Europe Insecticides Market Outlook - 2026

The Europe insecticides market for waste management accounted for $14,739.3 million in 2018, and is anticipated to reach $23,368.3 million by 2026, registering a CAGR of 5.8% from 2019 to 2026. Waste management is defined as the process of treating solid wastes through various processes, including collection, transport, treatment, and disposal of waste along with inspection and regulation. Treatment of waste can be accomplished through numerous methods, which include mechanical, biological, and others. Insecticides are used at treatment stage of waste management process. Insecticides used for waste management are analyzed for Europe region, and the market estimation is provided in terms of revenue and volume.

The key factor that drives the growth of the Europe insecticide market for waste management includes rise in organic waste generation. This is attributed to the presence of countries such as Italy, Sweden, and Austria, which use biomass in large amount for generation of energy. Furthermore, favorable initiatives undertaken by the EU Legislation on waste management continues to propel the Europe insecticides market for waste management growth. For instance, governments of Germany, the UK, and France have taken initiatives toward recycling or reuse, thus reducing waste accumulation. However, high prices of insecticides is one of the major factors hindering the market growth. On the contrary, as compared to other regions, Europe insecticides market for waste management share is dominant in global waste management market, owing to the presence of large number of players in the region. The impact of the driving factors is expected to surpass that of the restraints.

Key players operating in the market are adopting numerous strategies such as agreement, business expansion, and acquisition to sustain in the intense completion. For instance, AMEY PLC established a new waste treatment plant in North Yorkshire, UK. This new plant includes three state-of-the-art technologies-mechanical treatment, anaerobic digestion, and energy from waste (EFW). It has not only reinforced its waste management business but has also strengthened its position in the Europe insecticides market for waste management.

The Europe insecticides market for waste management is segmented based on type, waste treatment method, method of application, active ingredient, and country. On the basis of type, the market is bifurcated into larvicide and adulticide. By waste treatment method, it is classified into mechanical biological treatment, incineration, and anaerobic digestion. Depending on method of application, it is fragmented into toxic bait, dichlorvos vaporizer, outdoor space-spraying, larvicide sprayers, and others. As per active ingredient, it is segregated into organophosphorus compounds, pyrethroids compounds, neonicotinoids, and insect growth regulator. Country wise, the Europe insecticides market for waste management is analyzed across Germany, France, the UK, Italy, Spain, Nordic Countries, the Netherlands, and rest of Europe.

Europe insecticides market for waste management analysis covers in-depth information of major industry participants. Some of the major key players operating in market include BIODEGMA GmbH, BTA International GmbH, Nehlsen AG, FCC Austria Abfall Service AG, Veolia, AMEY PLC, Biffa, Renewi PLC, REMONDIS SE & Co. KG, and LafargeHolcim Ltd. Other players operating in the market include the Alba, Indaver, Cespa, Lassila & Tikanoja, Saubermacher, van Gansewinkel, Shanks group, Ragn-Sells, and Urbaser.

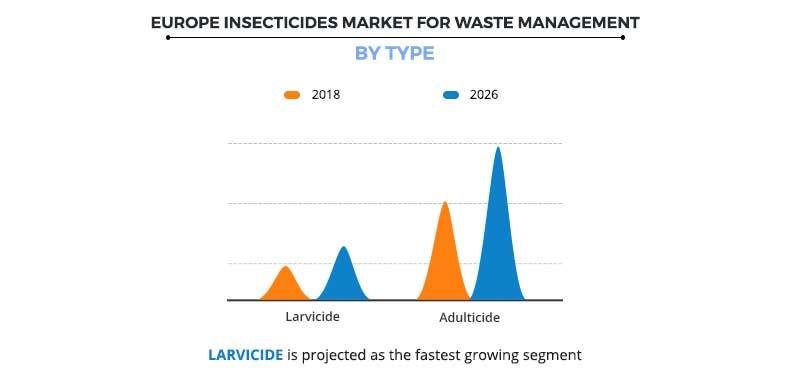

Europe insecticides market for waste management, by type

In 2018, the adulticide segment occupied the highest share of 74.8% in terms of revenue in the overall market, and is expected to continue its dominance throughout the analysis period. Adulticide is prominent type of insecticide used in waste management as there are large numbers of adult mosquitos and flies present in the waste treatment plants. These adults have a greater tendency to multiply rapidly in favorable temperature conditions. Thus, it is important to prevent their growth before their breeding season.

