FMCG Logistics Market Overview

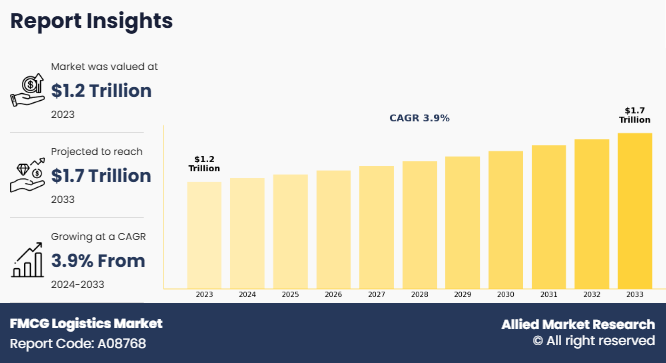

The global fmcg logistics market was valued at $1.2 trillion in 2023, and is projected to reach $1.7 trillion by 2033, growing at a CAGR of 3.9% from 2024 to 2033. The FMCG Logistics Market is witnessing strong growth fueled by rising e-commerce penetration, demand for faster deliveries, evolving consumer lifestyles, and increasing adoption of tech-driven logistics solutions, including IoT-enabled connected devices.

Key Market Trends

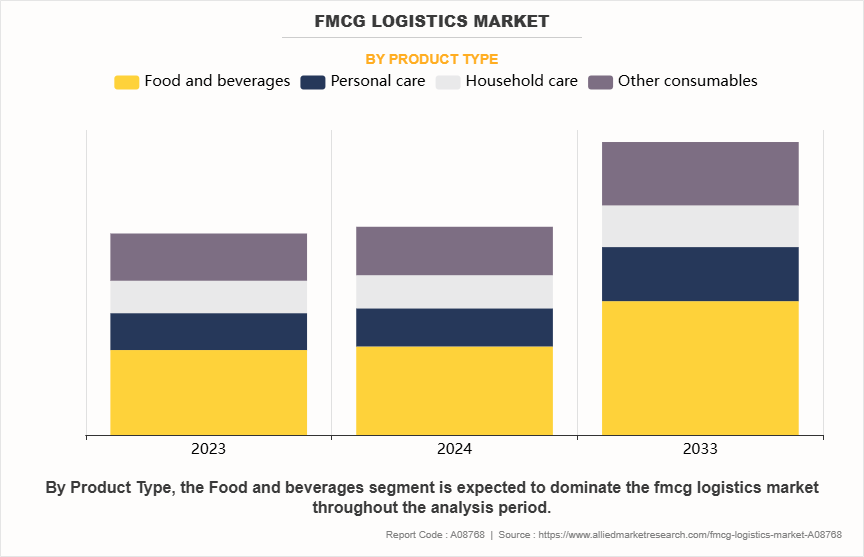

Product Type: The food and beverage segment is expected to witness notable growth in the FMCG logistics market soon.

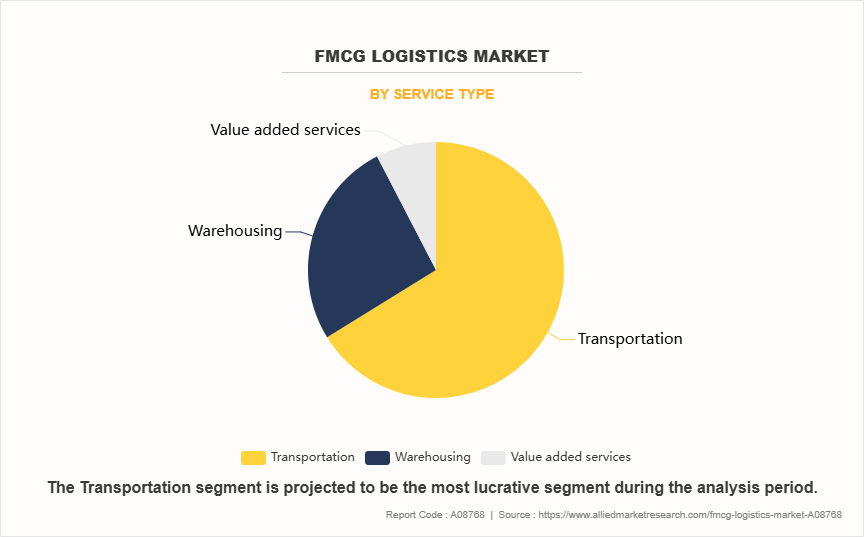

Service Type: The transportation segment is projected to grow significantly in the coming years.

