Feed Premix Market Research, 2031

The global feed premix market was valued at $5.1 billion in 2021, and is projected to reach $11.4 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

Premix is a mixture of feed additives or a mixture of one or more feed additives with feed materials or water employed as transporters, not intended for direct feeding to animals. Typically, this premix is added into the compound feed at a rate of 0.2% to 0.5%. Only feed premix has been taken into consideration for the purposes of this report. The market segments and variables influencing the growth of the commercial feed premix industry are extensively studied in the report.

For the growth and development of farm animals, an increase in the demand for and consumption of livestock-based products such dairy and dairy-based products, meat, and eggs is anticipated to boost the use of feed additives. The FAO reports that by 2025, the world's meat production is expected to increase by 16%. Due to its great demand, low production costs, and low product pricing in both, developed and emerging nations, poultry meat is the main factor driving the expansion of global meat production. According to statistics provided by the FAO, the output of chicken meat reached 120.5 million tons in 2017, compared to 118.7 million tons for swine, 70.8 million kilograms for cattle, and 14.9 million tons for ovine. There is a growing trend for animal-sourced protein in the form of meat, eggs, or milk because of the expanding understanding of the dynamics of food nutrients, particularly protein, on total physical and mental growth and development.

Due to the overuse or improper usage, antibiotic use decreased after the EU imposed its prohibition in several nations globally, particularly in China, India, and the U.S. Companies were obliged to discontinue using antibiotics in feed premixes because of restrictions on the use of antibiotics as a growth booster in feed in many countries. This poses a significant obstacle for producers of feed premixes based on antibiotics.

In 2017, the combined demand from emerging economies in the Asia-Pacific and Latin America regions represented 47% of global consumption. According to the FAO report, "World Agriculture: Towards 2015/2030," the population of developing nations in the Asia Pacific region, including India, China, Indonesia, Vietnam, and Thailand, is predicted to consume meat at a rate of 2.4% annually until 2030. To improve the meat weight and quality of the animals, the demand for premium feed concentrates and premixes have boosted. To fulfill the rising demand for feed premixes, major players in the new Feed Premix Market Opportunity to start premix production facilities in these areas. Similar to this, Brazil had the greatest population of cattle in South America in 2017 with a headcount of 330 million, and the FAO anticipates that it will continue to increase far faster than the average for the region. A high Feed Premix Market Demand is anticipated due to increased consumer awareness of nutrient-dense foods and the need for meat products of export quality.

Segmental Overview

The feed premix market is segmented into livestock, type, form, and region. Depending on livestock the market is divided into swine, ruminants, poultry, aquatic animals, and others. On the basis of type, the market is segregated into vitamins, minerals, amino acids, and antibiotics. On the basis of form, the market is bifurcated into organic and conventional. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for more than 35% share of the total revenue in 2021, followed by Europe and Asia-Pacific.

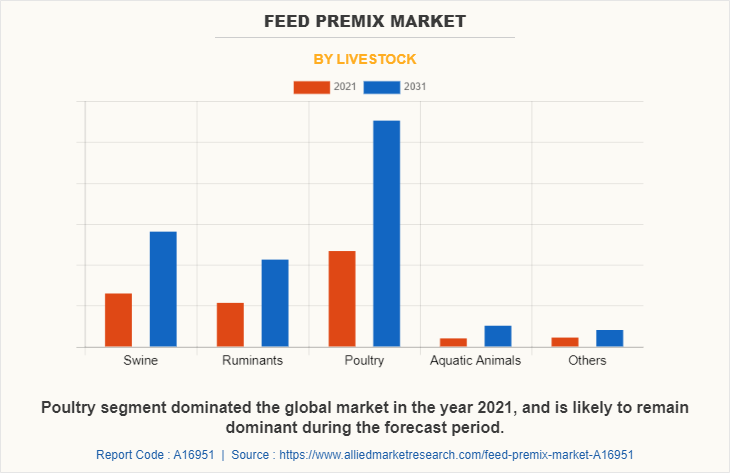

By livestock

On the basis of livestock, the poultry segment dominated the global market in 2021. This is attributed to the rising consumption of poultry meat, eggs, and other animal-sourced commodities, which has dramatically expanded during the past few decades. In addition, across a wide range of countries, customs, and religions, poultry meat and eggs are among the animal-derived items that are most commonly consumed on a global scale. The consumption of poultry meat, eggs, and other animal-sourced commodities has dramatically expanded during the past few decades. Population expansion, urbanization, and rising wages in developing nations have been the main drivers of growing demand. Due to its widespread affordability, low-fat content, and lack of significant religious and cultural barriers, chicken dominates the feed premix industry. Due to population increase and rising individual consumption, the demand for poultry meat and eggs is anticipated to rise further. Regardless of location or income level, the market for poultry meat is anticipated to grow, with emerging regions experiencing slightly faster per capita growth than established ones.

