Farming as a Service Market Insights, 2031

The global farming as a service market share was valued at USD 2.9 billion in 2021, and is projected to reach USD 12.8 billion by 2031, growing at a CAGR of 16.1% from 2022 to 2031.

Adoption of advanced technologies in agricultural products is driving the farming as a service market growth. Modern agricultural technologies including data management software, GPS, yield mapping software (YMS), variable rate technology (VRT), and mapping software help enhance profit growth and soil fertility while lowering farming costs and promoting sustainable agriculture. In addition, gaining popularity of internet of things (IoT) in agriculture and reduced energy consumption and cost effectiveness. Thus, these factors drive the growth of the farming as a service market size. However, lack of technical awareness and high initial investments is hampering the growth of the market. On the contrary, the increasing number of agritech start-ups will provide major lucrative opportunities for growth of the market.

Farming as a Service (FaaS) is a business model that allows farmers to procure a service on a pay-per-use or subscription basis offering advanced, professional, & user-friendly solutions in agriculture. It is a framework of professional services that offer a suite of agrarian management solutions. Moreover, it gives farmers access to various services such as precision farming tools, analytics, utility & labor services, equipment rentals, and entrance to a broader audience & markets, among others. Furthermore, FaaS provides farmers with easy accessibility in crop production, on-time availability of labor, equipment rental for the desired time, and utility services like irrigation facilities & power supply. The farming as a service market is segmented into Service Type, Delivery Model and End User.

Segment Review

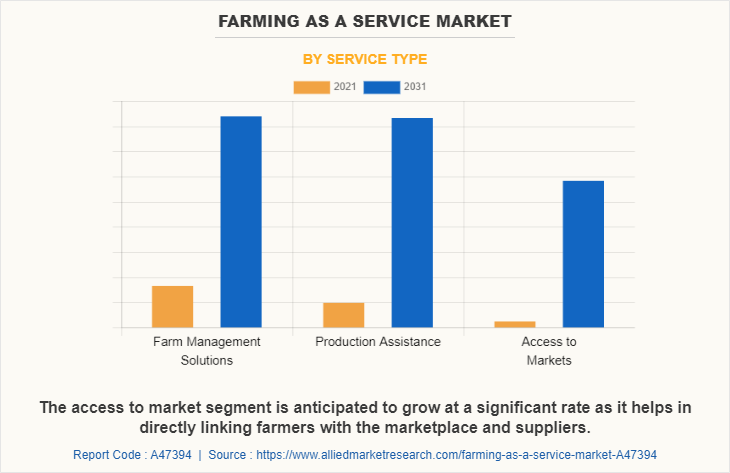

The farming as a service market is segmented on the basis of service type, delivery model and end user. By service type, it is segmented into farm management solutions, production assistance and access to markets. By delivery model, it is segmented into subscription and pay-per-use. By end user, it is segmented into farmers, governments, corporate, financial institutions, and advisory bodies. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of service type, the farm management solutions segment held the largest market share in 2021 due to rise in internet penetration and rise in acceptance of farming solutions by end users such as farmers. However, the access to markets segment is anticipated to grow at highest growth rate in farming as a service market forecast due to rise in access to markets platforms provide by government and major corporate players.

