Frozen Hake Market Research, 2034

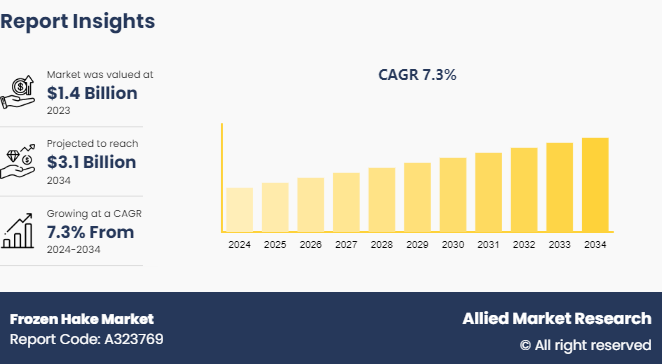

The global frozen hake market size was valued at $1.4 billion in 2023, and is projected to reach $3.1 billion by 2034, growing at a CAGR of 7.3% from 2024 to 2034.

Market Introduction and Definition

Frozen hake is a versatile fish species typically harvested from cold waters such as the North Atlantic. It is known for its mild flavor and delicate texture. They are of two types which include Pacific and Atlantic hake. Pacific hake is also called whiting, which is found along the west coast of North America, while Atlantic hake is abundant in the eastern Atlantic Ocean. Frozen hake is utilized in various culinary applications, including baking, grilling, and frying. Its flaky white flesh makes it ideal for dishes such as fish tacos, fish cakes, and chowders. With its affordability and adaptability, frozen hake is a popular choice for consumers seeking a nutritious and convenient seafood option.

Key Takeaways

The frozen hake market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2035.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The frozen hake market is anticipated to rise owing to factors such as healthy protein source aligning with increase in consumer demand for nutritious food options. The sustainability of hake fisheries appeals to environmentally conscious consumers. Moreover, technological advancements in freezing and packaging techniques enhance product quality and extend shelf-life boost accessibility and convenience for consumers. Economic factors such as affordability compared to other seafood options further fuel market growth that appeal to budget-conscious shoppers. The versatility of frozen hake in various cuisines and cooking methods broadens its consumer base, catering to diverse culinary preferences. Furthermore, globalization and the expansion of distribution networks enable wider market reach, particularly in emerging economies. These combined factors contribute to a robust trajectory for the frozen hake market share and drive domestic and international consumption among the consumers.

Competition from alternative seafood options, such as salmon, cod, and tilapia, which offer similar nutritional benefits and may be more familiar to consumers. Moreover, concerns regarding overfishing and sustainability practices in hake fisheries could harm the market's reputation and deter environmentally conscious consumers. Fluctuations in fish stock abundance due to environmental factors like climate change and ocean pollution pose another risk to supply stability, potentially leading to price volatility and supply chain disruptions. Furthermore, the perception of frozen seafood as lower quality compared to fresh alternatives limits the frozen hake market growth.

Rise in consumer awareness of the health benefits associated with hake consumption opens avenues for targeted marketing campaigns, emphasizing its nutritional value, including high protein content and omega-3 fatty acids. Moreover, tapping into emerging consumer trends such as the rising demand for convenient, ready-to-cook meal solutions presents an opportunity to develop value-added hake products, such as pre-marinated fillets or meal kits. In addition, leveraging technological advancements in packaging and freezing techniques enhances product quality, prolongs shelf life, and improves convenience for consumers. Furthermore, exploring new market segments and geographical regions, particularly in rapidly growing economies, offers opportunities for market expansion and diversification.