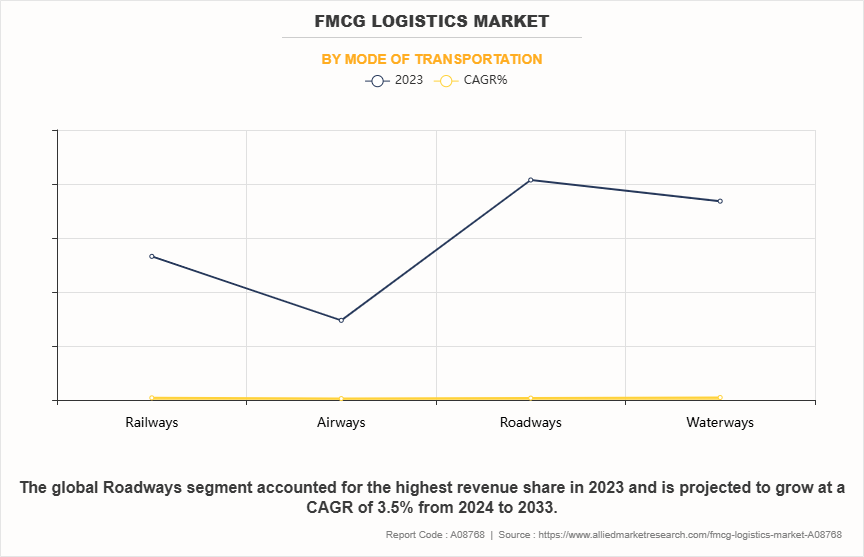

Mode of Transportation: The waterway segment is anticipated to register substantial growth in the FMCG logistics industry in the near future.

Market Size & Forecast

2033 Projected Market Size: USD 1.7 trillion

2023 Market Size: USD 1.2 trillion

Compound Annual Growth Rate (CAGR) (2024-2033): 3.9%

Report Key Highlighters:

The FMCG logistics market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The FMCG logistics market share is highly fragmented, into several players including C.H. Robinson Worldwide Inc., Kuehne+Nagel, DSV , Db Schenker, XPO Logistics, Inc., Geodis, United Parcel Service, Inc., A.P. Moller – Maersk, Deutsche Post Ag and FedEx. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

FMCG logistics refers to the specialized supply chain management and distribution processes which involved handling products that have a short shelf life, and are in continuous demand. FMCG logistics include procurement, warehousing, inventory management, transportation, and last-mile delivery to ensure goods such as food, beverages, personal care products, and household items reach retailers and consumers efficiently. The FMCG logistics process also includes maintaining product freshness, minimizing transit times, managing high-volume distribution, and optimizing storage to reduce waste and costs. In recent years there is also growing adoption of advanced technologies such as real-time tracking, AI-driven demand forecasting, and automation to streamline FMCG logistics operations.

What factors are driving and restraining the market growth

The global FMCG logistics industry growth is driven by growing penetration of e-commerce in the FMCG industry, changing lifestyles & consumer habits coupled with rise in disposable income, and rise in tech-driven logistics services and growing adoption of IoT-enabled connected devices. However, factors such as poor infrastructure and higher logistics costs, and lack of control of manufacturers and retailers on logistics service hinders the growth of the market to some extent. On the contrary, emergence of last mile deliveries coupled with logistics automation and reduction in cost and lead time due to use of multi-modal system are anticipated to offer lucrative market growth opportunities for FMCG logistics market size.

Earlier, consumers used to purchase products by physically visiting stores. However, with evolving technological advancements, there has been a significant shift towards online shopping. This transformation has been driven by several factors, including the rising awareness of personal care products, the growing adoption of health and wellness products, and the increasing popularity of cosmetics and other consumer essentials. These trends have significantly contributed to the expansion and sales of fast-moving consumer goods.

