Flooring Market Research, 2031

Flooring Market Dynamics

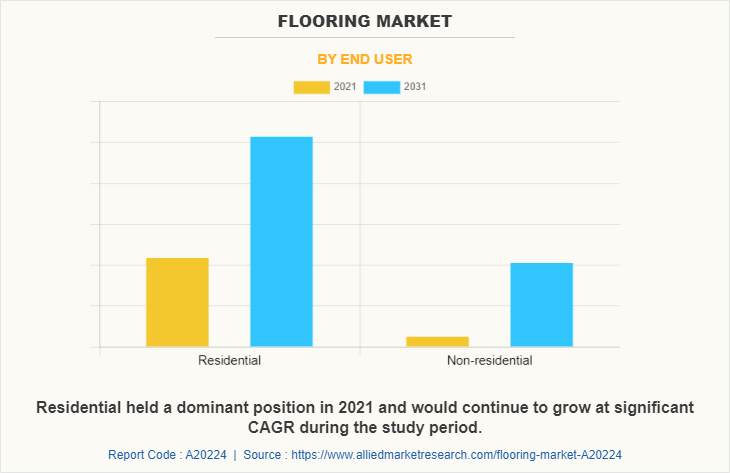

Rise in the construction of residential buildings in the developing nations has significantly increased the demand for flooring solutions. In addition, owing to the COVID-19, the global tourism sector witnessed a slight downtrend. However, such negative trends are expected to subside in the next two years. This will lead to the increased number of buildings such as hotels and resorts, thereby increasing demand for the flooring market. Furthermore, home remodeling is witnessing a boom in developed countries in regions such as Europe and North America, owing to increase in disposable income and exponential rise in cost of new homes.

This is expected to drive the demand for flooring market. For instance, according to a Harvard Joint Centre for housing studies article published in January 2021, the growth of house remodeling and repair expenditures has increased from 3.5% in 2020 to 3.8% in 2021, based on the most recent Leading Indicator of Remodeling Activity (LIRA). In addition, various governments across the world are investing in the residential sector in response to the rise in population and improved living conditions. Several incentive schemes for efficient residential structures and refurbishment were modified and relaunched at the start of 2021 to help fulfil these goals. As a result of increase in population, these expenditures in the building sector are expected to enhance the use of indoor flooring, resulting in flooring market growth.

In addition, major manufacturers of flooring offer a wide range of products and services to meet customer needs. This helps the manufacturers to stay competitive in the flooring market. For instance, Armstrong Flooring Inc., a major market player in the flooring industry, introduced three new innovative heterogeneous sheet collections, Asana, Nidra, and Zenscape. These sheets include the company's patented technology known as Diamond 10 Technology. It includes a wear layer that uses cultured diamonds to provide scratch, stain, and scuff resistance to the floor, while eliminating the need for polish.

The novel coronavirus had rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many flooring components due to lockdown. Initially, the economic slowdown reduced spending on various residential and non-residential building construction projects. However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly decreased. As of mid-2022 the number of COVID-19 cases had diminished significantly. This led to the full-fledged reopening of flooring manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

In addition, rise in the number of non-residential projects under public-private partnership is expected to provide lucrative growth opportunities for the flooring market. Furthermore, the increased focus on sustainability has significantly boosted the use of flooring solutions with a lower carbon footprint.

