Gas-to-Liquid Fuels Market Research, 2032

The global gas-to-liquid fuels market was valued at $5.4 billion in 2022, and is projected to reach $8.2 billion by 2032, growing at a CAGR of 4.3% from 2023 to 2032.

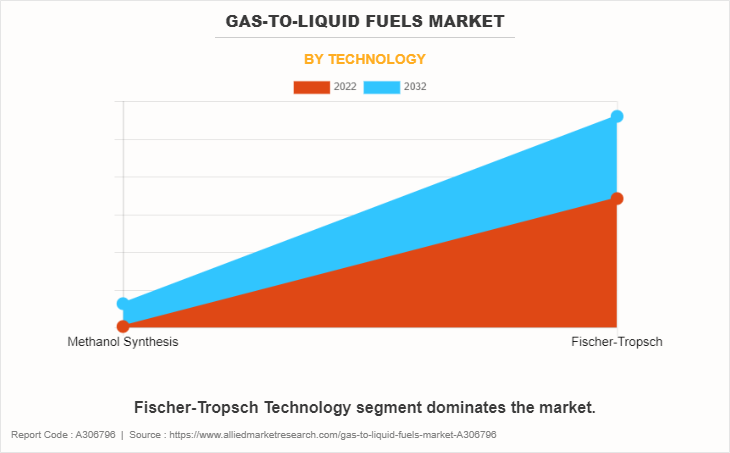

GTL technology involves the conversion of natural gas to liquid fuels such as synthetic diesel and synthetic jet fuel through a series of chemical processes such as methanol synthesis, and fisher-tropsch. The gas-to-liquid (GTL) fuels market has witnessed significant growth in recent years, driven by technological advancements and a growing emphasis on cleaner and more sustainable energy sources across the globe.

The increase in demand for cleaner alternatives to traditional fossil fuels is one of the key drivers for the expansion of the gas-to-liquid fuels market. Industries and governments are exploring cleaner energy options due to the rise in carbon emissions. However, gas to liquid fuels (GTL) industry offer a viable solution as they produce lower emissions than conventional diesel and gasoline in the transportation and power generation sectors.

The diverse range of applications is another contributing factor to gas-to-liquid fuels market growth. The adaptability of gas-to-liquid fuels to existing infrastructure for diesel engines, without requiring extensive modifications, makes them an appealing choice for various sectors, including transportation and industrial processes.

Moreover, gas-to-liquid fuels exhibit several advantages, including higher cetane numbers for diesel, which improves combustion efficiency and reduces emissions. In addition, gas-to-liquid fuels have lower sulfur content, which contributes to reduced air pollution and has a positive impact on the environment. The ability of gas-to-liquid fuels to enhance fuel properties while offering a cleaner alternative aligns with global efforts to transition toward more sustainable energy solutions.

The market for gas-to-liquid fuels is also influenced by geopolitical factors and energy security considerations. Diversifying the energy mix by incorporating gas-to-liquid fuels helps reduce dependence on traditional oil-producing regions, contributing to energy security for importing nations.

However, challenges persist, and the gas-to-liquid fuels market is subject to the volatility of natural gas prices. Fluctuations in gas prices can impact the economic viability of GTL projects. Additionally, the initial capital investment required for GTL facilities can be substantial, posing a barrier to entry for some market players.

As technology continues to evolve, ongoing research and development efforts aim to improve the efficiency and cost-effectiveness of GTL processes. Advancements in catalyst technologies, reactor design, and process optimization contribute to making gas-to-liquid fuels more competitive in the broader energy market.

