Family Floater Health Insurance Market Research, 2031

The global family floater health insurance market was valued at $38.6 billion in 2021, and is projected to reach $105.1 billion by 2031, growing at a CAGR of 10.9% from 2022 to 2031.

Health insurance is a type of insurance that covers medical expenses that arise due to an illness. These expenses could be related to hospitalization costs, cost of medicines or doctor consultation fees. In health insurance policies, there are different type of plans and one of them is a family floater health insurance which is also known as family health insurance, which covers the entire family under a single plan. The sum insured under this plan floats upon all the family members insured in it. In addition, a family floater is a health insurance plan that extends the coverage to the entire family rather than just an individual. Simply, a floater family health insurance brings all the members of the family under an umbrella cover. Being covered under a floater, every family member gets benefits under a larger common pool.

The family floater health insurance plan covers health insurance under which all the family members can be covered by paying only one premium. Moreover, if there are multiple claims at the same time, the sum assured will be split amongst all family members. Furthermore, policy is beneficial if the person has more than two members in the family. In addition, the family floater health insurance plan provides the tax benefits under Section 80D of the Income Tax Act. Health insurance is one of the primary investments for any individual to ensure complete security during medical emergencies for themselves and their families. Therefore, these are some of the factors that propel the growth of the family floater health insurance market.

However, surge in fraudulent activities like, padding, inflating claims, staging accidents, misrepresenting facts on an insurance application, submitting claims for injuries or damage that never occurred are some of the major frauds occur in the insurance sector. In addition, frauds such as internal fraud, rate evasion, underwriting fraud, claims fraud, and cybersecurity fraud are committed at different points in transaction by applicants, policyholders, third-party claimants, and professionals providing services to claimants, which restricts the growth of the market across the globe. On the contrary, the growing number of small insurance firms and technology improvements in the insurance industry are likely to propel the family floater health insurance market to new heights.

The report focuses on growth prospects, restraints, and trends of the family floater health insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the family floater health insurance market.

Segment Review

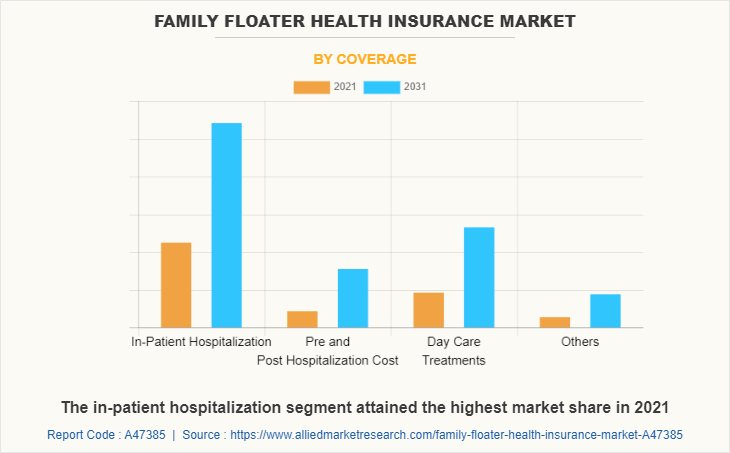

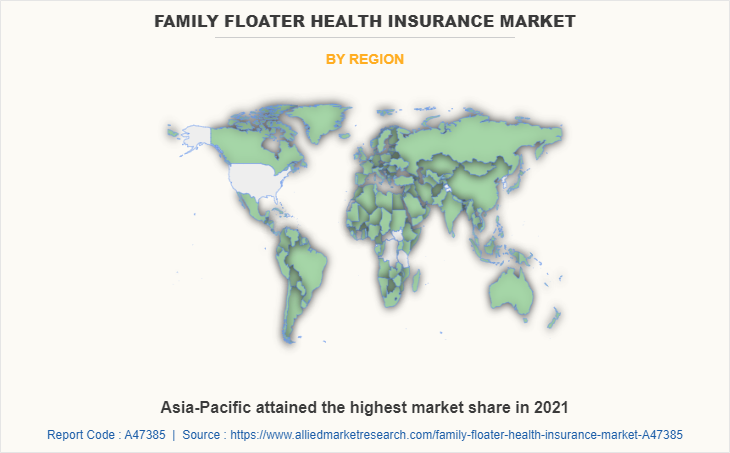

The family floater health insurance market is segmented on the basis of coverage, distribution channel, plan type, and region. By coverage, it is segmented into in-patient hospitalization, pre and post hospitalization cost, day care treatments, and others. By distribution channel, it is bifurcated into, insurance companies, banks, agents and brokers, and others. By plan type, it is segmented into immediate family plan and extended family plan. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By coverage, the in-patient hospitalization segment attained the highest growth in 2021. This is attributed to the fact that the inpatient hospitalization coverage refers to someone who is admitted to the hospital for medical treatment. Moreover, most patients use the inpatient hospitalization policy for a pre-planned surgery or treatment or during emergencies. Additionally, in this policy the days stay in hospital, medical expenses are not just restricted to the hospital but also follows at home after discharge. Thus, all these factors collectively contribute toward the growth of the global family floater health insurance market.