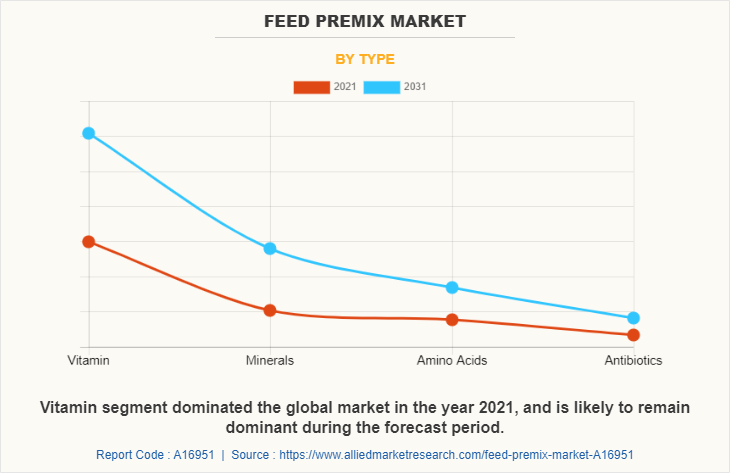

By Type

On the basis of type, the vitamin segment had the major feed premix market Size in 2021. This is attributed to rising awareness regarding vitamin deficiencies among animals. Similar to humans, livestock animals require a balanced diet that includes all the vitamins, minerals, fluids, and nutrients they require. There are numerous risks to the health of a large group of animals without a balanced diet. Ruminant animals, like cattle, are particularly prone to the issues brought on by an unbalanced or bad diet. As a result, many farmers who raise cattle rely on the use of cow supplements to maintain the health and productivity of their herds. There are 20 known inorganic elements that are used by the body to carry out crucial tasks. Although just a very tiny portion of dietary nutrients, such as vitamins, are necessary for normal physiological processes like growth, development, and reproduction as well as animal welfare and general health status, vitamins are vital, irreplaceable micronutrients. In general, when a particular vitamin is missing from the diet, all animals exhibit clear morphological and physiological deficiency indications.

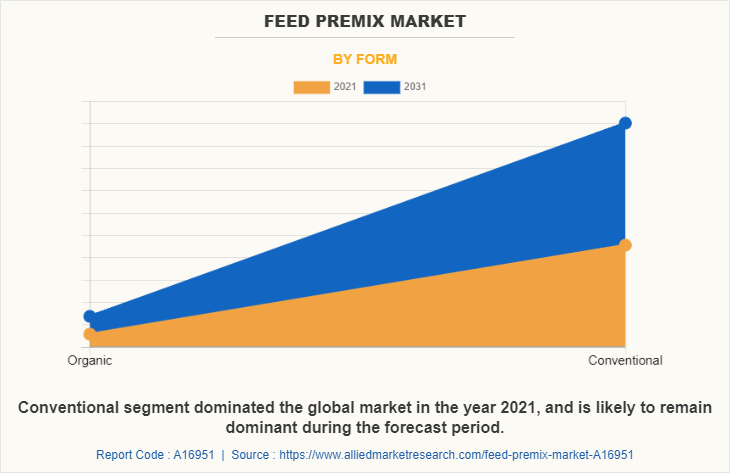

By Form

On the basis of form, the market is bifurcated into organic and conventional. The conventional segment had the major feed premix market size in 2021. The organic segment is likely to be the fastest-growing segment during the Feed Premix Market Forecast year. Many governments around the globe, especially those in North America and Europe, are now concerned about feed safety. Globally, consumers are becoming more knowledgeable and conscious of the external characteristics of the meat they eat. These elements have increased the value of organic feed among consumers globally. For instance, in 2017, Belgian and Dutch authorities discovered eggs contaminated with the insecticide, fipronil. A problem with the quality of meat and eggs surfaced in Germany in August 2017. Aldi, a large grocery chain, removed eggs from its shelves after tests revealed the potential for insecticide contamination. In the same year, stores and warehouses in these nations had to recall millions of eggs. Due to the potential health dangers, other nations, including Slovakia and South Korea, prohibited the importation of pork from Germany in the same year.

These occurrences have increased the need for wholesome, secure feed, including organic feed premix, throughout the area. In addition, using organic feed gives animals a balanced diet and shields them from such dangerous threats. It is crucial in resolving problems with animal welfare, environmentally sustainable meat production, and assurance of animal feeding. In addition to preserving the integrity of feed items, organic feed premix provides nutrients that increase livestock output. To protect animals from pesticide contamination, growers in this region are concentrating on manufacturing organic feed, which is expected to fuel the expansion of the global organic feed premix market.

