Crystalline Fructose Market Research, 2035

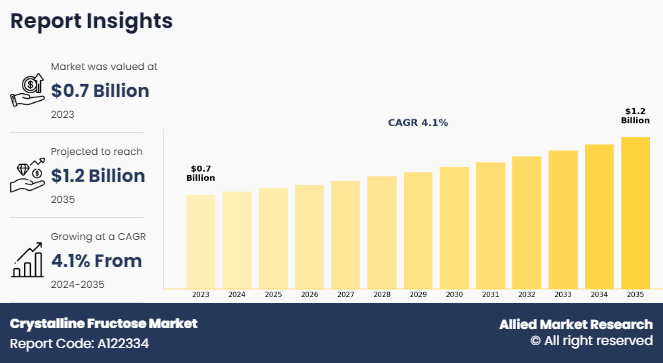

The global crystalline fructose market was valued at $743.3 million in 2023, and is projected to reach $1,198.6 million by 2035, growing at a CAGR of 4.1% from 2024 to 2035. The demand for crystalline fructose is primarily driven by its extensive utilization in the food and beverage industry, acting as a prominent sweetener and functional ingredient. The rising prevalence of lifestyle diseases such as obesity and diabetes has led to a growing demand for low-calorie sweeteners, propelling the consumption of crystalline fructose as a substitute for traditional sugar. Additionally, the increasing popularity of clean-label products and the shift towards natural ingredients have contributed to the escalating demand for crystalline fructose in the food and beverage sector. Furthermore, the expanding confectionery and bakery industries, particularly in developing economies, have acted as a significant driving force for the crystalline fructose market size.

Crystalline fructose is a naturally occurring sweetening substance and food additive found in fruits, vegetables and honey but can be cheaply produced from sugarcane or corn. It is sweeter than normal sugar, low in glycemic index, has slow blood glucose response, and slow release of insulin. Commercially, crystalline fructose is made from corn or sugarcane through enzymatic, purification and crystallization processes. It is widely used as a nutritive sweetener in food and beverage due to its functional properties and health benefits. Depending on the temperature at which the products are being consumed, crystalline fructose is the sweetest naturally occurring sugar of around 1.4 to 1.8 times when compared to sucrose.

Key Takeaways of the Crystalline Fructose Market Report

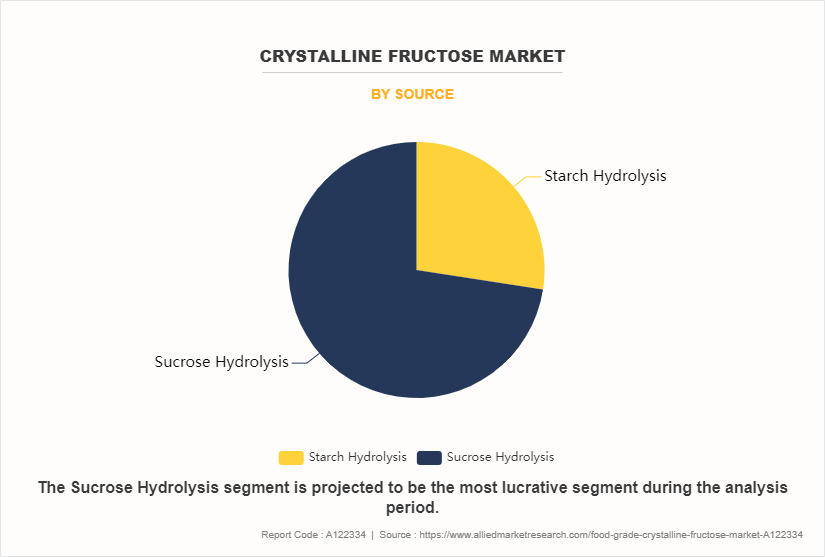

- By Source, the sucrose hydrolysis segment was the highest revenue contributor to the market in 2023.

