Gelatin Substitutes Market Research, 2034

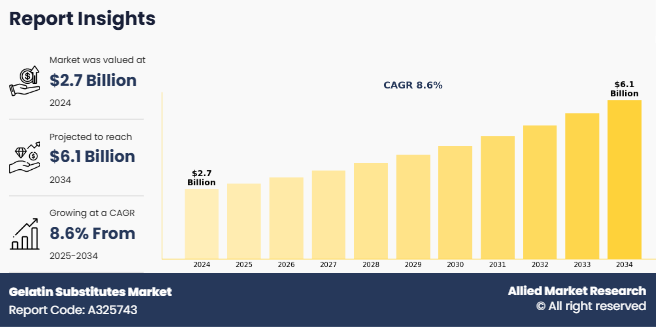

The global gelatin substitutes market was valued at $2.7 billion in 2024, and is projected to reach $6.1 billion by 2034, growing at a CAGR of 8.6% from 2025 to 2034. A gelatin substitute refers to any ingredient or substance used to replicate the gelling, thickening, or stabilizing properties of traditional gelatin, which is derived from animal collagen. These substitutes are typically plant-based, vegan, and often cater to dietary restrictions such as gluten- free, kosher, or halal. The common gelatin substitutes include agar-agar, pectin, carrageenan, xanthan gum, and guar gum. It is used in a variety of applications, such as in food products (gummies, jellies, desserts), pharmaceuticals (capsules), and cosmetics (creams, lotions), offering a cruelty-free and often more sustainable alternative to animal-based gelatin.

Market Dynamics

Consumers are increasingly demanding transparency in the food and personal care products they purchase, leading to a surge in preference for clean-label products. The clean-label products are those that contain simple, recognizable, and natural ingredients without artificial additives or preservatives. Gelatin substitutes, such as agar- agar, pectin, and xanthan gum, align perfectly with this trend as they are natural, plant-based, and free from animal- derived ingredients. Moreover, as consumers continue to prioritize products with minimal ingredients and clear labeling, the gelatin substitutes market is witnessing a surge in demand across sectors such as food, pharmaceuticals, and cosmetics.

Increase in adoption of veganism and plant-based diets is a significant trend that is shaping the gelatin substitutes industry. With more people moving toward vegan lifestyles due to health, environmental, or ethical reasons, the demand for animal-free alternatives to gelatin has increased. Agar-agar, pectin, and guar gum have emerged as popular plant-based substitutes in a variety of food products such as gummies, marshmallows, and confectioneries, as well as in pharmaceuticals and cosmetics. This trend is expected to continue gelatin substitutes market growth, especially in regions such as North America and Europe, where plant-based eating habits are expanding rapidly.

However, the key challenges for gelatin substitutes is their inability to replicate the unique texture and gelling properties of traditional gelatin, particularly in products where specific texture is essential. For instance, agar-agar tends to form a more brittle gel compared to gelatin, and this is expected to be an issue for applications in the confectionery industry, such as gummy candies, where elasticity is crucial. The functional limitations of gelatin plant- based substitutes in creating the same texture and mouthfeel experience as gelatin has made it difficult for manufacturers to fully replace gelatin in some product categories.

The production cost of gelatin substitutes is often higher than that of traditional gelatin. Agar-agar, for instance, is derived from seaweed, and the harvesting and processing methods are more resource intensive. Similarly, pectin is extracted from fruits, which adds additional costs to the production process. The higher cost of these substitutes presents a barrier to their widespread adoption, particularly in price-sensitive markets or industries that rely on cost- effective ingredients, such as large-scale food production. This limits the accessibility of gelatin substitutes for manufacturers, especially in developing regions that limits the growth of gelatin substitutes market demand.

The growing trend toward natural, vegan, and allergen-free products presents a major opportunity for gelatin substitutes in the pharmaceutical and cosmetics industries. As consumers demand vegetarian capsules, tablets, and skin care products that are free from animal-derived ingredients, gelatin substitutes such as pectin and xanthan gum are increasingly being incorporated into these products. The clean-label movement is also driving demand for plant- based ingredients in both sectors. This shift presents a significant opportunity for manufacturers to innovate and meet the evolving needs of health-conscious and ethical consumers in these fast-growing industries that can help companies to cater gelatin substitutes market share.