Moreover, factors such as rising disposable income, shifting consumption patterns, and evolving lifestyles have further fuelled the demand for FMCG products. Additionally, rapid urbanization, higher incomes, and expanding organized online retail have boosted food and beverage consumption. These factors are expected to further drive the demand for FMCG logistics market during the forecast period.

What are the Recent Developments in the FMCG logistics Market

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

March 2025, XPO Logistics, Inc. partnered with DCS Group for full truckload logistics services in the UK. The major aim of the new partnership is to leverage XPO Logistics' expertise in the fast-moving consumer goods (FMCG) sector and implement the XPO Logistics IT solutions to enhance DCS Group's customer experience. DCS group provide financing and manufacturing support to Brands include Colgate, Pampers, Cow andamp; Gate, Lemsip, Calpol, Nurofen, Daz, Surf, Comfort, Febreze, Andrex, Fairy, Finish, Domestos, Winalot, Felix, Bakers, Pedigree, and Go Cat. The company will use Hydrotreated Vegetable Oil (HVO) fuel vehicles as an alternative to diesel vehicles for deliveries.

January 2024, United Parcel Service, Inc announced it has completed the acquisition of Frigo-Trans and its sister company BPL, which is a industry leading, complex healthcare logistics solutions provider across Europe. The acquisition will help UPS to further develop its UPS Healthcare segment, and tackle its growing need for temperature-controlled and time-critical logistics solutions globally.

On November, 2024 Kuehne+Nagel collaborated with Menarini for distribution of its products in Türkiye. Menarini, is a global pharma company the partnership will leverage Kuehne+ Nagel expertise in cold chain and FMCG logistics to distribute the company products throughout Türkiye.

FMCG Logistics Market Segment Review

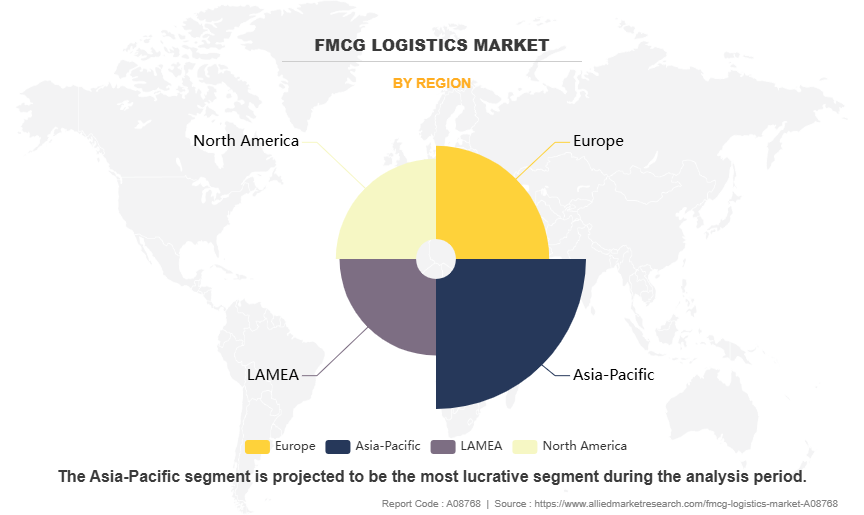

The global FMCG logistics market share is segmented into product type, service type, mode of transportation and region. On the basis of product type the market is analysed into food & beverages, personal care, household care, and other consumables. Based on service type, the global market is segregated into transportation, warehousing and value added services. On the basis of mode of transportation, the global market is analysed into railways, airways, roadways, and waterways. Region wise the market is analysed into North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

By product type, the global FMCG logistics market size is categorized into food and beverages, personal care, household care, and other consumables. The food and beverage segment dominated the global FMCG logistics market in 2023, owning to the growing trend toward healthy lifestyle is influencing the sector expansion, as consumers are become more health-conscious and adopt special diets, the demand for food and beverage logistics grows.

By Service Type

By service type, the global FMCG logistics market growth is analyzed into transportation, warehousing and valued added services. The transportation segment dominated the global FMCG logistics market in 2023, owing to the rapid expansion of e-commerce, growing urbanization, and evolving consumer expectations for faster deliveries. As FMCG products, including food, beverages, personal care items, and household goods, require quick replenishment and efficient distribution, require efficient transportation. Moreover, the surge in online shopping and digital retail platforms has intensified the need for last-mile delivery solutions, forcing companies to invest in efficient transportation system.

