Gluten free flour Market Research, 2031

The global gluten free flour market size was valued at $6.4 billion in 2022, and is projected to reach $9.4 billion by 2031, growing at a CAGR of 4% from 2023 to 2031. Gluten free flour is a specialized flour crafted from grains and starches that lack gluten‐”an essential protein in wheat, barley, and rye. Tailored for those with gluten sensitivity, celiac disease, or a preference for gluten-free diets, this flour relies on alternatives like rice, corn, almond, and coconut flours. Achieving the desired texture and structure in gluten-free baking involves skillful combinations of these flours and binding agents. While indispensable for specific dietary needs, using gluten-free flour may demand recipe modifications for optimal outcomes, making it a vital choice for those seeking alternatives in the culinary realm.

The Gluten Free Flour Market is projected to be fueled by the rising celiac disease cases and weight management trends. The increasing occurrences of celiac disease and the growing focus on weight management are significant drivers elevating the demand for gluten-free flour in the market. As more individuals are diagnosed with celiac disease, an autoimmune condition triggered by gluten, there is a rising need for gluten-free alternatives. The awareness surrounding celiac disease has prompted a broader adoption of gluten-free flour to address dietary requirements and manage associated symptoms effectively. Additionally, the upswing in weight management trends contributes significantly to the market demand for gluten-free flour. Many individuals pursuing weight control and healthier eating habits find gluten-free diets appealing for their perceived benefits. In this context, gluten-free flour emerges as a pivotal ingredient, allowing people to indulge in a variety of baked goods while adhering to their dietary goals. This dual influence of health consciousness and weight management trends underscores the growing significance of gluten-free flour in the market.

Moreover, the expansion of specialty diets has emerged as a significant catalyst propelling the demand for gluten-free flour in the market. With the increasing popularity of unique dietary approaches such as paleo and keto, which often exclude gluten-containing grains, there is a growing need for suitable alternatives. Consumers adhering to these specialty diets seek gluten-free flour as a foundational ingredient to create diverse and satisfying meals that align with their nutritional preferences. As specialty diets become more mainstream, the demand for gluten-free flour experiences a corresponding surge. The versatility of gluten-free flour in accommodating the requirements of various specialty diets contributes to its rising popularity. This expansion not only broadens the consumer base but also encourages innovation in gluten-free flour formulations, further enhancing its appeal for individuals embracing specialized dietary patterns. In essence, the market for gluten-free flour is intricately connected to the evolving landscape of specialty diets, reflecting a dynamic and responsive industry meeting the diverse needs of health-conscious consumers.

Additionally, the surge in global cuisine trends has become a significant driving force behind the escalating demand for gluten-free flour in the market. As consumers increasingly explore and embrace diverse culinary traditions from around the world, many traditional recipes incorporate naturally gluten-free flour. The demand for gluten-free flour has witnessed an upswing as individuals seek to recreate these global dishes while adhering to gluten-free dietary preferences. The appeal of gluten-free flour in global cuisine trends lies in its versatility and ability to cater to a wide array of international recipes. From Asian to Latin American cuisines, gluten-free flour allows individuals to enjoy a rich tapestry of flavors without compromising on dietary restrictions. This dynamic interplay between the popularity of global culinary exploration and the flexibility of gluten-free flour positions it as a crucial ingredient in contemporary kitchens, reflecting a broader consumer shift towards diverse and inclusive eating habits.

However, baking challenges pose significant restraints on the Gluten Free Flour Market Demand. The absence of gluten, a key structural element in traditional baking, presents difficulties in achieving the desired texture and elasticity in gluten-free baked goods. This inherent challenge can deter both home bakers and commercial producers, limiting the widespread adoption of gluten-free flour in various recipes. Consumers may be dissuaded from embracing gluten-free alternatives if the baking process proves intricate or if the end products lack the familiar qualities associated with gluten-containing counterparts.

