Facility Management Market Size & Share:

The global facility management market size was valued at USD 39.9 billion in 2020, and is projected to reach USD 119.4 billion by 2030, growing at a CAGR of 11.8% from 2021 to 2030.

Increase in adoption of cloud-based solutions and change in organization culture and work style boost the growth of the global facility management market. In addition, introduction of innovative products and adoption of various strategies by key vendors positively impacts the growth of the facility management market. However, lack of awareness about facility management solutions hinder the FM industry growth. On the contrary, increase in demand of services outsourcing is expected to offer remunerative opportunities for expansion of the FM industry during the forecast period.

Facilities management can be defined as the tools and services that support the functionality, safety, and sustainability of buildings, grounds, infrastructure, and real estate. There are two basic areas, including hard facilities management (hard FM) and soft facilities management (soft FM). Hard FM deals with physical assets, such as plumbing, wiring, elevators, and heating & cooling. Soft FM focuses on tasks performed by people, such as custodial services, lease accounting, catering, security, and groundskeeping.

Segment Review:

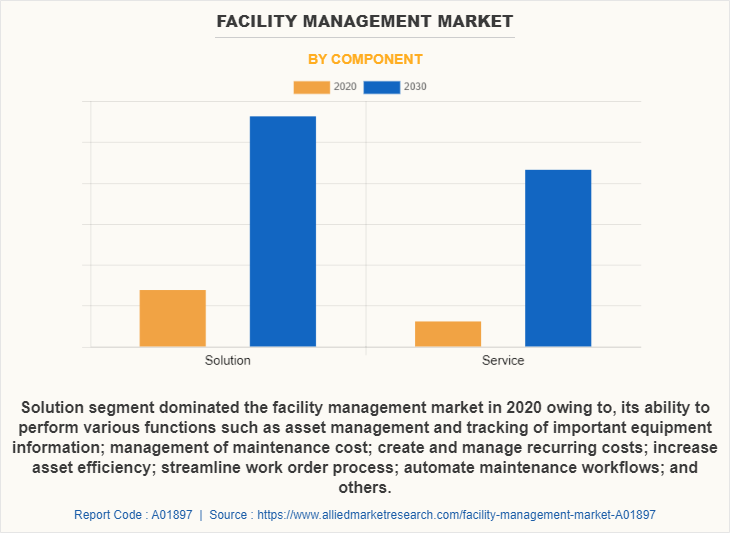

The facility management market is segmented on the basis of component, solution type, deployment model, enterprise size, industry vertical, and region. On the basis of component, it is divided into solution and service. By solution type, it is fragmented into, asset management, workplace and relocation management, strategic planning management, real estate and lease management, maintenance management, and others. Depending on deployment model, it is segmented into on-premise and cloud. As per the enterprise size, it is studied across large enterprise and SMEs. By industry vertical, it is fragmented into public sector, BFSI, manufacturing, IT and telecom, healthcare, retail, education, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the facility management industry are Accruent, Archibus, CA Technologies, iOFFICE, FM System, IBM Corporation, PLANON, Oracle Corporation, SAP SE, and Trimble, Inc.

Depending on component, solution segment holds the largest facility management market share, as it offers numerous features, including maintenance management, space management, asset management, move management, and real-estate portfolio management. It reduces the complication rate and expenses associated with space management. Furthermore, it extends lifespan of assets and reduces energy related expenses. This positively impacted the facility management services market. However, the services segment is expected to grow at the highest rate during the forecast period, due to adoption of IT as a service model among organizations. It is an IT service model for enterprises that manages strategic business requirements of the organizations along with the usual operations, which experience considerably higher growth rates during the forecast period.

Region wise, the facility management market share was dominated by North America in 2020, and is expected to retain its position during the forecast period, due to demand for facility management services created by expansion from growth in domestic oil & gas production, increase in adoption of smart technology in workspace, surge in need to address data security concerns of clients to ensure a competitive position, and rise in positive impact of mid-size commercial organizations boost the facility management market in North America. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to increase in demand for facility management solutions and rise in adoption of cloud-based solutions, particularly in Iraq, Pakistan, Afghanistan, and India. These factors drive the market growth in Asia-Pacific.

Top Impacting Factors:

Increase in Adoption of Cloud-based Solutions

Cloud-based solutions can be defined as application-based on subscription or on demand. In addition, FM industry provides flexible solution for an organization, easy to deploy, and require less maintenance. Demand for cloud-based solutions is increasing across the globe, owing to the rise in IoT applications, increase in internet penetration, and surge in adoption of smart devices. Each facility is managed by its stake holder in isolation from the management of other similar facilities is one of the problems with the current practices in the various domains of facility management. A cloud-based platform manages sensor-based bridge infrastructures and smart machinery. It has two applications, one of which is the proposed cloud-based platform is designed to support/manage a multitude of smart facilities. This helps in boosting the facility management industry towards growth.