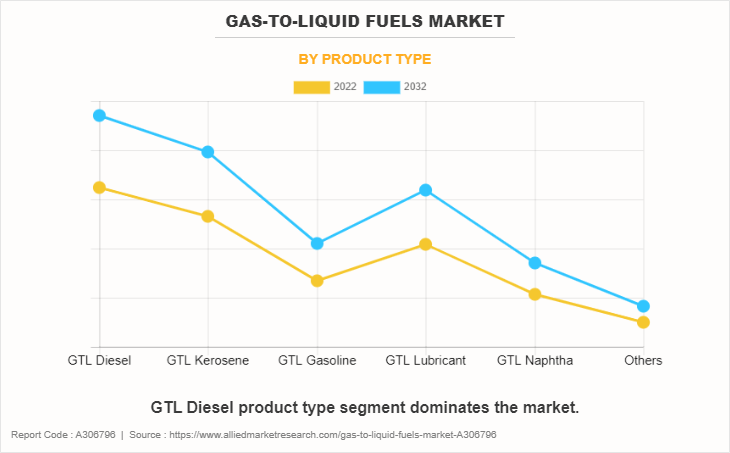

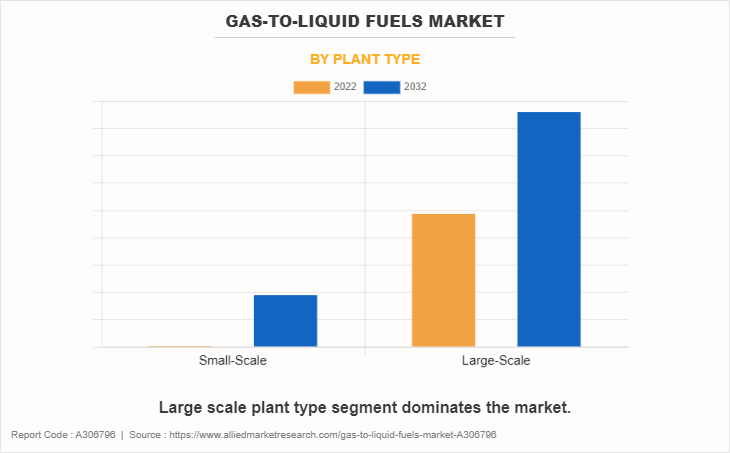

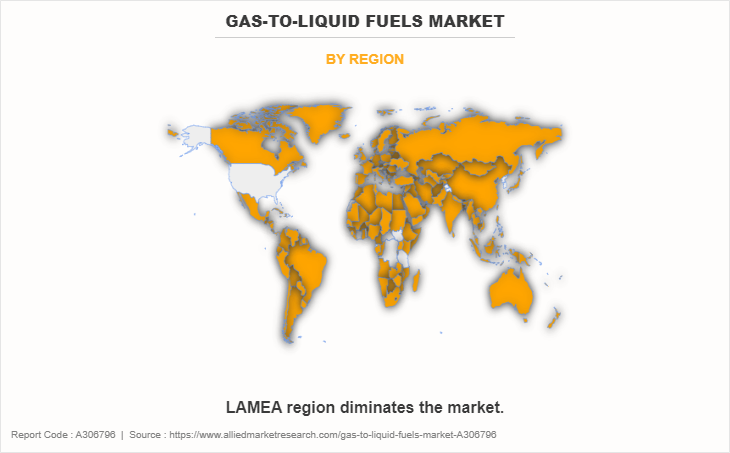

The global gas-to-liquid fuels market scope is segmented on the basis of product type, plant type, technology, and country. By product type, the market is divided into GTL diesel, GTL kerosene, GTL gasoline, GTL lubricant, GTL naphtha, and others. On the basis of the plant type, it is bifurcated into small scale and large scale. Depending on technology, the market is categorized into methanol synthesis and fisher-tropsch. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In North America, GTL technologies aim to leverage the abundant natural gas reservoirs in the U.S., Canada, and Mexico. Despite ample reserves, the primary focus in this region has historically been on exploring liquefied natural gas (LNG) and petrochemical production rather than extensive GTL projects. While sporadic interests and pilot projects have been undertaken in the U.S. and Canada, large-scale initiatives have been limited. Mexico has expressed intermittent curiosity about GTL technology, yet the implementation of significant GTL facilities remains constrained.

The economic interest in utilizing abundant natural gas resources for GTL conversion processes, however, continues to positively impact the industry. The region recognizes GTL as a promising avenue for converting natural gas reservoirs into valuable liquid fuels, such as gasoline, jet fuel, and diesel.

