pandemic accelerated the adoption of remote work, making collaboration tools indispensable. The shift to hybrid work models, combining in-office and remote work, has further increased the demand for collaborative solutions that facilitate seamless communication and teamwork. Furthermore, VR and AR are being explored for collaboration, particularly in industries like design, engineering, and education. These technologies offer immersive experiences and enhance remote collaboration, which is expected to fuel the market growth during the forecast period.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the enterprise collaboration market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of enterprise collaboration market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the enterprise collaboration market segmentation assists in determining the prevailing enterprise collaboration market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global enterprise collaboration market trends, key players, market segments, application areas, and market growth strategies.

Enterprise Collaboration Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 195.1 billion |

| Growth Rate | CAGR of 15.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 520 |

| By Type |

|

| By Deployment Mode |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Salesforce, Inc., Cloud Software Group, Inc., Huawei Technologies Co. Ltd., Adobe Inc., IBM Corporation, Meta, SAP SE, Microsoft Corporation, Cisco Systems, Inc., Google LLC |

Analyst Review

Enterprise collaboration enables employees to interact and communicate within and outside their work environment by providing access to technology that can streamline processes and encourage collaboration. Organizations are anticipated to adopt market-leading solutions as the workforce becomes more distributed, with many workers working remotely and others from conventional offices. With enterprise collaboration tools, staff members can easily keep track of and manage projects, encourage individual responsibility, and build stronger bonds of trust, all of which contribute to greater transparency within the workplace. The platform provides a centralized location for all communication and teamwork requirements within the organization. It boosts efficiency by eliminating redundant applications with overlapping features.

The CXOs further added that market players have adopted strategies such as product launch for enhancing their services in the market and improving customer satisfaction. For instance, in June 2022, Fujitsu and Salesforce Japan Co., Ltd. announced the partnership to create new digital solutions for the healthcare sector in the Japanese market. The two companies were to support this project by utilizing Salesforce Japan's track record and skills as an industry leader in customer relationship management and Fujitsu's expertise in the trustworthy handling of medical and pharmaceutical data and computer technology. Such strategies are anticipated to boost the growth of the enterprise collaboration market.

Moreover, some of the key players profiled in the report are Adobe Inc, Cloud Software Group, Inc., Microsoft Corporation, Huawei Technologies Co. Ltd., SAP SE, IBM Corporation, Cisco Systems, Inc., Salesforce, Inc., Meta, and Google LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global enterprise collaboration market was valued at USD 48.6 billion in 2022, and is projected to reach USD 195.1 billion by 2032.

The global enterprise collaboration market is projected to grow at a compound annual growth rate of 15.2% from 2021-2030 to reach USD 195.1 billion by 2032

The key players profiled in the report include enterprise collaboration market analysis includes top companies operating in the market such as Adobe Inc., Cloud Software Group, Inc., Microsoft Corporation, Huawei Technologies Co. Ltd., SAP SE, IBM Corporation, Cisco Systems, Inc., Salesforce, Inc., Meta, and Google LLC.

North America held the highest market share in 2022

The key factor that drives the growth of the enterprise collaboration market include growing demand for real-time and remote collaboration tools and increase in adoption of cloud-based services to accelerate collaboration.

Loading Table Of Content...

Loading Research Methodology...