Frozen Potato Market Summary

The global frozen potato market size was valued at $60.3 billion in 2021 and is projected to reach $92.7 billion by 2031, growing at a CAGR of 4.2% from 2022 to 2031.

Key Market Trends and Insights

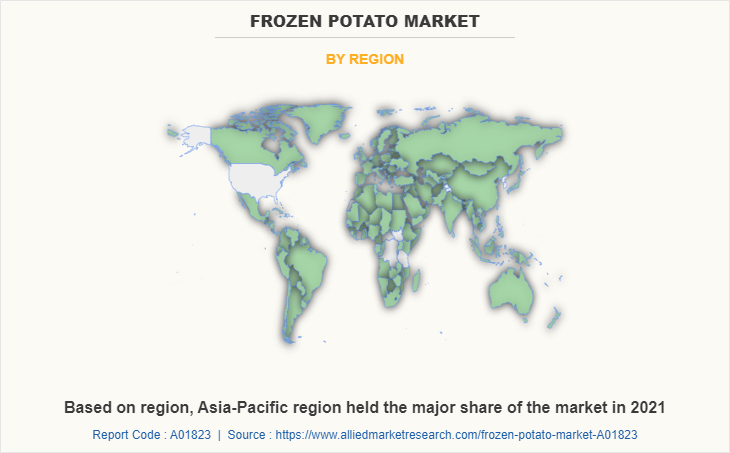

Region wise, Asia-Pacific generated the highest revenue in 2021.

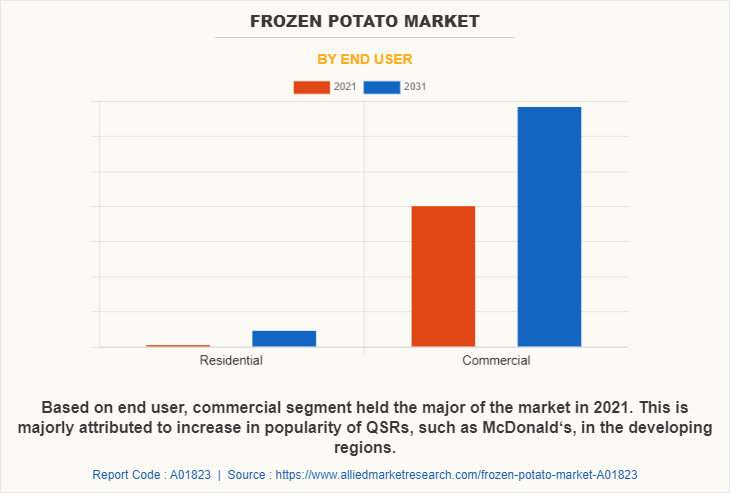

The global frozen potato market share was dominated by the commercial segment in 2021 and is expected to maintain its dominance in the upcoming years

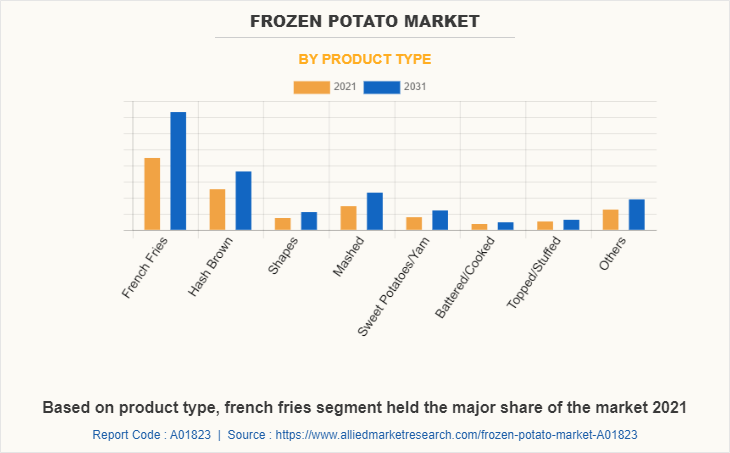

The french fries segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 60.3 Billion

- 2031 Projected Market Size: USD 92.7 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 4.2%

- Asia-Pacific: Generated the highest revenue in 2021

Market Dynamics

Potato is a major staple food, ranked fourth in terms of global production after wheat, rice, and maize. It is consumed either as fresh potatoes or processed potatoes on a commercial and residential scale. Frozen potatoes are among the main types of processed potatoes and are highly convenient and flexible in terms of preparation time and contain different nutrients & vitamins in naturally preserved form with long shelf life. Frozen potatoes and their different products are obtained via the processing of fresh potatoes by using a variety of advanced machinery and extremely low temperatures. These are available in various forms in the market, such as French fries, hash brown, shapes, mashed, sweet potatoes/yam, battered/cooked, twice baked, and topped/stuffed. These products are either consumed via quick service restaurants (QSRs) or through retail stores.

The ongoing changes in lifestyle worldwide are paving a path for a multitude of opportunities. This definitely brings in some good news for prominent market players across business verticals. Increase in women's workforce coupled with resultant time–constraints and socializing at home drive sales in the frozen food sector. Acceptance of western culture and the rise in demand for freshly prepared food is believed to be the common reasons for the growth of convenience food, which indirectly supports the frozen potato market growth.

A rise in consumer spending, the increasing influence of food delivery services, the surge in the number of fast food restaurants, an increase in working age population, and rapid urbanization are some of the factors driving the demand for fast food, which in turn stimulates the expansion of the market. Furthermore, the rising preference of the millennial population for ready-to-eat and ready-to-cook food is further likely to support the growth of the frozen potato industry.

