Life Reinsurance Market Research, 2032

The global life reinsurance market was valued at $230.7 billion in 2022, and is projected to reach $731.2 billion by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

Reinsurance for life insurance firms allows them to shift all or a portion of their risk to another insurer. It allows life insurance companies to spread their risks, reduce their liabilities, and increase assets. Life reinsurers assume the risks associated with virtually every product sold by life insurers. In addition, the practice of reinsurance helps in keeping premiums low for clients and allowing insurance companies to remain in business when losses are widespread in their area.

Moreover, life reinsurance serves the objective of assisting ceding insurers in managing their exposure to financial risks associated with life insurance policies, such as mortality and longevity risk. It makes it possible for insurance firms to spread out their risk, make the most of their resources, and guarantee that they can fulfil their responsibilities to policyholders. In the insurance sector, life reinsurance is a crucial risk management tactic that offers financial protection.

Growth in focus on insurers to stabilize losses by limiting risks is the key driver for the growth of life reinsurance market. The main benefit of reinsurance is to protect a company from insolvency. It ensures that insurance companies can make payments on all claims. This strengthens the company’s foundations and gives them the confidence to take on more risks and offer their services to even more clients. Furthermore, it reduces the burden of risk. When an insurance company single-handedly ensures many clients, they take on a huge amount of risk. Reinsurance is an ideal strategy to minimize that risk, by placing some of the burdens on a reinsurance company instead of shouldering the burden completely alone. In addition, the rise in claims in the life insurance sector, and expansion of insuring capacity are the major driving factors for the life reinsurance market.

However, high cost of life reinsurance is the major factor that hamper the growth of the life reinsurance market. Purchasing reinsurance reduces insurers’ insolvency risk by stabilizing loss experience, increasing capacity, limiting liability on specific risks, and/or protecting against catastrophes. Consequently, purchasing life reinsurance should reduce capital costs. Contrarily, increased collaboration of insurtech players presents a significant opportunity for the life reinsurance industry. Insurtech companies often specialize in sophisticated data analytics, leveraging artificial intelligence and machine learning algorithms. Collaborating with these firms enables life reinsurance providers to harness the power of data for more accurate risk assessments, pricing models, and underwriting processes. Advanced analytics can lead to improved decision-making and a better understanding of emerging trends.

The report focuses on growth prospects, restraints, and trends of the life reinsurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the life reinsurance market.

