Frozen Tuna Market Research, 2032

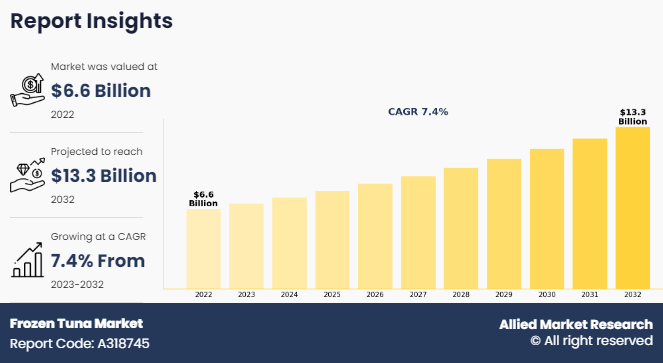

The global frozen tuna market was valued at $6.6 billion in 2022, and is projected to reach $13.3 billion by 2032, growing at a CAGR of 7.4% from 2023 to 2032.Frozen tuna typically refers to tuna fish that has been caught and immediately frozen to preserve its freshness. This process is commonly used in seafood industry to maintain the quality of fish during transportation and storage. Freezing helps prevent the growth of bacteria and the deterioration of fish, ensuring that it remains safe for consumption. Frozen tuna is often used in various culinary applications, including sushi and sashimi. Many restaurants and retailers require frozen tuna to provide high-quality tuna products consistently, regardless of the seasonal availability of fresh tuna.

The exponentially growing global population is a fundamental driver of the demand for seafood, including frozen tuna. As more people inhabit the planet, the need for protein-rich food sources grows, and seafood is considered a valuable & nutritious option. Shifting consumer preferences toward healthy and protein-rich diets fuel the demand for seafood. Tuna, being a rich source of lean protein and omega-3 fatty acids, is particularly favored by health-conscious consumers. Economic development and rise in disposable income in various regions enable consumers to afford high-quality & diverse food options, including premium seafood products such as frozen tuna. Improved transportation and logistics have facilitated the globalization of food supply chains. This has allowed for easier distribution of frozen tuna products across borders, meeting the demand of consumers.

Tuna is known for its health benefits, including being a good source of omega-3 fatty acids, vitamins, and minerals. Surge in awareness regarding the health advantages associated with tuna consumption fuels its demand in the global market. Frozen tuna offers convenience and an extended shelf life as compared to fresh seafood. This factor appeals to consumers seeking convenient and time-saving options, contributing to the market demand for frozen tuna. With boosting awareness of environmental issues and sustainable fishing practices, consumers are significantly seeking responsibly sourced seafood. Companies that prioritize sustainability in their tuna fishing and processing contribute to the overall demand for frozen tuna industry.

However, the frozen tuna market size is affected by environmental concerns related to fishing methods, bycatch, and the impact on marine ecosystems. Adhering to environmentally sustainable practices requires companies to invest in technology and adopt methods which minimize negative effects on non-target species & habitats, which increases the operational costs. Compliance often requires accurate traceability of the tuna supply chain from catch to consumer. Companies are expected to maintain detailed documentation to prove the legality and sustainability of their products. This becomes challenging, particularly for smaller or technologically less advanced operations. Some markets demand specific certifications, such as the Marine Stewardship Council (MSC) certification, to ensure the sustainability of the tuna supply chain.

Acquiring and maintaining these certifications is time-consuming and costly. Companies involved in international trade are anticipated to navigate complex import and export regulations. Compliance with various countries' customs and quarantine requirements complicates the operation, requiring companies to stay informed about changes in regulations across different jurisdictions. The regulatory landscape for the fishing industry is dynamic and subject to frequent changes. Companies are projected to stay updated on evolving regulations and adjust their practices accordingly, which requires continuous investment in monitoring and compliance infrastructure.