By region, Asia Pacific attained the highest growth in 2021. This is attributed to the fact that family floater health insurance market is rapidly growing in the Asia-Pacific region, driven by a growing demand from customers expecting fast, seamless trading as well as customized user experiences. Moreover, the second-largest market share in the health insurance is held by the Asia-Pacific region owing to increasing expenditure on health facilities which generates more demand for the family floater health insurance market in the global market.

The report analyzes the profiles of key players operating in the family floater health insurance market such as Aetna Inc., Aviva, Care Health Insurance, Cigna, eHealthinsurance Services, Inc., Future Generali India Insurance Company Ltd., HDFC ERGO, IFFCO-Tokio General Insurance Company Limited, Niva Bupa Health Insurance, Now Health International. These players have adopted various strategies to increase their market penetration and strengthen their position in the family floater health insurance market.

Market Landscape and Trends

Over the past two years, the coronavirus pandemic has moderately affected the insurance sector. With the aid of latest technology, insurers can use data from IoT devices such as the various components of smart homes, automobile sensors, and wearable technologies to better determine rates, mitigate risk, and even prevent losses in the first place. Moreover, with an increasing focus on personalized premiums and usage-based coverage, insurers are leveraging Internet of Things, advanced analytics and machine learning to develop more granular individual profiles. In addition, collaboration between traditional insurance and InsurTech firms will give rise to newer models and revenue streams, higher profitability and reduced operational costs for family floater health insurance industry.

Furthermore, digitalized workplaces and simplified operations along with accelerated performance are expected to drive the growth of the global family floater health insurance market over the forecasted period. In addition, companies' companies who are providing health insurance services are continuously attempting to reduce their capital expenditures and operational costs. Because of the current competitive environment and global economic crisis, the adoption of cost-effective strategies for restructuring existing business models has increased. Therefore, these are the major market trends of family floater health insurance market.

Top Impacting Factors

Covers the Entire Family Health Insurance

The family floater health insurance plan covers health insurance under which all the family members can be covered by paying only one premium. In addition, if there are multiple claims at the same time, the sum assured will be split amongst all family members. Moreover, policy is beneficial if the person has more than two members in the family. Additionally, family floater health insurance policy is cost-effective as you get cover for all family members with a single premium. Furthermore, it covers their whole health liability for various critical issues, which may arise if the insured face some illness. In addition, sum insured in a family floater plan is set higher to cover for the entire family. This will ensure that if two people fall ill at the same time, there won't be a shortage of funds. This is one of the best benefits of family health insurance plans. Therefore, these are the major factors that propel the market growth.

Ease in Process of Settling Claims

The customer submits a claim to the insurance company, including all pertinent details. The process then determines the merit of the claim and the amount the insurance will pay during the claim settlement. Furthermore, insurance companies cannot afford to lose customer satisfaction as it is a key competitive advantage in the market, and so, they will try to assist their customers as quickly as possible by going through the claims they have submitted, thereby helping the customers to settle their claims in an easy and swift way. Therefore, the ease of settling claims is driving the growth of the family floater health insurance market during the forecast period.

Offers Better tax Benefits

The family floater plan provides the tax benefits under Section 80D of the Income Tax Act. Health insurance is one of the primary investments for any individual to ensure complete security during medical emergencies for themselves and their families. Moreover, the income tax act allows the deduction for premium on health insurance through tax Section 80D. The Mediclaim deduction is available on premiums paid for self, family and dependent parents. The maximum amount of deduction on premiums paid for self (if senior citizen) and family plus premiums paid for separate health insurance for parents (if senior citizens) could be ₹1,00,000 per year. Therefore, as the health insurance income tax deduction is quite substantial, it reduces the money outflow for taxes in the financial year for which tax is computed. Thus, these factor helps to boost the family floater health insurance market.