Segment Review

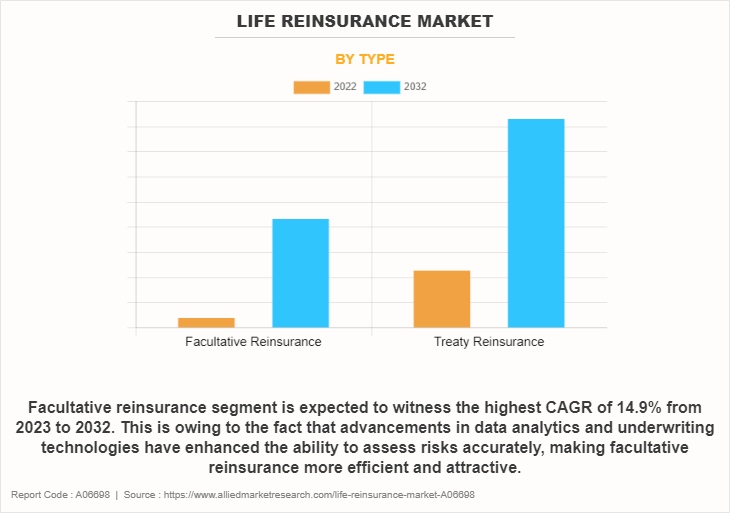

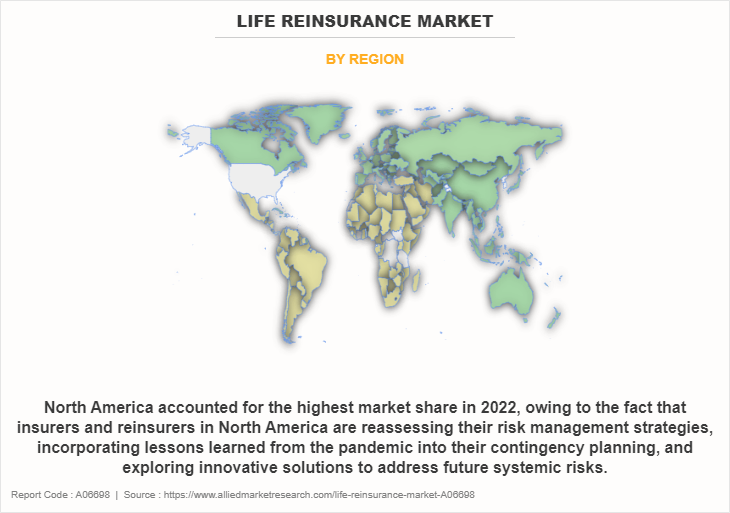

The life reinsurance market is segmented on the basis of type, product offering, and region. On the basis of type, it is bifurcated into facultative reinsurance and treaty reinsurance. On the basis of product offering, it is classified into mortality solutions, morbidity solutions, longevity solutions, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the facultative reinsurance segment is projected to manifest the highest CAGR from 2023 to 2032, owing to the fact that advancements in data analytics and underwriting technologies have enhanced the ability to assess risks accurately, making facultative reinsurance more efficient and attractive.

On the basis of region, North America held the highest life reinsurance market share in 2022, owing to the fact that insurers and reinsurers in North America are reassessing their risk management strategies, incorporating lessons learned from the pandemic into their contingency planning, and exploring innovative solutions to address future systemic risks.

The report analyzes the profiles of key players operating in the life reinsurance market such as AXA XL, Berkshire Hathaway Life, Everest Group, Ltd., Hannover Re, Liberty Mutual Reinsurance, Munich Re, RGA Reinsurance Company, Sompo International Holdings Ltd., Swiss Re, and The Canada Life Assurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the life reinsurance market.

Market Landscape and Trends

The life reinsurance market is undergoing a digital transformation, with a focus on integrating insurtech solutions. Insurtech companies are playing a pivotal role in streamlining processes, enhancing customer experiences, and introducing innovative technologies such as artificial intelligence, blockchain, and data analytics. Reinsurance providers are collaborating with insurtech firms to stay agile and technologically competitive. In addition, with increasing life expectancy, longevity risk has become a significant concern.

Life reinsurance providers are actively involved in developing solutions to manage longevity risk, including the creation of longevity swap arrangements and the introduction of innovative pension risk transfer products. These strategies help reinsurers address the challenges associated with longer lifespans. Further, the demographic trend of an aging global population presents a growth opportunity for life reinsurance market. With longer life expectancies, there is an increased demand for retirement and pension-related products. Life reinsurance companies will collaborate with primary insurers to offer solutions that address the unique risks and financial considerations associated with an aging population. These are the major trends in the life reinsurance market.

Top Impacting Factors

Expansion of Insuring Capacity

Life reinsurance enhances the fundamental financial risk-spreading function of life insurance and serves at least four basic functions for the direct insurance company which includes increasing the capacity to write insurance (under prevailing insurance-regulatory law), stabilizing financial results in the same manner that insurance protects any other purchaser against spikes from realized financial losses, protecting against catastrophic losses, and financing growth. In addition, by using life reinsurance, insurers reach out to new customers and geographical areas. To expand a business, it offers financial protection for entering countries with various regulatory and risk profiles. Moreover, innovative life insurance product development is supported by life reinsurance. Offering novel and unique products that draw a larger consumer base and help in capacity expansion falls under this category. Therefore, expansion of insuring capacity drives the demand of the life reinsurance market.