Segmental Overview

The gluten free flour industry analysis is segmented based on product, source, application, and region. By product, the market is classified into amaranth flour, almond flour, oat flour, corn flour, and others. By source, the market is classified into cereals and legumes. By application, the market is classified into bread and bakery products, soups and sauces, and ready-to-eat products. By region, the market is classified into North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, the UK, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and the Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Turkey, and Rest of LAMEA).

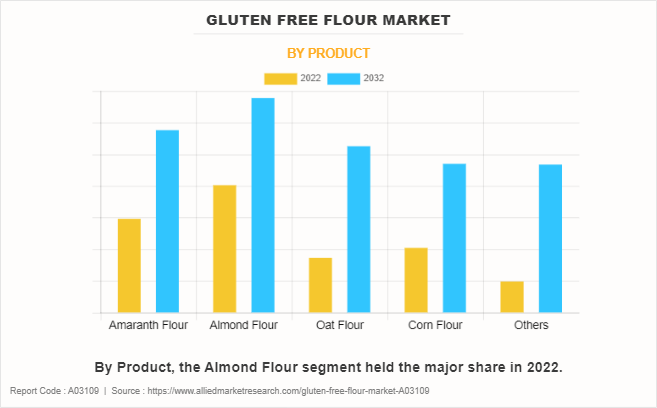

By Product

Based on product, the Gluten Free Flour Market Forecastis classified into amaranth flour, almond flour, oat flour, corn flour, and others. The almond flour segment accounted for a major gluten free flour market share in 2022 and is expected to grow at a significant CAGR during the forecast period. Almond flour, made from ground almonds, is a gluten-free and low-carb option. It imparts a subtly sweet, nutty flavor to baked goods. Almond flour is experiencing increased demand as consumers embrace low-carb and gluten-free lifestyles.

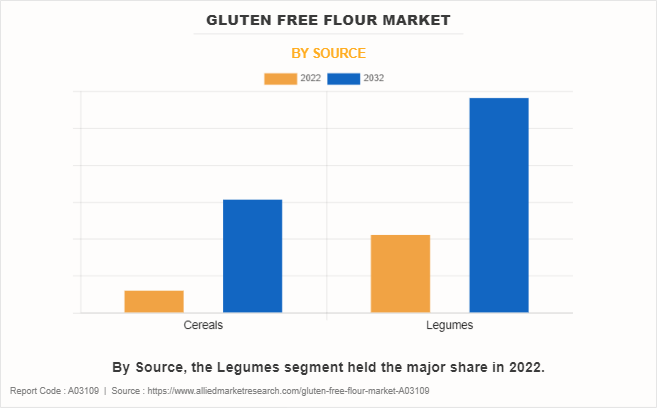

By Source

Based on source, the market is classified into cereals and legumes. The legumes segment accounted for a major gluten-free flour market share in 2022 and is expected to grow at a significant CAGR during the forecast period. Legume-based gluten-free flour is sourced from leguminous plants such as chickpeas, lentils, and peas. Known for their high protein content and versatility, legume flours are gaining traction in the gluten-free market. The growing demand for legume-based gluten-free flours is driven by the increasing recognition of their nutritional benefits and versatility.

