Halal Food Ingredients Market Research, 2034

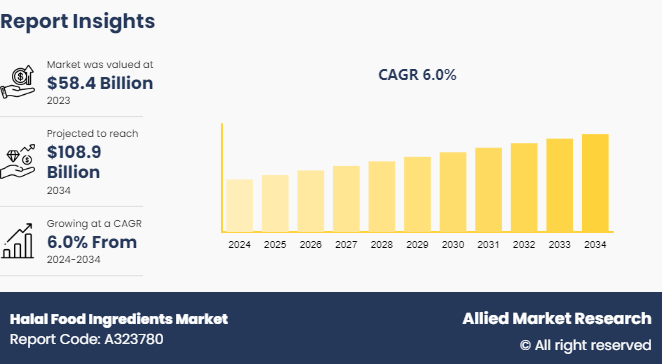

The global halal food ingredients market size was valued at $58.4 billion in 2023, and is projected to reach $108.9 billion by 2034, growing at a CAGR of 6.0% from 2024 to 2034.

Market Introduction and Definition

Halal food ingredients are substances deemed permissible under Islamic law for consumption and use. Moreover, these must be free from any haram (prohibited) elements such as alcohol, blood, and pork, and must be processed according to halal standards. The types of halal ingredients include food ingredients (such as meat, dairy, grains, and additives such as emulsifiers and enzymes) , pharmaceutical ingredients (such as active components and excipients) , and cosmetic ingredients (such as additives in skincare, hair care, makeup, and fragrances) . These ingredients are used in the production of food & beverages, medicines, and personal care products to ensure they comply with Islamic dietary laws.

Key Takeaways

The halal food ingredients market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2035.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The rise in consumption of halal food and beverages significantly boosts the demand for halal ingredients in the global market. This surge is primarily driven by the growing Muslim population, which is expected to reach nearly 3 billion by 2060. As more consumers adhere to Islamic dietary laws, there is a higher demand for food and beverage products that are certified halal. This demographic shift is particularly notable in regions with large Muslim populations, such as Asia-Pacific and the Middle East, where halal food and beverages are staples in daily diets.

Moreover, the perception of halal products as being healthier, cleaner, and safer is attracting a broader consumer base, including non-Muslims. This trend is further amplified by increasing health consciousness and ethical concerns among consumers, leading to a preference for halal-certified products. The expansion of e-commerce platforms has made these products more accessible globally, allowing consumers in non-Muslim-majority countries to purchase halal ingredients more easily. Consequently, the halal ingredients market has experienced robust growth, fueled by the rise in demand for halal food & beverages and the expanding reach of these products through digital channels. Thus, all these factors contribute in the growth of halal food ingredients market share.

Consumer awareness and education significantly restrain the market demand for halal ingredients due to widespread confusion and lack of understanding about halal certification. Many consumers are not fully aware of what constitutes halal certification, leading to skepticism and mistrust. This lack of clarity deters consumers from seeking out halal products, even when they are available, thereby limiting market growth. Without proper knowledge, consumers fail to recognize the benefits and the strict standards adhered to in halal certification, impacting their purchasing decisions?.

Furthermore, the inconsistent and fragmented nature of halal certification across different regions exacerbates the issue. Consumers encounter varying standards and labels, which can be confusing and reduce confidence in the authenticity of halal products. This inconsistency hampers the ability of companies to effectively market their halal-certified ingredients, as they struggle to educate and assure a diverse consumer base about the integrity of their products. Consequently, the lack of consumer awareness and education poses a significant barrier to the expansion of the halal food ingredients market growth, as it undermines consumer trust and limits demand.

As the global Muslim population continues to grow, there is a rise in demand for halal-certified products across various industries, including food, cosmetics, pharmaceuticals, and personal care. This increase in demand drives manufacturers to innovate and develop new halal formulations to cater to the diverse needs and preferences of Muslim consumers worldwide.

Moreover, the growing awareness of halal principles among non-Muslim consumers is expanding the market beyond traditional Muslim-majority regions, presenting opportunities for halal ingredient suppliers to tap into new markets and customer segments. By offering a wide range of halal-certified ingredients, including flavors, colors, preservatives, and additives, suppliers support manufacturers in creating halal-compliant products that meet stringent religious requirements while maintaining high standards of quality and safety.

