Functional Beverages Market Research, 2030

Functional beverages are drinks formulated with ingredients that provide health benefits in addition to basic nutrition. These beverages often contain added vitamins, minerals, herbs, amino acids, or probiotics to support specific health functions such as boosting energy, improving digestion, enhancing immunity, or promoting hydration. Common types include energy drinks, fortified waters, herbal teas, and sports drinks. Functional beverages gained popularity owing to an increase in consumer interest in wellness and healthy living, offering a convenient way to incorporate beneficial nutrients into daily routines.

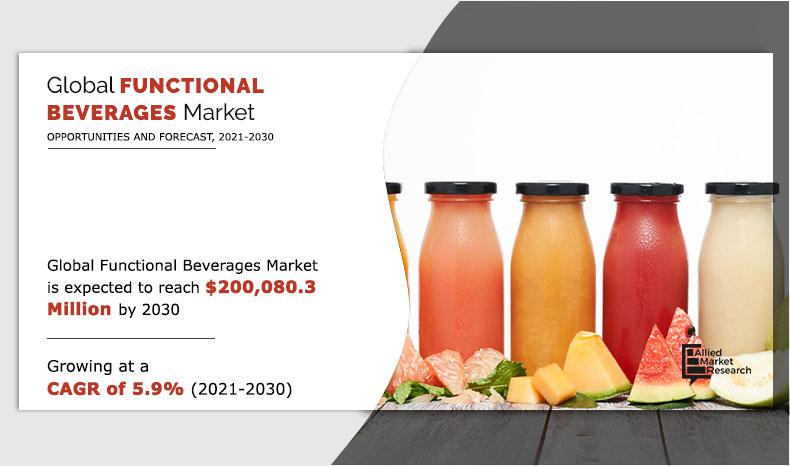

Market Value Projections and Insights

The functional beverages market size was valued at $ 110,148.9 million in 2020, and is estimated to reach $ 200,080.3 million by 2030, registering a CAGR of 5.9% from 2021 to 2030.

In 2020, depending on type, the dairy-based beverages segment accounted for $ 7,215.1 million, garnering 6.6% of the global market share.

On the basis of distribution channel, the E-Commerce segment acquired $ 12,555.8 million, exhibiting 11.4% of the global market share.

In 2020, by end user, the athletes segment was valued at $35,319.6 million, accounting for 32.1% of the market share.

U.S. was the most prominent market in North America in 2020, and is projected to reach $ 53,683.3 million by 2030, growing at a CAGR of 4.2% during the forecast period.

The functional beverages market size has expanded owing to increase in consumer demand for health-oriented products. With rise in awareness of maintaining a healthy lifestyle, consumers seek beverages that offer added benefits such as improved immunity, better digestion, and enhanced energy. Manufacturers have responded by developing a wide range of beverages fortified with vitamins, probiotics, and natural ingredients to meet the growing functional beverages market demand. As health-conscious lifestyles expand globally, the functional beverages market share has increased, particularly among younger demographics seeking convenient wellness solutions.

However, the market faces restraints owing to the high costs associated with producing these beverages. Functional beverages often contain specialized ingredients and require advanced processing techniques, leading to higher prices for consumers. Price factor limits the accessibility of functional beverages, particularly in price-sensitive regions. Despite this, a significant functional beverages market opportunity exists in the development of plant-based and organic beverages, as clean-label products continue to rise in popularity in recent years. Companies that innovate in these areas have the potential to tap into a growing segment focused on sustainability and natural health solutions.

By Type

Energy Drinks segment helds the major share of 40.7% in 2020

Industry Highlights

The functional beverages market has seen increased product innovation, with brands offering diverse flavors and formulations to meet consumer preferences and health needs.

A trend toward plant-based and organic ingredients has prompted manufacturers to create beverages that align with consumers' interest in sustainability and clean-label products.

The rise of health-conscious consumers has intensified competition from traditional beverages like sodas and juices, which are being reformulated with functional ingredients.

