Frozen Food Market Research, 2032

The global frozen food market size was valued at $397.3 billion in 2022, and the frozen food market forecast to reach $607.2 billion by 2032, growing at a CAGR of 4.4% from 2023 to 2032.

Food that has been frozen and stored in packaging for consumption by humans or other animals is referred to as frozen food. Crystalline ice may be found in the freeze-concentrated solids of frozen food. The ability of the solutes to lower the melting temperature of ice and the temperature both affect how much ice is present. The amount of ice in frozen meals also impacts mechanical qualities by altering the glass transition temperature of partially freeze-concentrated solute matrices and by potential linkages within the ice network.

A number of elements that rely on temperature and content are connected to the stability of frozen food. Food ingredients that lower the ice melting temperature, lower the glass transition temperature of frozen solids, and have an impact on the amount of unfrozen water present when food is stored at a certain temperature. It is important to take temperature and freeze concentration into account while predicting the shelf life of frozen food. Even the most discerning taste testers may tolerate eating frozen food. A dish that has been properly prepared, kept at 0°F, and heated in accordance with instructions of the manufacturer tastes just as something that has been prepared on-site. Some of the best chefs in the world develop recipes used in frozen prepared dishes. Freezing the product right away after preparation guarantees consistent product quality in every serving.

The user may purchase food that is completely edible when it is frozen. Up to 40% of a raw vegetable is lost during shelling and peeling before the vegetable is suitable for cooking, according to studies on 13 different vegetables. More than half of households in the U.S. only have one or two occupants, according to the Census Bureau. For these households specifically, many frozen food has been developed. There are single-serving dinners, desserts, and side dishes. Since there are no leftovers, there is no waste. Individual portions also allow each family member to enjoy their preferred dish without having to spend time and money cooking big quantities of each cuisine. In addition, frozen food in poly bags (pasta, fruits, and vegetables) make portion control simple. Simply pour out what is required, then put the remaining liquid back in the freezer for later use.

One of the main reasons why frozen food has become more and more popular in developing nations is changes in consumer habits. The increase in per capita income in Asia-Pacific nations has caused eating habits of consumers to change. The market size and total demand have grown significantly as a result of rise in aspirations and a preference for luxury lifestyles. Furthermore, during the past ten years, per capita income in Latin America and the Middle East has expanded significantly, which is predicted to significantly enhance the demand for upscale food during the forecast period. Emerging nations steal a larger share of the purchasing power across the globe, making it difficult for developing nations to catch up. The largest country, China, is expected to maintain its position as the country with the highest purchasing power and is on track to more than quadruple it by 2060, according to the Organisation for Economic Co-operation and Development (OECD). Following the global epidemic and the ensuing economic crisis, consumer spending in the U.S. has largely recovered and has been increasing. Consumer spending is currently valued at $17.4 trillion yearly, up from $12.08 trillion in April 2020, per a poll conducted by the U.S. Bureau of Economic Analysis and the U.S. Bureau of Labour Statistics.

Fast food, bakery goods, ice cream, and other such lifestyle food products have gained popularity as consumer spending on upscale food items rises quickly. There is a growth in demand for premium frozen bakery items such as cakes and pastries due to the introduction of innovative products by various competitors. Moreover, there is a growth in demand of prepared and semi-cooked frozen food sales in developing nations such as China and India, which considerably aids in the expansion of the global frozen food industry due to hectic consumer lifestyles.

Eating habits in homes have changed over time as a result of dual income, a range of dining options, and rise in health consciousness. Originally believed to be the preserve of the upper class, eating out, ready-to-cook meals, take-out, and pre-prepared meals are now commonplace. This type of consumption is now extensively availed across the globe despite the fact that eating habits differ from household to household. Food habits or eating habits have undergone a tidal change that is influenced by the kind of job and leisure time as more women enter the workforce with unpredictable work schedules and busy lifestyles. In emerging nations, there has been a rise in number of women working which has increased the demand for prepared food and fast food. In addition, since frozen non-baked food such as meat, pork, and beef may be kept and used for a long time, retail customers use them more frequently in households. The previously assumed women to be in the care of the good diet of the family no longer have the time or energy to prepare home-cooked meals as a result of an increase in number of women entering the workforce. As a result, they have changed their taste in frozen food with long shelf lives, helping to flourish the frozen food market demand.