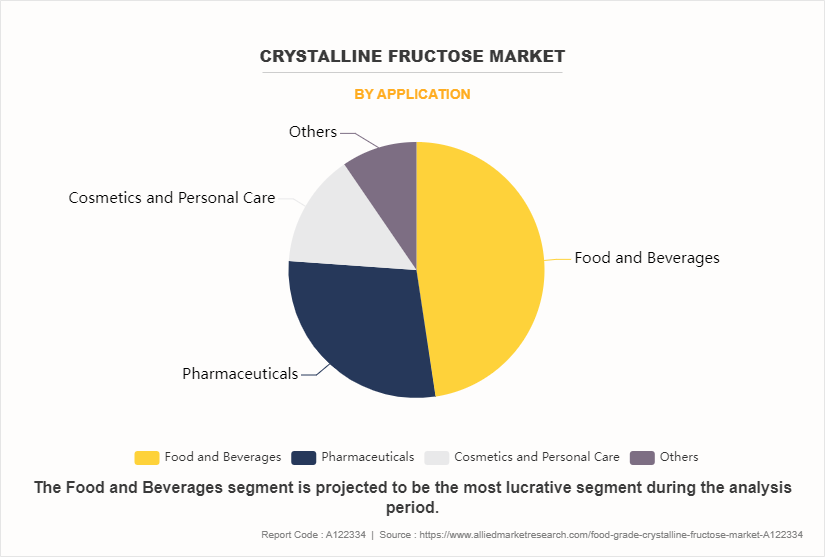

- As per Application, the food and beverages segment was the largest segment in the global crystalline fructose market during the forecast period.

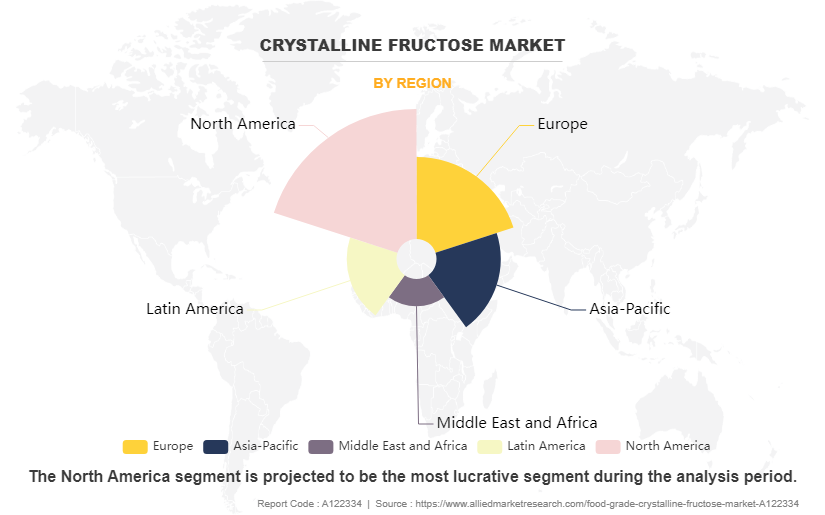

- Region-wise, North America was the highest revenue contributor in 2023 owing to the rising health consciousness, and growing sports and fitness industry.

Market Dynamics

The growing demand for natural sweeteners has increased the market demand for crystalline fructose significantly. As consumers increasingly prioritize health and wellness, there is a growing preference for artificial sweeteners like high fructose corn syrup (HFCS) and a preference for natural alternatives. Crystalline fructose, derived from fruits such as corn or sugar cane, fits this demand perfectly. Its natural origin appeals to health-conscious consumers seeking cleaner, more wholesome ingredients in their food and beverages. Furthermore, crystalline fructose offers a distinct advantage over other natural sweeteners like sucrose owing to its higher sweetness level and lower glycemic index, making it an attractive option for those monitoring their blood sugar levels or seeking to reduce their overall sugar intake.

