Ergonomic Chair Market Summary, 2031

The global ergonomic chair market was valued at $8.5 billion in 2021, and is projected to reach $16.4 billion by 2031, growing at a CAGR of 6.6% from 2022 to 2031. The ergonomic chair market refers to the market for chair specifically designed to promote correct posture and reduce stress on the body. These chairs are commonly used in office environments but are becoming increasingly popular in other environments such as home offices and schools.

The ergonomic chair industry, which encompasses a wide range of products from basic task chairs to high-end executive chairs, is driven by factors such as increasing awareness of the importance of ergonomics, the shift to working from home, and advances in technology and materials.

In recent years, the use of ergonomic products such as chairs, desks and keyboards has increased in various settings. The use of ergonomic products in offices and workplaces is increasing as companies recognize the importance of ergonomic seating and equipment to employee comfort and productivity. Many companies are now investing in ergonomic chairs, desks, and keyboard trays to prevent musculoskeletal disorders and improve employee health.

Ergonomic products are also becoming popular in healthcare environments such as hospitals and clinics. This is due to the realization that ergonomic seating and equipment can prevent healthcare worker fatigue and injury and improve patient care.

Schools and colleges are also beginning to introduce ergonomic products in their classrooms, libraries, and computer labs. This is due to the recognition that ergonomic seating can improve student comfort and learning. The trend of working from home has increased the demand for ergonomic products for the home office. People who work from home invest in ergonomic chairs and desks to avoid the discomfort and fatigue of sitting for long periods of time.

Ergonomic products like gaming chairs, desks, and keyboard trays are becoming more and more popular among gamers. These products are designed to provide comfort and support for long gaming sessions. Overall, the use of ergonomic products in a variety of settings is increasing as people realize the benefits that ergonomic seating and equipment bring to their comfort, productivity, and well-being.

Moreover, increasing awareness about the importance of ergonomics in the workplace is one of the key drivers of the ergonomic chair industry. Ergonomics is the study of how people interact with their environment, and it is becoming increasingly clear that ergonomic design can have a significant impact on employee health and productivity.

By reducing stress on the body and promoting good posture, ergonomic chairs can help to prevent musculoskeletal disorders (MSDs) such as back pain and repetitive strain injuries. This is particularly important as more people are spending long hours sitting in front of a computer, which can exacerbate existing health problems and lead to new ones.

Another factor boosting demand in the market is the shift to telecommuting. As more companies adopt remote work policies, employees are increasingly working from home and setting up home offices, which provide comfortable, supportive homes such as ergonomic chairs. His office furniture is in high demand.

In addition to these drivers, the ergonomic chair market size is also driven by advances in technology and materials. Today's ergonomic chairs are often made from quality materials such as mesh and breathable fabrics designed to keep the occupant cool and comfortable. It also has a wide range of features such as adjustable lumbar support, adjustable armrests and a reclining mechanism that can be adjusted to suit the user's specific needs.

Despite the growth of the ergonomic chair market share, there are also some challenges such as the high cost of ergonomic chairs which may be a barrier for some businesses and individuals. Additionally, the market for ergonomic chairs is not standardized, which can make it difficult for consumers to compare different products and make an informed decision.

As ergonomic design becomes more mainstream, there is a growing demand for innovative and advanced ergonomic chairs that offer better support and comfort. Companies that invest in research and development to create new and improved ergonomic chairs can differentiate themselves from their competitors and tap into this growing market.

Additionally, there is a niche market for ergonomic chairs developed for specific industries and user groups, such as healthcare and gaming. Companies that specialize in these niches can differentiate themselves from their competitors and capitalize on these opportunities.

The market is also growing due to increased awareness of the importance of ergonomics in the workplace, the shift to remote work, and advances in technology and materials. The market for ergonomic chairs is expected to continue to grow as more companies prioritize employee well-being and invest in ergonomic office furniture. Despite the challenges, the market is expected to continue to perform well during the forecast period.

The market for ergonomic chairs has grown in recent years due to growing awareness of the importance of ergonomics in the workplace and the potential health benefits of using ergonomic chairs. The trend is expected to continue as more companies prioritize employee health and invest in ergonomic office furniture. Additionally, the shift to remote work and the need for comfortable home office furniture are also likely to contribute to the continued growth of the ergonomic chair market demand.