Recent attention has been directed toward proposed GTL plants in the U.S., including locations such as Lake Charles (Louisiana), Karns City (Pennsylvania), and Ashtabula (Ohio). Additionally, smaller-scale GTL projects in eastern Kentucky and Colorado reflect a diversified interest in this technology across various regions. The emergence of micro GTL plants signals a growing inclination toward decentralized and localized fuel production methods.

Despite the promising potential, challenges persist within the U.S. gas-to-liquid fuels market, influenced by economic volatility and infrastructure complexity. Economic fluctuations in energy markets impact the feasibility of GTL projects, and the specialized infrastructure required poses logistical challenges.

In Europe, the gas-to-liquid fuels market statistics is influenced by a push for cleaner energy alternatives. The region's commitment to environmental sustainability aligns with GTL processes producing cleaner-burning fuels compared to traditional petroleum products. Germany, France, and the UK are at the forefront of exploring GTL technology to address environmental concerns and diversify their energy mix.

The Asia-Pacific region, including China, Japan, and India, sees GTL as a means to meet the increased demand for energy while addressing environmental issues. GTL-derived fuels offer a cleaner alternative, aligning with stringent environmental regulations in these countries.

In LAMEA, including Brazil, Saudi Arabia, and South Africa, GTL technology is seen as a strategic approach to enhance energy security and sustainability. The region's interest in GTL stems from the need to reduce reliance on traditional oil reserves and comply with environmental regulations.

The global gas-to-liquid fuels market faces constraints due to economic volatility and infrastructure complexity. Fluctuations in energy markets impact the economic viability of projects, while specialized infrastructure requirements pose challenges to widespread adoption. However, the market's transformative growth potential lies in offering cleaner-burning GTL-derived fuels, fostering international trade relationships, and positioning regions as global leaders in sustainable fuel solutions.

Partnerships and investments across government, private sectors, and technology developers are crucial for accelerating GTL technology advancement worldwide. The industry is growing rapidly through strategic opportunities that balance technological advancements with market stability and targeted investments, contributing to a sustainable and robust global gas-to-liquid fuels industry.

Based on product type, the GTL diesel segment held the highest market share in 2022, accounting for nearly one-third of the global gas-to-liquid fuels market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, the others segment is projected to manifest a CAGR of 5.4% from 2023 to 2032.

Based on plant type, large-scale segment held the highest market share in 2022, accounting for nearly three-fourths of the global gas-to-liquid fuels market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, small-scale segment is projected to manifest a CAGR of 5.0% from 2023 to 2032.

Based on the technology, the Fischer-Tropsch segment held the highest market share in 2022, accounting for more than four-fifths of the global gas-to-liquid fuels market revenue, and is estimated to maintain its leadership status throughout the forecast period. Moreover, the methanol synthesis segment is projected to manifest a CAGR of 4.9% from 2023 to 2032.

Based on region, LAMEA held the highest market share in terms of revenue in 2022, accounting for nearly one-third of the global gas-to-liquid fuels market share, and is likely to dominate the market during the forecast period. However, the Asia-Pacific region is expected to witness the fastest CAGR of 4.7% from 2023 to 2032.

The major players operating in the global gas-to-liquid fuels market forecast are Royal Dutch Shell Plc, Chevron Corporation, ExxonMobil Corporation, Sasol Limited, Petroliam Nasional Berhad (PETRONAS), Velocys plc, Gazprom International Limited, PetroChina Company Limited, BP p.l.c., and CompactGTL.

Other players include Oryx GTL, Primus Green Energy Inc., PetroSA, InfraLNG, Greyrock Energy, and Fluor Corporation.

Strategic developments undertaken by key players:

- Royal Dutch Shell Plc:

- Shell focused on its Integrated Gas segment, involving liquefied natural gas (LNG) and gas-to-liquids (GTL) fuels.

- Executed changes in its executive committee and directorate in July 2023, merging Integrated Gas and Upstream businesses.