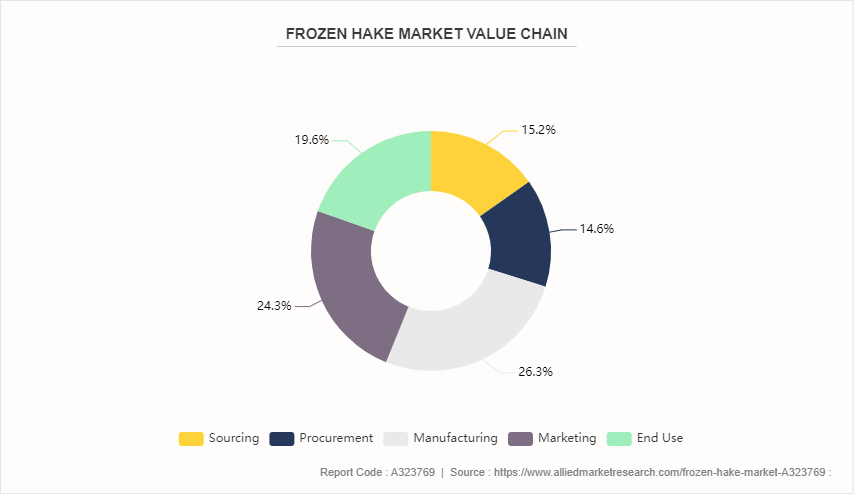

Value Chain of Frozen Hake Market

The frozen hake industry value chain begins with the wild fishing of hake species such as Atlantic hake, Pacific hake, and Cape hake. primarily in the Atlantic and Pacific Ocean waters. The freshly caught hake is then transported to shore-based processing plants. At the processing facilities, the hake goes through cleaning, scaling, gutting, and filleting processes depending on the desired final product form - whole fish or fillets. The prepared hake is then rapidly frozen using techniques such as air blast freezing or immersion in freezing solutions to preserve quality and extend shelf life. In addition, frozen hake either as whole fish or fillets, is packaged into boxes, bags, or other bulk packaging materials suitable for cold storage and distribution. Proper labeling and coding happen at this stage as well. The packaged frozen hake is then stored in cold storage warehouses or directly loaded into refrigerated trucks or shipping containers for distribution to various market channels and end customers.

Moreover, frozen hake products are distributed through food distributors, wholesalers and importers/exporters who supply food service businesses like restaurants, hotels and catering companies forming a major part of the end-user segment. Supermarkets, grocers, and online retail channels facilitate distribution to household/retail consumers. Food processors also source frozen hake as an input for value-added products.

Market Segmentation

The frozen hake market is segmented into species, form, distribution channel, and region. On the basis of species, the market is divided into Atlantic hake, Pacific hake, and others. By form, the market is segregated into frozen whole hake, frozen hake fillets, and others. On the basis of distribution channel, the market is classified into local distributors, supermarkets/hypermarkets, and online channels. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/ Country Market Outlook

The Asia-Pacific region has emerged as a dominant force in the frozen hake market for several compelling reasons. Firstly, the region's large and diverse consumer base, including countries like China, Japan, and South Korea, presents significant opportunities for market expansion. These countries have a long-standing tradition of seafood consumption and a growing demand for imported frozen seafood products. In addition, the strategic geographical location of many Asia-Pacific countries provides access to key fishing grounds, facilitating the sourcing and processing of hake. Moreover, improvements in cold chain logistics and infrastructure have enhanced the distribution and availability of frozen hake products across the region and further drive the growth of frozen hake market. The dynamic economic growth in many Asia-Pacific countries has led to rising disposable incomes and changing consumer preferences, with a growing inclination towards Western dietary habits and convenience foods. Furthermore, this shift in consumer behavior has contributed to increased demand for frozen hake as a convenient and versatile seafood option.

Industry Trends:

According to a report by the British Frozen Food Federation (BFFF) , in 2021, frozen food including frozen fish products and other frozen foods sales maintained the momentum gained in 2020 during the pandemic lockdown. Compared to pre-pandemic levels, frozen food sales have grown by about 13.5%.

Competitive Landscape

The major players operating in the frozen hake market include Pacific Seafood, High Liner Foods, Iglo Group, Trident Seafoods, Nomad Foods, Cooke Aquaculture, Thai Union Group, Pescanova, Maruha Nichiro and Oceana Group.

Key Sources Referred

World Bank

Comstat Data Hub

Aquatic Food Studies

U.S. Bureau

Food and Agriculture Organization (FAO)

British Frozen Food Federation (BFFF)

Sea Food Organization

International Institute of Refrigeration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the frozen hake market analysis from 2024 to 2034 to identify the prevailing frozen hake market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the frozen hake market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global frozen hake market trends, key players, market segments, application areas, and market growth strategies.

Frozen Hake Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 3.1 Billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 345 |

| By Species |

|

| By Form |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Thai Union Group, High Liner Foods, Pacific Seafood, Maruha Nichiro, Pescanova, Oceana Group, Iglo Group, Nomad Foods, Cooke Aquaculture, Trident Seafoods |

The global frozen hake market size was valued at $1.4 billion in 2023, and is projected to reach $3.1 billion by 2034

The global Frozen Hake market is projected to grow at a compound annual growth rate of 7.3% from 2024 to 2034 $3.1 billion by 2034

The major players operating in the frozen hake market include Pacific Seafood, High Liner Foods, Iglo Group, Trident Seafoods, Nomad Foods, Cooke Aquaculture, Thai Union Group, Pescanova, Maruha Nichiro and Oceana Group.

The Asia-Pacific region has emerged as a dominant force in the frozen hake market for several compelling reasons.

Loading Table Of Content...