Lack of Knowledge about Family Floater Health Insurance Policies

Family floater health insurance is a policy, which is not common among consumers as they are aware about life insurance policies and general insurance policies. Most of the consumers are not aware if family floater health insurance exists and if they know, they are not aware of the coverage under the policy. Therefore, lack of understanding and awareness regarding family floater health insurance coverage is a major factor that restrains the growth of the family floater health insurance market. Therefore, this is a major factor that hampers the family floater health insurance market growth.

Surge in Fraudulent Activities

Padding, inflating claims, staging accidents, misrepresenting facts on an insurance application, submitting claims for injuries or damage that never occurred are some of the major frauds occur in the insurance sector. In addition, frauds such as internal fraud, rate evasion, underwriting fraud, claims fraud, and cybersecurity fraud are committed at different points in transaction by applicants, policyholders, third-party claimants, and professionals providing services to claimants. Therefore, this is one of the major factors that hampers the growth of family floater health insurance market size.

Technological Advancements in the Field of Insurance

The growing number of small firms and technology improvements in the insurance industry are likely to propel the family floater health insurance market to new heights. In addition, predictive analytics is used by several family floater health insurers to collect a variety of data in order to fully understand the client's medical background. By delivering advanced services, such as quick and convenient insurance policies with reduced premium rates, the use of technology is aimed to promote client loyalty and expand the company's market position.

Moreover, the family floater health insurance sector is predicted to develop as a result of government initiative regulation and consumer awareness relating to health insurance after COVID-19. Furthermore, the use of artificial intelligence (AI) has rapidly expanded, with AI-enabled devices becoming commonplace in homes around the world. With the help of AI, insurers can improve claims turnaround cycles and fundamentally change the underwriting process. Therefore, these factors will provide opportunities for the growth of family floater health insurance market share.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the family floater health insurance market forecast from 2022 to 2031 to identify the prevailing family floater health insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the family floater health insurance market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global family floater health insurance market trends, key players, market segments, application areas, and market growth strategies.

Family Floater Health Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 105.1 billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 348 |

| By Coverage |

|

| By Plan Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Aviva, Future Generali India Insurance Company Ltd., Care Health Insurance, Cigna, Now Health International, Niva Bupa Health Insurance, eHealthinsurance Services, Inc., HDFC ERGO, Aetna Inc., IFFCO-Tokio General Insurance Company Limited |

Analyst Review

The major demand for family floater health insurance is typically for the coverage that provides comprehensive medical coverage for all members of a family under a single policy. Furthermore, the demand is growing for the policy because of the various benefits included such as deductibles, co-payments, co-insurance, and coverage for prescription drugs. In addition, family floaters often provide coverage for preventive services such as check-ups and immunizations. Moreover, the family floater health insurance is used by parents, married couples, or any group of people related by blood or marriage. It is especially beneficial for families who have multiple members requiring medical coverage at the same time. In addition, it usually covers pre-existing conditions and a range of medical treatments and services.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, in September 2022, HDFC ERGO General Insurance Company Limited has partnered with HDFC Life to launch Click2Protect Optima secure to offer all-round protection to customers. With this partnership, the HDFC ERGO aims to provide un-complicated financial planning for customer by offering the term health insurance plans with a minimum sum assured of 50,000. Therefore, such strategy helps to grow the family floater health insurance market.

Moreover, some of the key players profiled in the report include are Aetna Inc., Aviva, Care Health Insurance, Cigna, eHealthinsurance Services, Inc., Future Generali India Insurance Company Ltd., HDFC ERGO, IFFCO-Tokio General Insurance Company Limited, Niva Bupa Health Insurance, and Now Health International. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Some upcoming trends that may affect the market include an increasing focus on preventative care, the use of technology to improve the claims process and customer experience, and the incorporation of wellness and lifestyle management programs. Additionally, with the ongoing global pandemic, there may be an increased demand for health insurance in general, as well as greater awareness of the importance of having insurance coverage.

Asia-Pacific is the largest regional market for Family Floater Health Insurance

The global family floater health insurance market was valued at $38.63 billion in 2021, and is projected to reach $105.11 billion by 2031, growing at a CAGR of 10.9% from 2022 to 2031.

Aetna Inc., Aviva, Care Health Insurance, Cigna, eHealthinsurance Services, Inc., Future Generali India Insurance Company Ltd., HDFC ERGO, IFFCO-Tokio General Insurance Company Limited, Niva Bupa Health Insurance, Now Health International

Loading Table Of Content...