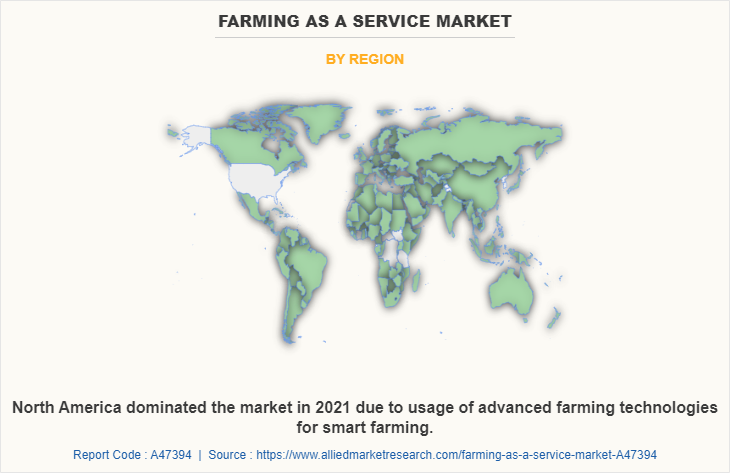

Based on region, North America attained the highest revenue in 2021 due to increasing acceptance of smart farming methods, which has led to an increase in the use of agriculture farming-as-a-service. However, Asia-Pacific is expected to register highest growth rate during the forecast period due to rise in government friendly policies and rise in food production demand.

Top Impacting Factors

Adoption of advanced technologies in agricultural products

Smart agriculture, when used to its full potential, can help farmers resist the negative effects of climate change on crops by collecting geospatial data on planting, soil, livestock, and other inter- and intra-field data. Moreover, smart agriculture also provides information on how much pesticides, herbicides, liquid fertilizer, and irrigation are required, reducing waste. Modern agricultural technologies including data management software, GPS, yield mapping software (YMS), variable rate technology (VRT), and mapping software help enhance profit growth and soil fertility while lowering farming costs and promoting sustainable agriculture.

In addition, growing business productivity through automated procedures and more remarkable produce at lower farming costs are two important characteristics of smart agricultural technologies. As a result, business-minded farmers have begun to employ a variety of smart agricultural instruments to boost crop yields and profits. Furthermore, smart agriculture techniques are intended to make agribusiness more profitable than ever before.

The Internet of Things (IoT) is gaining popularity in agriculture

Farmers have benefitted from the expanding usage of Internet of Things (IoT) technology in agriculture by receiving real-time help through loT applications. Traditional agriculture practices that use loT applications save time and money by reducing the amount of time and money spent on farming resources like land, energy, and water, allowing farmers to focus on providing high-quality food to their customers.

Moreover, farmers can respond to substantial changes in air efficiency, humidity, and weather thanks to the agricultural sector's extensive use of loT technology. It uses diverse management tools and technologies, visualization, and data analytics to automate traditional farming procedures. By preserving energy and water resources through sophisticated sustainable solutions, loT technology in agriculture boosts farm output while cutting carbon emissions.

In addition, farmers may stay informed about how to use information and communication technologies to maximize earnings and ensure resource conservation under varied climatic conditions as internet coverage grows in the agricultural sector. As a result, during the forecast period, the increased usage of the Internet of Things (IoT) in the agriculture sector is expected to fuel farming as a service Industry growth.

Reduced energy consumption and cost effectiveness

The more precise and resource-efficient approach of the software, the introduction of innovative farm management approaches has resulted in lower energy usage and overall cost-effective operations. As a result of the growing preference for smart farming solutions that are more convenient than traditional ways, the smart farming industry is expected to rise. In addition, the farmers are getting same productivity with reduced input cost and energy and this is expected to drive the industry.

Lack of technical awareness and high initial investments

Lack of understanding is preventing many farmers from investing in new agricultural technologies. The second most common explanation for respondents' limitations was a lack of financial resources, followed by uncertainty about the future and supply chain issues. Moreover, farmers must be trained on how to use apps and technologies for smart agriculture to be more widely adopted as many of them are not acquainted with newer technologies and there exists digital illiteracy among many of them. Also, the initial investments are restricting many of them to adopt smart agriculture processes. Hence, these factors are expected to hinder the farming as a service market growth over the forecast period.

Need for continuous internet

Farming as a service has a significant disadvantage in that it necessitates an endless or constant internet connection to be successful. This means that this agricultural practice is entirely unworkable in rural communities, particularly in developing countries where mass crop production is common. Moreover, farming as a service will be impossible in locations where internet connections are painfully slow. A large proportion of the population in countries like India are living in rural areas where internet connectivity is not available or not that smooth which may restrict the farming as a service market from expanding.

