Ethyl Acetate Market Research, 2031

The global ethyl acetate market was valued at $5.7 billion in 2021, and is projected to reach $10.3 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031. The ethyl acetate market is driven by its expanding applications in the pharmaceuticals and cosmetics industries, where it is used as a solvent in drug formulation and personal care products. Moreover, growing demand in the coatings and paints sector boosts market growth, as ethyl acetate serves as a key ingredient in the production of fast-drying paints and coatings, essential for automotive and construction applications.

Ethyl acetate is an organic compound with the chemical formula C₄H₈O₂. It is a colorless, sweet-smelling liquid commonly used as a solvent in various industrial and commercial applications, such as coatings, adhesives, and cosmetics. It is produced by the esterification of ethanol and acetic acid. Ethyl acetate evaporates quickly, making it ideal for applications requiring fast drying. It is also used in the decaffeination of coffee and tea, as well as in the production of synthetic fruit essences. Ethyl acetate is flammable and should be handled with care to avoid ignition.

Market Dynamics

One of the primary uses of ethyl acetate is in the pharmaceutical industry. Ethyl acetate is used as a solvent in drug manufacturing processes, particularly for the extraction of active pharmaceutical ingredients (APIs) from plants. India is a significant producer of generic drugs, and the demand for ethyl acetate as a solvent is expected to continue to grow as the pharmaceutical industry expands. In the paints and coatings industry, ethyl acetate is used as a solvent for nitrocellulose lacquers, acrylic lacquers, and other coating systems. The growth of the construction industry has led to an increase in demand for paints and coatings, which in turn has boosted the demand for ethyl acetate as a solvent.

The increasing demand in the coatings and paints industry significantly boosts the ethyl acetate market. As a vital solvent, ethyl acetate is essential for producing fast-drying paints and coatings used in various applications, including automotive and construction. In 2023, the U.S. exported $2.9 billion in paint and coatings products, achieving a trade surplus of $1.7 billion. Key export markets included Canada ($1.3 billion) and Mexico ($815 million), which together accounted for 70% of the total U.S. exports. China was the third-largest market at $117 million, followed by Japan and South Korea, with exports of $50 million and $48 million, respectively. This robust performance in the paint and coatings sector is expected to drive the demand for ethyl acetate, a crucial solvent used in the formulation and production of these products. As the industry expands internationally, the need for high-quality solvents such as ethyl acetate is expected to rise, thus supporting its market development.

The printing industry also uses ethyl acetate as a solvent for inks. ethyl acetate-based inks are fast-drying and produce high-quality prints, making them ideal for printing on a variety of surfaces, including paper, plastic, and metal. Ethyl acetate has numerous applications in various industries. One of its main uses is as a solvent in the manufacture of paints, coatings, and adhesives. It is an excellent solvent for cellulose acetate, nitrocellulose, and other resins commonly used in these industries. Ethyl acetate is also used as a solvent for cleaning and degreasing metal parts and electronic components.

Another major application of ethyl acetate is as a flavoring agent in the food industry. It is commonly used to add fruity notes to food and beverage products, such as fruit-flavored candies, ice cream, and soft drinks. Ethyl acetate is also used in the production of artificial flavors and fragrances. All these factors drive the demand of the global ethyl acetate market. In addition, growing demand for ethyl acetate in solvent application drives the demand of the global market.

Ethyl acetate is a commonly used solvent in various industrial applications due to its excellent solvent properties, low toxicity, and low boiling point. One of the main reasons for the growing demand for ethyl acetate as a solvent is its low toxicity. Compared to other solvents such as toluene and xylene, ethyl acetate is less toxic and has a lower vapor pressure, making it safer for workers to handle. This has led to an increasing preference for ethyl acetate as a solvent in industries that prioritize worker safety and environmental sustainability.

However, availability of substitute products such as methyl ethyl ketone (MEK) and acetone hampers the market growth. Methyl ethyl ketone (MEK) is a solvent that can be used as a substitute for ethyl acetate in some applications. It has a similar solvency power and can be used in some coatings, adhesives, and paints. It helps to dissolve the resins and improve their flow properties, resulting in a smooth and uniform coating. MEK is used as a solvent for various synthetic polymers in adhesives, including vinyl acetate, polyvinyl alcohol, and acrylics. It helps to dissolve the polymers and improve their flow properties, resulting in a strong and durable bond.

