Flexible AC Transmission System Market Research, 2032

The global flexible AC transmission system market was valued at $1.2 billion in 2022 and is projected to reach $2.3 billion by 2032, growing at a CAGR of 7% from 2023 to 2032. The flexible AC transmission systems market is expected to witness notable growth during the forecast period, owing to the advancement of electric power transmission systems, an increase in demand for controllability of power systems, and the need for high reliability under contingencies across the globe. In addition, the Flexible AC Transmission Systems (FACTS) Market is anticipated to benefit from the emergence of smart grids and an increase in dependency on renewable energy resources during the forecast period. On the contrary, the high initial cost of installation is anticipated to limit the growth of the flexible AC transmission systems market during the forecast period.

Flexible alternating current transmission system (FACTS) devices refer to a set of power electronic devices and systems used in electrical power transmission networks to enhance the control and flexibility of alternating current (AC) power flows. These devices are designed to improve the overall performance and efficiency of power transmission systems by regulating voltage, maintaining power flow stability, and increasing the transfer capability of transmission lines.

FACTS devices are typically installed at key points within the power grid, such as substations or along transmission lines, where they can actively control the voltage, impedance, and phase angle of the electrical signals. By manipulating these parameters, FACTS devices can mitigate problems such as voltage fluctuations, line congestion, and power factor issues. This enables utilities to achieve better utilization of existing transmission infrastructure, enhance system stability, and optimize power flow in real-time.

Some common types of FACTS devices include:

- Static var compensator (SVC): SVC devices are used to regulate and control the reactive power in a power system, thereby stabilizing voltage levels and supporting voltage control for flexible AC transmission line and flexible AC transmission system devices.

- Static synchronous compensator (STATCOM): STATCOM devices provide fast-reacting reactive power support to maintain voltage stability, improve power quality, and enhance the transient response of the system.

- Unified power flow controller (UPFC): UPFC devices offer simultaneous control of active and reactive power flow in transmission lines, allowing for enhanced power transfer capability and improved voltage regulation.

- Thyristor-controlled series capacitor (TCSC): TCSC devices use variable series capacitors to adjust the line reactance, thereby improving system stability, damping power oscillations, and increasing transmission capacity.

Segmentation Overview

The flexible AC transmission system market is segmented into Compensation Type, Controller, and Industry Vertical.

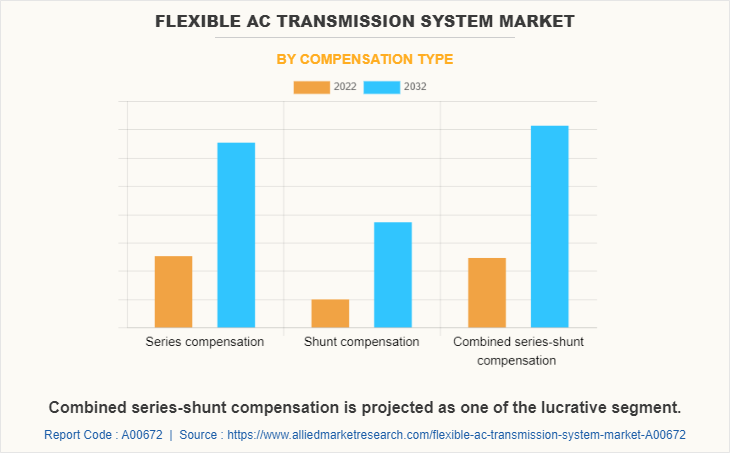

Based on compensation type, the flexible AC transmission system market outlook is divided into series compensation, shunt compensation, and combined series-shunt compensation. In 2022, the series compensation segment dominated the market in terms of revenue, and the combined series-shunt compensation segment is projected to acquire the highest CAGR from 2023 to 2032.

