Frozen Dough Market Summary

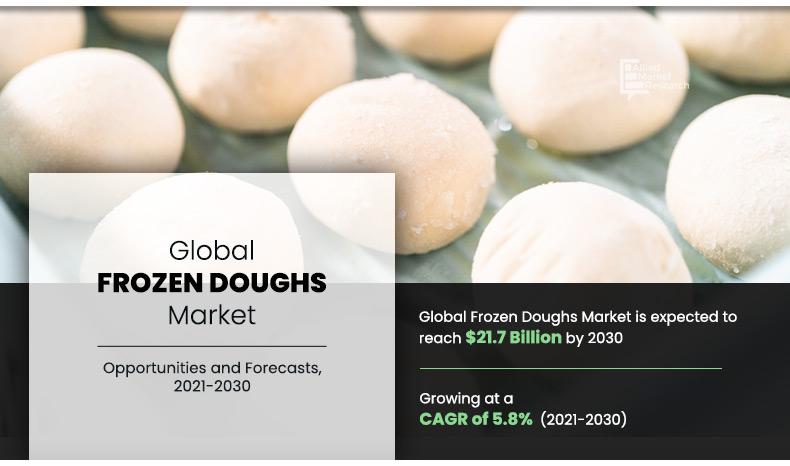

The frozen dough market size was valued at $10.1 billion in 2020, and is estimated to reach $21.7 billion by 2030, registering a CAGR of 5.8% from 2021 to 2030.

Key Market Trends and Insights

Region wise, Europe generated the highest revenue in 2020.

The global frozen dough market share was dominated by the food services segment in 2020 and is expected to maintain its dominance in the upcoming years

The bread & pizza dough segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2020 Market Size: USD 10.1 Billion

- 2030 Projected Market Size: USD 21.7 Billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 5.8%

- Europe: Generated the highest revenue in 2020

Frozen dough are uncooked or semi cooked food products that are stored or preserved at low temperature for a time duration of more than two months. They are often stored in freezers or cryogenic refrigerators. Frozen or refrigerated frozen dough includes cakes, cookies, muffins, pizza crust and others products.

Expansion of sales channel is the major factor that is expected to contribute in the frozen dough market growth in the near future, and online retail platform is the fastest growing segment. Presently, many retail players are managing their own web-based retail stores where customers can learn more about the organization and its products. The availability of multiple options of products and their price comparison on online platforms is also resulting in an increase in online shopping by the consumers. This is beneficial to the key players as it is eliminating the need for any physical outlets or stores and is also helping the customers to read reviews provided by other users, and compare various stores, products as well as the price by different sellers for the particular frozen dough purchased. Furthermore, as per the data of World Bank from 2019, North American region is the leader with approximately 88.4% of the population being internet users, followed by Europe and Central Asia, accounting for around 83.9% of internet users. Some of the popular online retailers in the market are Amazon.com, and Flipkart.com among others. Furthermore, besides only sales channel, the product availability is rising even in convenient stores and local shops in small regions, which is augmenting the market growth.

Segment review

The frozen dough market is segmented on the basis of type, end user, distribution channel and region. On the basis of type, the market is subdivided into biscuit & cookies, bread & pizza crust, rolls & pastry and other. On the basis of end user, the market is bifurcated into residential and food services segment. On the basis of distribution channel, the market is classified into hypermarket/supermarket, specialty stores, business to business and online sales channels. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, ASEAN, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, UAE, Saudi Arabia, South Africa and rest of LAMEA).

By End User

The food service segment dominates the Global Frozen Doughs Market and is expected to retain its dominance throughout the forecast period.

On the basis of type, the bread is the dominating segment, owing to its high consumption globally among consumers, which is propelling the demand for bread frozen dough in the market.

By Type

The Bread & pizza dough segment dominates the global Frozen Doughs market and is expected to retain its dominance throughout the forecast period.

By end user, the food service is the fastest growing segment, owing to the growing demand for ready to cook and serve snacks, which is propelling the demand for frozen dough. However, the residential segment will remain the largest dominating segment of the market, owing to high consumption of frozen dough by consumers at home, due to growth of sedentary lifestyle.

By Distribution Channel

The Business to Business segment dominates the global Frozen Doughs market and is expected to retain its dominance throughout the forecast period.

By distribution channel, online sales channel is the fastest growing segment, owing to the growth of internet penetration and smart phones around the globe, which is propelling the demand for refrigerated snacks.

By Region

The European region dominates the global Frozen Doughs market and is expected to retain its dominance throughout the forecast period.

Competitive Landscape

The players operating in the global frozen dough market have adopted various developmental strategies to increase their market share, gain profitability, and remain competitive in the market. The key players operating in the market include- General mills, Tyson Foods Inc., Ajinomoto, Rich Products Corp, CSM ingredients, J&J snacks Foods Corp., Bridgeford Foods, Europastry, Nestle, and Guttenplans.

COVID-19 impact analysis

- The COVID-19 pandemic has a negative impact on the global market.

- The demand for frozen dough increased in the residential segment during the pandemic as people were preferring to avoid stepping out of the home and frozen dough were an easy to store and cook option available, which led to the upsurge in consumption of frozen or refrigerated products during the pandemic.

- Owing to strict lockdown policies, restaurants and food services were shut down, which are the dominating segments of frozen dough. Therefore, due to the pandemic, the frozen dough market faced a negative impact.

- The market is expected to regain its market position by 2023.

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the frozen dough market trends, estimations, and dynamics of the market size from 2020 to 2030 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth frozen dough market analysis and the market size and segmentation assist to determine the prevailing frozen dough market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning analysis facilitates benchmarking and provides a clear understanding of the present position of the market players in the frozen dough industry.

Frozen Dough Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

Analyst Review

The consumption of frozen dough is on the rise, owing to surge in consumption from the commercial segment, majorly in bakeries and restaurants. Frozen dough are used for the production of biscuits & pastries. This dough works as a useful ingredient for a variety of dishes in bakeries and restaurants. Another factor that influences the demand for frozen dough is rise in demand for organic dough. There is an increase in the demand for organic products as consumers are becoming health conscious. Consequently, the demand for organic frozen dough has seen a multifold increase in the past four years, especially in the developed countries of North America and Europe regions including but not limited to the U.S., Canada, the UK, and Germany. The demand for organic frozen dough is expected to gain high traction across the globe with the growing consumer awareness regarding organic variant of the product and downward pressure on the price point.

The frozen dough market still faces multiple stiff challenge from the availability of the alternative products including but not limited to freshly cooked cakes and sweet baked snacks, bread, biscuit, sweets, pies, pastry cookies, pizza are some among others. Where breads are highly consumed snacks in the market, which does not require refrigeration and can be consumed directly. Moreover, in the UK, bread is bought by 99.8% of British households, and the equivalent of nearly 11 million loaves are sold each day. Furthermore, the U.S. and France are the leading consumers of bread and cookies, which further states that the consumption of alternate products is high and regular in the market, which is hampering the frozen dough market growth.

The frozen dough market was valued at $10.1 billion in 2020, and is estimated to reach $21.7 billion by 2030

The global Frozen Dough market is projected to grow at a compound annual growth rate of 5.8% from 2021 to 2030 $21.7 billion by 2030

The key players operating in the market include- General mills, Tyson Foods Inc., Ajinomoto, Rich Products Corp, CSM ingredients, J&J snacks Foods Corp., Bridgeford Foods, Europastry, Nestle, and Guttenplans.

The European region dominates the global Frozen Doughs market

Growth in Food Service Industry, Increase in Demand for Ready-to-Bake Products, Globalization and Culinary Trends

Loading Table Of Content...