- Chevron Corporation:

- Expanded collaboration with Cummins on hydrogen and renewable natural gas, with plans to encompass other liquid renewable fuels.

- Allocated approximately $2.3 billion for refining, marketing, and transport fuels, including a push for renewable fuels and products.

- ExxonMobil Corporation:

- Invested in R&D for next-gen, lower-emission solutions, including carbon capture, hydrogen, and lower-emission fuels.

- Released the 2023 corporate plan, aiming to grow production from low-cost assets and increase sales of performance chemicals and lower-emission fuels.

- Sasol Limited:

- Worked on extending its gas-to-liquids (GTL) footprint globally, with advanced plans in Nigeria, Uzbekistan, Canada, and the U.S.

- Petroliam Nasional Berhad (PETRONAS):

- Committed to sustainable energy solutions and launched Gentari, a new entity focusing on cleaner energy, hydrogen, and green mobility.

- Contributed to society's progress through responsible and sustainable energy production and delivery.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas-to-liquid fuels market analysis from 2022 to 2032 to identify the prevailing gas-to-liquid fuels market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas-to-liquid fuels market size segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global gas-to-liquid fuels market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas-to-liquid fuels market trends, key players, market segments, application areas, and market growth strategies.

Gas-to-Liquid Fuels Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.2 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 256 |

| By Product Type |

|

| By Plant Type |

|

| By Technology |

|

| By Region |

|

| Key Market Players | PETROLIAM NASIONAL BERHAD (PETRONAS), CompactGTL, Velocys plc, PetroSA, PetroChina Company Limited, Primus Green Energy Inc., BP p.l.c., ExxonMobil Corporation, Shell Plc., Sasol Limited, Gazprom International Limited, Chevron Corporation, Oryx GTL |

Analyst Review

In the Gas-to-Liquid (GTL) market, CXOs highlight the pivotal role of technological advancements and industry collaborations in propelling market growth. The utilization of GTL technology across diverse sectors like construction, automotive, transportation, and oil and gas amplifies its significance within North America. GTL's application extends to various industries owing to its versatility and adaptability in meeting rising energy demands. Specifically, GTL's prominence in sectors like transportation and environmental management, such as fuel applications and waste management, underscores its multifaceted advantages.

The technology's ability to convert natural gas into liquid products provides an efficient and sustainable alternative, aligning with the region's growing focus on environmental preservation. However, challenges persist, including the cost of raw materials, hindering the widespread adoption of GTL solutions. Despite this, the industry witnessed continual advancements in manufacturing techniques, offering promising avenues for growth. The presence of strategic alliances, acquisitions, and expansions among key players underscore the pursuit of sustainable business models and global market presence, shaping the future landscape of the gas-to-liquid fuels industry.

The CXOs further added that the technological advancements in the manufacturing of gas-to-liquid fuels and the surge in the use of environmentally friendly products offer lucrative growth opportunities. Moreover, the industry is characterized by a high number of new market entrants that seek to tap lucrative opportunities in the global market while existing players enter strategic collaborations to increase capacities and expand their reach into emerging markets. The acquisition, collaboration, and expansion activities in the industry have increased significantly over the past decade. Companies constantly seek to establish long-term contract agreements with trusted partners for sustainable business operations globally.

$8.2 billion is the estimated industry size of Gas-to-Liquid Fuels in 2032.

Carbon-neutral GTL Technologies, Growing Investment in GTL Research and Development, Expansion of GTL Facilities Globally, Increasing Integration of Renewable Energy Sources in GTL Processes, Advancements in Fischer-Tropsch Synthesis for GTL Production are the upcoming trends of Gas-to-Liquid Fuels Market in the world.

GTL Diesel is the leading application of Gas-to-Liquid Fuels Market.

LAMEA is the largest regional market for Gas-to-Liquid Fuels.

Royal Dutch Shell Plc, Chevron Corporation, ExxonMobil Corporation, Sasol Limited, Petroliam Nasional Berhad (PETRONAS) are the top companies to hold the market share in Gas-to-Liquid Fuels

Loading Table Of Content...

Loading Research Methodology...