The rise in demand for natural sweeteners has led to increased adoption of crystalline fructose across various industries, particularly in food and beverage manufacturing. Companies are reformulating their products to incorporate crystalline fructose as a natural sweetening agent, catering to consumer preferences for healthier options. Moreover, the versatility of crystalline fructose allows for its use in a wide range of applications, from soft drinks and baked goods to dairy products and confectionery, further fueling its market demand as a preferred natural sweetener choice.As per the crystalline fructose market forecast, this trend is expected to continue, with sustained growth projected in the coming years as more consumers prioritize clean label products and seek alternatives to artificial sweeteners.

However, health concerns and regulations can restrain the for crystalline fructose market share. Despite its natural origin, crystalline fructose, like other sweeteners, has faced scrutiny regarding its potential health effects. Some studies have raised concerns about excessive fructose consumption and its links to health issues such as obesity, diabetes, and metabolic syndrome. As a result, health-conscious consumers may opt to reduce their intake of fructose-containing products, including those sweetened with crystalline fructose. Additionally, regulatory bodies may impose restrictions or guidelines on the usage of crystalline fructose in food and beverage products to address these health concerns, further impacting its market demand.

Moreover, regulations related to labeling and claims can also impact the market demand for crystalline fructose. In many regions, food and beverage manufacturers are required to provide transparent and accurate labeling, including information on ingredients and nutritional content. As consumers become increasingly aware of the health implications of sugar consumption, they may actively seek out products with reduced sugar content or opt for alternatives to traditional sweeteners like crystalline fructose. Consequently, manufacturers may face pressure to reformulate their products or explore alternative sweetening options to comply with regulatory requirements and consumer preferences, potentially impacting the crystalline fructose market growth.

Furthermore, in pharmaceuticals, crystalline fructose is utilized as a filler in various formulations, particularly in oral medications and syrups. Its chemically inactive properties, stability, and sweetening capabilities make it a desirable ingredient for enhancing edibility and masking the taste of active pharmaceutical ingredients (APIs), thereby improving patient compliance and adherence to medication regimens. Moreover, the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions has stimulated the demand for sugar alternatives in pharmaceutical formulations, driving the adoption of crystalline fructose in the production of diabetic-friendly medications and dietary supplements.

Similarly, in the nutraceutical sector, crystalline fructose is gaining traction as a natural sweetener and functional ingredient in dietary supplements, sports nutrition products, and health beverages. Consumers are increasingly seeking healthier alternatives to traditional sweeteners, aligning with the clean label trend, and prioritizing natural ingredients in their nutritional supplements. Crystalline fructose offers a practical solution, providing sweetness without compromising on naturalness or healthiness. Additionally, its compatibility with various formulations and potential health benefits, such as its low glycemic index compared to other sweeteners, further positions it as a preferred choice for manufacturers in the nutraceutical industry, creating opportunities for growth and expansion in this market segment.

Segmental Overview

The crystalline fructose market analysis is segmented into source, application, and region. By source, the market is categorized into starch hydrolysis and sucrose hydrolysis. As per application, the market is classified into food and beverages, pharmaceuticals, cosmetics and personal care, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Source

By Source, the sucrose hydrolysis segment dominated the global crystalline fructose market in 2023 and is expected to register the highest CAGR of 3.9% during the forecast period, owing to the abundant availability and cost-effectiveness of sucrose, derived from sugarcane or sugar beets, making it a more economical choice as the raw material compared to starch sources used in the starch hydrolysis process. Additionally, the well-established infrastructure and processes of the sugar industry for extracting and purifying sucrose can be leveraged for crystalline fructose production through sucrose hydrolysis, reducing the need for significant additional investments.

By Application

By Application, the food and beverages segment dominated the global crystalline fructose market in 2022 and is anticipated to maintain its dominance during the forecast period with the highest CAGR of 3.9% during the forecast period. The unique properties of crystalline fructose, such as its high sweetness intensity, low glycemic index, and humectant properties, make it a desirable ingredient for manufacturers seeking to develop products that cater to health-conscious consumers and address concerns related to obesity, diabetes, and calorie intake. Additionally, the versatility of crystalline fructose allows for its integration into various formulations, enhancing flavor profiles and textures.

