Frozen Lamb Market Research, 2032

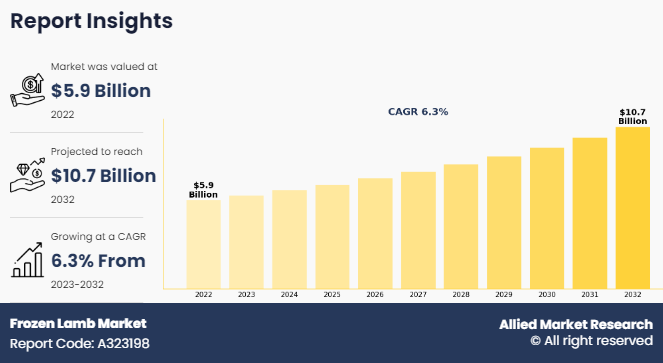

The global frozen lamb market size was valued at $5.9 billion in 2022, and is projected to reach $10.7 billion by 2032, growing at a CAGR of 6.3% from 2023 to 2032. The Food and Agriculture Organization of the United Nations reports that global meat consumption is projected to increase by 1.6% annually between 2019 and 2028, with Asia-Pacific leading the growth. Frozen lamb is a type of lamb meat that is cooled to sub-zero temperatures to extend its shelf life. This preservation method prevents bacterial growth and maintains the meat's quality for an extended period. Various cuts of lamb, including chops, roasts, and ground lamb, are available in frozen form, which consumers can purchase from supermarkets, butchers, and other retail outlets. To ensure the safety and taste of frozen lamb before consumption, proper thawing and cooking techniques are essential. This product offers convenience and versatility, allowing lamb enthusiasts to enjoy their favorite dishes year-round.

Key Takeaways

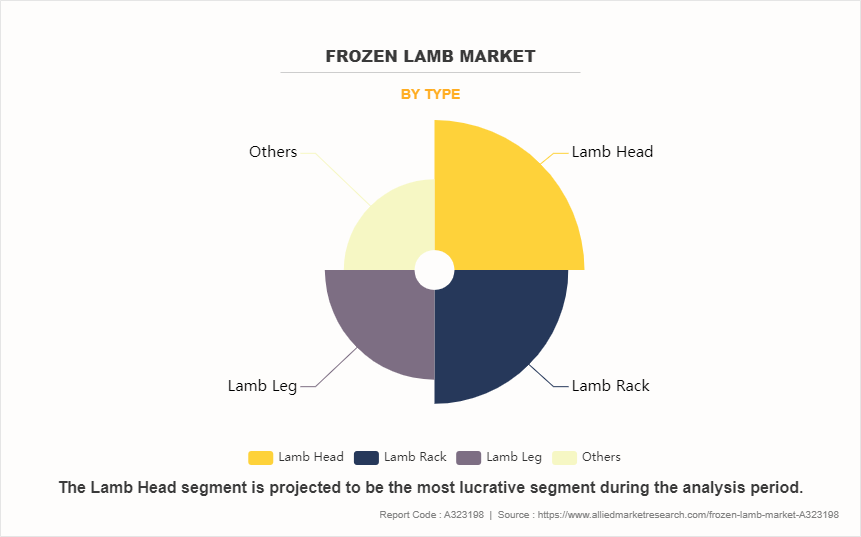

By type, the lamb head segment was the highest revenue contributor to the frozen lamb Industry in 2022 and is expected to grow at a significant CAGR during the forecast period.

