Epigenetics Market Size & Trends, 2030

Epigenetics is the study of changes in gene expression or cellular phenotype that do not involve alterations to the underlying DNA sequence. These changes can occur due to environmental factors, lifestyle, or chemical exposure and are mediated by mechanisms such as DNA methylation, histone modification, and non-coding RNA molecules. Epigenetic modifications can be heritable and reversible, influencing how genes are turned on or off without changing the genetic code itself. This field helps explain how organisms adapt and how diseases like cancer develop.

Market Value Projections and Insights

- The global epigenetics market size was valued at $1.0 billion in 2020, and is projected to reach $4.1 billion by 2030, growing at a CAGR of 14.8% from 2021 to 2030.

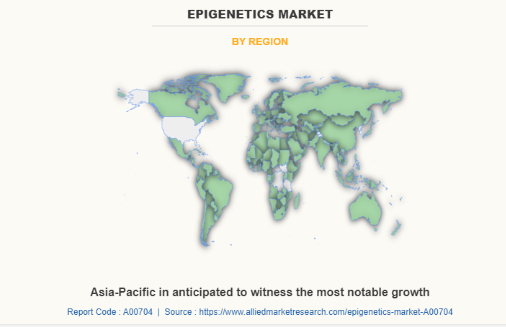

- The Asia-Pacific is expected to register the highest CAGR during the forecast period as increasing research activities and investments in biotechnology.

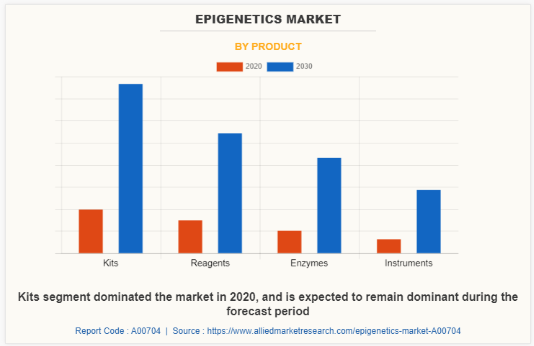

- The kits segment holds the largest epigenetics market share.

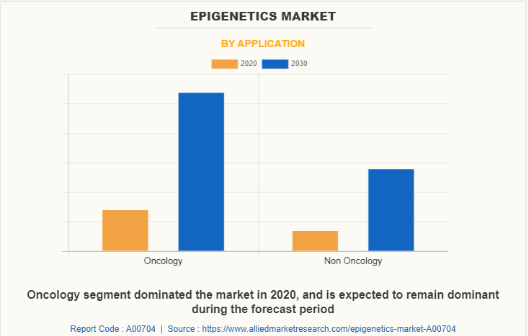

- Oncology segment dominated the epigenetics market share in 2020.

Personalized medicine is becoming one of the trends gaining much interest from patients and healthcare professionals with an epigenetic approach helping in selecting appropriate therapies for individuals. In addition, introduction of new painless methods of diagnosis including investigating liquid biopsies with the help of epigenetic markers.

The rise in the number of patients diagnosed with cancer and other chronic diseases involving epigenetic alterations in their development and progression is one such market motivator. For instance, epigenetic modifications including DNA methylation and histone acetylation, which are active in silencing or activating certain genes especially in cancer cells, are winners in the race of development of novel therapeutics techniques, namely, epigenetic therapies. A lot of money is being spent by pharmaceutical companies on epigenetic drug design and development, and it is already possible to treat cancer with hormones which have been developed on the basis of epigenetics, such as HDAC or DNMT inhibitors.

However, the promises offered by the epigenetics market are covered with several impediments particularly concerning the understanding of the complexities of epigenetic mechanisms and how they operate in various diseases and between individuals. There are also such hurdles as high R&D costs, and low adherence to long-term research of biological side effects of epigenetic modifications. Furthermore, increased use of epigenetics for non-cancer applications such as neurology and autoimmune diseases offer significant growth potential.

Industry Highlights

- Increasing focus on personalized medicine is driving the adoption of epigenetic therapies, particularly in cancer.

- Government and private sector spending on epigenetics research is surging, aiming to uncover new therapeutic solutions for chronic diseases, including neurodegenerative disorders and autoimmune conditions.

- The development of next-generation sequencing (NGS) and other advanced technologies has revolutionized epigenetic research, making it easier to understand gene expression and regulation mechanisms.