By Region

Region-wise, North America is anticipated to dominate the market with the largest share during the forecast period. The region has a well-established food and beverage industry, which is one of the primary consumers of crystalline fructose as a sweetening agent. With a large population and a high consumption rate of processed foods and beverages, there is a consistent demand for sweeteners like crystalline fructose. Additionally, North America benefits from a well-established infrastructure for sugar production, particularly from corn, which serves as a key feedstock for crystalline fructose production via sucrose hydrolysis. Moreover, consumer preferences for natural and clean label ingredients align with crystalline fructose's profile, further driving its demand in the region.

Competitive Analysis

Several well-known and up-and-coming brands are competing for market dominance in the expanding crystalline fructose industry. Smaller, niche firms have become more well-known for catering to consumer demands and tastes. Large conglomerates, however, still control the majority of the market and frequently buy creative start-ups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Companies that can influence the preferences of their considered audience and coordinate with their ethical and environmental principles hold a competitive edge against competitors.

Recent Developments in Crystalline Fructose Market

- In January 2023, Tate & Lyle, a world leader in ingredient solutions for healthier food and beverages, launched its new brand as Science Solutions Society.

- In August 2022, Cargill announced an investment worth USD 50 million toward building a sustainable corn syrup refinery in the Fort Dodge region, Iowa.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the crystalline fructose market analysis from 2023 to 2035 to identify the prevailing crystalline fructose market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the crystalline fructose market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global crystalline fructose market trends, key players, market segments, application areas, and market growth strategies.

Crystalline Fructose Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 294 |

| By Application |

|

| By Source |

|

| By Region |

|

| Key Market Players | Mitsubishi Corporation, Foodchem International Corporation, galam ltd., Xiwang Group, DuPont Nutrition & Biosciences, Tate & Lyle, Archer Daniels Midland Company, Gadot Biotechnology, Hebei Huaxu, Danisco |

Analyst Review

The perspectives of the leading CXOs in the crystalline fructose market are presented in this section. The demand for crystalline fructose is driven by its dual appeal originating from its versatile usage and numerous health benefits. Crystalline fructose serves as a compelling alternative sweetener owing to its exceptional sweetness profile and diverse applications across various industries. Its high sweetness intensity allows for reduced usage levels compared to traditional sweeteners, offering cost-effective solutions for food and beverage manufacturers while maintaining desirable taste profiles in their products. Moreover, crystalline fructose's solubility and stability make it an attractive ingredient for a wide array of food and beverage formulations, enhancing product quality and extending shelf life.

Furthermore, the food and beverage industry present a promising sector for crystalline fructose manufacturers to capitalize on its functional properties and health benefits. As manufacturers strive to meet evolving consumer demands for healthier product options, there is an increasing need for alternative sweeteners like crystalline fructose. Its ability to enhance product taste, texture, and quality while aligning with consumer preferences for natural ingredients positions it as a valuable ingredient for innovation in the food and beverage sector. By capitalizing on these opportunities, companies can meet the evolving needs of consumers while driving growth and innovation in the food and beverages sector.

The global crystalline fructose market was valued at $743.3 million in 2023, and is projected to reach $1,198.6 million by 2035

The global Crystalline Fructose market is projected to grow at a compound annual growth rate of 4.1% from 2024 to 2035 $1,198.6 million by 2035

The key players profiled in the reports includes Xiwang Group, Gadot Biotechnology, Tate & Lyle, Hebei Huaxu, Foodchem International Corporation, DuPont Nutrition & Biosciences, Danisco, Archer Daniels Midland Company, galam ltd., Mitsubishi Corporation

Region-wise, North America is anticipated to dominate the market with the largest share during the forecast period.

Growing Demand for Natural Sweeteners, Expanding Food and Beverage Industry, Preference for Low Glycemic Index Sweeteners

Loading Table Of Content...

Loading Research Methodology...