By Mode of Transportation

By mode of transportation, the global FMCG logistics market is segmented into railway, airway, roadways and waterways. The roadway segment dominated the global market in 2023, owing to growing demand for e-commerce, rapid urbanization, and increase in consumer demand for faster deliveries. Moreover, with the increase growth in online retail and quick commerce, companies are investing in efficient road transport networks to support same-day and last-mile deliveries. In addition, roadways provide door-to-door service, which is critical for FMCG distribution, particularly in rural and remote areas where other modes such as rail or air are less accessible.

By Region

Region wise the global FMCG logistics industry is segregated into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the global market share in 2023, owing to rapid urbanization, particularly in China, India, Indonesia, and Southeast Asia, has led to an increasing demand for packaged food, personal care products, and household essentials. Moreover, higher spending on premium and convenience products particularly in countries such as India and China have seen rise in per capita income, leading to greater demand for online grocery shopping, ready-to-eat meals, and health-conscious FMCG products.

Growing penetration of e-commerce in the FMCG industry

E-commerce involves the buying and selling of goods through the internet and is transforming the global retail industry. E-commerce offered additional benefits such as real-time inventory visibility, estimated delivery times, multiple shipping options with tracking, and easy return policies. Moreover, in recent years with the technological development in the logistics industry online grocery services and retailers such as Big Basket, Flipkart, and Amazon, have enhance the accessibility of FMCG products by offering discounts, festive sales, and same-day delivery options.

For instance, from March 7 to March 13, 2025, Flipkart announced its Big Saving Days sale. During this event, the company offered discounts on a wide range of FMCG products, including groceries, personal care items, and household essentials. The sale featured price discounts, limited-time flash deals, and additional discounts for Flipkart Plus members, making everyday essentials more affordable for a diverse range of consumers. Additionally, the company introduced bundle offers, cashback deals, and no-cost EMI options to enhance savings. Moreover, Flipkart also announced same-day and next-day delivery services for FMCG items, catering to the increasing demand for quick and convenient online grocery shopping. Such offers by major e-commerce companies are anticipated to be a major driving factor for the growth of FMCG logistics market trends.

Emergence of last mile deliveries coupled with logistics automation

Last-mile logistics refers to the final stage of the delivery process, where goods are transported from a distribution centre or warehouse to the end customer. With the rapid expansion of e-commerce companies, the demand for fast and efficient last-mile deliveries has grown significantly, making it a key focus area in the FMCG logistics market opportunities.

Additionally, same-day delivery is become increasingly common, further driving the growth of last-mile delivery services. The rising demand for FMCG products, including groceries, perishables, and food & beverages, has also pushed e-commerce companies to enhance their last-mile logistics capabilities. As a result, logistics service providers are investing in faster, more reliable, and cost-effective last-mile delivery solutions to meet evolving consumer expectations.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the FMCG logistics market forecast, segments, current trends, estimations, and dynamics of the FMCG logistics market analysis from 2023 to 2033 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the FMCG logistics market demand.

- The report includes the analysis of the regional as well as global FMCG logistics market insights, trends, key players, market segments, application areas, and market growth strategies.

FMCG Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.7 trillion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Product Type |

|

| By Service Type |

|

| By Mode of Transportation |

|

| By Region |

|

| Key Market Players | XPO Logistics, Inc., United Parcel Service Inc., DB Schenker, DSV, Deutsche Post AG, FedEx, GEODIS, C.H. Robinson Worldwide Inc., A.P. Moller - Maersk, Kuehne+Nagel |

The integration of autonomous and driverless technology are the upcoming trends in the FMCG logistics industry.

Roadside assistance is the leading application of the FMCG logistics Market.

Asia-Pacific is the largest regional market for FMCG logistics market.

The FMCG logistics industry was valued at $1,189.2 billion in 2023 and is estimated to reach $1,729.1 billion by 2033

Miller Industries, Inc., JERRDAN, LLC, Dynamic Towing Equipment & Manufacturing., Stellar Industries are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...