- A growing number of clinical trials for epigenetic therapies, especially in oncology, is further boosting market demand, highlighting the role of histone modification and DNA methylation in drug development.

The epigenetics market is advancing rapidly due to increased research funding, technological innovations, and growing awareness of epigenetic mechanisms in disease and therapy. Key highlights include a surge in investments in both academic and commercial research, the development of advanced tools and technologies for epigenetic analysis, and a growing focus on personalized medicine and targeted therapies. Additionally, the epigenetics market is seeing increased applications in oncology, neurology, and genetic disorders, with pharmaceutical companies exploring epigenetic drugs and therapies. The landscape is competitive and evolving, with significant potential for growth as understanding of epigenetics deepens and new therapeutic approaches are developed.

Key Areas Covered in the Report

- The epigenetics market is highly competitive, with both established pharmaceutical companies and startups vying for market share. Intense competition in drug development, pricing strategies, and innovation remains a key challenge, especially in oncology and chronic disease applications.

- Rising demand for tailored therapies based on individual genetic profiles, driving the adoption of epigenetic solutions.

- High costs and time-consuming processes in research and clinical trials create bottlenecks in the value chain, slowing the commercialization of epigenetic therapies.

- Companies are focusing on integrating technologies like next-generation sequencing (NGS) to enhance research capabilities.

The epigenetics market is witnessing rapid growth due to increasing demand for personalized medicine, particularly in cancer treatment. However, competition remains fierce, with companies racing to develop innovative therapies targeting DNA methylation and histone modification. Consumer preferences are shifting toward cost-effective and accessible solutions, though the high cost of R&D and lengthy clinical trials pose significant value chain challenges. Advancements in next-generation sequencing (NGS) and strategic partnerships between biotech firms and pharmaceutical companies are helping to overcome these barriers, while expanding applications in areas like neurodegenerative diseases and metabolic disorders further fuel market expansion.

Topics discussed in the report

- DNA Methylation

- Next-Generation Sequencing (NGS)

- Autoimmune Diseases

- Epigenetics as collectibles

- Precision Medicine

- Clinical Trials in Epigenetics

- Regulatory Challenges in Epigenetics

Segment Overview

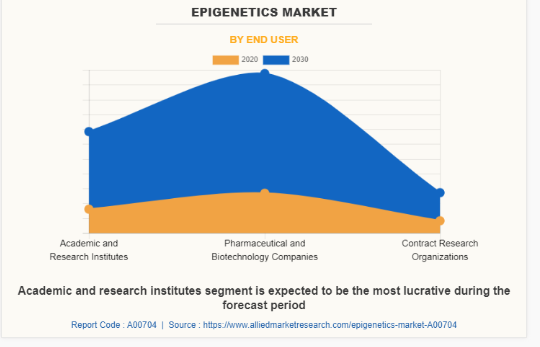

The epigenetics market is divided by product, application, end user, and region. By product the market is classified into reagents, enzymes, instruments, and kits. By application, the market is divided into oncology and non-oncology. According to the end user, the market is divided into academic and research institutes, pharmaceutical and biotechnology companies, contract research organizations, and contract research organizations. By region, the market is divided into North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Middle East and Africa, Latin America).

Comparative Matrix of Key Segments

Parameters | Reagents | Enzymes | Instruments | Kits |

Market Share | Significant portion of consumable products in research | Essential but specialized; smaller market share | High-cost, high-precision equipment; moderate share | Growing segment with increasing demand for efficiency |

End Users | Academic and research institutions, pharmaceutical companies | Biotech companies, academic research labs | Research institutions, diagnostic labs, biotech firms | Research labs, clinical labs, pharmaceutical companies |

Challenges | High variability, needs standardization | Costly production, complex storage | High initial investment, maintenance costs | Limited flexibility, may not cater to all research needs |

Key Players | Thermo Fisher, Merck, Abcam | New England Biolabs, Thermo Fisher | Illumina, Bio-Rad, Agilent Technologies | QIAGEN, Zymo Research, Sigma-Aldrich |

Regional Dynamics and Competition

The most significant trend in the epigenetics market is heated regional competition driven by the different levels of research spending, the economic, legal and healthcare systems. In North America, and primarily in the U.S., the market is fueled by the considerable amounts of money allocated for research and the presence of advanced biotechnology infrastructure. Europe is also attractive because of its active academic and industrial research base, which however possesses challenging regulatory obstacles. Asia-Pacific is growing fast supported by the investment in research and the shift towards population medicine. Expansion of the healthcare activities in the region together with the conducive policies enacted by the governments are also making the region overtake others in this technology. Countries in Latin America and those in the Middle East also present some opportunities although at a more sluggish pace than the former regions due to opportune investment levels coupled with regulatory issues. It can be stated that even if now north America and Europe are on the top, the investment and rapid growth trends of Asia-Pacific indicate there would be a more diverse and global market in the near future.