The process of freezing food is the most well-known method of food preservation. Commercial quick-freezing techniques preserve nutritional value of food without using chemical preservatives, and food that has been properly stored and quickly frozen retains its high nutritional value. Food that are frozen has consistent quality. The finest components are utilized. The reason for this is the strict industry quality control procedures, which start on the farm. Food that are frozen have a longer shelf life than those that are fresh, providing the most flexibility. In contrast to fresh broccoli, which is often required to be consumed within a week, frozen broccoli keeps its freshness in the freezer for up to eight months. The freshness of food is preserved by freezing. There is no opportunity for error or undercooked meals with frozen food because they come with clear cooking instructions. In addition, since the preparation (dicing, chopping, and others) has already been completed, all that is left to do is heat and serve, reducing the possibility of food contamination during preparation.

The cost of frozen meals is low. Food that is purchased frozen typically costs less per edible ounce than food that is purchased fresh. The U.S. Department of Agriculture study found that five out of the six vegetables evaluated, all of which were canned, fresh, or frozen, were most affordable when bought that way. Fresh produce may fluctuate in price from 99 cents at the start of the season to 39 cents at the halfway point, and then without warning, spike up again. There are no such significant pricing variations for frozen items.

In addition, prepared food frozen outperforms those made from scratch. The whole cost of the ingredients needed to prepare a meal at home must be considered. For instance, purchasing flour, sugar, eggs, shortening, spices, or flavoring, and any additional ingredients required to produce a frosting or topping would be required to bake a cake. These factors may make a cake rather pricey. If a customer rarely bakes and does not use the leftover ingredients, frozen baked products are definitely a wiser investment.

Segmental Overview

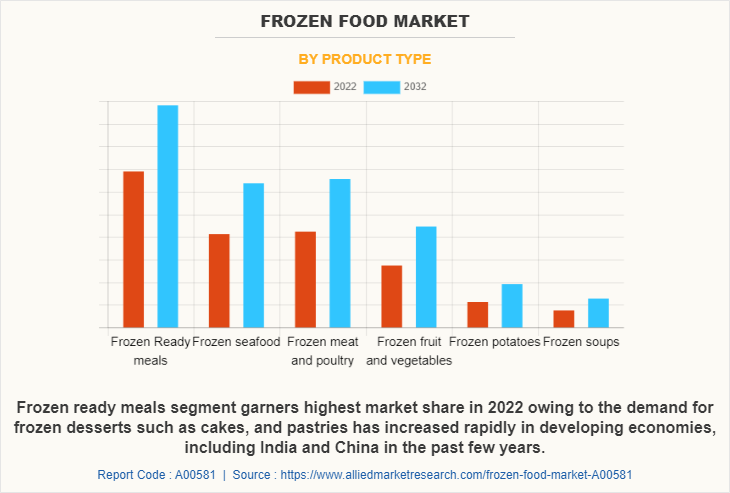

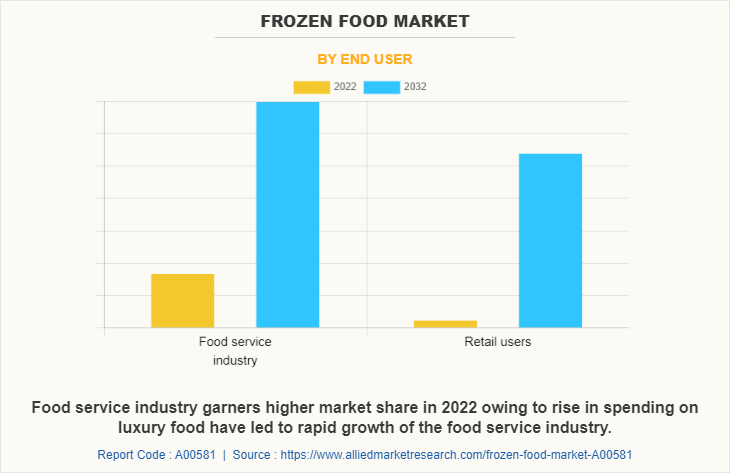

The frozen food market is segmented on the basis of type, end-user, and region. On the basis of product type, the market is categorized into ready meals, frozen meat & poultry, frozen seafood, frozen vegetables & fruits, frozen potatoes, and frozen soups. On the basis of end user, it is bifurcated into food service industry and retail users. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Argentina, and Rest of LAMEA).