In addition, the OSHA Ergonomics Program Management Guidelines for Meat Processing Plants provides employers with information on how to identify and avoid ergonomic hazards in the meat processing industry. NIOSH also has a page on Ergonomics and Musculoskeletal Disorders (MSD) that provides information and resources for preventing injury and disability in the ergonomic workplace, including information on office ergonomics and computer workstations.

The Occupational Safety and Health Administration (OSHA) recommends using an ergonomic chair to prevent musculoskeletal disorders (MSD) from prolonged sitting. They suggest that an ergonomic chair should be customizable to the individual user and provide adequate support for the back, arms, and legs. The American Physical Therapy Association (APTA) also recommends supports the use of ergonomic chairs. They recommend that the chair should be adjustable to fit the individual user, provide lumbar support and allow for proper posture.

The University of California, San Diego conducted a study on the effects of ergonomic interventions, such as the use of ergonomic chairs, on the incidence of low back pain. The study found that ergonomic interventions, including the use of ergonomic chairs, were effective in reducing the incidence of low back pain among office workers. Another study by the Center for Health, Work & Environment at the University of Colorado found that the use of ergonomic chairs resulted in a significant reduction in reported pain and discomfort among office workers.

Many companies that manufacture ergonomic chairs are making new efforts to increase their market share. This includes developing innovative new products, improving manufacturing processes to reduce costs, and investing in marketing and advertising campaigns to increase brand awareness. Additionally, many companies are adopting sustainability and environmentally friendly manufacturing practices to appeal to consumers who prioritize these values.