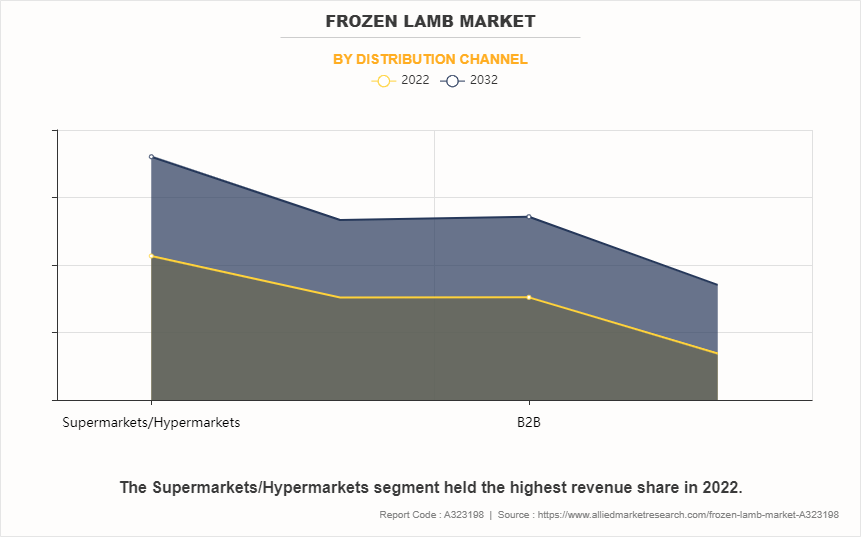

By distribution channel, the supermarkets/hypermarkets segment was the highest revenue contributor to the market in 2022 and is expected to grow at a significant CAGR during the forecast period.

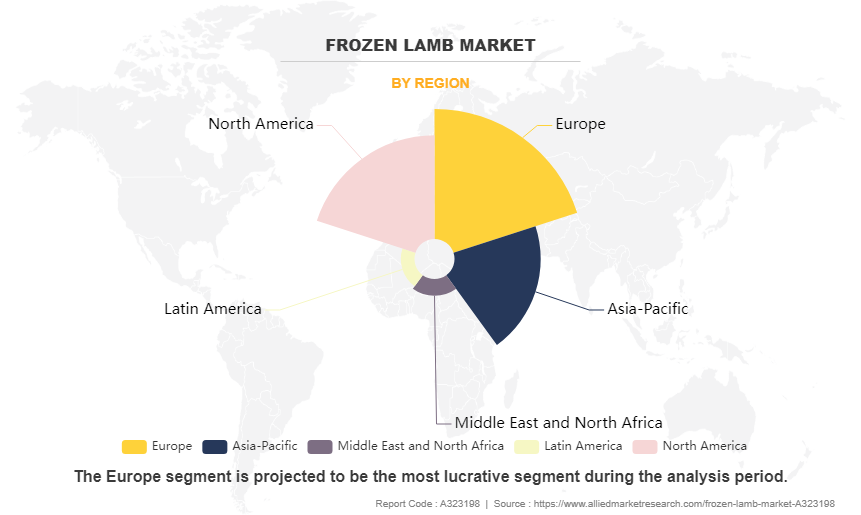

By region, Europe was the highest revenue contributor to the market in 2022 and is expected to grow at a significant CAGR during the forecast period.

Market Dynamics

The frozen lamb market demand is on the rise due to the growth of the global meat processing industry. As the industry expands, there is an increasing need for convenient and easily available meat products. Frozen lamb fits this requirement perfectly, as it offers a long shelf life without compromising on quality. Meat processors often purchase large quantities of lamb to meet consumer demand for various processed meat products such as sausages, meatballs, and ready-to-cook meals. Frozen lamb serves as a reliable source for these processors, ensuring they can produce a consistent range of products throughout the year.

Furthermore, the growth of the global meat processing industry creates opportunities for frozen lamb exporters, as they can fulfill the increasing demand from processing facilities worldwide. These facilities often prefer frozen lamb due to its extended shelf life, allowing them to manage inventory effectively and minimize waste. Therefore, as the meat processing industry continues to thrive, the demand for frozen lamb is expected to increase, driven by the industry's need for convenient, high-quality meat products that meet consumer preferences for taste, convenience, and reliability.

Expansion of retail distribution channels significantly boosts the demand for frozen lamb products. When retail channels like supermarkets, grocery stores, and online platforms increase their availability of frozen lamb, it becomes more accessible to consumers. This increased accessibility means that more people, including those living in areas without easy access to fresh lamb, can purchase and enjoy lamb meat conveniently. As a result, the overall market demand for frozen lamb rises.

Moreover, expanding retail distribution channels enhances the visibility of frozen lamb products to shoppers. When frozen lamb is displayed alongside other meat options during grocery trips, consumers may be more inclined to try it out or incorporate it into their meal plans. The increased visibility and availability of frozen lamb in retail outlets contribute to a surge in market demand for this product. In summary, the expansion of retail distribution channels plays a crucial role in driving the frozen lamb market growth by making the product more accessible and appealing to consumers.