By product type

On the basis of product type, ready meals constituted the largest frozen food market share in 2022 with a CAGR of 3.6%. Packaged ready-to-eat food, baked goods, snacks, and desserts are all included in frozen-ready meals. Frozen bakery items are one of the many kinds of frozen ready meals that witnessed a growth in demand. The food processing sector is profitable from an investment standpoint due to the high return on investment. In addition, the use of frozen bread, pizza crusts, and bakery goods expands quickly in the food service sector, which is a significant driver of the global market expansion. In addition, during the past several years, developing nations such as China and India have seen a sharp rise in demand for frozen delicacies including cakes and pastries.

By end user

On the basis of end user, the food service segment was the highest revenue contributor i.e., $213,012.20 million in 2022 and is expected to reach $319,725.20 million by 2032 at a CAGR of 4.2%. The largest market for frozen food is the food service sector. The hotel industry, quick food shops, cash & carry stores, caterers, and other business buyers are all included in the food service sector. Frozen food have become more and more popular in the food service industry as a result of their ability to be kept and used for extended periods of time while requiring less maintenance. Furthermore, quick-service restaurants and fast food chains have started using them in place of fresh ingredients as they take less time to prepare and decrease customer wait times. The demand for frozen meat, seafood, vegetables, potatoes, fast food, baked goods, and other frozen food products has increased as a result of greater purchasing power of consumers and increased expenditure on upscale meals. Frozen meat, seafood, fruits, and vegetables are widely used in the food service business, which considerably aids in the expansion of the global market.

By region

On the basis of region, Europe holds the largest share i.e., $133,382.20 million in 2022, and is expected to reach $178,633.50 million by 2032 at a CAGR of 3.0%. The key drivers of the frozen food market growth in Asia-Pacific are an increase in purchasing power and modifications in lifestyle and eating practices. The fastest-growing market segment is frozen bakeries, which increases demand for goods including frozen dough, bread, rolls, and other confectionery items. Another significant element that has supported the expansion of the frozen food sector is the rise in the number of fast food franchises, cafés, and hotels. In addition, busy lifestyles, and an increase in the number of working women contribute to an increase in the consumption of processed frozen food, which supports the market expansion.

Competitive Analysis

The market is being driven by factors such as rapid growth in infrastructural development as well as various advancements in developing countries. The major players operating in the global frozen food are Nestlé S.A., Conagra Brands, Inc., The Kraft Heinz Company, Cargill, Incorporated, Kellogg Company, JBS S.A., Associated British Foods plc, Ajinomoto Co., Inc., General Mills, Inc, and Aryzta AG., Nestlé.

Some Examples of Collaboration in the Global Frozen Food Market

- In March 2022, Ajinomoto Co., Inc., announced to collaborate with SuperMeat the Essence of Meat Ltd., which is a food tech company. Through this collaboration, it is projected to invest in SuperMeat, as one of its corporate venture capital projects.

Some Examples of Acquisition in the Global Frozen Food Market

- In June 2022, General Mills, Inc., acquired TNT Crust, which is a leading manufacturer of high-quality frozen pizza crust, in order to expand its portfolio.

Some Examples of Partnership in the Global Frozen Food Market

- In October 2022, General Mills, Inc., through its brand Progresso announced a partnership with a trained chef & restauranteur namely, Carla Hall, in order to inspire new flavorful soup pairings.

- In March 2023, The Kraft Heinz Company expanded its partnership with BEES in order to digitize its sales process and expand its business in Mexico, Colombia, and Peru.

Some Examples of Product Launch in the Global Frozen Food Market

- In August 2021, General Mills, Inc., through its brand Pillsbury, launched six new ready-to-eat and easy-to-make products. The product lineup comprises two pull-apart bread kits, mini cinni stix, mini pizza crusts and snack-size edible Cookie Dough Poppins.

