Flavored Alcohol Market Research, 2032

The global flavored alcohol market size was valued at $1.2 trillion in 2022, and is projected to reach $1.8 trillion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. ‘Flavored alcohol’ is a term used to describe alcoholic beverages that have been infused or flavored with various extra ingredients to give them a specific taste or aroma that is distinct from the natural flavor of the base spirit. Fruits, herbs, spices, botanicals, and other natural and artificial flavorings are examples of flavorings.. Plants, seeds, roots, or herbs are used as flavoring materials in the distillation procedure. They are softened in the base spirit, then combined with additional spirits and distilled. After the base spirit is completely flavored, it is sweetened and filtered. Plant liqueurs are frequently colored with vegetable colorings.

Changing consumer preferences have contributed significantly to the growth of the flavored alcohol market. Modern consumers, particularly younger generations such as millennials and generation Z, are increasingly looking for unique and novel beverage experiences. They are drawn to flavors that give novelty and excitement rather than standard alcoholic beverages. Flavored alcoholic drinks meet these preferences by offering a variety of flavors, including fruity, spicy, herbal, and even unusual combinations. Consumers are interested in the full sensory experience, which includes the textures and scents that flavored options provide. This need for diversity and exploration has boosted the expansion of the flavored alcohol market, as producers continue to introduce new and fascinating flavor profiles in order to grab the interest of consumers. All thses factors are anticipted drive the flavored alcohol market growth.

The flavored alcoholic drinks industry encounters regulatory constraints in many locations, which can affect product availability and marketing. Specific flavor additives used in these drinks may be restricted by regulatory bodies owing to health concerns or to prevent misleading or deceptive claims. Furthermore, alcoholic beverage labeling standards, such as the disclosure of ingredients and alcohol concentration, can be strict and must be followed by manufacturers. Age verification is extremely important in the marketing and sale of flavored alcoholic drinks, as rules frequently require stringent steps to ensure that these goods are not promoted to minors. These regulatory barriers are anticipated to hamper market expansion as complying with multiple rules can be challenging and costly for businesses.

The flavored alcoholic industry is well-positioned to capitalize on the rising demand for ready-to-drink (RTD) beverages. Modern customers, who lead hectic lives and value convenience, are looking for hassle-free solutions that allow them to enjoy alcoholic beverages on the move or in social settings. RTD cocktails and pre-mixed beverages offer an optimal solution, as they come in convenient packaging and are immediately consumable without the need for any additional preparation or mixing.. The RTD market also appeals to consumers who lack substantial knowledge or expertise in mixology but yet want to enjoy a well-crafted beverage. The convenience element, combined with the large variety of flavors available, gives a substantial opportunity for growth and market expansion.