Improved marketing strategies using social media and influencer partnerships have successfully engaged younger demographics, fostering a loyal customer base for wellness-oriented beverages.

Functional beverages have gained significant traction owing to their health benefits and the growing consumer emphasis on wellness. These beverages attract health-conscious individuals seeking convenient options that provide nutritional advantages, such as improved digestion, boosted immunity, and increased energy levels. The functional beverages market thrives on innovation, with brands continuously introducing new formulations and flavors to capture consumer interest. Limited-edition releases and unique ingredient combinations contribute to the functional beverages industry demand, creating a sense of exclusivity among consumers.

As people become more aware of the impact of dietary choices on overall health, functional beverages serve as effective options that align with modern lifestyles focused on well-being. Moreover, functional beverages meet the demand for products that support health goals while providing satisfying and refreshing choices for daily consumption. In addition, the rise of social media has enabled brands to engage with consumers directly, driving trends and encouraging feedback that shapes future product development. With the ongoing expansion of this market, functional beverages are set to become a staple in health-conscious diets worldwide.

By Distribution Channel

Supermarket and Hypermarket segment helds the major share of 39.6% in 2020

Key Areas Covered in the Report

Functional beverages support targeted health benefits, such as hydration, digestion, and cognitive function, appealing to diverse consumer needs.

The trend of personalized nutrition drives demand for tailored beverages that align with individual health goals.

Innovative ingredients such as adaptogens and superfoods have gained popularity, attracting consumers interested in holistic health approaches.

The rise of e-commerce has expanded access to functional beverages, allowing consumers to explore a wider range of options online.

The functional beverages market faces competition from traditional beverage options such as carbonated drinks, juices, and bottled waters, as consumers have many choices for hydration and nutrition. With the growing emphasis on health and wellness, there is an increase in demand for beverages that offer specific benefits, such as immunity support, enhanced energy, or digestive health. Brands such as GT's Kombucha and Health-Ade have benefited from the popularity of gut health by offering a variety of kombucha flavors that appeal to health-conscious consumers. Similarly, companies such as BOLT24 and ODWALLA have introduced functional sports drinks designed to provide hydration and recovery benefits for active lifestyles. In addition, the rise of wellness influencers on social media platforms has significantly influenced consumer preferences. Thus, as consumers prioritize health and convenience, the functional beverages market trends is expected to expand rapidly in the coming years.

By End User

Fitness Lifestyle Users segment helds the major share of 43.8% in 2020

Topics discussed in the report

Health benefits and nutritional ingredients

Functional beverages in sports and fitness nutrition

Emerging trends in flavors and formulations

Impact of social media and influencers

Competition from traditional beverage categories

Sustainability and eco-friendly practices

The role of e-commerce in functional beverages market growth

Comparative Matrix of Key Segments

Parameters | Energy Drinks | Sports Drinks | Dairy-based Beverages | Juices | Others |

Market Share | Dominant in terms of traditional sales | Growing rapidly with digital platforms | Niche but increasing in popularity | High market share, widely recognized | Emerging segment with unique offerings |

Distribution Channels | Supermarkets, Convenience Stores, Online Retail | Supermarkets, Sports Retailers, Online Retail | Grocery Stores, Health Food Stores, Online Retail | Supermarkets, Convenience Stores, Online Retail | Niche Markets, Specialty Stores, Online Retail |

Challenges | Health concerns, Regulatory scrutiny | Competition from water and health drinks | Short shelf life, Consumer perception of health | Competition from carbonated drinks and smoothies | Limited awareness, Fragmented market |

Key Players | Red Bull, Monster Energy, Rockstar Energy | Gatorade, Powerade, BodyArmor | Fairlife, Lifeway, Danone | Tropicana, Minute Maid, Simply Orange | Various local and niche brands |