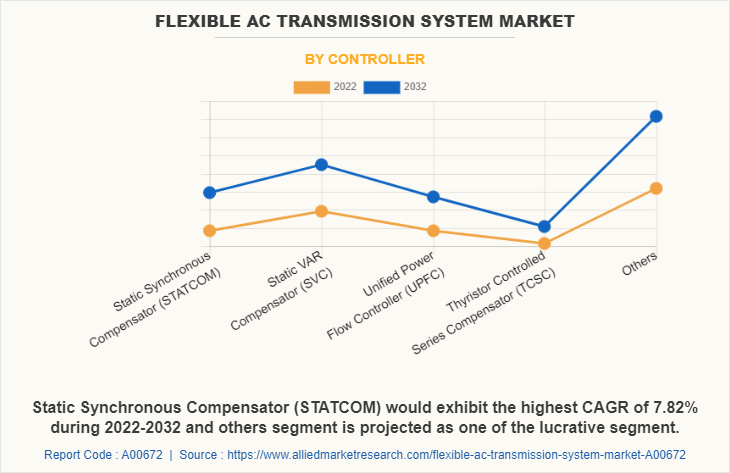

Based on the controller, the flexible AC transmission system market forecast is segregated into synchronous compensator (STATCOM), static VAR compensator (SVC), unified power flow controller (UPFC), thyristor-controlled series compensator (TCSC), and others. The other segment acquired the largest share in 2022, and synchronous compensator (STATCOM) is expected to grow at a significant CAGR from 2023 to 2032.

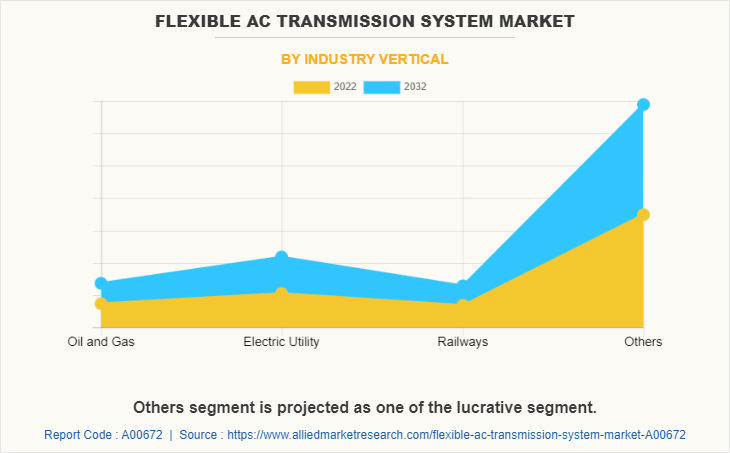

Based on industry vertical, the flexible AC transmission system market growth is bifurcated into oil and gas, electric utility, railways, and others. The other segment acquired the largest share in 2022, and the electric utility segment is expected to grow at a significant CAGR from 2023 to 2032.

Region-wise, the flexible AC transmission systems market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Regional Analysis

Region-wise, the U.S. acquired a prime share in the flexible AC transmission systems market in the North American region and is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, Germany dominated the flexible AC transmission system market share, in terms of revenue, in 2022, and is expected to follow the same trend during the forecast period. However, France is expected to emerge as the fastest-growing country in Europe's flexible AC transmission system market share with a CAGR of 7.61%.

In Asia-Pacific, China is expected to emerge as a significant market for the flexible AC transmission system industry, owing to a significant rise in investment by prime players due to a rise in investment in renewable energy resources for rural and urban electrification in the region.

By LAMEA region, Latin America held a significant market share in 2022. The LAMEA flexible AC transmission system market size has been witnessing improvement, owing to the surge in inclination of companies toward research and development and expansion of manufacturing units of various compensation types and industry verticals across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 6.16% from 2023 to 2032.

Historical Data & Information

The global flexible AC transmission systems market is highly competitive, owing to the strong presence of existing vendors. Vendors of the flexible AC transmission systems market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

ABB Ltd, Adani Power Ltd, ALSTOM SA, CG Power and Industrial Solutions Limited, Eaton Corporation, General Electric, Hyosung Corporation, Mitsubishi Electric Corporation, NR Electric Co., Ltd, and Siemens AG are the top companies holding a prime share in the flexible AC transmission systems market. Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others, to expand their foothold in the flexible AC transmission systems (FACTS) market.

- In March 2023, Mitsubishi Electric Corporation announced that it received an order for a static synchronous compensator (STATCOM) rated at ±700MVA, the largest capacity class, from Tohoku Electric Power Network Co., Inc., which is headquartered in Sendai, Miyagi Prefecture. The STATCOM is expected to be operational by the end of 2031. Renewable energy generation in northeastern Japan's power grid is expected to contribute the carbon neutrality..