Some of the major players analyzed in this report are PerkinElmer, Inc., Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Illumina Inc., Active Motif, Inc., Hologic Inc., Abcam Plc., Merck Millipore, QIAGEN N.V., Zymo Research.

Epigenetics Market News Release

- In 2023, the TRANSCAN-3 program launched its third Joint Transnational Call for research proposals focused on "Translational research on cancer epigenetics." This initiative aims to enhance the understanding of epigenetic changes in cancer and develop clinical applications for early detection and treatment. The call encourages interdisciplinary collaborations among researchers and clinicians to translate scientific findings into practical healthcare solutions.

- According to the Beiersdorf annual report 2021, Beiersdorf is pioneering research into epigenetic changes related to skin aging. They have analyzed over 1,000 skin samples and identified more than 850,000 methylation sites, contributing to the development of an "age clock" algorithm aimed at rejuvenating skin through targeted active ingredients.

- The increasing number of cancer cases globally is a major factor propelling the market. In 2023, World Health Organization (WHO), there were an estimated 20 million new cancer cases. This surge necessitates the development of advanced diagnostic tools and treatments, which epigenetics research aims to address.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the epigenetics market analysis from 2022 to 2032 to identify the prevailing epigenetics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the epigenetics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global epigenetics industry growth.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global epigenetics market trends, key players, market segments, application areas, and market growth strategies.

Epigenetics Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Hologic Inc., Active Motif, Inc., Merck Millipore, Abcam Plc., PerkinElmer, Inc., Zymo Research, QIAGEN N.V., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Illumina Inc. |

Analyst Review

This section provides opinions of top-level CXOs in the epigenetics industry. According to CXOs, epigenetics has enhanced diverse fields of life sciences by research, innovation, and development. Oncology-and non-oncology-related investigation areas, such as developmental biology & drug discovery, are anticipated to benefit through epigenetic interventions.

CXOs further stated that the epigenetics market has gained momentum, owing to surge in number of genome mapping projects across the globe, significant technological advancements in epigenetics, and surge in prevalence of cancer and other chronic diseases. In addition, rise in awareness regarding epigenetics and its advantages supplement the market growth. Emerging economies in Asia-Pacific and LAMEA are expected to present lucrative growth opportunities to key players in the industry.

According to perspectives of CXOs of leading companies in the market, demand for DNA sequencing has significantly increased, owing to increase in research, innovation, and development sectors. In addition, owing to increase in cancer prevalence globally, significant technological advancements in epigenetics research and surge in collaborations & partnerships among academic & government research institutes and pharmaceutical & biotechnology companies globally majorly influence the market growth.

Utilization of epigenetics products is higher in pharmaceutical & biotechnology companies and in academic & government research institutes, owing to epigenetic studies, such as acetylation, histone modification, DNA methylation, and other studies that facilitate in their research. Employment of technologically advanced epigenetics products is highest in North America, owing to increase in adoption of epigenetics products, followed by Europe and Asia-Pacific.

The total market value of epigenetics market is $1,018.1 million in 2020.

Oncology is the leading application of epiegentics market.

Increase in cases of cases, surge in other chronic diseases and various technological advancements in epigenetics development is anticipated to drive the market in the forecast period.

North America is projected to account for a major share of the global epigenetics market during the forecast period. U.S. dominated the North America epigenetics market owing to presence of key players and rise in R & D activities for epigenetic procedures across the country.

Top companies such as Abcam Plc., Active Motif, Inc., Agilent Technologies, Inc., Hologic Inc. (Diagenode), Illumina Inc., Merck KGaA (Merck Millipore), PerkinElmer, Inc., QIAGEN N.V., Thermo Fisher Scientific Inc., and Zymo Research held a high market position in 2020.

Loading Table Of Content...