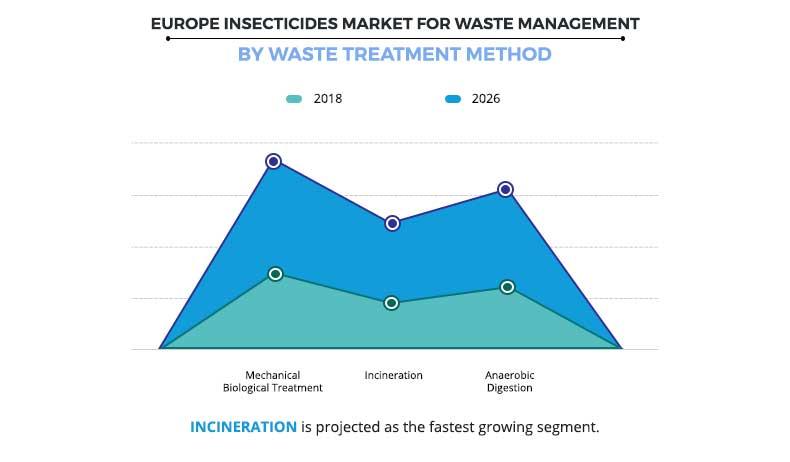

Europe insecticides market for waste management, by waste treatment method

In waste treatment method segment, mechanical biological treatment (MBT) accounted for the highest share of 40.5% in terms of revenue in 2018. It is widely adopted as compared to traditional treatment methods, owing to positive environmental externalities comprising improved landfill efficacy, such as the positive modification of leachate and landfill gas (LFG) production and quality.

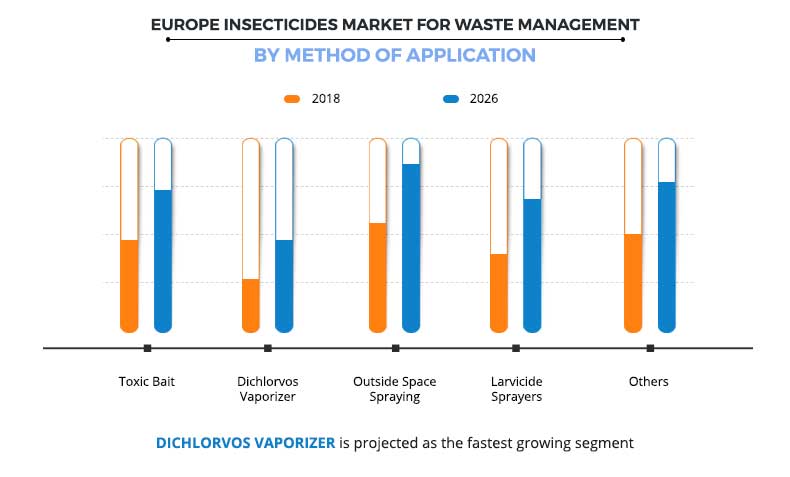

Europe insecticides market for waste management, by method of application

On basis of method of application, the outdoor space spraying segment dominated the market in 2018, with a revenue share 25.2%. Outdoor space spraying method is widely adopted in Europe, as it has an immediate effect on adult populations of insect, and less insecticide is required for one-time application.