Regional Dynamics and Competition

The North America functional beverages market has seen growth driven by regulations and consumer trends specific to the region. The Food and Drug Administration (FDA) and Health Canada closely regulate energy drinks, focusing on caffeine content and labeling requirements. Recent regulations in the U.S. have pushed manufacturers to provide more transparent ingredient lists, particularly around sugar and stimulants. In Canada, new regulations around natural health products have impacted functional beverages containing herbal extracts. Major cities such as New York, Los Angeles, and Toronto have emerged as hubs for functional beverage demand, driven by health-conscious consumers and fitness culture. The rise of plant-based beverages and protein drinks has been especially strong in these urban centers. Furthermore, the growing consumer preference for clean-label, sustainable beverages in North America has also led to innovation in packaging and formulations that align with local regulations.

By Region

North America region helds the major share of 39.5% in 2020

Competition Analysis

Some of the major players analyzed in this report are Red Bull, Meiji Co., Ltd., Monster Beverage Corporation, Clif Bar, MaxiNutrition, The Coca-Cola Company, Dupont Nutrition Biosciences ApS, Nestlé S.A., Pepsico, Inc., and National Beverage Corp.

Functional Beverages Market News Release

In October 2023, Tropicana launched two new smoothie flavors, pineapple & mango and strawberry & banana, across India in all distribution channels to increase its presence in India.

In August 2023, Brisk partnered with TikTok influencers to promote its pure leaf and brisk iced tea products on social media in Canada and other regions to expand its market reach.

In March 2023, Dole introduced 100% fruit-based functional beverages, including pineapple juice and digestive bliss fruit juice to strengthen its product portfolio of functional beverages.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the functional beverages market analysis from 2022 to 2032 to identify the prevailing functional beverages market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the functional beverages market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global functional beverages market forecast, key players, market segments, application areas, and market growth strategies.

Functional Beverages Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | National Beverage Corp., Clif Bar, NESTLÉ S.A., The Coca-Cola Company, MEIJI CO., LTD., Red Bull, Dupont Nutrition Biosciences ApS, Pepsico, Inc., MONSTER BEVERAGE CORPORATION, MaxiNutrition |

Analyst Review

Functional beverages contain raw fruit, minerals, herbs, probiotics and some artificial ingredients which fortify the nutritional value of the beverages and it can address the specific needs of the diseases. Sports and energy drinks collectively accounting for highest share in functional beverages market and is expected to grow at considerable CAGR growth rate especially in developing countries such as India and China. Growing participation of the people in sports related activities, increasing enrolment for fitness centers and health clubs and increasing popularity of the adventurous tours like motor biking, treking and mountain climbing are likely to encourage people to consume instant energy food and beverages, thereby increase the demand for functional beverages.

In 2020, North America dominated the global functional beverages market, owing to increase in health concerns and rise in awareness toward the benefits of consuming energy drinks. The Asia-Pacific region is anticipated to grow at the highest rate during the forecast period, owing to surge in disposable income and change in demographics.

Existing challenges, such as close substitutes and lack of awareness regarding functional beverages benefits, are expected to hamper the growth of the functional beverages market during the forecast period. Furthermore, lack of proper distribution channel in rural and remote area and increasing inclination of the people for fresh, natural, organic and artificial additives less beverages are key challenges facing by the functional beverages processing companies.

Functional beverages market size was valued at $ 110,148.9 million in 2020, and is estimated to reach $ 200,080.3 million by 2030

The global Functional Beverages market is projected to grow at a compound annual growth rate of 5.9% from 2021 to 2030 $ 200,080.3 million by 2030

The key players profiled in this report include Red Bull, Dupont Nutrition Biosciences ApS, MaxiNutrition, Clif Bar, The Coca-Cola Company, Monster Beverage Corporation, Meiji Co., Ltd, Nestlé S.A., National Beverage Corp., and Pepsico, Inc

North America region helds the major share

increase in demand for products that provide instant energy and rise in athletes and sports persons are majorly attributed for the growth of the functional beverages market, Growing number of health conscious people and demand for super premium high nutritional food and beverages is further accelerating the growth of the market

Loading Table Of Content...