On the contrary, the frozen tuna market has a lucrative opportunity due to improvements in freezing and packaging technologies, which help extend the shelf life of frozen tuna products. Advanced freezing technologies help maintain the texture, flavor, and nutritional content of tuna. This ensures that the frozen product closely resembles fresh tuna, meeting consumer expectations for quality and taste. The improvement in preservation reduces waste and enhances the product's market appeal by providing a long storage period for both retailers and consumers. Technological advancements contribute to higher safety standards in processing & freezing, reducing the risk of contamination and ensuring compliance with food safety regulations.

This helps to build consumer trust and loyalty. Sustainable freezing technologies that prioritize energy efficiency prove to be advantageous for companies striving to reduce their environmental impact. This not only aligns with consumer preferences for eco-friendly products but also helps companies meet sustainability goals. Automation and improved processing methods streamline production processes, leading to cost savings and increase in efficiency. This positively impacts the overall competitiveness of companies within the frozen tuna market. Technological advancements allow for more precise control over freezing conditions, enabling companies to tailor products to specific market demands. This customization leads to innovative product variations which cater to niche markets or evolving consumer preferences. These major factors are projected to offer remunerative growth opportunities for market players during the forecast period.

The key players profiled in this report include Brig-Star LLC, Chicken of the Sea, Dongwon Enterprise Company, High Liner Foods, Marine Harvest, Nippon Suisan Kaisha aka Nissui, Pescanova SA, SalMar ASA, Zoneco Group, and Tassal Group. Investment and agreement are the common strategies followed by major market players. For instance, in May 2019, J.P. Verwijs, a Dutch frozen food supplier introduced a new compostable packaging for its various seafood products, including tuna fish.