Growth in Focus on Insurers to Stabilize Losses by Limiting Risks

The main benefit of reinsurance is to protect a company from insolvency. It ensures that insurance companies can make payments on all claims. This strengthens the company’s foundations and gives them the confidence to take on more risks and offer their services to even more clients. Furthermore, it reduces the burden of risk. When an insurance company single-handedly ensures many clients, they take on a huge amount of risk. Reinsurance is an ideal strategy to minimize that risk, by placing some of the burdens on a reinsurance company instead of shouldering the burden completely alone. In addition, insurance companies are exposed to a variety of risks, including operational, investment, mortality, and life risk. The transfer of some of uncertainty risks to reinsurers through life reinsurance helps insurers in reducing risks. As a result, primary insurers' financial performance is stabilized, and their capital reserves is safeguarded. Moreover, life reinsurance gives insurers a financial safety net, allowing them to weather unexpected or disastrous occurrences without suffering large financial losses. Both insurers and policyholders’ profit from this steadiness. Therefore, the rise in focus on insurers to stabilize losses by limiting risk drives the demand of the life reinsurance market.

Rise in Claims in the Life Insurance Sector

With an increased rate of claims in the life insurance category, re-insurers have gained profit in the life reinsurance market. It limits liability for a specific risk, stabilizes the losses, protects against catastrophes, and increases the capacity to take on new clients. Furthermore, many life reinsurers have reported an increase in premium rates, owing to higher life insurance claims. By keeping the price of premiums high, reinsurance firms cope with the risk of losses and perform better. In addition, various market players are adopting different key strategies to offer additional services to their life insurance policies to drive their revenue growth opportunities and to improve their service efficiencies, which fuels the life reinsurance market. Furthermore, life reinsurance's main goal is to give beneficiaries a death benefit upon the insured's passing. A rise in payouts is caused by a rise in mortality claims brought on by the aging population and unforeseeable incidents. Moreover, an important consideration is the longevity risk, or the possibility that policyholders will live longer than anticipated. As life expectancies rise, life reinsurers have to deal with the difficulty of paying claims over longer periods of time, necessitating more reinsurance backing. Therefore, rise in claims in the life insurance sector are driving the demand of the life reinsurance market.

High Cost of Life Reinsurance

The main factor that limits the growth of the life reinsurance market is that buying reinsurance is costly. Purchasing reinsurance reduces insurers’ insolvency risk by stabilizing loss experience, increasing capacity, limiting liability on specific risks, and/or protecting against catastrophes. Consequently, purchasing life reinsurance should reduce capital costs. However, transferring risk to reinsurers is expensive. The cost of reinsurance for an insurer can be much larger than the actual price of the risk transferred. As a result, the purchase of reinsurance significantly increases insurers’ costs but significantly reduces the volatility of the loss ratio. With purchasing life reinsurance, insurers accept to pay higher costs of life insurance products to reduce their underwriting risk. Furthermore, primary insurers' profit margins may be impacted by high reinsurance expenses. When reinsurance is expensive, policyholders pay higher premiums, which make life insurance more expensive. Moreover, increased premiums for policyholders result from high life reinsurance expenses. The market growth slows down in some circumstances as these higher rates discourage people from buying life insurance. Therefore, high cost of life reinsurance policy hampers the growth of the life reinsurance market size.

Increasing Awareness about Insurance Products

Heightened awareness fosters collaboration among stakeholders in the insurance industry. Reinsurers can collaborate with primary insurers, brokers, and other intermediaries to educate the public about the benefits of insurance. This collaborative approach not only enhances market awareness but also strengthens the relationships between different players in the insurance value chain. In addition, a larger pool of policies that insurers want to reinsure can be created by raising general awareness of the value of insurance and expanding the life reinsurance market. Owing to the increased risk, this results in a rise in the need for life reinsurance. Moreover, insurers create new plans to appeal to these individuals as awareness of insurance products spreads to new client segments, such as younger demographics or underserved communities. This is expected to enable life reinsurers to assist in the underwriting of reinsurance products. Therefore, increasing awareness about insurance products is anticipated to provide lucrative opportunity for life reinsurance market.