- In October 2021, GE Research and Prolec GE teamed with Cooperative Energy and announced to develop and install the flexible large power transformer at the utility’s major substation in Columbia, Mississippi. This substation is part of a service network that delivers power to nearly half a million homes and businesses across Mississippi.

- In September 2021, Adani Transmission Ltd announced an investment of 160 MN USD in eastern Madhya Pradesh to strengthen the power transmission system for MP Power Management Company Ltd (MPPMCL).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flexible AC transmission system market from 2022 to 2032 to identify the prevailing flexible AC transmission system market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the flexible AC transmission system market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global flexible AC transmission system market trends, key players, market segments, application areas, and market growth strategies.

Flexible AC Transmission System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.3 billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 275 |

| By Compensation Type |

|

| By Controller |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Hyosung Corporation., Mitsubishi Electric Corporation, Alstom SA, NR Electric Co., Ltd., General Electric, CG Power and Industrial Solutions Limited., ABB Ltd., Eaton Corporation, Siemens, Adani Power Ltd |

Analyst Review

According to the perspectives of CXOs of a leading flexible AC transmission systems (FACTS) market is expected to continue growing in the coming years, owing to increase in demand for electricity, grid modernization initiatives, integration of renewable energy sources, and focus on grid flexibility and reliability.

In addition, the increase in adoption of flexible AC transmission systems (FACTS) in various applications, such as voltage control, power flow management, renewable energy integration, grid stability enhancement, and power quality improvement, is driving the growth of the market. In voltage control, FACTS devices like static VAR compensators (SVC) and static synchronous compensators (STATCOM) regulate voltage levels and maintain grid stability. Power flow management involves devices like unified power flow controllers (UPFC) and thyristor-controlled series capacitors (TCSC) that optimize active and reactive power flow, reducing congestion and improving system efficiency. FACTS technologies also play a vital role in integrating renewable energy sources into the grid by addressing the challenges of intermittency, voltage regulation, and power quality control. Furthermore, FACTS devices enhance grid stability by providing rapid control of reactive power and damping power oscillations. Lastly, FACTS devices contribute to power quality improvement by reducing voltage fluctuations, harmonics, and other disturbances, ensuring reliable and high-quality power supply. The wide range of applications and benefits associated with FACTS devices are fueling their increasing adoption in the market.

There is a rise in demand for electricity, particularly in emerging economies, owing to the growing population and urbanization. This increase in demand for electricity in emerging economies is driving the growth of the flexible AC transmission systems (FACTS) market. The need for reliable and efficient power transmission becomes paramount with growth in population and expansion of urbanizationtransmission. FACTS devices play a crucial role in meeting this demand by optimizing power flow, enhancing grid stability, and maximizing transmission capacity.

In emerging economies, the rapid urbanization and industrialization processes put significant strain on existing power infrastructure. The deployment of FACTS technologies enables utilities to improve the efficiency and reliability of their power transmission networks. FACTS devices help address the challenges associated with increasing electricity demand by regulating voltage, managing power flow, and mitigating grid issues.

Furthermore, emerging economies often face challenges related to integrating renewable energy sources into their power grids. FACTS devices offer solutions for voltage control, power flow management, and stability enhancement, facilitating the smooth integration of renewable energy resources. This is particularly important as many emerging economies seek to reduce their reliance on fossil fuels and transition towards more sustainable energy systems.

The growth of the FACTS market in emerging economies is also supported by government initiatives and investments in infrastructure development. Governments recognize the importance of modernizing their power grids to meet the rise in energy demand and achieve energy security and sustainability goals. Supportive policies, regulatory frameworks, and financial incentives further drive the adoption of FACTS technologies in these markets.

Growing Demand for Renewable Energy Integration and Expansion of High Voltage Direct Current (HVDC) Systems are the upcoming trends of Flexible AC Transmission System Market in the world.

Electric Utility is the leading application of Flexible AC Transmission System Market.

Asia-Pacific is the largest regional market for Flexible AC Transmission System.

The global flexible ac transmission system market was valued at $1,194.22 million in 2022.

ABB Ltd, Adani Power Ltd, ALSTOM SA, CG Power and Industrial Solutions Limited, Eaton Corporation, General Electric, Hyosung Corporation, Mitsubishi Electric Corporation, NR Electric Co. Ltd, and Siemens AG are the top companies to hold the market share in Flexible AC Transmission System.

Loading Table Of Content...

Loading Research Methodology...