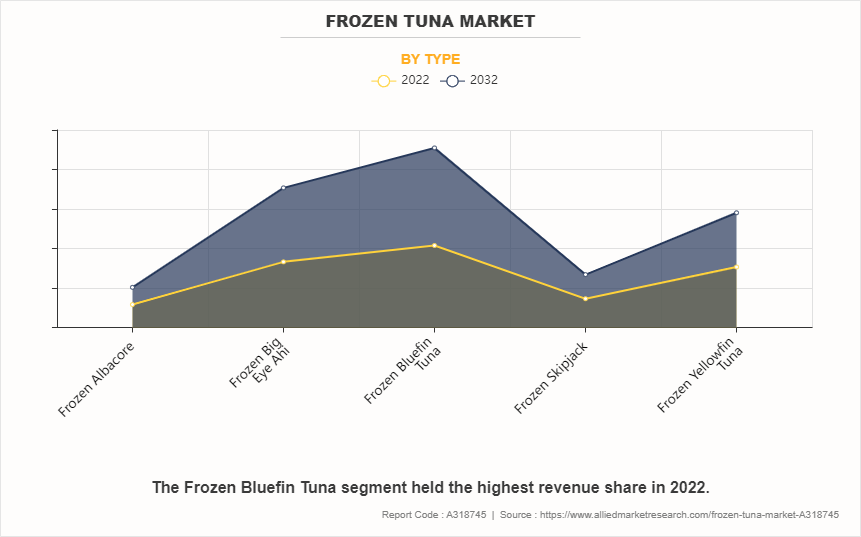

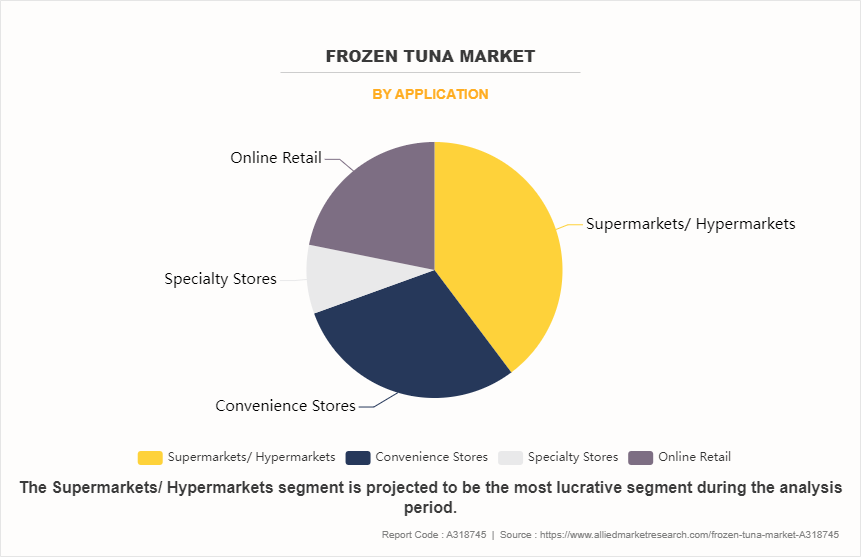

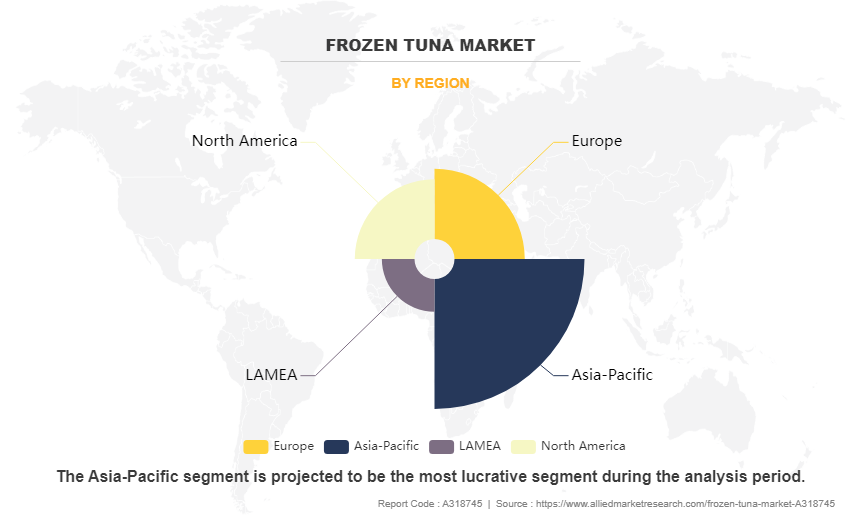

The frozen tuna market is segmented by type, application, and region. As per type, the market is divided into frozen albacore, frozen big eye ahi, frozen bluefin tuna, frozen skipjack, and frozen yellowfin tuna. Depending on application, the market is classified into supermarkets/hypermarkets, convenience stores, specialty stores, and online retail. By region, the frozen tuna market growth is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Overview

The frozen tuna market is segmented into type, application and region.

By Type

By type, the frozen bluefin tuna segment dominated the market in 2022. Consumer preferences & demand for bluefin tuna, which is known for its rich flavor and high-quality flesh, contribute significantly to the growth of the frozen bluefin tuna segment. The popularity of sushi and sashimi, in which bluefin tuna is a relished ingredient, has boosted the demand for frozen bluefin tuna. As these traditional Japanese dishes gain global popularity, the market for bluefin tuna is anticipated to expand. Regulatory measures aimed at sustainable fishing and conservation of bluefin tuna stocks influence the market dynamics. Compliance with regulations, such as catch quotas and size limits, impact the supply chain & pricing of frozen bluefin tuna.

Advancements in fishing technologies and processing methods contribute to the availability of high-quality frozen bluefin tuna. Improved freezing techniques help maintain the quality and freshness of the fish during storage & transportation. Consumer awareness & concerns pertaining to overfishing and conservation of marine resources have led to increase in demand for sustainably sourced seafood, including bluefin tuna. Companies that adopt sustainable fishing practices find a large number of consumers in their favor. Culinary trends and innovations that incorporate bluefin tuna into new dishes & cuisines contribute to the market growth. Chefs and food enthusiasts experimenting with diverse culinary creations fuel the demand for frozen bluefin tuna. These are expected to be the major factors impacting the frozen bluefin tuna segment during the forecast period.