Increasing number of agritech start-ups

Startups in the agritech industry are offering new viewpoints. To give farmers immediate fixes for these issues, they are combining remote sensing, data analytics, loT, and Al. Moreover, they are using a combination of remote sensing, data analytics, loT, and Al to provide farmers with quick solutions to their problems. These inventions aided in the establishment of technologies that allow growers to choose their marketplace and sell their commodities at higher rates.

In addition, with the integration of advanced technologies like the Internet of Things (IoT), remote sensing, Big Data, Cloud Computing, Artificial Intelligence (AI), image analytics & processing, Machine Learning (ML) into farming practices, coupled with the growing use of drones, AG-robots, etc., to bring efficiency in the agriculture sector, the adoption of farming-as-a service is anticipated to rise significantly among farmers during the forecast period and generate lucrative growth opportunities for the leading players in the industry.

Market Landscape and Trends

Farming as a service refers to using technologies such as machine learning and the internet of things in yield monitoring and collecting weather data. Owing to the several advantages, such as enhanced productivity and efficiency through data-driven decisions, the use of FaaS will rise in the coming years as the internet connectivity in rural areas continues to improve inefficiencies in the agricultural supply chain, such as low productivity, a lack of farm mechanization, market access, and data asymmetry, can be addressed with the aid of FaaS.

Moreover, it promotes the development of new products, including technologies for instantaneous data collection and analysis and agricultural machinery with many uses. Furthermore, rapid automation adoption in farming process, growing adoption of mechanical development tools in the farming sector, and rising demand for smart solutions are major trends in the farming as a service market. Therefore, these are the major market trends for farming as a service industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the farming as a service market analysis from 2021 to 2031 to identify the prevailing farming as a service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the farming as a service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global farming as a service market trends, key players, market segments, application areas, and market growth strategies.

Farming as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.8 billion |

| Growth Rate | CAGR of 16.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 230 |

| By Service Type |

|

| By Delivery Model |

|

| By End User |

|

| By Region |

|

| Key Market Players | 63Ideas Infolabs Private Limited, Mahindra & Mahindra Ltd., apollo agriculture, Taranis, Deere & Company, Trimble Inc., Accenture, SGS Société Générale de Surveillance SA, BigHaat.com, Precision Hawk |

Analyst Review

Farming as a Service is gaining traction owing to the efficient and data-driven agriculture possible with the services, thereby improving the farm outputs. It gives farmers access to various services such as precision farming tools, analytics, utility & labor services, equipment rentals, and entrance to a broader audience & markets, among others.

Furthermore, market players are adopting acquisition strategies for enhancing their services in the market and improving customer satisfaction. For instance, on August 2021, Deere & Company acquired Bear Flag Robotics to accelerate autonomous technology on the farm. This deal accelerates the development and delivery of automation and autonomy on the farm and supports John Deere's long-term strategy to create smarter machines with advanced technology to support individual customer needs.

Some of the key players profiled in the report include Apollo Agriculture, Deere & Company, Trimble Inc., Mahindra & Mahindra Ltd., SGS Société Générale de Surveillance SA, Accenture, Taranis, Precision Hawk, BigHaat.com and 63Ideas Infolabs Private Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the farming as a service market.

The global farming as a service market was valued at $2,943.89 million in 2021, and is projected to reach $12,762.48 million by 2031

The global farming as a service market is projected to grow at a compound annual growth rate of 16.1% from 2021-2031 to reach USD 12.8 billion by 2031

Apollo Agriculture, Deere & Company, Trimble Inc., Mahindra & Mahindra Ltd., SGS Société Générale de Surveillance SA, Accenture, Taranis, Precision Hawk, BigHaat.com and 63Ideas Infolabs Private Limited.

North America is the largest regional for Farming as a Service Market.

The adoption of advanced technologies in agricultural products is driving the farming as a service market growth.

Loading Table Of Content...