Ingredients such as agar-agar, pectin, and carrageenan require specialized extraction, purification, and processing techniques to ensure consistent quality, gel strength, and functional properties. The dependency on specific plant sources, seasonal variations, and agricultural yield fluctuations can further drive costs, impacting the overall pricing of gelatin substitutes. For small- and medium-sized food, pharmaceutical, and cosmetic manufacturers, these higher costs may discourage switching from conventional gelatin, particularly in price-sensitive markets. Additionally, the processing, transportation, and storage requirements for plant-based substitutes can add to operational expenses, making them less competitive in regions where cost considerations dominate procurement decisions. The premium pricing of gelatin substitutes, coupled with limited awareness among end-users in certain regions, can slow adoption rates. Although rising demand for plant-based products drives market growth, cost constraints continue to challenge large-scale penetration and widespread use, particularly in emerging markets and low-margin product segments, limiting overall market expansion.

Segmental Overview

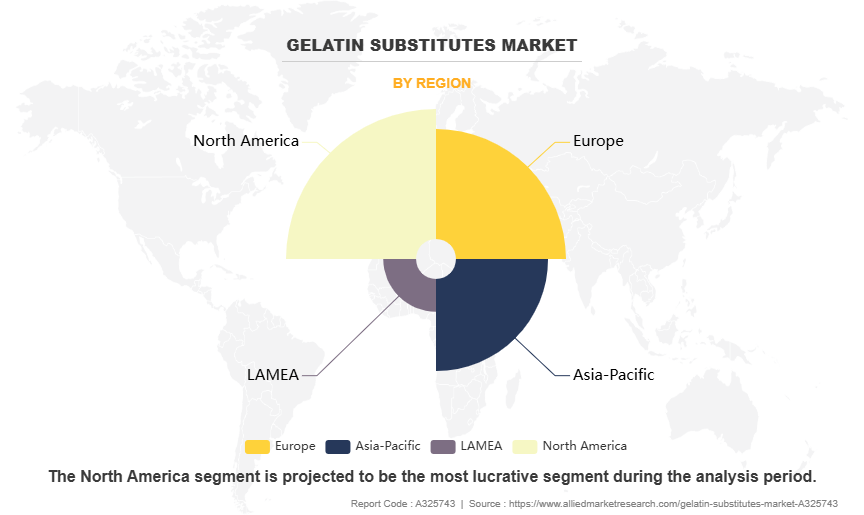

The gelatin substitutes market size is segmented on the basis of product type, application, distribution channel, andregion. On the basis of product type, it is categorized into agar-agar, pectin, carrageenan, xanthan gum, guar gum, and others. On the basis of application, it is divided into food & beverage, pharmaceuticals, cosmetics, and others. On the basis of distribution channel, it is segregated into online stores, supermarkets/hypermarkets, specialty store, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

By product type, the pectin segment dominated the gelatin substitutes market size in 2024 and is anticipated to maintain its dominance during the forecast period. Pectin is widely used as a gelling agent in a variety of food applications, particularly in fruit jams, jellies, and gummy candies. As a plant-based, naturally derived ingredient, it is a preferred alternative to gelatin in vegan, vegetarian, and health-conscious products. The growing demand for clean-label products and those made with natural ingredients has further increased pectin’s adoption across the food and beverage industry. Moreover, it also offers numerous health benefits, including its high fiber content and potential to support digestive health. With increasing awareness about digestive health and the rising trend of functional foods, pectin is becoming a popular choice for those seeking health-conscious alternatives to gelatin.

By Application

By application, the food & beverages segment dominated the gelatin substitutes market in 2024 and is anticipated to maintain its dominance during the gelatin substitutes market forecast period. With the growing trend of veganism, vegetarianism, and plant- based diets, there is a significant shift toward plant-derived gelatin substitutes such as agar-agar, pectin, and guar gum. In addition, consumers are increasingly opting for products that align with their dietary preferences, health goals, and ethical considerations. This trend has led to a rise in the adoption of gelatin substitutes across various food products, including desserts, candies, jellies, and marshmallows, which traditionally rely on gelatin. Consumers are increasingly demanding clean-label products, which contain simple, natural ingredients without artificial additives. Plant-based gelatin substitutes, being free from animal-derived ingredients and artificial substances, are perceived as more natural and transparent options.