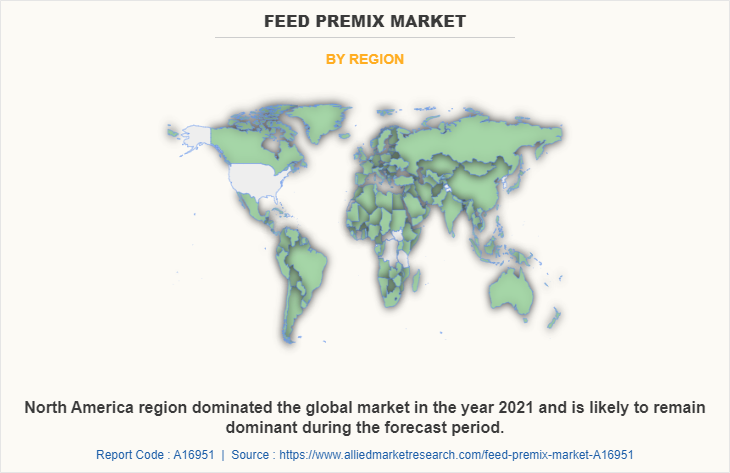

By Region

By region, the market is divided into North America, Europe, Asia-Pacific, and LAMEA. North America led in terms of feed premix market Share in 2021 and is expected to retain its dominance during the forecast period. According to the International Health, Racquet & Sports Club Association (IHRSA), due to the growth of the U.S. health and fitness industry, the consumption of animal protein is likely to increase and is expected to grow at a faster rate during the forecast period. This is attributed to the rising number of U.S. consumers adopting a healthy lifestyle or indulging in activities that promote an active and healthy lifestyle. Presently, about 20% of U.S. adults have fitness club memberships, and the number is expected to increase in the future. This is further expected to boost the demand for better feed premix in the process.

The report focuses on the feed premix market growth prospects, restraints, and opportunities of the global feed premix market. The study provides Porter’s five forces analysis to understand the impact of various factors such as competitive intensity of competitors, the bargaining power of suppliers, the threat of substitutes, the threat of new entrants, and the bargaining power of buyers of the Feed premix market.

Competitive Landscape

The players operating in the global feed premix market have adopted various developmental strategies to increase their market share, gain profitability, and remain competitive in the market. The key players operating in the feed premix market include DSM, BASF SE, Cargill, Incorporated, Nutreco N.V., InVivo Group, Jubilant Life Sciences, Koninklijke Coöperatie Agrifirm U.A., Phibro Animal Health Corporation, Archer Daniels Midland Company, Agrofeed, and Novus international.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the feed premix market analysis from 2021 to 2031 to identify the prevailing feed premix market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the feed premix market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global feed premix market trends, key players, market segments, application areas, and market growth strategies.

Feed Premix Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 11.4 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 232 |

| By Livestock |

|

| By Type |

|

| By Form |

|

| By Region |

|

| Key Market Players | SVH Holding N.V., Kemin Industries, Inc., Archer Daniels Midland Company, Novus International, Inc., De Heus Voeders B.V., Koninklijke DSM N.V., BASF SE, Phibro Animal Health Corporation, Alltech, Inc., Cargill, Incorporated, Royal Agrifirm Group, AgroFeed Ltd. |

Analyst Review

The increasing adoption of sustainable and environment-friendly animal farming among growers results in new and innovative product search. In addition, the increasing demand for organic products with visibility for nutritional content is expected to support the demand for feed premix. Furthermore, increasing egg and meat consumption is contributing to the market growth.

As disposable income of the consumers increases, meat consumption tends to increase. High expenditure elasticity in poultry indicates its dominance in the diet, both in the developed and the developing countries. There is generally a positive relationship between per capita consumption of poultry products and per capita incomes. This positive relationship supports the general economic theory, which suggests that as incomes increase, particularly in developing countries, people are predicted to increase their consumption of high income-elastic food.

Technology change in the poultry industry, led by advances in breeding that improved animal size, fecundity, growth rate, and uniformity, has enabled farmers to increase output per unit of feed, produce more birds per year, improve animal disease control, and decrease mortality. These factors enhance the market for feed premix.

Pet humanization has become a common practice as majority of the pet owners tend to treat pets like a family member. This trend has led to a corresponding increase in the amount of money that people are willing to spend on their pets, as well as the number of products and services available in the market to meet the demands of pet owners. The increase in pet humanization has led to rise in demand for pet food, which includes feed premix. Pets are increasingly being seen as members of the family, and as such, pet owners are willing to invest in pet’s diet and nutrition. According to American Pet Products Association (APPA), in the year 2021, $123.6 billion was spent on pet out of $50 billion was spent only on pet food and treats in U.S alone. This trend is expected to continue, as the bond between humans and their pets continues to grow.

The global feed premix market was valued at $5.1 billion in 2021, and is projected to reach $11.4 billion by 2031

The global Feed Premix market is projected to grow at a compound annual growth rate of 8.8% from 2022 to 2031 $11.4 billion by 2031

Phibro Animal Health Corporation, AgroFeed Ltd., SVH Holding N.V., BASF SE, Royal Agrifirm Group, Cargill, Incorporated, Novus International, Inc., De Heus Voeders B.V., Archer Daniels Midland Company, Alltech, Inc., Koninklijke DSM N.V., Kemin Industries, Inc.

North America led in terms of feed premix market Share in 2021

Increase in the standard of living among people, Increase in demand and consumption of livestock-based products such dairy and dairy-based products, meat, and eggs

Loading Table Of Content...