Functional Food Market Research, 2033

Market Introduction and Definition

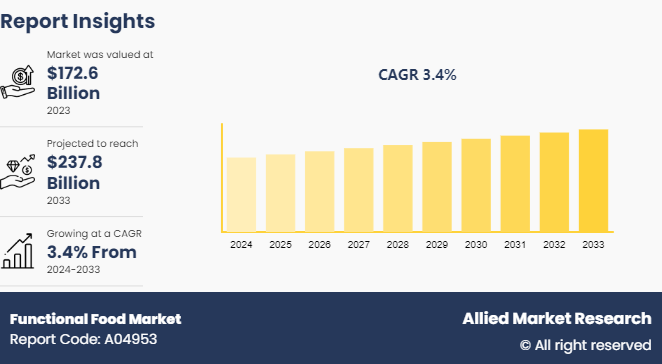

The global functional food market size was valued at $172.6 billion in 2023, and is projected to reach $237.8 Billion by 2033, growing at a CAGR of 3.4% from 2024 to 2033.

Functional foods are items that provide health benefits beyond basic nutrition due to their specific bioactive compounds or ingredients. They are categorized based on their health-promoting properties, such as probiotics, prebiotics, antioxidants, omega-3 fatty acids, and fortified foods with added vitamins and minerals. These foods offer diverse uses, including improving digestive health, boosting immunity, reducing the risk of chronic diseases like heart disease and diabetes, enhancing cognitive function, and supporting weight management. Functional foods have gained popularity as consumers seek ways to optimize their health through dietary choices, contributing to a growing market of products tailored to meet various health needs.

Key Takeaways

The functional food market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global functional food markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends:

Consumers have gained a deeper comprehension of how nutrition influences both physical and mental well-being. Rise in awareness extends to recognizing the health advantages offered by functional foods, which play a role in safeguarding against various diseases like cancer, heart disease, and diabetes. Consequently, the favorable effects of functional foods on health are bolstering functional food market demand and expansion. The increasing population and evolving dietary preferences among individuals stand out as primary factor which drive functional food market growth.

35-40% of consumers are inclined toward foods containing functional ingredients to reduce the risk of certain health conditions, such as obesity, weight management, diabetes, and cardiovascular diseases. The hectic lifestyles and increasing stress have contributed to the increasing prevalence of such health disorders. Moreover, people tend to consume big meals three to four times a day. This has created a negative impact on people's health. The growing awareness and shift in eating habits have led to a trend of eating multiple smaller meals during the day.

Key Market Dynamics

The functional food market is driven by several key factors such as increasing consumer awareness and interest in health and wellness drive demand for products that offer specific health benefits beyond basic nutrition. Moreover, rise in chronic diseases like obesity, diabetes, and heart disease has prompted consumers to seek out nutrient-rich food and functional foods that help to prevent or manage these conditions. Technological advancements in food processing and ingredient formulation have also led to the development of more effective and palatable functional food products. Aging populations and growing concerns about aging-related health issues fuel demand for functional foods targeting issues like cognitive decline and bone health. Furthermore, government initiatives promoting healthy eating habits and the inclusion of functional foods in dietary guidelines further support functional food market growth.

Ensuring the safety and efficacy of functional food ingredients and health claims requires rigorous scientific evidence and regulatory approval. Limited consumer understanding and skepticism about the effectiveness of some functional food products also hinder market expansion. In addition, taste and texture be a barrier, as some functional foods may not meet consumer expectations in terms of flavor and mouthfeel. Furthermore, pricing be a deterrent, with functional foods often commanding a premium compared to conventional alternatives. Moreover, competition from dietary supplements and pharmaceuticals offering similar health benefits poses a threat to the growth of the functional food market share.

Expanding consumer interest in personalized nutrition creates avenues for tailored functional food solutions targeting specific health needs and preferences. Leveraging advanced technologies like genetic testing and artificial intelligence facilitate the development of personalized functional food products. Moreover, collaborations between food companies and healthcare providers offer opportunities to integrate functional foods into disease management and prevention programs, tapping into the increasing healthcare market. Moreover, addressing emerging health concerns such as mental well-being and gut health presents opportunities to introduce novel functional food ingredients and formulations. Furthermore, leveraging digital platforms and e-commerce channels enables direct-to-consumer marketing and distribution, enhances market reach and accessibility.