Change in Organization Culture and Work Style

Organization culture is evolving very fast with globalization. Companies are diversifying their business operations and work culture. Technological advancement and innovation influence the work culture. Demand for work from home, flexible timings, and decentralizations of authority is driving the organization culture and work style. In addition, this culture consists of shared beliefs and values established by leaders and then communicated and reinforced through various methods, ultimately shaping employee perceptions, behaviors, and understanding. Organizational culture sets the context for everything that an enterprise does. Hence, changing organizational culture and work style boosts the FM industry growth. These factors are anticipated to fuel the facility management market growth.

Regional Insights:

North America holds a dominant position in the market due to the widespread adoption of integrated facility management solutions, particularly in the U.S. and Canada. The rising number of commercial spaces, corporate buildings, and the increasing demand for energy-efficient solutions supports this growth. The region’s robust technological infrastructure further drives the adoption of automated systems in facility management.

Europe follows closely, with countries such as Germany, the U.K., and France leading the market. Strict government regulations related to energy conservation and sustainability are pushing businesses to adopt facility management services to comply with these mandates. The region also has a growing trend of outsourcing facility management services, especially in sectors like healthcare and real estate.

Asia-Pacific is emerging as the fastest-growing region, particularly driven by the increasing commercial and residential developments in countries like China, India, and Japan. The rapid urbanization and industrialization in these nations are driving the demand for efficient facility management services. Additionally, the growing focus on smart buildings and sustainable infrastructure is fueling market growth in the region.

Middle East and Africa is also witnessing steady growth, with a focus on large infrastructure projects, particularly in the UAE and Saudi Arabia. The region’s emphasis on luxury properties, hospitality, and industrial growth is contributing to the increasing demand for facility management services.

Key Industry Developments:

January 2023: CBRE Group Inc. announced its acquisition of Turner & Townsend, a global consultancy firm, to expand its project management and real estate solutions portfolio. This acquisition strengthened CBRE’s position in offering integrated facility management services globally.

April 2023: Sodexo launched a new digital platform in Europe that integrates artificial intelligence (AI) to enhance operational efficiency and predictive maintenance in facility management, focusing on reducing operational costs for clients.

August 2023: ISS Group, a leading player in facility management, entered a strategic partnership with Microsoft to implement smart facility solutions in major office spaces across North America. The collaboration aims to integrate IoT and data analytics for better workspace optimization.

Key Benefit for Stakeholders:

- The study provides an in-depth analysis of the global facility management market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global facility management market trends is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- Quantitative facility management market analysis from 2021 to 2030 is provided to determine the market potential.

Facility Management Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Solution Type |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | ORACLE CORPORATION, IBM CORPORATION, ACCRUENT, LLC, FM SYSTEM, INC., SAP SE, ARCHIBUS, INC., IOFFICE CORPORATION, CA TECHNOLOGIES, INC., PLANON CORPORATION, TRIMBLE, INC. |

Analyst Review

The International Facility Management Association (IFMA) defined facility management as the practice of coordinating physical workplace with the people and work of the organization, which encompasses various activities, including equipment maintenance, space planning, and portfolio forecasting. Facility management encompasses various competencies, such as emergency preparedness & business continuity, environmental sustainability, human factors, communication, project management, quality, real estate & property management, and leadership & strategy. However, the study is mainly focused toward technology part of the facility management, which includes software and services used to increase efficiency and effectiveness of facility management services.

The key providers of the facility management market such IBM Corporation, Oracle Corporation, and SAP SE account for a significant share in the market. Various companies are indulging into strategic merger and acquisition to enhance their capabilities with the growth in requirement for facility management software. For instance, in February 2020, Oracle Acquired Landmark Elevator, a trusted provider of elevator service, modernization, and new installation in Maryland, Virginia, West Virginia and Pennsylvania. The acquisition was the foundation for Oracle Elevator’s northeast expansion plans and enhanced Oracle’s position as the leading independent alternative to the multinational elevator companies.

In addition, in June 2021, SAP SE partnered with Honeywell to create a joint cloud-based solution based on Honeywell Forge, the company’s enterprise performance management offering and SAP cloud platform that will streamline and combine operational and business data to support better decision-making and drive enhanced efficiencies.

Furthermore, various companies expand their current capabilities by entering into product launch with diversification among customers with growth in investment across the globe and increase in demand for facility management. For instance, in May 2020, Trimble Inc. introduced its next-generation integrated workplace management system (IWMS) with the launch of the ManhattanONE software suite. Built for the cloud, ManhattanONE is a comprehensive solution for centralizing key real estate functions and data analyses essential for optimizing real estate performance, improving decision-making, and enhancing the employee experience.

Increase in adoption of cloud-based solutions and change in organization culture and work style boost the growth of the global facility management market. In addition, introduction of innovative products and adoption of various strategies by key vendors positively impacts the growth of the market.

The leading solution of facility management market are asset management, workplace and relocation management, strategic planning management, real estate and lease management, maintenance management, and others.

North America is the largest regional market for Facility Management.

The global facility management market was valued at $39.85 billion in 2020, and is projected to reach $119.43 billion by 2030, registering a CAGR of 11.8% from 2021 to 2030.

The key players that operate in the facility management industry are Accruent, Archibus, CA Technologies, iOFFICE, FM System, IBM Corporation, PLANON, Oracle Corporation, SAP SE, and Trimble, Inc.

Loading Table Of Content...