- In June 2022, Conagra Brands, Inc., launched more than 50 new products including multi-serve frozen meals through its brands such as Healthy Choice, Marie Callender's, Banquet, Frontera, and others in order to satisfy its customers.

- In April 2022, Conagra Brands, Inc., launched carbon-free certified carbon-neutral single-serve frozen meals in order to expand its portfolio and step further toward protecting the environment.

- In August 2022, The Kraft Heinz Company through its brand, Oscar Mayer, launched Cold Dog, which is a flavored frozen pop in order to expand its portfolio.

- In April 2023, JBS S.A., through its brand Seara, announced to launch of ten innovative frozen breaded poultry products in order to expand its portfolio of breaded chicken products in Brazil.

Some Examples of Expansion in the Global Frozen Food Market

- In June 2021, Nestlé S.A., through its subsidiary Nestlé USA announced to invest $100 million in its frozen food factory in Gaffney, South Carolina in order to expand its operations.

- In April 2022, JBS S.A., brought two new processed food plants in Saudi Arabia and the United Arab Emirates that mainly produce frozen food in order to expand its business in the Middle East.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the frozen food market analysis from 2022 to 2032 to identify the prevailing frozen food market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the frozen food market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global frozen food market trends, key players, market segments, application areas, and market growth strategies.

Frozen Food Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 607.2 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 370 |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | General Mills, Inc., The Kraft Heinz Company, Cargill, Incorporated, Nestle S.A., Aryzta AG, Associated British Foods plc, Kellogg Company, JBS S.A., Conagra Brands, Inc., Ajinomoto Co., Inc. |

Analyst Review

As per the perspective of top-level CXOs, the global frozen food market is expected to unleash attractive business opportunities in developing economies, however, is dealing with challenges simultaneously. Developing economies are further expected to emerge as major markets for frozen food in a decade with increase in per capita income. Retail shops witness transition in terms of storage facilities and kind of inventory as countries in the Asia-Pacific region are undergoing infrastructural development with better and advanced connectivity.

Furthermore, as rural markets are expected to gain access to enhanced transport and electricity facilities, the overall market size would gradually increase in upcoming years. Frozen food products comprising healthy and natural ingredients are perceived to be healthier food alternatives by consumers and have witnessed double-digit growth in the past few years in developed markets. The usage of frozen food in the food service industry, including quick service restaurants, is anticipated to continue to increase manifold, as it reduces operating costs and customer waiting time.

The global market for frozen food is significantly constrained by the availability of fresh alternative food products. The everyday procurement of things such as meat, poultry products, cattle, pork, pizza crusts, and bread is difficult for bulk company buyers. They prefer to purchase frozen food and store it in their warehouse, which hinders the market expansion to minimize order processing time, prevent customer annoyance, and save operating expenses. One of the primary drivers for the increase in demand for frozen food is the increased demand for healthy products and flavorful products in the market. Many new market players are expected to enter the frozen food market over the forecast period, attracted by profitable growth and high-profit margins.

Another factor that influences the demand for frozen food is the rise in demand for vitamin-rich products across the globe. Consequently, the demand for frozen food has seen a multifold increase in the past four years, especially in the developed countries of North America and Europe regions including but not limited to the U.S., Canada, the UK, and Germany. The demand for frozen food is likely to gain high traction across the world with the rise in customer awareness regarding frozen food products and downward pressure on the price point.

The global frozen food market size was valued at $397.3 billion in 2022, and the frozen food market forecast to reach $607.2 billion by 2032

The global Frozen Food market is projected to grow at a compound annual growth rate of 4.4% from 2023 to 2032 $607.2 billion by 2032

The market is being driven by factors such as rapid growth in infrastructural development as well as various advancements in developing countries. The major players operating in the global frozen food are Nestlé S.A., Conagra Brands, Inc., The Kraft Heinz Company, Cargill, Incorporated, Kellogg Company, JBS S.A., Associated British Foods plc, Ajinomoto Co., Inc., General Mills, Inc, and Aryzta AG., Nestlé.

On the basis of region, Europe holds the largest share

Increase in consumption of fast food and rise in demand for French fries, chips, and other snacks among all age group drives the growth of the segment

Loading Table Of Content...

Loading Research Methodology...