Increased collaboration of insurtech players

Insurtech companies often specialize in sophisticated data analytics, leveraging artificial intelligence and machine learning algorithms. Collaborating with these firms enables life reinsurance providers to harness the power of data for more accurate risk assessments, pricing models, and underwriting processes. Advanced analytics can lead to improved decision-making and a better understanding of emerging trends. In addition, insurtech solutions streamline underwriting processes through automation and digitization. By integrating insurtech platforms, life reinsurance providers can expedite the underwriting workflow, reduce manual errors, and enhance the overall efficiency of assessing and pricing risks.

Furthermore, insurtech solutions are designed to enhance the overall customer experience. By collaborating with insurtech companies, life reinsurance providers can leverage customer-centric technologies such as chatbots, online portals, and personalized communication tools. These enhancements contribute to increased customer satisfaction, loyalty, and retention. Therefore, these trends are projected to further drive the growth of the life reinsurance market during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the life reinsurance market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of life reinsurance market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the life reinsurance market segmentation assists in determining the prevailing life reinsurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global life reinsurance market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the life reinsurance market players.

- The report includes an analysis of the regional as well as global life reinsurance market trends, key players, market segments, application areas, and life reinsurance market growth strategies.

Life Reinsurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 731.2 billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 321 |

| By Type |

|

| By Product Offering |

|

| By Region |

|

| Key Market Players | Munich Re, Swiss Re, Everest Group, Ltd., Liberty Mutual Reinsurance, AXA XL, Hannover Re, Berkshire Hathaway Life, RGA Reinsurance Company, The Canada Life Assurance Company, Sompo International Holdings Ltd. |

Analyst Review

Life reinsurance significantly contributes to capital optimization, supports solvency, and improves the effectiveness of risk transfer in the insurance industry. Due to the numerous difficulties insurers have been experiencing owing to shifting market conditions, the most recent life reinsurance solutions have been aiding the growth of the industry. Moreover, to acquire risk protection & distribution and enhance capital, many insurers are turning to the use of various forms of life reinsurance. Furthermore, demand for life insurance products is being driven by a growing understanding of the value of financial security and life insurance. As primary insurers attempt to reduce their exposure to risk, this in turn causes the market for life reinsurance to grow. In addition, Life reinsurance is in high demand due to diverse regions' robust economic growth. The need for financial stability, retirement planning, and life insurance coverage increases as people and businesses accumulate wealth. Furthermore, the surge in demand for insurance protection is a result of growing knowledge of the risk of natural disasters. In the event of such disasters, life reinsurance contributes to the provision of financial assistance.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in September 2023, Swiss Re expanded its life reinsurance service with continued growth momentum for non-life reinsurance. Swiss Re emphasizes the significance of better underwriting data, improved modeling, and rebalancing of the insurance value chain for a viable reinsurance market in light of the growing demand for and awareness of reinsurance. Swiss Re is still dedicated to working with primary insurers to help them expand in an unpredictable world, foresee & manage risk, and respond to disasters. Moreover, in May 2020, according to PR newswire Canada Life Reinsurance entered into a major longevity risk reinsurance agreement with NN Life covering $5.8 billion of in-force liabilities. Canada Life Reinsurance will reinsure about 82,000 definite benefit pensioners who are currently receiving payments under the terms of this agreement. These strategies by the market players operating at a global and regional level is expected to help the market to grow significantly during the forecast period.

The life reinsurance market is projected to reach $731.16 billion by 2032.

The life reinsurance market is estimated to grow at a CAGR of 12.5% from 2023 to 2032.

The key growth strategies of life reinsurance players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

The key players profiled in the report include life reinsurance market analysis includes top companies operating in the market such as AXA XL, Berkshire Hathaway Life, Everest Group, Ltd., Hannover Re, Liberty Mutual Reinsurance, Munich Re, RGA Reinsurance Company, Sompo International Holdings Ltd., Swiss Re, and The Canada Life Assurance Company.

Expansion of insuring capacity, growth in focus on insurers to stabilize losses by limiting risks, and rise in claims in the life insurance sector contribute towards the growth of the market.

Loading Table Of Content...

Loading Research Methodology...