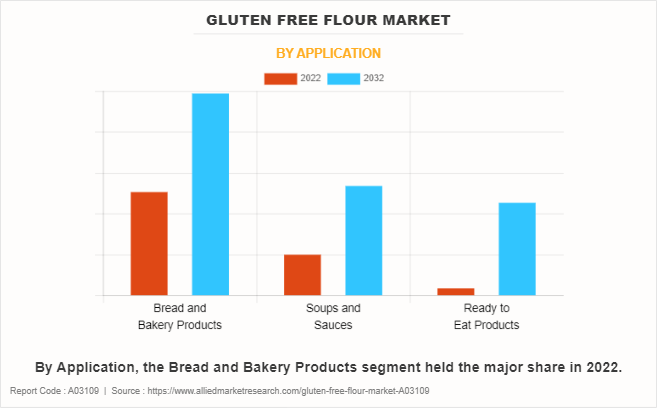

By Application

Based on application, the market is classified into bread and bakery products, soups and sauces, and ready-to-eat products. The bread and bakery products segment accounted for a major gluten-free flour market share in 2022 and is expected to grow at a significant CAGR during the forecast period. Gluten-free flour finds application in bread and bakery products, serving as a substitute for traditional wheat flour. The demand for gluten-free flour in bread and bakery products is surging as consumers increasingly adopt gluten-free diets.

By Region

Based on region, the market is classified into North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, the UK, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and the Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Turkey, and Rest of LAMEA). The Europe region accounted for a major share of the Gluten-free flour market in 2022 and is expected to grow at a significant CAGR during the forecast period. Europe has a higher prevalence of gluten-related disorders, creating a larger consumer base for gluten-free products. Moreover, strict food labeling regulations in Europe ensure clear and reliable labeling of gluten-free products, enhancing consumer trust. In addition, European consumers are more health-conscious and have a higher disposable income, making them more inclined to purchase gluten-free products.

Competitive Landscape

The major players operating in the gluten-free flour market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. Some of the key players in the gluten-free flour market include AGRANA Beteiligungs-AG, SunOpta Inc., Cargill, Incorporated, The Scoular Company, Enjoy Life Foods LLC, Parrish and Heimbecker, Archer Daniels Midland Company, Hain Celestial Group Inc., General Mills, Inc., Associated British Foods Plc.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gluten free flour market analysis from 2022 to 2032 to identify the prevailing gluten free flour market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gluten free flour market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gluten free flour market trends, key players, market segments, application areas, and Gluten Free Flour Market Growth strategies.

Gluten free flour Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.4 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 666 |

| By Product |

|

| By Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bob's Red Mill Natural Foods, Inc., Associated British Foods Plc., Archer-Daniels-Midland Company, King Arthur Baking Company, Inc., The Scoular Company, Hometown Food Company, General Mills, Inc., To Your Health Sprouted Flour Co., Ardent Mills, Shipton Mill Ltd. |

Analyst Review

According to the insights of the CXOs, the global gluten free flour market is expected to witness robust growth during the forecast period. This is attributed to the increasing awareness of gluten sensitivity. As more individuals recognize and understand their sensitivity to gluten—a protein found in wheat and certain grains—there is a growing inclination towards adopting gluten-free diets. This heightened awareness is fueling a broader shift in consumer preferences towards gluten-free products, including flour, as people seek options that align with their dietary needs and help manage symptoms associated with gluten sensitivity.

However, the fear of cross-contamination can result in hesitancy among consumers to embrace gluten-free flour, even if the product itself is inherently gluten-free. This constraint is particularly pronounced in the food industry, where ensuring a completely gluten-free production process is challenging. As a result, individuals with gluten-related disorders may be reluctant to incorporate gluten-free flour into their diets, impacting the market demand for these products.

The global gluten free flour market size was valued at $6.4 billion in 2022, and is projected to reach $9.4 billion by 2031

The global Gluten-free flour market is projected to grow at a compound annual growth rate of 4% from 2023 to 2031 $9.4 billion by 2031

Some of the key players in the gluten-free flour market include AGRANA Beteiligungs-AG, SunOpta Inc., Cargill, Incorporated, The Scoular Company, Enjoy Life Foods LLC, Parrish and Heimbecker, Archer Daniels Midland Company, Hain Celestial Group Inc., General Mills, Inc., Associated British Foods Plc.

The Europe region accounted for a major share of the Gluten-free flour market in 2022 and is expected to grow at a significant CAGR during the forecast period.

Expansion of Gluten-Free Product Lines, Gluten Sensitivity Awareness

Loading Table Of Content...

Loading Research Methodology...