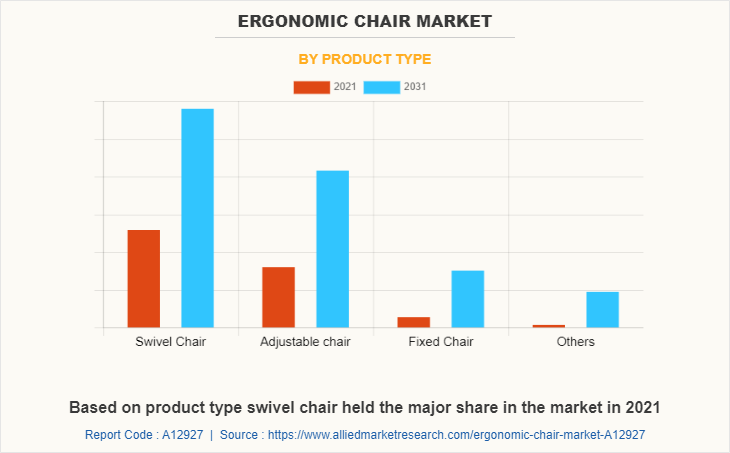

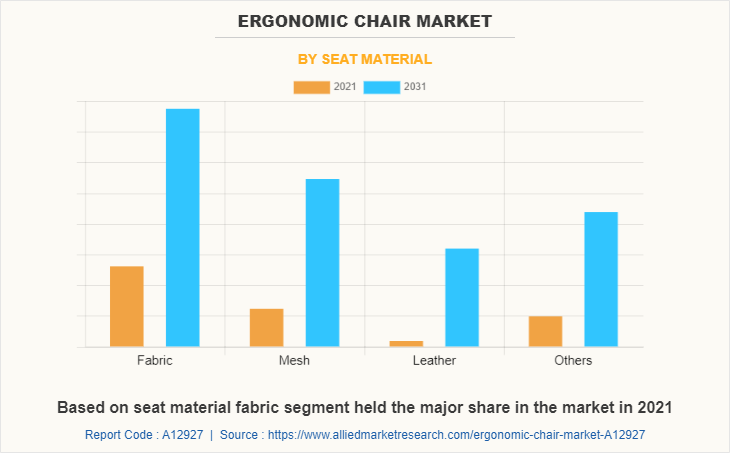

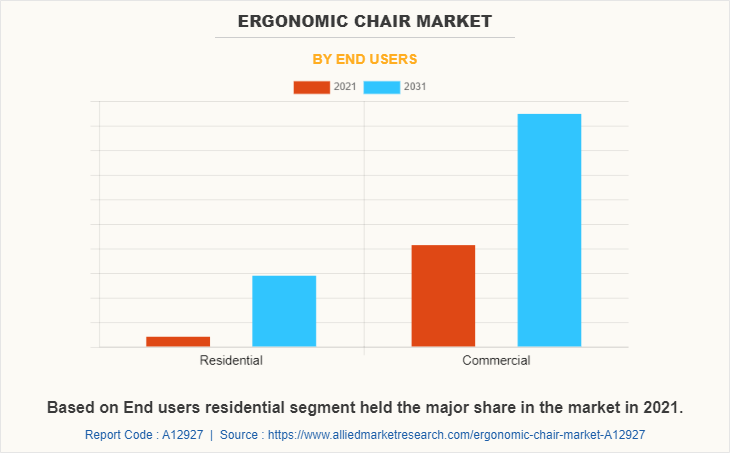

The global ergonomic chair market forecast based on product type, seat material, end users, distribution channel, and region. According to product type, the market is categorized into Swivel Chair, Adjustable chair, Fixed chair, and others. Depending on seat material, the ergonomic chair market is fragmented into the fabric, mesh, leather, and others. As end users, it is divided into residential and commercial.

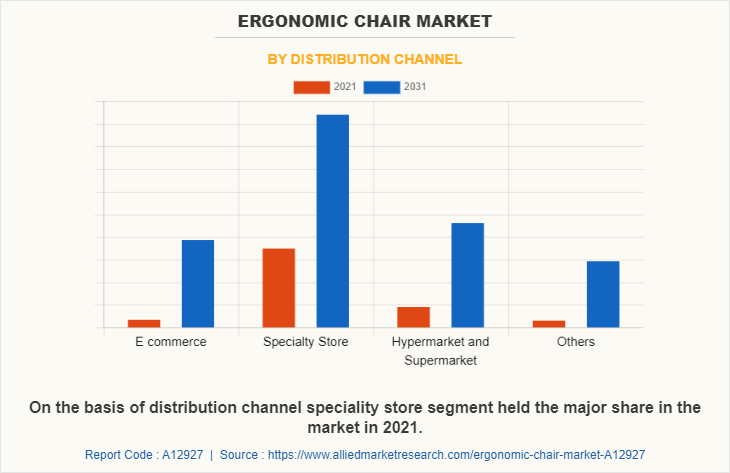

On the distribution channel market is segmented into E-commerce, specialty store, hypermarket and supermarket, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Russia, France, Spain, Italy, and the rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Chile, Argentina, Saudi Arabia, South Africa, and rest of LAMEA).

Based on product type, swivel chair held the major share in the market. Swivel chairs include adjustability, material, ergonomics, and durability. In terms of adjustability, chairs may have height adjustment, tilt, and recline functions, lumbar support, armrests, and headrests.

However, the adjustable chair segment is projected to manifest the highest CAGR from 2022 to 2031. The market trend for ergonomic adjustable chairs has been growing steadily in recent years, driven by increasing awareness of the importance of ergonomics in the workplace, and the rise of remote work and the gig economy.

On the basis of seat material, the fabric segment held the major share in the ergonomic chair market and is expected to dominate during the forecast period. Fabric material ergonomic chairs typically include design, material, adjustability, and durability. In terms of design, fabric material ergonomic chairs may have a traditional, contemporary, or modern style. However, the mesh segment is projected to manifest the highest CAGR from 2022 to 2031.

Based on end users, commercial segment held the major share in the market. The market trend for ergonomic commercial chairs includes a focus on adjustability, ergonomics, sustainability, and multi-functionality, and there is an increasing demand for chairs that can be easily adjusted to fit the user's specific needs and promote proper posture. However, the residential segment is projected to manifest the highest CAGR from 2022 to 2031. The durability of residential ergonomic chairs is influenced by the choice of material and the quality of construction. High-quality materials and construction methods can ensure that the chair can withstand frequent use and last for a longer period.