The growing popularity of lamb meat in different cuisines is leading to an increase in demand for frozen lamb products. As people all over the world become more daring in their culinary tastes, they are exploring new and diverse flavors, including those offered by lamb. Lamb is valued for its tender texture and unique taste, which makes it a versatile ingredient in a variety of dishes, from traditional roasts to exotic curries and kebabs. As a result, consumers are looking for convenient options to enjoy lamb throughout the year, regardless of seasonal availability or geographic location.

The rise in the popularity of lamb meat in various cuisines also creates opportunities for frozen lamb suppliers to meet this growing demand. Frozen lamb offers convenience and flexibility, enabling consumers to access high-quality lamb products at any time. Additionally, frozen lamb can be stored easily for longer periods without compromising its taste or nutritional value, making it a practical choice for both consumers and food service establishments. Overall, the increasing appreciation for lamb in different culinary traditions is driving the expansion of the frozen lamb market, contributing to its success and growth.

Advancements in freezing and packaging technologies have greatly increased the demand for frozen lamb in the market. These developments ensure that lamb meat remains fresh and maintains its quality during the freezing process, thus extending its shelf life. With improved freezing techniques, lamb can be preserved for longer periods without compromising its taste or texture. This longer shelf life makes frozen lamb a convenient option for consumers who may not have regular access to fresh lamb or those who prefer to stock up on meat for later use.

Moreover, advancements in packaging technologies help to maintain the quality and safety of frozen lamb by providing effective barriers against moisture, air, and contaminants. This ensures that the lamb meat is protected from freezer burn and maintains its freshness and flavor until it is ready to be consumed. Consequently, consumers have more faith in the quality of frozen lamb products, increasing in market demand for these convenient and dependable options.

However, concerns about the quality of frozen meat can restrain the market demand for frozen lamb. For instance, some consumers worry that freezing could affect the taste, texture, or nutritional value of the lamb, and may prefer fresh meat instead. In addition, freezer burn can occur if the meat is not properly packaged or stored, further diminishing its quality. These worries about the overall quality of frozen lamb may deter some consumers from purchasing it, especially if they have access to fresh lamb or other protein options.

Additionally, consumers may perceive frozen meat to be inferior to fresh meat, which could impact their confidence in frozen lamb products. Despite improvements in freezing and packaging technologies, there may still be lingering doubts among consumers about the quality and freshness of frozen lamb compared to its fresh counterpart. As a result, concerns about the quality of frozen meat can act as a barrier to market demand for frozen lamb, particularly among discerning consumers who prioritize freshness and quality in their food choices.

Offering value-added frozen lamb products, such as marinated or pre-seasoned options, presents significant opportunities in the market for frozen lamb. These products cater to consumers who seek convenience and flavor enhancement in their meals. By providing pre-marinated or pre-seasoned frozen lamb, manufacturers can save consumers time and effort in meal preparation, making it an attractive option for busy households and individuals with hectic lifestyles. Additionally, these products appeal to consumers who may lack culinary expertise or time to prepare elaborate meals from scratch but still desire flavorful and convenient dining options.

Furthermore, value-added frozen lamb products allow manufacturers to differentiate their offerings in a competitive market landscape. By offering a variety of marinades and seasonings, they can cater to diverse consumer tastes and preferences, thereby expanding their customer base. These products also present opportunities for innovation and creativity in product development, as manufacturers can experiment with different flavor profiles and ingredients to meet evolving consumer demands for exciting and convenient frozen lamb options.

Segments Overview

The frozen lamb market forecast is segmented into type, distribution channel, and region. By type, the market is classified into lamb head, lamb rack, lamb leg, and others. By distribution channel, the market is segregated into supermarkets-hypermarkets, departmental stores, B2B, and online sales channel. By region, the market is analyzed across North America, Europe, Asia-Pacific, LA, and MENA.

By Type

The lamb head segment accounted for a major frozen lamb market share in 2022 and is expected to grow at a significant CAGR during the forecast period. The lamb head segment holds a major share in the frozen lamb market primarily due to its versatility and demand in various cuisines. Lamb heads offer a wide range of cuts suitable for different culinary purposes, including traditional dishes and delicacies. Additionally, they are often utilized in food processing for the production of value-added products such as minced meat and sausages. The segment's popularity also stems from its affordability and availability, making it a preferred choice for consumers and food manufacturers alike in the frozen lamb market.