Segment Review

The frozen potato market is segmented into product type, end-user, and region. On the basis of product type, the market is categorized into French fries, hash brown, shapes, mashed, sweet potatoes/yam, battered/cooked, and topped/stuffed. and other. By end users, it is bifurcated into residential and commercial. The commercial segment is further segregated into full-service restaurants, quick-service restaurants, and others. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, the Netherlands, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, and rest of LAMEA)

On the basis of product type, the French fries segment was the highest contributor to the global market and accounted for about 40% of the total global market share. French fries are widely consumed owing to the upsurge in the consumption of Western-style cuisine in emerging economies, due to the rapid expansion of QSRs such as Subway, Burger King, McDonald’s, Wendy’s, and Dunkin’ Donuts. The French fries market possesses high potential for growth owing to the development of new products and variations by the key manufacturers to meet consumer preferences.

On the basis of end user, the commercial segment held the major market share in 2021. The commercial sector is the key end-user of frozen potatoes, and possesses the high market potential for investment, owing to their rise in demand and expanding QSRs business in different countries. Frozen potatoes and related products are used at a commercial level in hotels, fast food chains, and quick service restaurants (QSRs). These products are commercially accepted on a large scale, owing to their reduced preparation time and ease of use. Moreover, many caterers are inclined toward the use of frozen food, owing to the convenience offered by these products and climatic challenges, which fuel the adoption of frozen food products, thereby supplementing the market growth.

Region-wise, Asia-Pacific dominated the market in 2021 and is expected to sustain its dominance throughout the frozen potato market forecast period. Asia-Pacific is considered the potential market for frozen potatoes, owing to the expansion of QSRs. An increase in the female working population boosts the demand for convenience food, resulting in a substantial increase in the consumption of convenience products such as frozen French fries, along with dehydrated potato products. Furthermore, the rise in fast food restaurants, increase in food processing capacity, rise in income, increase in urbanization, and lower tariffs from WTO on the import & export of frozen potatoes are some of the factors supplementing the growth of the Asia-Pacific frozen potato market during the forecast period.

Competitive Landscape

The players operating in the global frozen potato market have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. Launching new products and making acquisitions are the main development methods used by major players in the global market to meet rising client demand. Launching new products and making acquisitions are the main development methods used by major players in the global market to meet rising client demand. Acquisitions help companies to share technological requirements for their existing and new products. The market leaders would ultimately benefit from this because it would allow them to expand their product portfolio for comparatively lower costs and thereby increase their market share. The key players profiled in market report include Agrarfrost GmbH & Co. KG. (Agrarfrost), Agristo NV (Agristo), Bart’s Potato Company, Co-Operative Royal Cosun U.A. (Aviko B.V.), Farm Frites International B.V., Greenyard N.V., Himalya International Limited, J.R. Simplot Company, McCain Foods Limited and Lamb Weston Holdings, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the frozen potato market analysis from 2021 to 2031 to identify the prevailing frozen potato market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the frozen potato market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global frozen potato market trends, key players, market segments, application areas, and market growth strategies.

Frozen Potato Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 92.7 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 310 |

| By End User |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | Agrarfrost GmbH & Co. KG. (Agrarfrost), Farm Frites International B.V., Greenyard N.V., Himalya International Limited, McCain Foods Limited, Agristo NV (Agristo), Bart’s Potato Company, J.R. Simplot Company, Cosun, Lamb Weston Holdings, Inc. |

Analyst Review

Various CXOs from leading companies perceive that a surge in the number of quick service restaurants (QSRs) in developing & developed nations, an increase in urbanization, and the rise in disposable income in emerging countries drive the market growth. According to CXOs, Asia-Pacific is the leading region in terms of consumption of different kinds of frozen potato products, mainly frozen French fries. Further, this region is anticipated to grow at the highest CAGR, owing to the rapid development of the food & beverages sector in China, India, and South Korea. As per the perspective of top-level CXOs, the global frozen food market is expected to unleash attractive business opportunities in developing economies, however, is dealing with challenges simultaneously. With the increase in per capita income, developing economies are further expected to emerge as major markets for frozen food including frozen potatoes in a decade. The usage of frozen food in the food service industry, including quick service restaurants, is anticipated to continue to increase manifold, as it reduces operating costs and customer waiting time. Thus, the above factors are likely to support the growth of the frozen food market including frozen potato market during the forecast period.

The global frozen potato market size was valued at $60.3 billion in 2021 and is projected to reach $92.7 billion by 2031

The global Frozen Potato market is projected to grow at a compound annual growth rate of 4.2% from 2022 to 2031

The key players profiled in this report include Agrarfrost GmbH & Co. KG. (Agrarfrost), Agristo NV (Agristo), Bart’s Potato Company, Co-Operative Royal Cosun U.A. (Aviko B.V.), Farm Frites International B.V., Greenyard N.V., Himalya International Limited, J.R. Simplot Company, McCain Foods Limited and Lamb Weston Holdings, Inc.

Region-wise, Asia-Pacific dominated the market in 2021

Frozen potatoes offer convenience to consumers as they are pre-cut, pre-washed, and can be cooked easily without any hassle, Frozen potatoes have a longer shelf life as compared to fresh potatoes, which reduces food waste, With busy lifestyles and a rise in the number of working women, there has been a growing demand for convenience foods.

Loading Table Of Content...

Loading Research Methodology...