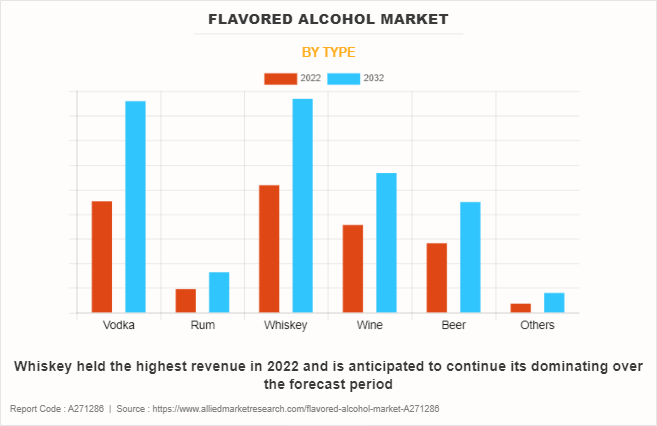

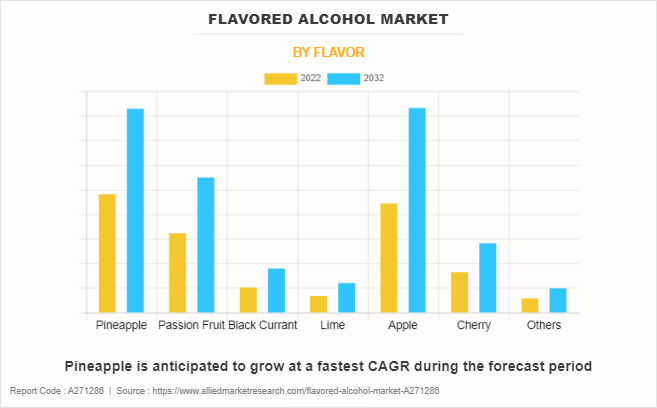

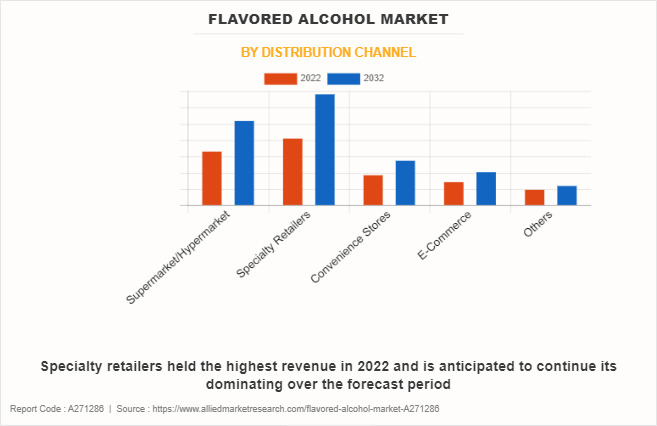

The flavored alcohol market is segmented on the basis type, flavor, distribution channel, and region. By type, the market is divided into vodka, rum, whiskey, wine, beer, and others. By flavor, the market is classified into pineapple, passion fruit, black currant, lime, apple, cherry, and others. By distribution channel, the market is classified into supermarket/hypermarket, specialty retailers, convenience stores, e-commerce, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segmental Overview

By Type

By type, the whiskey sub-segment dominated the market in 2022. Some of the significant drivers expected to boost demand include the increasing number of innovations in whisky products, including diverse flavors and product quality, as well as the easy affordability of the world's middle-class population. In recent years, global manufacturers have increased their investments in whisky product R&D and have taken efforts to promote whisky as a source of protein with improved digestibility. These initiatives have likely contributed to the enhanced global popularity of these products.. Furthermore, the rapid growth of the retail sector and the rapid development of various online retailing portals, which allow customers to make hassle-free purchases of whisky products, as well as the significant increase in promotional activities conducted by key market companies to capture consumer attention, are major factors driving the segment growth during flavored alcohol market forecast period.

By Flavor

By flavor, the pineapple sub-segment dominated the global flavored alcohol market share in 2022. Pineapple is a tropical and fruity flavor that many consumers find appealing. Its sweet and tangy taste makes it a popular choice for flavored alcoholic drinks. Pineapple-flavored alcohol is versatile in mixing cocktails, making it attractive to both bartenders and consumers who enjoy crafting their drinks. Pineapple-flavored ready-to-drink (RTD) cocktails, such as pineapple rum or pineapple vodka-based drinks, are convenient and popular among consumers seeking flavorful and easy-to-enjoy options. Pineapple is often a key ingredient in popular cocktails like piña coladas and tropical drinks. As cocktail culture continues to grow, demand for pineapple-flavored spirits is anticipated to increase.

By Distribution Channel

By distribution channel, the specialty retailers sub-segment dominated the global flavored alcohol market share in 2022. Specialty retailers are becoming increasingly popular due to the availability of a large selection of alcoholic beverages under one roof. Customers choose to buy alcoholic beverages that are on sale and offer health benefits owing to moderate intake. Furthermore, products are placed close to one another, allowing shoppers to quickly compare them and choose which item to purchase. specialty retailers appeal is enhanced further by urbanization, an increase in working-class population, and competitive prices. Customers can purchase goods from these sales formats at reasonable pricing, and they are often located in easily accessible locations. Therefore, consumers can meet all of their purchasing needs while saving time, attracting a significant consumer base to this sector.