On the basis of distribution channel, specialty store segment held the major share in the market. The specialty store market for ergonomic chairs has grown in recent years due to the growing awareness of the health and comfort benefits of ergonomic products.

Demand for ergonomic office furniture, ergonomic computer accessories, and ergonomic home products is increasing as more and more people spend more time in front of their computers at home. However, e-commerce segment is witnessing the highest CAGR from 2022 to 2031.

North America held the major share in the ergonomic chair market. The use of innovative technologies such as smart sensors, adjustable lumbar support, and adjustable armrests has increased the popularity of ergonomic chairs.

However, the Asia-Pacific region is projected to manifest the highest CAGR from 2022 to 2031. In terms of market growth, the Asia-Pacific ergonomic chair market is expected to continue to grow rapidly in the coming years, driven by the increasing demand for ergonomic chairs in both residential and commercial settings, and the growing trend towards sustainable and eco-friendly products.

The major players operating in the global ergonomic chair are Steelcase Inc., Branch Office, Inc., MillerKnoll, Inc., Okamura Corporation, Bristol Technologies Sdn. Bhd., Huzhou Shenglong Furniture Co., Ltd., Haworth Inc., Featherlite, Nilkamal Limited, PSI Seating Ltd., Teknion Group, UE Furniture Co. Ltd, Kimball International, Inc., Eurotech Design Systems Pvt. Ltd, Jiangmen Shengshi Furniture Co., Ltd.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ergonomic chair market analysis from 2021 to 2031 to identify the prevailing ergonomic chair market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the ergonomic chair market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global ergonomic chair market trends, key players, market segments, application areas, and market growth strategies.

Ergonomic Chair Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 16.4 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Product Type |

|

| By Seat Material |

|

| By End Users |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Huzhou Shenglong Furniture Co., Ltd., Featherlite, Kimball International, Inc., UE Furniture Co. Ltd, Bristol Technologies Sdn. Bhd., Okamura Corporation, Nilkamal Limited, Eurotech Design Systems Pvt. Ltd, MillerKnoll, Inc., Steelcase Inc., Teknion Group, Jiangmen Shengshi Furniture Co., Ltd., PSI Seating Ltd., Haworth Inc., Branch Office, Inc. |

Analyst Review

A recent innovation in the ergonomic chair market is the use of dynamic seating. This type of chair uses technology such as air cushions, flexible materials, and adjustable supports to allow the chair to move and adapt to the user's movements throughout the day. This reduces pressure on specific areas of the body, improving posture and blood circulation. Another innovation is the use of intelligent sensors and tracking technology that can monitor the user's posture and provide feedback on how to adjust the chair for optimal comfort and support.

The rapid pace of urbanization, the increase in single and dual-living households, and the rise in the trend of a classy yet compact ergonomic chair for enhancing overall household aesthetics support the adoption of folding furniture. Additionally, minimal use of sustainable materials and online retailing of furniture also boosts the market demand among the various income groups. The trend of online shopping substantially influences the ergonomic chair market. Operating players in this market prefer to sell their products through e-commerce platforms for maximizing reach. Tie-ups between chair manufacturers are another trend gaining popularity in the industry and are acting as an emerging sales channel for the manufacturers.

The ergonomic chair market was valued at $8.5 billion in 2021, and is estimated to reach $16.4 billion by 2031, growing at a CAGR of 6.6% from 2022 to 2031.

The ergonomic chair market to grow at a CAGR of 6.6% from 2022 to 2031.

The major players operating in the global ergonomic chair are Steelcase Inc., Branch Office, Inc., MillerKnoll, Inc., Okamura Corporation, Bristol Technologies Sdn. Bhd., Huzhou Shenglong Furniture Co., Ltd., Haworth Inc., Featherlite, Nilkamal Limited, PSI Seating Ltd., Teknion Group, UE Furniture Co. Ltd, Kimball International, Inc., Eurotech Design Systems Pvt. Ltd, Jiangmen Shengshi Furniture Co., Ltd.

North America held the major share in the ergonomic chair market.

The market for Ergonomic Chair industry is expected to grow in the coming years as the number of telecommuters increases due to the ongoing COVID-19 pandemic.

Loading Table Of Content...

Loading Research Methodology...