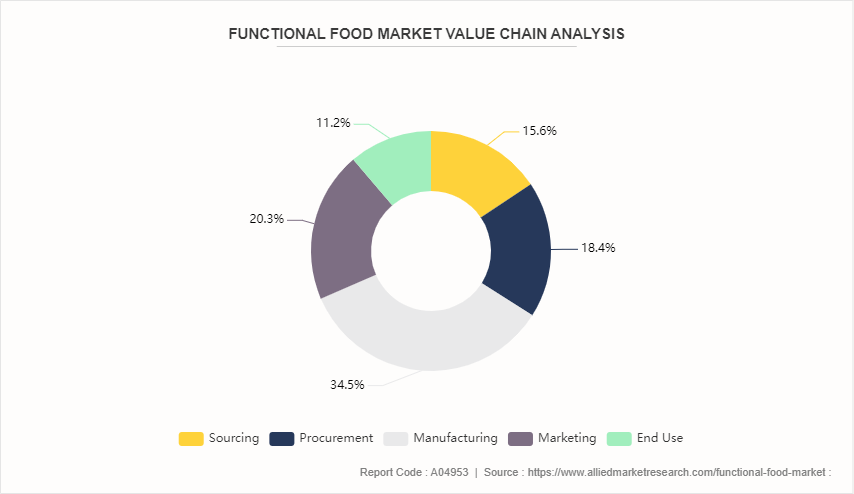

Value Chain of Global Functional Food Market

The value chain for the functional food industry begins with agricultural production, involving the growing and harvesting of raw materials like grains, fruits, vegetables, and dairy ingredients. This sourcing stage encompasses both conventional farming methods as well as organic agricultural practices. The next stage is processing and ingredient manufacturing. It includes milling grains into fortified flours, extracting nutrients, fibers, and probiotics from plant and dairy sources, as well as manufacturing functional ingredients like vitamins, minerals, and nutraceutical compounds. The third major step is product formulation and manufacturing. This involves combining the extracted and processed functional ingredients into food and beverage product recipes and formulations. Finished products like functional bakery items, dairy products, beverages, and snacks are developed through techniques such as baking, fermentation, and nutrient enrichment before packaging for distribution. Furthermore, the distribution and retail stage follow, where the finished functional food products are transported and distributed through various retail channels like supermarkets, grocery stores, convenience outlets, as well as direct-to-consumer online retail platforms.

Market Segmentation

The functional food market is segmented into type, source, distribution channel and region. On the basis of type, the market is divided into bakery & cereals, dairy products, beverages, dietary supplements, and other products. On the basis of source, the market is bifurcated into conventional and organic. As per distribution channel, the functional food market size is classified into supermarkets/hypermarkets, specialty stores, online channels, and convenience stores. Region wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

Regional/ Country Market Outlook

The Asia-Pacific region stands out as a significant market for functional food products. The growth is fueled by rising consumer curiosity and a deeper appreciation for the immune-boosting potential of a balanced diet and healthy eating habits. This rising awareness is particularly driving sales of vitamin-fortified and mineral-enriched food and beverage products. As a result, Japan is experiencing an increase in awareness regarding food labeling, with a particular focus on calorific values and fat contents as crucial nutritional information. The Japanese Health And Beauty report of 2021 revealed that 1145 products were officially registered as functional foods. For Instance, in February 2021, Nestle Japan introduced almond and oat milk lattes, tapping into the growing demand for plant-based alternatives.

Furthermore, a significant portion of the Chinese populace exhibits lactose intolerance, prompting them to gravitate towards plant-based yogurt as a preferable alternative. Its fermented nature renders it easily digestible, enhancing its appeal among consumers. For instance, in May 2021, the Chinese plant-based snacking company, Marvelous Foods, launched Yeyo coconut yogurt on the e-commerce platform, Tmall. Yeyo is plant-based coconut yogurt with zero added sugar, artificial flavors, and sweeteners. The initial launch showcased three stock-keeping units (SKUs) , offering a 'pure' sugar-free variant along with two yogurt-granola cups featuring seasonal fruit and nut granola toppings for added flavor and nutrition. There's a growing consumer inclination towards minimally processed food and beverages with natural, organic ingredients, combined with environmental sustainability, all of which contribute positively to market growth in the Asia-Pacific region.

Competitive Landscape

The major players operating in the functional food market include Nestle, PepsiCo, Danone, General Mills, Kellogg's, Yakult Honsha, Meiji Co. Ltd., Mond?lez International, Unilever and Red Bull GmbH.

Recent Key Strategies and Developments

In February 2023, Hindustan Unilever Ltd (HUL) announced the launch of its new chocolate flavor Millet Horlicks in Tamil Nadu. The company claims that Millet Horlicks in chocolate flavor is HUL's first product with super-grain which contains multi-millets like Finger Millet (Ragi) , Sorghum (Jowar) , Foxtail Millet (Kanngani) and Pearl Millet (Bajra) and these multi-millets are claimed to be a natural source of calcium, iron, protein, and fiber.

In April 2023, Nestlé announced the launch of its two new vegan chocolate chips under its Toll House brand. These chips are claimed to be dairy-free and were launched to meet the demand for plant-based products.

Key Sources Referred

Food and Agriculture Organization of the United Nations

National Institute of Health (NIH)

European Food Information Council

The Food Institute

Today’s Dietitian Magazine

American Council of Science and Health

Food Insights Organization

Food and Agriculture Organization

Food and Drug Law Institute

USDA Food Data Central

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the functional food market analysis to identify the prevailing functional food market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the functional food market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global functional food market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global functional food market trends, key players, market segments, application areas, and market growth strategies.

Functional Food Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 237.8 Billion |

| Growth Rate | CAGR of 3.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 342 |

| By Type |

|

| By Source |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Yakult Honsha, Meiji Co. Ltd., Danone, Unilever, General Mills, Red Bull GmbH, Mond?lez International, Kellogg's, PepsiCo, Nestle |

The global functional food market size was valued at $172.6 billion in 2023, and is projected to reach $237.8 Billion by 2033

The global Functional Food market is projected to grow at a compound annual growth rate of CAGR of 3.4% from 2024 to 2033 $237.8 Billion by 2033

The major players operating in the functional food market include Nestle, PepsiCo, Danone, General Mills, Kellogg's, Yakult Honsha, Meiji Co. Ltd., Mond?lez International, Unilever and Red Bull GmbH.

The Asia-Pacific region stands out as a significant market for functional food products.

Growing Health Awareness, Rising Incidence Of Chronic Diseases, Shifting Dietary Preferences

Loading Table Of Content...