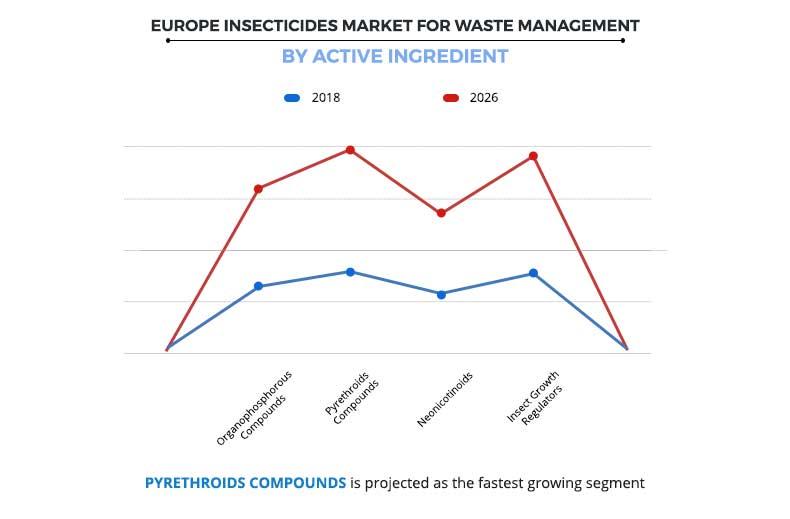

Europe insecticides market for waste management, by active ingredient

The pyrethroids compounds segment dominated the market in 2018, as these products act as ideal alternatives for insecticides. Their demand is expected to further increase during the forecast period, owing to the fact that stable pyrethroid-based insecticides are witnessing increased demand, replacing dichlorodiphenyltrichloroethane (DDT) and other chlorinated hydrocarbons.

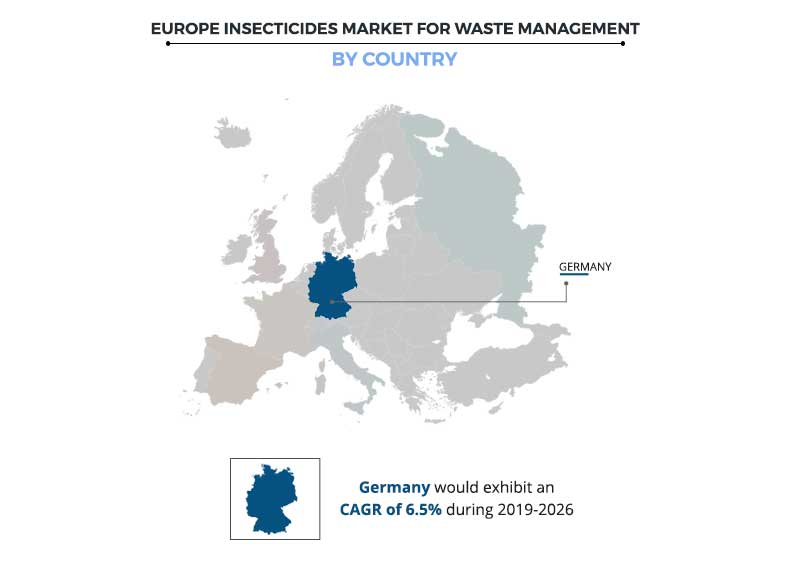

Europe insecticides market for waste management, by country

Italy accounts for major share in the Europe insecticides market for waste management. This is attributed to increase in generation of organic waste, which correspondingly increases the adoption of insecticides.

Key Benefits for Europe Insecticides Market:

- The report provides an in depth analysis of the forecast with the help of current and future trends.

- Europe insecticides market for waste management trends are analyzed for segments.

- The major countries in Europe region have been mapped according to their individual revenue contribution to the regional market.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the Europe insecticides for waste management industry for strategy building.

- The Europe insecticides market for waste management size is mentioned in the report in terms of revenue and volume.

- It outlines the current trends and future scenario of the market from 2019 to 2026 to understand the prevailing opportunities and potential investment pockets.

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study.

- The profiles of key players along with their key strategic developments are enlisted in the report.

Europe Insecticides Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Waste Treatment Method |

|

| By Application |

|

| By Active Ingredient |

|

| By Country |

|

| Key Market Players | Nehlsen AG, FCC Austria Abfall Service AG, Veolia, REMONDIS SE & Co. KG, CNIM, LafargeHolcim Ltd, Renewi PLC, AMEY PLC, BIODEGMA GmbH, Biffa, Viridor, BTA International GmbH |

Analyst Review

The Europe waste management sector is expected to witness intense competition. This is attributed to rise in concerns regarding waste generation. Competitive and efficient waste management in Europe has resulted lower prices for customers/consumers. In addition, the fact that the Europe waste management sector is a highly regulated sector acts as a major challenge for new entrants. The growth of the Europe insecticides market for waste management is driven by factors such as increase in generation of waste and rise in insect population.

Most of the waste management companies are consuming insecticides in large quantities, which in turn is expected to fuel their demand. To prevent the transmittance of diseases through flies, the waste management companies are using insecticides.

Loading Table Of Content...