By Application

By application, the supermarkets/hypermarkets segment dominated the global frozen tuna market share in 2022. Supermarkets/hypermarkets offer a one-stop shopping experience for consumers. The convenience of finding a variety of products, including frozen tuna, in a single location encourages consumers to choose these outlets. Large retail spaces in supermarkets/hypermarkets allow for better product visibility and accessibility. Frozen tuna products are prominently displayed, attracting the attention of consumers and influencing their purchasing decisions. Supermarkets/hypermarkets typically offer a wide range of frozen tuna products, including different cuts, brands, and packaging options.

This variety caters to diverse consumer preferences and increases the likelihood of making a sale. Supermarkets often run promotions, discounts, and package deals, which attract budget-conscious consumers. These marketing strategies boost sales of frozen tuna products within the supermarket/hypermarket segment. Supermarkets have the infrastructure for proper cold storage, ensuring the quality and safety of frozen products such as frozen tuna. This capability is crucial for maintaining the integrity of frozen seafood and meet the regulatory standards. Strong brand presence as well as effective marketing campaigns by frozen tuna producers lead to higher visibility and shelf space in supermarkets. Brands that invest in marketing have an advantage in attracting consumers to these retail outlets.

By Region

By region, Asia-Pacific dominated the frozen fish market in 2022. Asia-Pacific has a significantly high demand for seafood, including tuna. The exponentially growing population, increasing disposable income, and changing dietary preferences toward protein-rich foods fuel this demand. Advances in fishing technologies such as improved vessels & equipment and innovations in processing techniques positively impact the efficiency as well as quality of frozen tuna production in the APAC region. Compliance with international regulations and standards, particularly in terms of sustainable fishing practices, is becoming substantially important.

Access to markets is often contingent on meeting these standards and companies that adhere to sustainable practices gain a competitive advantage. Surge in awareness among consumers about the importance of sustainable and responsibly sourced seafood influences their purchasing decisions. This leads to a preference for frozen tuna products that are certified as sustainable by recognized organizations. Geopolitical factors, trade agreements, and international relations impact the flow of tuna products across borders. In addition, changes in trade policies and agreements affect the export and import of frozen tuna in Asia-Pacific. Furthermore, economic conditions and fluctuations in currency exchange rates influence the cost of production, pricing, and overall market dynamics in the frozen tuna market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the frozen tuna market analysis from 2022 to 2032 to identify the prevailing frozen tuna market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the frozen tuna market forecast segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global frozen tuna market trends, key players, market segments, application areas, and market growth strategies.

Frozen Tuna Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.3 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zoneco Group, chicken of the sea, Dongwon Enterprise Company, Nippon Suisan Kaisha aka Nissui, Pescanova SA, SalMar ASA, High Liner Foods, Brig-Star LLC, Tassal Group, Marine Harvest |

The global frozen tuna market size was valued at USD 6.6 billion in 2022, and is projected to reach USD 13.3 billion by 2032.

The global frozen tuna market is projected to grow at a compound annual growth rate of 7.4% from 2023-2032 to reach USD 13.3 billion by 2032.

The key players profiled in the reports includes Brig-Star LLC, Chicken of the Sea, Dongwon Enterprise Company, High Liner Foods, Marine Harvest, Nippon Suisan Kaisha aka Nissui, Pescanova SA, SalMar ASA, Zoneco Group, and Tassal Group.

Asia-Pacific dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Frozen tuna offers convenience and extended shelf life compared to fresh tuna. It is a convenient option for consumers who do not have access to fresh seafood or prefer the convenience of storing and using frozen products. The freezing process helps preserve the quality of the tuna and extends its shelf life. These factors are projected to generate excellent opportunities in the frozen tuna market.

Loading Table Of Content...

Loading Research Methodology...