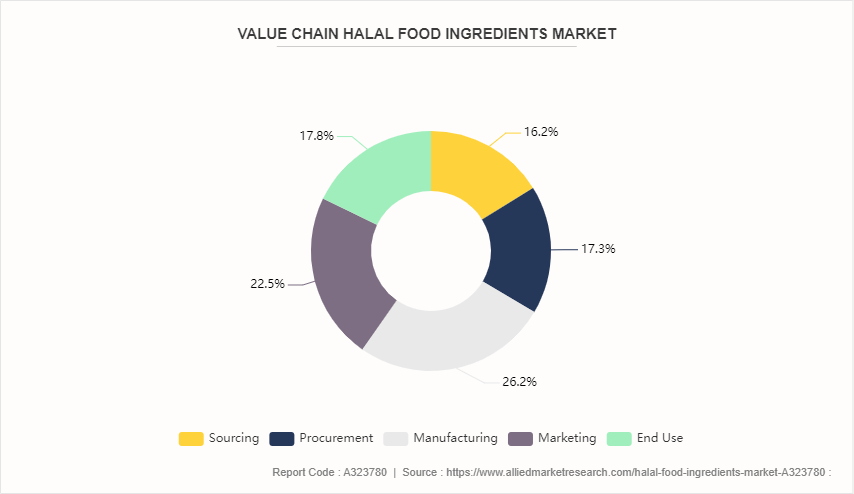

Value Chain of Halal Food Ingredients Market

The halal food ingredients industry value chain begins with the sourcing of raw materials that are permissible under Islamic laws and principles. This includes plant-based sources like grains, pulses, fruits, vegetables as well as allowable animal-derived ingredients like gelatin and enzymes from halal-certified animal sources. The next stage involves processing these raw materials into various halal ingredient products. For plant proteins, this may involve processes like milling, extraction, and isolation. Animal-based ingredients undergo halal slaughtering, processing, and purification steps as per guidelines. Synthetic halal ingredients are also produced through approved chemical synthesis routes.

In addition, the processed halal ingredient inputs then go into formulation activities to develop products such as halal protein concentrates/isolates, flavors, colors, preservatives, and other additives customized for different applications such as food, pharmaceuticals, or cosmetics while adhering to halal compliance. These formulated halal ingredient products need to undergo certification by authorized halal certification bodies, which verify their sources, processing aids used and overall adherence to halal standards through audits and testing. Once certified, the halal ingredient products are packaged and labeled accordingly before entering distribution channels such as ingredient suppliers, food/beverage manufacturers, dietary supplement brands, pharmaceutical companies, and personal care product makers across domestic and international markets.

Market Segmentation

The halal food ingredients market is segmented into type, source, application, and region. On the basis of type, the market is divided into proteins, gelatin & collagen, enzymes & emulsifiers, flavors & colors, and other ingredients. As source, the market is segregated into plant based, animal based and synthetic. On the basis of application, the market is bifurcated into food & beverages, bakery & confectionery, dairy & frozen desserts, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/ Country Market Outlook

Asia-Pacific region boasts a sizable Muslim population, constituting a significant consumer base with a preference for halal-certified products. As a result, there is a strong demand for halal ingredients across various industries, including food, cosmetics, and pharmaceuticals. Moreover, countries within the Asia-Pacific region, such as Malaysia, Indonesia, and Pakistan, have established themselves as key players in halal certification and production. They have developed stringent halal standards and regulations, fostering confidence among consumers regarding the authenticity and integrity of halal products originating from this region.

In addition, the Asia-Pacific region benefits from robust economic growth and increasing disposable incomes, driving consumer spending on halal products. Additionally, governments in this region have been actively promoting halal industries through supportive policies and initiatives, further fueling market growth. Furthermore, the combination of a large Muslim population, strong regulatory frameworks, economic development, and government support has positioned the Asia-Pacific region at the forefront of the halal ingredients market, making it the most dominating region in the industry.

Industry Trends:

According to Euromonitor International, approximately 66% of halal consumers consider ethical and sustainable sourcing important when purchasing halal products, influencing ingredient sourcing practices.

As per Thomson Reuters, companies target international markets, with Asia-Pacific and the Middle East emerging as key regions for halal ingredient exports, accounting for 80% of global halal trade.

Competitive Landscape

The major players operating in the halal food ingredients market include Nestlé S.A., Merck, Cargill, Inc., QL Foods, Prima Agri-Products, Dagang Halal Group, Saffron Road, Midamar Corporation, Al Islami Foods and Tahira Foods Limited.

Recent Key Strategies and Developments

In June 2021, Merck, renowned for its advancements in science and technology, declared that its complete range of cosmetics, along with the Candurin pharmaceutical and food offerings, has obtained certification according to various globally acknowledged halal standards. Consequently, Merck broadened its array of halal-certified products to encompass special effect pigments, food colorants, and cosmetic ingredients.

Key Sources Referred

Food Safety and Inspection Council

Illinois Department of Agriculture

International Food Information Council

World Bank

U.S. Department of Agriculture

Malaysia - Nutritional and Food Supplements

Administration National Strategy on Hunger, Nutrition and Health

Euromonitor International

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the halal food ingredients market analysis from 2024 to 2034 to identify the prevailing halal food ingredients market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the halal food ingredients market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global halal food ingredients market trends, key players, market segments, application areas, and market growth strategies.

Halal Food Ingredients Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 108.9 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 345 |

| By Type |

|

| By Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | Tahira Foods Limited, Nestlé S.A., Prima Agri-Products, Merck, Midamar Corporation, Cargill, Inc., QL Foods, Al Islami Foods, Dagang Halal Group, Saffron Road |

The global halal food ingredients market size was valued at $58.4 billion in 2023, and is projected to reach $108.9 billion by 2034

The global Halal Food Ingredients market is projected to grow at a compound annual growth rate of 6.0% from 2024 to 2034

The key players profiled in the reports includes QL Foods, Saffron Road, Prima Agri-Products, Nestlé S.A., Merck, Dagang Halal Group, Midamar Corporation, Cargill, Inc., Tahira Foods Limited, Al Islami Foods

Asia-Pacific region boasts a sizable Muslim population, constituting a significant consumer base with a preference for halal-certified products.

Rising Consumption Of Halal Food And Beverages, Health And Ethical Concerns, Product Innovation

Loading Table Of Content...