By Region

By region, Europe dominated the global flavored alcohol market in 2022. The growing number of millennials interested in craft beers, seeking a fresh and innovative taste, as well as the calming ambiance of microbreweries and brewpubs, is driving the regional flavored alcohol market demand. According to the Brewers of Europe, Czechia had the highest per capita beer consumption in Europe in 2020, with 135 liters drunk, followed by Austria with 100 liters, Germany with 95 liters, Poland with 93 liters, and Romania with 87 liters. Furthermore, the popularity of specialty beer (craft beer) is growing across the region. Many new companies have entered the market with product offers that are specifically geared to particular client target groups. According to European Union Beer data, there were 9,500 breweries in operation in the European Union in 2020, representing an increase of nearly 1,000. There were approximately 6,000 new breweries in 2021 than the previous year. To increase sales, key businesses such as Anheuser-Busch InBev are redefining their strategies and bringing craft beers as an integral component of their growth plans.

Competitive Landscape

The key players profiled in this report include Kerry Group, Cargill Inc., ADM, Givaudan, Symrise AG, TOSHEV, Austria Juice, MANE, Dakini Health Foods, and Castel Group. Investment and agreement are common strategies followed by major market players. For instance, in June 2021, The Kerry Group introduced a new line of natural and organic alcoholic flavors to the global beverage sector. The flavors are intended to meet the growing desire for healthier and more sustainable alternatives.

Impact of COVID-19 on the Global Flavored Alcohol Industry

- Consumer behavior changed dramatically due to the lockdowns, social distancing measures, and limitations on the operations of bars &d restaurants. People started buying more alcohol for at-home use, particularly flavored alcohol, which resulted in higher retail sales and e-commerce orders. The pandemic accelerated the expansion of e-commerce in the alcohol sector. Customers switched to Internet platforms to buy flavored alcohol, resulting in an increase in online alcohol sales.

- During the pandemic, Ready-to-drink (RTD) flavored alcohol beverages, such as canned cocktails and hard seltzers, gained popularity as they provided a convenient, pre-mixed alternative for individuals who like to drink at home. Furthermore, some companies worked on producing new flavored alcohol products that responded to altering consumer preferences.

- Furthermore, with the return of all economic operations in the post-pandemic period, demand for alcoholic beverages is expected to increasing in the future. It is also expected that consumer spending on alcoholic drinks would increase as active players in the food & beverage industry develop new products in the alcoholic beverage market to provide customers with a diverse variety of options.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flavored alcohol market analysis from 2022 to 2032 to identify the prevailing flavored alcohol market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flavored alcohol market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flavored alcohol market trends, key players, market segments, application areas, and market growth strategies.

Flavored Alcohol Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.8 trillion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Flavor |

|

| By Distribution channel |

|

| By Region |

|

| Key Market Players | Symrise AG, TOSHEV, ADM, MANE, Kerry Group, Austria Juice, Cargill Inc., Dakini Health Foods, Givaudan, Castel Group |

The global flavored alcohol market size was valued at $1.2 trillion in 2022, and is projected to reach $1.8 trillion by 2032

The global Flavored Alcohol market is projected to grow at a compound annual growth rate of 4.6% from 2023 to 2032 $1.8 trillion by 2032

The key players profiled in this report include Kerry Group, Cargill Inc., ADM, Givaudan, Symrise AG, TOSHEV, Austria Juice, MANE, Dakini Health Foods, and Castel Group. Investment and agreement are common strategies followed by major market players.

By region, Europe dominated the global flavored alcohol market in 2022.

Changing consumer preferences, particularly among millennials and Generation Z, Growing demand for RTD beverages

Loading Table Of Content...

Loading Research Methodology...