By Distribution Channel

The supermarkets/hypermarkets segment accounted for a major frozen lamb market share in 2022 and is expected to grow at a significant CAGR during the forecast period. Supermarkets/hypermarkets hold a major share in the frozen lamb market due to their extensive reach, convenience, and consumer trust. These retail channels offer a wide selection of frozen lamb products, making them easily accessible to a large number of consumers. Moreover, hypermarkets and supermarkets often leverage promotional strategies and discounts to attract customers, further boosting sales of frozen lamb. Their ability to provide a one-stop shopping experience, along with ample storage space for frozen products, solidifies their dominance in catering to the demand for frozen lamb among diverse consumer demographics.

By Region

Europe accounted for share in 2022 and is expected to grow at a significant CAGR during the forecast period. Europe dominates the frozen lamb market due to several factors. Firstly, European countries have a long history of sheep farming and a tradition of consuming lamb, which creates a strong demand. Secondly, Europe's advanced infrastructure and technology enable efficient processing and distribution of frozen lamb products. Additionally, European consumers prioritize quality and are willing to pay premium prices for frozen lamb that meets their standards. Lastly, trade agreements and strategic partnerships with lamb-producing countries outside of Europe ensure a steady supply, further solidifying Europe's position in the market.

Competitive Analysis

Major players such as El Moreno, Kühne + Heitz, Selina Wamucii, CS Foods, Damaco Group, Sao-Salvadoralimentos have adopted product approval, partnership, agreement, and acquisition as key developmental strategies to improve the product portfolio of the frozen lamb market.

Recent Developments in the Frozen Lamb Industry

On September 28, 2020, Pre Brands LLC, a food processing company headquartered in Illinois, successfully introduced purely grass-fed lamb to the U.S. market. Known for its organic products, Pre Brands LLC made this debut to meet the increasing demand for such offerings.

In 2019, Niman Ranch partnered with Peapod to distribute its range of products, including fresh lamb and beef, across the Chicagoland area. This move was in response to the rising consumer interest in a variety of meat products in the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the frozen lamb market analysis from 2022 to 2032 to identify the prevailing frozen lamb market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the frozen lamb market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global frozen lamb market trends, key players, market segments, application areas, and market growth strategies.

Frozen Lamb Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 345 |

| By Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | El Moreno, DC International LLC, Delta Group, Sao-Salvadoralimentos, CS Foods, Selina Wamucii, Davmet, Kühne + Heitz, Damaco Group |

Analyst Review

According to the insights of the CXOs, the global frozen lamb market is expected to witness robust growth during the forecast period. The growth of the frozen lamb market is influenced by several key determinants, stemming from evolving consumer preferences, industry dynamics, and macroeconomic factors. Firstly, changing lifestyles and dietary habits drive demand for convenient food options, including frozen meats like lamb. As urbanization accelerates globally, consumers increasingly seek convenient and time-saving solutions for meal preparation.

CXO further added that, technological advancements and innovations in food processing and packaging contribute to the growth of the frozen lamb market. Improved freezing techniques, such as blast freezing and IQF (individually quick frozen) methods, help preserve the freshness, flavor, and nutritional value of lamb meat while extending its shelf life. Advanced packaging materials and techniques enhance product protection and minimize freezer burn, ensuring the quality and safety of frozen lamb products during storage and transportation.

The global frozen lamb market size was valued at USD 5.9 billion in 2022, and is projected to reach USD 10.7 billion by 2032.

The global frozen lamb market is projected to grow at a compound annual growth rate of 6.3% from 2023-2032 to reach USD 10.7 billion by 2032.

The key players profiled in the reports includes Delta Group, Selina Wamucii, Kühne + Heitz, Damaco Group, Davmet, DC International LLC, CS Foods, El Moreno, Sao-Salvadoralimentos.

Europe dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Growth of the Global Meat Processing Industry, Expansion of Retail Distribution Channels, Rising Popularity of Lamb in Diverse Cuisines, Advancements in Freezing and Packaging Technologies, Health and Convenience Trends, Concerns Over Freshness and Quality, Opportunities in Value-Added Frozen Lamb Products, Sustainability and Ethical Sourcing majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...