On the contrary, production of renewable ethyl acetate is anticipated to offer lucrative growth opportunities in the global market. Renewable ethyl acetate can be produced from renewable feedstocks instead of traditional fossil fuels. Ethyl acetate can be produced through the fermentation of renewable feedstocks, such as sugarcane, corn, or other agricultural waste. During fermentation, the feedstock is broken down by microorganisms, which produce ethanol. The ethanol is then converted to ethyl acetate through a process called esterification.

Renewable ethyl acetate can also be created by catalytically converting sources of renewable energy such as lignocellulosic biomass or waste vegetable oil. The raw material is broken down into its constituents and then reassembled into ethyl acetate using a catalyst in this process. Another method for producing renewable ethyl acetate is through electrochemical conversion. In this process, electricity is used to convert carbon dioxide into ethyl acetate. This method can use renewable energy sources, such as wind or solar power, to produce ethyl acetate.

Segment Overview

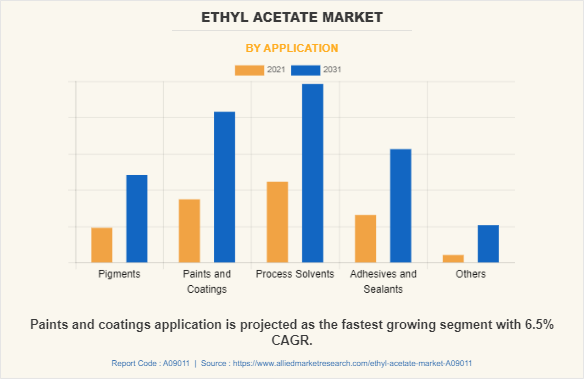

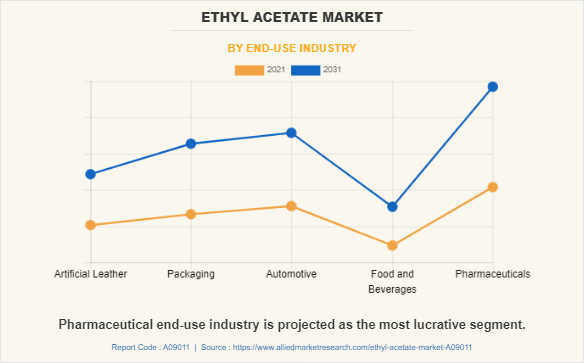

The ethyl acetate is segmented into application, end-use industry, and region. On the basis of application, the market is segmented into pigments, paints and coatings, process solvents, adhesives and sealants and others. On the basis of end-use industry, the market is divided into artificial leather, packaging, automotive, food and beverages, and pharmaceutical. Region-wise the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Ethyl Acetate Market By Application

On the basis of application, the process solvents segment dominated the ethyl acetate market in 2021. Ethyl acetate is becoming increasingly popular as a process solvent for adhesives used in various sectors, such as automotive, construction, and woodworking. It is considered safe for use in food applications as it is non-toxic and has a low odor & taste. The food processing business accounts for around $130 billion from the overall food and beverage industry, contributing 10% of agricultural GDP and 12% of manufacturing GDP. This is expected to boost the ethyl acetate market during the forecast period.

Ethyl Acetate Market By End-Use Industry

By end-use industry, the pharmaceuticals segment dominated the ethyl acetate market in terms of revenue in 2021. Ethyl acetate is a versatile solvent used in the pharmaceutical industry for the production of various medicines, such as antibiotics, analgesics, and anti-inflammatory drugs.

It is also used in the extraction of natural products from plant materials for use in pharmaceutical products, such as essential oils, alkaloids, and other active compounds from medicinal plants. Ethyl acetate is used as a purification solvent in the pharmaceutical industry to remove impurities and contaminants. It is also used as a coating material for tablets and capsules to improve their appearance, taste, and stability.

Ethyl Acetate Market By Region

By region, the Asia-Pacific dominated the ethyl acetate market in terms of revenue in 2021. Ethyl acetate is widely used in various industries in the Asia Pacific region, including food and beverage, pharmaceutical, and cosmetics. It is used as a solvent, reagent, and purification agent in chemical synthesis and chromatography.

It is also used as a reagent in chemical synthesis and as a purification agent in chromatography. Ethyl acetate is safe for use in food and pharmaceutical applications in the Asia Pacific region, and demand is expected to grow due to the growing demand for processed foods, pharmaceuticals, and cosmetics.

The major players operating in the ethyl acetate market include Celanese Corporation, Daicel Corporation, Eastman Chemical Company, INEOS, IOL Chemicals and Pharmaceuticals Limited, Jubilant Ingrevia Limited, Maharashtra Aldehydes and Chemicals Ltd., Sasol Limited, Sipchem and Solvay.