By Distribution Channel

By distribution channel, the supermarket/hypermarket segment dominated the gelatin substitutes market in 2024 and is anticipated to maintain its dominance during the forecast period. Supermarkets and hypermarkets are the primary retail channels for consumers seeking convenience in their shopping experience. Furthermore,these retail outlets offer a wide variety of products, including gelatin substitutes, in easily accessible locations. Consumers prefer one- stop shopping experience provided by supermarkets and hypermarkets, where they are able to purchase everything from food and beverages to pharmaceuticals and personal care products, all under one roof. The high foot traffic in these stores makes them an ideal platform for gelatin substitutes, ensuring that these products reach a large and diverse customer base.

By Region

Region-Wise, the North America segment dominated the gelatin substitutes market in 2024 and is anticipated to maintain its dominance during the forecast period. North America, particularly the U.S. and Canada, has seen a substantial rise in plant-based and vegan lifestyles. This trend is driven by increasing health consciousness, environmental concerns, and ethical considerations. As a result, there is a growing preference for plant-based alternatives to animal-derived products such as gelatin. Gelatin substitutes, such as pectin, agar-agar, and xanthan gum, are gaining traction in North American food products, especially in confectionery, dairy alternatives, and health supplements. This shift toward plant-based eating is a significant growth driver for the gelatin substitutes market in the region.

Competition Analysis

The key players profiled in this report include CP Kelco, Tate & Lyle, B&V srl, Cargill Incorporated, Gino Gums Stabilizers, Indoflora Cipta Mandiri, AEP Colloids, Great American Spice Company, Ingredion, and Jebsen & Jessen Life Science Inc

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gelatin substitutes market analysis from 2024 to 2034 to identify the prevailing gelatin substitutes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gelatin substitutes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gelatin substitutes market trends, key players, market segments, application areas, and market growth strategies.

Gelatin Substitutes Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 6.1 billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 380 |

| By Product Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Great American Spice Company, Cargill Incorporated, AEP Colloids, Gino Gums Stabilizers , Jebsen & Jessen Life Science Inc., B&V srl, Ingredion, CP Kelco, Tate & Lyle, Indoflora Cipta Mandiri |

Analyst Review

The gelatin substitutes market represents a high-growth and innovative segment within the broader food and beverage industry. The market is gaining recognition due to shifting consumer preferences toward plant-based, allergen-free, and clean-label products. The increasing demand for vegan and plant-based alternatives, combined with the growing awareness of the health risks associated with animal-derived ingredients, positions gelatin substitutes as a lucrative opportunity for market expansion and differentiation. Moreover, to capitalize on this trend, it is essential to focus on expanding distribution channels, particularly in North America and Europe, where the demand for plant-based and clean-label products is already strong.

However, ensuring production efficiency and managing costs is expected to be crucial, as the manufacturing of gelatin substitutes requires specialized ingredients and processes that impact pricing. The scalability of production and managing ingredient sourcing will be key for long-term success in this market.

In addition, there is an increase in demand for food products that offer functional benefits without compromising on taste or texture. Marketing gelatin substitutes requires positioning them as versatile, healthy alternatives to traditional gelatin, highlighting their use in a wide range of applications, from confectioneries to beverages. Key strategies would include targeting health-conscious consumers, particularly millennials and Gen Z, who are more likely to experiment with plant-based alternatives. Furthermore, a strong brand narrative focused on sustainability, ethical sourcing, and the benefits of plant-based products help drive awareness. Leveraging digital marketing, social media engagement, and influencer partnerships would play a vital role in boosting consumer interest and expanding market reach.

The gelatin substitutes market was valued at $2,683 million in 2024 and is projected to reach $6,094 million by 2034, registering a CAGR of 8.6% from 2025 to 2034.

The gelatin substitute market is segmented on the basis of product type, application, distribution channel, and region. On the basis of product type, it is categorized into agar-agar, pectin, carrageenan, xanthan gum, guar gum, and others. On the basis of application, it is divided into food & beverage, pharmaceuticals, cosmetics, and others. On the basis of distribution channel, it is segregated into online stores, supermarkets/hypermarkets, specialty store, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include CP Kelco, Tate & Lyle, B&V srl, Cargill Incorporated, Gino Gums Stabilizers, Indoflora Cipta Mandiri, AEP Colloids, Great American Spice Company, Ingredion, and Jebsen & Jessen Life Science Inc.

The gelatin substitutes market report is available on request on the website of Allied Market Research.

The forecast period considered in the gelatin substitutes market report is from 2024 to 2034. The report analyzes the market sizes from 2025 to 2034 along with the upcoming market trends and opportunities. The report also covers the key strategies adopted by the key players operating in the market.

Loading Table Of Content...

Loading Research Methodology...