Flooring Market Segmantation Overview

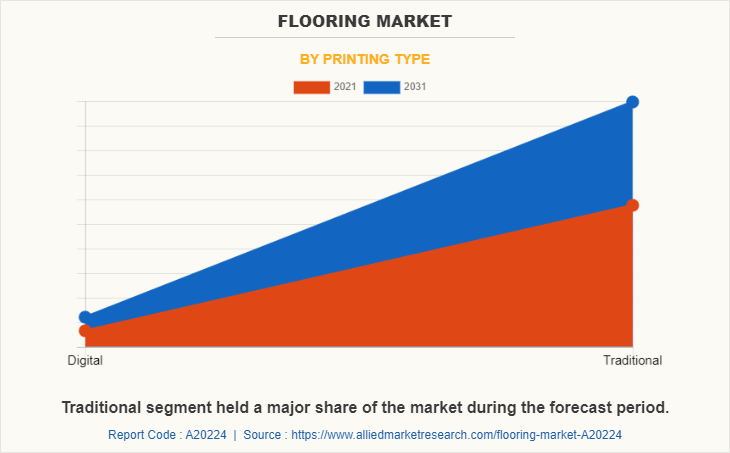

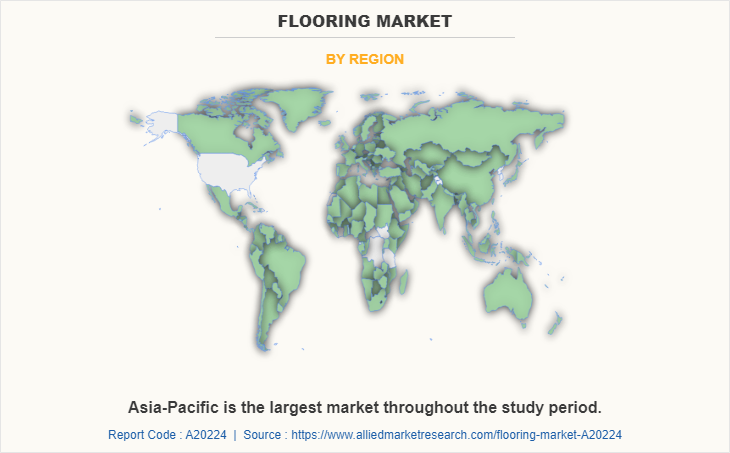

The flooring market is segmented into Printing Type, Material and End User. By printing type, the flooring market is bifurcated into digital and traditional. On the basis of material, the flooringmarket is categorized into wood, stone, ceramic, laminate, and others. By end-user industry, it is categorized into residential and non-residential. On the basis of region, the flooring market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific held the major flooring market share, accounting for the highest share. LAMEA is anticipated to grow at the highest CAGR during the forecast period. This is attributed to rise in urbanization and disposable income in the region.

Competition Analysis

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the flooring market segments, current trends, estimations, and dynamics of the flooring market analysis from 2021 to 2031 to identify the prevailing flooring market opportunity.

- The flooring market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flooring market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global flooring market.

- flooring market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flooring market trends, key players, market segments, application areas, and market growth strategies.

Flooring Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 558.2 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 229 |

| By Printing Type |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Tarkett S.A., ARMSTRONG FLOORING, Milliken and Company, Mohawk Industries, Inc., Beaulieu International Group, Mats Inc., Shaw Industries, ECORE International, Inc., FORBO FLOORING, Fiberon,, Interface Inc., Iron Woods, Toli Corporation, Ebaco India Pvt. Ltd., AZEK Company, Citadel Floors |

Analyst Review

The flooring market has witnessed significant growth in the past few years, owing to surge in spending on building construction activities.

Rise in the trend of home remodeling activities, particularly in high-income countries in North America and Europe, has fueled demand for flooring. In addition, rise in urbanization is positively influencing residential and non-residential building construction. Furthermore, the global tourism sector is driving the demand for construction of highly elegant guest accommodations. Such factors are expected to play an instrumental role in growth of flooring market.

Moreover, various countries, such as China, India, and Canada, are turning toward public-private partnerships (PPPs) as a mode of infrastructure development. Such government initiatives are expected to boost the flooring market, especially in the non-residential segment.

Furthermore, the concept of sustainable development is becoming the focus area of everyone across the globe, thus driving the demand for products with a lower carbon foot print. In addition, to support sustainability, key market players are innovating to produce PVC-free flooring solutions. Therefore, rise in demand for sustainable products is anticipated to provide lucrative opportunities for the market growth.

The increased use of digital printing technology is a major trend in the flooring market.

Flooring solutions are extensively used for indoor and outdoor applications in residential as well as non-residential buildings.

Asia-Pacific is the largest regional market for Flooring.

$320,289 Million is the estimated industry size of Flooring in 2021.

Armstrong Flooring, AZEK Company, Beaulieu International Group, Citadel Floors, Ebaco India Pvt. Ltd., ECORE International, Inc. and Fiberon are some of the top companies to hold the market share in Flooring.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The product launch is key growth strategy of flooring industry players.

The flooring market is projected to reach $558,208.6 million by 2031.

Loading Table Of Content...