Growth in Indian Pharmaceutical Industry Expected to Propel Ethyl Acetate Market

According to the India Brand Equity Foundation, the Indian pharmaceutical industry is projected to grow significantly to reach $65 billion by 2024, $130 billion by 2030, and $450 billion by 2047. In FY23, it was valued at approximately $50 billion, with over $25 billion from exports. The industry's rapid expansion boosts the demand for solvents such as ethyl acetate, which plays a crucial role in drug formulation and manufacturing processes. As India strengthens its presence in the global pharmaceutical market, reaching an estimated 13% market share, the need for high-quality, affordable, and innovative pharmaceutical products is expected to drive the increased use of ethyl acetate, thus supporting the ethyl acetate market growth.

Historical Trends of Ethyl Acetate:

- Ethyl acetate is an organic compound that has been known since ancient times, as it occurs naturally in many fruits and vegetables, including bananas, apples, and grapes. The compound was first isolated by the French chemist Jean-Baptiste Dumas in 1839, by distilling a mixture of ethanol and acetic acid in the presence of sulfuric acid.

- The commercial production of ethyl acetate began in the early 20th century, with the first large-scale production plant built in the U.S. in 1905.

- During World War I, ethyl acetate was used as a solvent for smokeless gunpowder. In the 1920s and 1930s, the demand for ethyl acetate increased due to its use in the production of artificial silk and other textiles.

- In the 1950s and 1960s, ethyl acetate was used as a solvent for the production of vinyl resins, which were used in the manufacture of coatings, adhesives, and other products.

- In the 1970s and 1980s, ethyl acetate was used as a solvent for the production of polyurethane resins, which are used in the manufacture of foams, adhesives, and other products.

- In 2001 Ethyl acetate is identified as a volatile organic compound (VOC) that contributes to air pollution and is regulated by the U.S. Environmental Protection Agency (EPA).

- In 2017 A study published in the journal ACS Sustainable Chemistry & Engineering describes a new method for producing ethyl acetate from waste carbon dioxide and ethanol, which could reduce greenhouse gas emissions and provide a more sustainable source of the compound.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ethyl acetate market analysis from 2021 to 2031 to identify the prevailing ethyl acetate market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the ethyl acetate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ethyl acetate market trends, key players, market segments, application areas, and market growth strategies.

Ethyl Acetate Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 10.3 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 512 |

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | IOL CHEMICALS AND PHARMACEUTICALS LIMITED, Solvay, Celanese Corporation, Maharashtra Aldehydes and Chemicals Ltd., Daicel Corporation, Sipchem, INEOS, Eastman Chemical Company, Jubilant Ingrevia Limited, Sasol Limited |

Analyst Review

According to the opinions of various CXOs of leading companies, the ethyl acetate market is driven by the growing demand of ethyl acetate in a solvent application. Ethyl acetate is used as a solvent in the production of paints, particularly in water-based paints, due to its low toxicity and environmental sustainability. It is also used in various adhesives, such as pressure-sensitive, hot-melt, and solvent-based.

However, the availability of substitutes is expected to restrain industry expansion. Methyl ethyl ketone (MEK) is a substitute for ethyl acetate in some applications, helping to dissolve resins and improve flow properties, resulting in a smooth and uniform coating. Acetone is also used as a cleaning agent in various industries to remove contaminants and ensure clean surfaces and equipment.

The Asia-Pacific region is projected to register robust growth during the forecast period. Ethyl acetate is widely utilized in a variety of industries throughout the Asia Pacific area, including food and beverage, pharmaceutical, and cosmetics. In the Asia-Pacific region, ethyl acetate is utilized as a solvent in the manufacture of various pharmaceutical products such as tablets, capsules, and injectables. It is also employed as a reagent in chemical synthesis and as a chromatographic purification agent.

Production of renewable ethyl acetate and cost effectiveness of ethyl acetate are the upcoming trends of ethyl acetate market in the world.

Process solvent application is the leading application of ethyl acetate market followed by paints and coatings application.

Asia-Pacific is the largest regional market for ethyl acetate.

The global ethyl acetate market was valued at $5.7 billion in 2021, and is projected to reach $10.3 billion by 2031, registering a CAGR of 6.1% from 2022 to 2031

Celanese Corporation, Daicel Corporation, Eastman Chemical Company, INEOS, and IOL Chemicals and Pharmaceuticals Limited are the top companies to hold the market share in Ethyl Acetate

Loading Table Of Content...

Loading Research Methodology...